10+ Anti money laundering for insurance agents info

Home » about money loundering idea » 10+ Anti money laundering for insurance agents infoYour Anti money laundering for insurance agents images are ready in this website. Anti money laundering for insurance agents are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering for insurance agents files here. Download all royalty-free photos and vectors.

If you’re searching for anti money laundering for insurance agents pictures information related to the anti money laundering for insurance agents topic, you have pay a visit to the right site. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

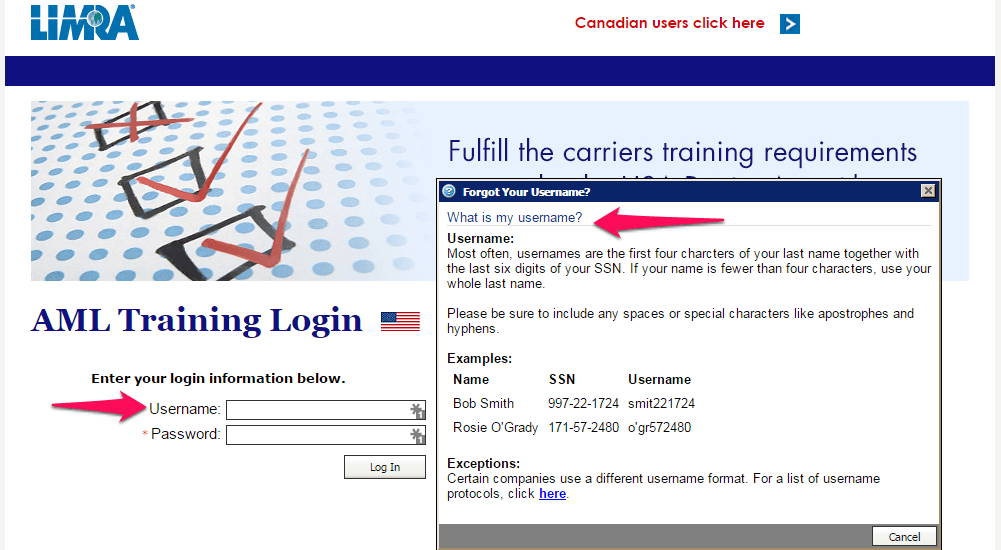

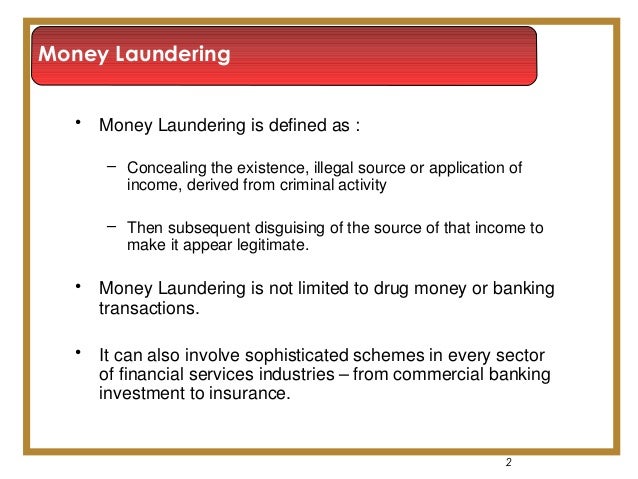

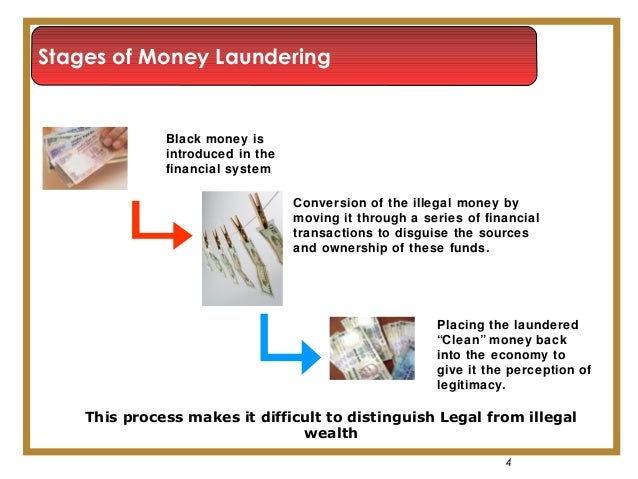

Anti Money Laundering For Insurance Agents. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Aml and Password is. Three Stages of Money Laundering. Enter Agent No and Password.

Complete Your Anti Money Laundering Training Here 2019 2020 From redbirdagents.com

Complete Your Anti Money Laundering Training Here 2019 2020 From redbirdagents.com

A covered product includes. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Most life insurance firms offer. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance. Aml and Password is. An annuity contract other than a group annuity contract.

Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US.

You can call us at 8015181956 with any questions or concerns. Click on Marketing Sales. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. Three Stages of Money Laundering. A covered product includes. Senior management must approve the program before it can become approachable to the Treasury Department of the company.

Source: redbirdagents.com

Source: redbirdagents.com

Elizabeth Sale Haley Adams Malcolm Aboud Chelsea Rubin. Overview of POCAMLAPOTA- Obligations of Reporting Institutions 4. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. The Act says Compliance is risk-based. Most life insurance firms offer.

Source: infopro.com.my

Source: infopro.com.my

Click on Marketing Sales. You can call us at 8015181956 with any questions or concerns. Anti-Money Laundering Certification Requirements for Insurance Agents The organization must implement an anti-money laundering scheme under the Patriot Act. In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must. Overview of FATF Recommendations.

Source: slideshare.net

Source: slideshare.net

In order to maintain a comprehensive risk-based compliance program which has effective processes and procedures that comply with AML regulatory requirements the insurance company must. Anti money laundering training for insurance agents. An annuity contract other than a group annuity contract. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance.

Source: infopro.com.my

Source: infopro.com.my

WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals. Overview of POCAMLAPOTA- Obligations of Reporting Institutions 4. You can call us at 8015181956 with any questions or concerns. Three Stages of Money Laundering. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance.

Source: slideshare.net

Source: slideshare.net

Enter Agent No and Password. The Act says Compliance is risk-based. Anti money laundering training for insurance agents. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Introduction to ML TF 2.

Source: youtube.com

Source: youtube.com

An annuity contract other than a group annuity contract. In the Insurance Sector. Introduction to ML TF 2. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Click on Marketing Sales.

Source:

Anti-Money Laundering Certification Requirements for Insurance Agents The organization must implement an anti-money laundering scheme under the Patriot Act. INSIGHT ARTICLE February 27 2019. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US. Anti-Money Laundering Certification Requirements for Insurance Agents The organization must implement an anti-money laundering scheme under the Patriot Act. Click on Marketing Sales.

Source: getid.ee

Source: getid.ee

The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. The purpose of the program is to prevent the company its products and its agents from being used for money laundering or terrorist financing purposes. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. For changes of general application that will apply to all Reporting Entity sectors as of June 1 2021 please refer to Part 1 of the guide. You can call us at 8015181956 with any questions or concerns.

Source: slideshare.net

Source: slideshare.net

Senior management must approve the program before it can become approachable to the Treasury Department of the company. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. Senior management must approve the program before it can become approachable to the Treasury Department of the company.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

Introduction to ML TF 2. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. In the Insurance Sector. Anti-Money Laundering AML Compliance Program for Insurance Companies. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program.

Source: redbirdagents.com

Source: redbirdagents.com

WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals. INSIGHT ARTICLE February 27 2019. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. For changes of general application that will apply to all Reporting Entity sectors as of June 1 2021 please refer to Part 1 of the guide. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the insurance.

Source: slideshare.net

Source: slideshare.net

Introduction to ML TF 2. You can call us at 8015181956 with any questions or concerns. Click on Marketing Sales. ML Terrorism Financing Risks in the Insurance Industry 3. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers.

Source: sanctionscanner.com

Source: sanctionscanner.com

ML Terrorism Financing Risks in the Insurance Industry 3. Insurers that meet the definition for inclusion in the anti-money laundering requirements must develop and implement a company-wide anti-money laundering program. Enter Agent No and Password. The Patriot Act gives law enforcement agencies broader powers in dealing with money laundering and terrorism and makes it more difficult for money launders to use their traditional financial channels to launder money. Elizabeth Sale Haley Adams Malcolm Aboud Chelsea Rubin.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering for insurance agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information