18+ Anti money laundering form nz ideas in 2021

Home » about money loundering Info » 18+ Anti money laundering form nz ideas in 2021Your Anti money laundering form nz images are ready. Anti money laundering form nz are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering form nz files here. Get all free photos and vectors.

If you’re searching for anti money laundering form nz pictures information linked to the anti money laundering form nz keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

Anti Money Laundering Form Nz. If youre a registered real estate agent you may need to put AMLCFT measures in place. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. The new law formally recognises that effective control of money laundering and crime that leads to it needs collaboration between the. Understanding the purpose and approach of AML Workflows.

Pdf Anti Money Laundering And Anti Terrorism Financing A Survey Of The Existing Literature And A Future Research Agenda From researchgate.net

Pdf Anti Money Laundering And Anti Terrorism Financing A Survey Of The Existing Literature And A Future Research Agenda From researchgate.net

Protect people and communities. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. This legislation 1 is in place to protect New Zealand from financial crime and means several industries including banks and real estate agencies need to check your details from time to time and could ask you to provide additional information. If youre a registered real estate agent you may need to put AMLCFT measures in place. The purpose of this law is to make it harder for criminals to launder money.

Under the law all banks in New Zealand are required to do more to verify a customers identity and in some cases account activity.

And prevent criminals from using the proceeds of. Protecting New Zealand From 1 October 2018 Accountants have been covered by the Anti-Money Laundering and Countering Financing Terrorism Act 2009. AMLCFT exists to ensure the integrity of New Zealands financial system. New Zealand has passed a law called the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 AMLCFT for short. Understanding the purpose and approach of AML Workflows. The Department of Internal Affairs supervises casinos non-deposit taking lenders money changers money remitters payroll remitters debt collectors factors financial leasors safe deposit box vaults non-bank credit card providers stored value card providers and cash transporters virtual asset service providers accountants lawyers conveyancers real estate agents high value dealers and any other.

Source: pdfprof.com

Source: pdfprof.com

Protecting New Zealand From 1 October 2018 Accountants have been covered by the Anti-Money Laundering and Countering Financing Terrorism Act 2009. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires a Border Cash Report to be completed by every person unless exempt who moves cash into or out of New Zealand and any person who is to receive cash from outside New Zealand sent either by the person or by another person AND the TOTAL. The purpose of the AMLCFT regime reflects New Zealands commitment to the international initiative to counter the impact that criminal activity has on people and economies within the global community. The purpose of this law is to make it harder for criminals to launder money.

Source: pdfprof.com

Source: pdfprof.com

New Zealand has passed a law called the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 AMLCFT for short. This will help prevent money laundering make it easier for authorities to find out where dirty money came from prosecute criminals seize illegally earned money and assets and stop crime and terrorism. The purpose of the AMLCFT regime reflects New Zealands commitment to the international initiative to counter the impact that criminal activity has on people and economies within the global community. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. This legislation 1 is in place to protect New Zealand from financial crime and means several industries including banks and real estate agencies need to check your details from time to time and could ask you to provide additional information.

Source: pdfprof.com

Source: pdfprof.com

This will help prevent money laundering make it easier for authorities to find out where dirty money came from prosecute criminals seize illegally earned money and assets and stop crime and terrorism. It is estimated that over 1 billion a year comes from drug dealing and fraud and is laundered through New Zealand businesses. Under the law all banks in New Zealand are required to do more to verify a customers identity and in some cases account activity. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. The new law formally recognises that effective control of money laundering and crime that leads to it needs collaboration between the.

Source: yumpu.com

Source: yumpu.com

Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. The Department of Internal Affairs supervises casinos non-deposit taking lenders money changers money remitters payroll remitters debt collectors factors financial leasors safe deposit box vaults non-bank credit card providers stored value card providers and cash transporters virtual asset service providers accountants lawyers conveyancers real estate agents high value dealers and any other. Heres a summary of the proposed changes. Anti-Money Laundering We are required by law to verify our customers information and in some cases account activity even if you have been a customer for a while. Over the next decade the cost to New Zealand businesses of complying with anti-money laundering legislation is expected to hit 1 billion.

Source: researchgate.net

Source: researchgate.net

If youre a registered real estate agent you may need to put AMLCFT measures in place. The purpose of the AMLCFT regime reflects New Zealands commitment to the international initiative to counter the impact that criminal activity has on people and economies within the global community. The new law formally recognises that effective control of money laundering and crime that leads to it needs collaboration between the. On 1 July 2018 lawyers and conveyancers became reporting entities under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009. Protecting New Zealand From 1 October 2018 Accountants have been covered by the Anti-Money Laundering and Countering Financing Terrorism Act 2009.

Source: researchgate.net

Source: researchgate.net

Protect people and communities. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires a Border Cash Report to be completed by every person unless exempt who moves cash into or out of New Zealand and any person who is to receive cash from outside New Zealand sent either by the person or by another person AND the TOTAL. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing. The Department of Internal Affairs supervises casinos non-deposit taking lenders money changers money remitters payroll remitters debt collectors factors financial leasors safe deposit box vaults non-bank credit card providers stored value card providers and cash transporters virtual asset service providers accountants lawyers conveyancers real estate agents high value dealers and any other. Over the next decade the cost to New Zealand businesses of complying with anti-money laundering legislation is expected to hit 1 billion.

Source: pdfprof.com

Source: pdfprof.com

Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. If youre a registered real estate agent you may need to put AMLCFT measures in place. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act requires a Border Cash Report to be completed by every person unless exempt who moves cash into or out of New Zealand and any person who is to receive cash from outside New Zealand sent either by the person or by another person AND the TOTAL. Understanding the purpose and approach of AML Workflows.

Source:

And prevent criminals from using the proceeds of. But as Jeremy Rose reports one of the countrys leading anti-money laundering experts says the legislation does virtually nothing to disrupt the proceeds and funding of serious crime. New Zealands AMLCFT regime has been in place in New Zealand since 2013 when the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 came into force. Under the law all banks in New Zealand are required to do more to verify a customers identity and in some cases account activity. The following modules in Anti-Money Laundering Workflows have been reviewed and extensively updated.

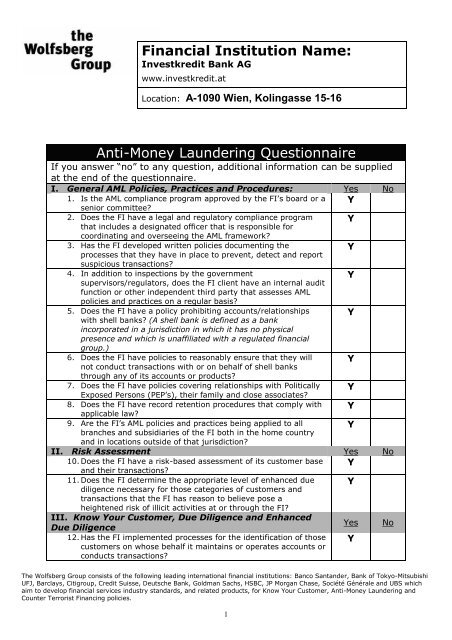

Source: docplayer.net

Source: docplayer.net

NZ Anti-Money Laundering AML Guidance for Accountants iFirm General Phase 1 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 AML Act Act came into effect in 2013 and placed obligations on financial institutions and casinos to comply with AML obligations. This will help prevent money laundering make it easier for authorities to find out where dirty money came from prosecute criminals seize illegally earned money and assets and stop crime and terrorism. The Department of Internal Affairs supervises casinos non-deposit taking lenders money changers money remitters payroll remitters debt collectors factors financial leasors safe deposit box vaults non-bank credit card providers stored value card providers and cash transporters virtual asset service providers accountants lawyers conveyancers real estate agents high value dealers and any other. The new law formally recognises that effective control of money laundering and crime that leads to it needs collaboration between the. Heres a summary of the proposed changes.

Source: docplayer.net

Source: docplayer.net

Over the next decade the cost to New Zealand businesses of complying with anti-money laundering legislation is expected to hit 1 billion. Financial institutions have had to comply with the AMLCFT Act since 2013 now other businesses will also need to comply including real estate agents and many lawyers and accountants. Heres a summary of the proposed changes. Protecting New Zealand From 1 October 2018 Accountants have been covered by the Anti-Money Laundering and Countering Financing Terrorism Act 2009. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing.

Source: pdfprof.com

Source: pdfprof.com

Modules in Anti-Money Laundering Workflows online ed Thomson Reuters have been reviewed and extensively updated by author Gary Hughes and are now available on Westlaw NZ. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 forms part of a legislative package that will implement the first tranche of reforms to New Zealands anti-money laundering and countering financing of terrorism regulatory regime. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 is designed to help detect and deter money laundering and terrorism financing. The new law formally recognises that effective control of money laundering and crime that leads to it needs collaboration between the. New Zealands AMLCFT regime has been in place in New Zealand since 2013 when the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 came into force.

Source: pdfprof.com

Source: pdfprof.com

If youre a registered real estate agent you may need to put AMLCFT measures in place. Over the next decade the cost to New Zealand businesses of complying with anti-money laundering legislation is expected to hit 1 billion. Information on Anti money laundering in New Zealand Information for business on AML compliance assessment and more. It is estimated that over 1 billion a year comes from drug dealing and fraud and is laundered through New Zealand businesses. The purpose of the AMLCFT regime reflects New Zealands commitment to the international initiative to counter the impact that criminal activity has on people and economies within the global community.

Source: pdfprof.com

Source: pdfprof.com

But as Jeremy Rose reports one of the countrys leading anti-money laundering experts says the legislation does virtually nothing to disrupt the proceeds and funding of serious crime. Anti-Money Laundering AML Template for Small Firms FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Over the next decade the cost to New Zealand businesses of complying with anti-money laundering legislation is expected to hit 1 billion. The purpose of the AMLCFT regime reflects New Zealands commitment to the international initiative to counter the impact that criminal activity has on people and economies within the global community. AMLCFT exists to ensure the integrity of New Zealands financial system.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering form nz by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas