19+ Anti money laundering guidance ideas in 2021

Home » about money loundering idea » 19+ Anti money laundering guidance ideas in 2021Your Anti money laundering guidance images are ready. Anti money laundering guidance are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering guidance files here. Download all royalty-free photos.

If you’re looking for anti money laundering guidance pictures information linked to the anti money laundering guidance topic, you have visit the right blog. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Anti Money Laundering Guidance. Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No. Anti-money laundering guidance for the legal sector. The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

Anti Money Laundering Regulations Compliance Process Policy Course From zoetalentsolutions.com

Anti Money Laundering Regulations Compliance Process Policy Course From zoetalentsolutions.com

Money laundering schemes are used to conceal the source and possession of money obtained through illegal. The basic requirements on anti-money laundering and combating the financing of terrorism AMLCFT in Japan such as identification and verification at the time of transactions are prescribed in the Act on Prevention of Transfer of Criminal Proceeds. The updated version builds upon the guidance previously published and. Anti-money laundering guidance for the legal sector. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act. 12 Terms and abbreviations used in this Guideline should be interpreted by reference to the definitions set out in the Glossary part of this Guideline.

FINRA Provides Guidance to Firms Regarding Anti-Money Laundering Program Requirements Under FINRA Rule 3310 Following Adoption of FinCENs Final Rule to Enhance Customer Due Diligence.

FINRA Provides Guidance to Firms Regarding Anti-Money Laundering Program Requirements Under FINRA Rule 3310 Following Adoption of FinCENs Final Rule to Enhance Customer Due Diligence. The ACCA Anti-Money Laundering resource for practitioners has been updated as of June 2021 and includes detailed guidance developed by CCAB and a free on demand lecture and standard documentation. Guidance on Anti-Money Laundering AML in Banking and Finance for 2021. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies.

Source: semanticscholar.org

Source: semanticscholar.org

The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. 115 Any enquiries pertaining to these Guidance Notes should be addressed to. Anti-Money Laundering and Sanctions Rules and Guidance AML AML VER04030220. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. 1 NTM 17-40.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

12 Terms and abbreviations used in this Guideline should be interpreted by reference to the definitions set out in the Glossary part of this Guideline. Requirements of the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism For Authorized Institutions issued by the HKMA for use by authorized institutions or to have regard to paragraphs 416 713 and 714 of this Guideline by RIs may reflect adversely on their fitness and. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms. By Jackie Wheeler May 26 2021. The ACCA Anti-Money Laundering resource for practitioners has been updated as of June 2021 and includes detailed guidance developed by CCAB and a free on demand lecture and standard documentation.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. Guidance on Anti-Money Laundering AML in Banking and Finance for 2021. Specific anti-money laundering guidance for barristersadvocates 2a trust or company service providers 2b notaries 2c 2b and 2c are to be read alongside part one of the guidance. The Legal Sector Anti-Money Laundering AML Group comprising legal sector regulators and representative bodies has completed an extensive review of the guidance that we published after the implementation of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: trulioo.com

Source: trulioo.com

Anti-money laundering AML policies are put in place to deter criminals from integrating illicit funds into the financial system. As such they have a significant role to play in ensuring their services. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms.

Source: amazon.com

Source: amazon.com

The ACCA Anti-Money Laundering resource for practitioners has been updated as of June 2021 and includes detailed guidance developed by CCAB and a free on demand lecture and standard documentation. Specific anti-money laundering guidance for barristersadvocates 2a trust or company service providers 2b notaries 2c 2b and 2c are to be read alongside part one of the guidance. Anti-Money Laundering and Sanctions Rules and Guidance AML AML VER04030220. Guidance on Anti-Money Laundering AML in Banking and Finance for 2021. The basic requirements on anti-money laundering and combating the financing of terrorism AMLCFT in Japan such as identification and verification at the time of transactions are prescribed in the Act on Prevention of Transfer of Criminal Proceeds.

Source: branddocs.com

Source: branddocs.com

2a is designed to be read independently of part one. Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. 11 This Guideline is published under section 7 of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance AMLO and section 73 of the Banking Ordinance BO. Requirements of the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism For Authorized Institutions issued by the HKMA for use by authorized institutions or to have regard to paragraphs 416 713 and 714 of this Guideline by RIs may reflect adversely on their fitness and.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

CCAB guidance Welcome to the Anti-Money Laundering Guide previously named Money Laundering Handbook. The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. Requirements of the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism For Authorized Institutions issued by the HKMA for use by authorized institutions or to have regard to paragraphs 416 713 and 714 of this Guideline by RIs may reflect adversely on their fitness and. NASD Provides Guidance to Member Firms Concerning Anti-Money Laundering Compliance Programs Required by Federal Law Apr. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms.

Source: ojk.go.id

Source: ojk.go.id

FINRA Provides Guidance to Firms Regarding Anti-Money Laundering Program Requirements Under FINRA Rule 3310 Following Adoption of FinCENs Final Rule to Enhance Customer Due Diligence. New guidance to help you implement AMLCTF reforms. The updated version builds upon the guidance previously published and. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. 2a is designed to be read independently of part one.

Source: bi.go.id

Source: bi.go.id

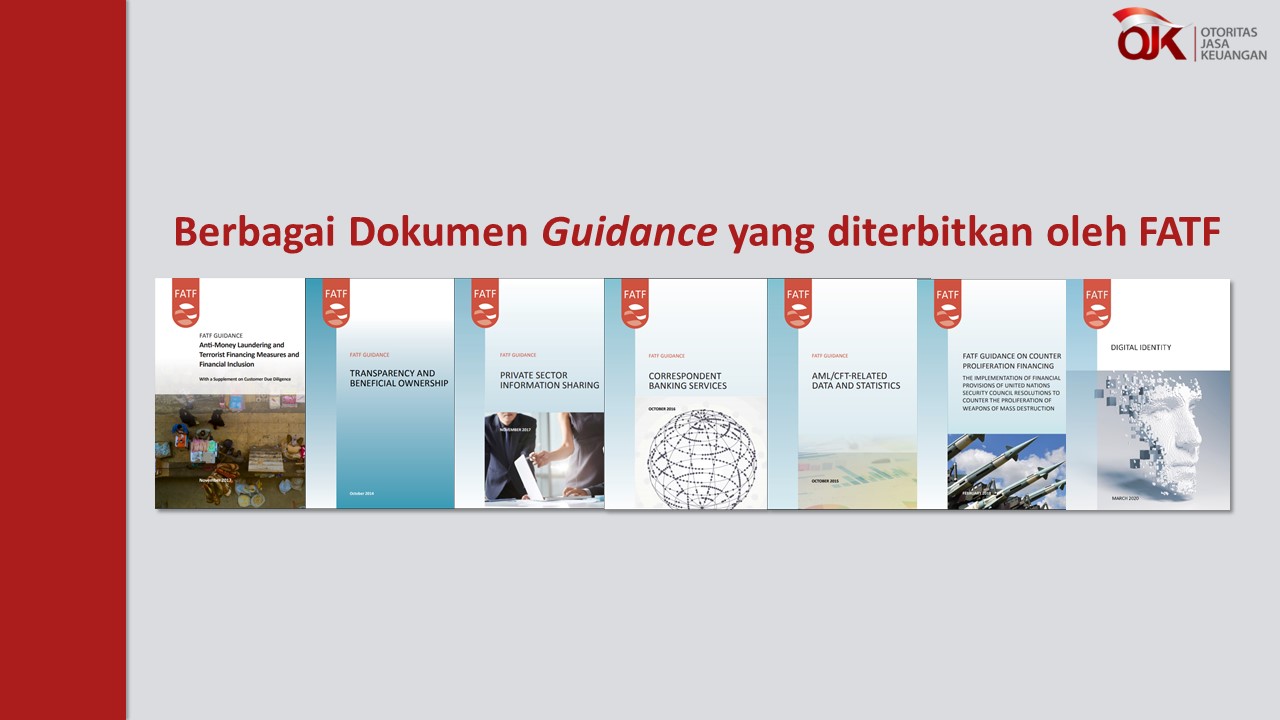

By Jackie Wheeler May 26 2021. CCAB guidance Welcome to the Anti-Money Laundering Guide previously named Money Laundering Handbook. The updated version builds upon the guidance previously published and. The FATF has prepared a Guidance paper to provide support to countries and their financial institutions in designing Anti-Money Laundering and Terrorist Financing AMLCFT measures that meet the national goal of financial inclusion without compromising the measures that exist for. By Jackie Wheeler May 26 2021.

Source: researchgate.net

Source: researchgate.net

By Jackie Wheeler May 26 2021. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. 115 Any enquiries pertaining to these Guidance Notes should be addressed to. 12 Terms and abbreviations used in this Guideline should be interpreted by reference to the definitions set out in the Glossary part of this Guideline. The purpose of the Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector the Guidelines is to assist credit and financial institutions Firms in understanding their AMLCFT obligations under Part 4 of the.

Source: zoetalentsolutions.com

Source: zoetalentsolutions.com

From 17 June 2021 reforms to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act came into effect that will streamline your compliance and help you protect your business from the harms of money laundering terrorism financing and other serious crimes. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. Specific anti-money laundering guidance for barristersadvocates 2a trust or company service providers 2b notaries 2c 2b and 2c are to be read alongside part one of the guidance. Money laundering schemes are used to conceal the source and possession of money obtained through illegal. Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies.

Source: napier.ai

Source: napier.ai

Anti-Money Laundering and Sanctions Rules and Guidance AML AML VER04030220. The guidance has two parts. New guidance to help you implement AMLCTF reforms. Financial institutions should on their part maintain updated anti- money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. The Legal Sector Anti-Money Laundering AML Group comprising legal sector regulators and representative bodies has completed an extensive review of the guidance that we published after the implementation of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: amazon.com

Source: amazon.com

The purpose of the Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector the Guidelines is to assist credit and financial institutions Firms in understanding their AMLCFT obligations under Part 4 of the. Anti-money laundering AML policies are put in place to deter criminals from integrating illicit funds into the financial system. 1 NTM 17-40. The ACCA Anti-Money Laundering resource for practitioners has been updated as of June 2021 and includes detailed guidance developed by CCAB and a free on demand lecture and standard documentation. The FATF has prepared a Guidance paper to provide support to countries and their financial institutions in designing Anti-Money Laundering and Terrorist Financing AMLCFT measures that meet the national goal of financial inclusion without compromising the measures that exist for.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering guidance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information