17++ Anti money laundering guidance for the accountancy sector info

Home » about money loundering idea » 17++ Anti money laundering guidance for the accountancy sector infoYour Anti money laundering guidance for the accountancy sector images are ready in this website. Anti money laundering guidance for the accountancy sector are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering guidance for the accountancy sector files here. Find and Download all royalty-free vectors.

If you’re searching for anti money laundering guidance for the accountancy sector pictures information related to the anti money laundering guidance for the accountancy sector topic, you have visit the right site. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Anti Money Laundering Guidance For The Accountancy Sector. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Issued by the Consultative Committee of Accountancy Bodies in August 2008. For the business itself. New guidance for all entities providing audit accountancy tax advisory insolvency or related services such as trust and company services by way of business.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

September 2020 saw the issue of the draft AMLGAS update pending final HM Treasury Approval. As such they have a significant role to play in ensuring their services. This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. This guidance is based on the law and regulations as of 10 January 2020. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy.

Accountants - Complying with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 PDF 12MB Tax Transfers Explanatory Note September 2018 This explanatory note clarifies whether activities relating to tax transfers payments and refunds are captured activities for the purposes of the AMLCFT Act.

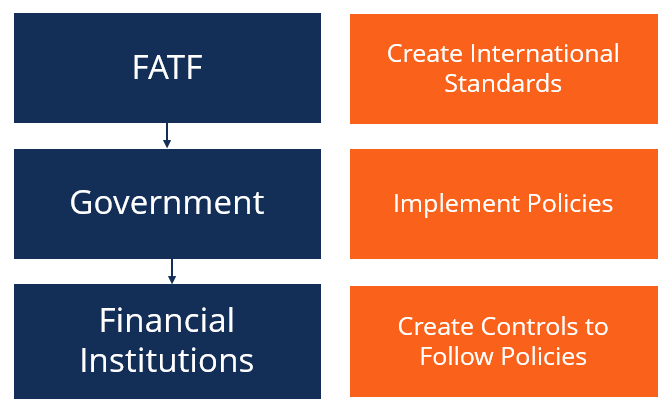

ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. This guidance is aimed at practitioners in the accountancy profession. Countries and their competent authorities practitioners in the banking sector and other financial and designated non-financial sectors that rely on the customer due diligence performed by accountantsThe guidance aims to support accounting professionals in the design of effective measures to manage their MLTF risks when. The FATF has prepared a Guidance paper to provide support to countries and their financial institutions in designing Anti-Money Laundering and Terrorist Financing AMLCFT measures that meet the national goal of financial inclusion without compromising the measures that exist for the purpose of combating crime. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing.

This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by The Institute of Certified Public Accountants in Ireland as Miscellaneous Technical Statement M42 Revised g Guidance Republic of Ireland Anti Money Launderin-to. It can be unnecessarily costly to apply anti-money laundering provisions to services that do not fall within the AML regime. This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by the Chartered Accountants Ireland as Miscellaneous Technical Statement M42 Revised Anti Money Laundering Guidance - Republic of Ireland to replace the existing M42 which was. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector Central Bank of Ireland Page 7 13 Data Protection Firms shall comply with their obligations under Part 4 of the CJA 2010 having regard to.

Source: slideshare.net

Source: slideshare.net

This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. Anti-Money Laundering and Counter-Terrorist Financing Guidance for the Accountancy Sector 2020. The FATF has prepared a Guidance paper to provide support to countries and their financial institutions in designing Anti-Money Laundering and Terrorist Financing AMLCFT measures that meet the national goal of financial inclusion without compromising the measures that exist for the purpose of combating crime. 115 This guidance applies to businesses and individuals who fall within the provisions of the UK anti-money laundering regime because they are part of the regulated sector The. As such they have a significant role to play in ensuring their services.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Accountants - Complying with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 PDF 12MB Tax Transfers Explanatory Note September 2018 This explanatory note clarifies whether activities relating to tax transfers payments and refunds are captured activities for the purposes of the AMLCFT Act. As such they have a significant role to play in ensuring their services are not used to further a criminal purpose. Anti-Money Laundering Guidance for the Accountancy Sector.

Source: researchgate.net

Source: researchgate.net

Countries and their competent authorities practitioners in the banking sector and other financial and designated non-financial sectors that rely on the customer due diligence performed by accountantsThe guidance aims to support accounting professionals in the design of effective measures to manage their MLTF risks when. Countries and their competent authorities practitioners in the banking sector and other financial and designated non-financial sectors that rely on the customer due diligence performed by accountantsThe guidance aims to support accounting professionals in the design of effective measures to manage their MLTF risks when. This guidance is based on the law and regulations as of 10 January 2020. The Anti-Money Laundering Guidance for the Accountancy Sector AMLGAS was therefore due for an update following the amendments to the AML regulations. This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by The Institute of Certified Public Accountants in Ireland as Miscellaneous Technical Statement M42 Revised g Guidance Republic of Ireland Anti Money Launderin-to.

Source: unitar.org

Source: unitar.org

This is draft guidance pending approval from HM Treasury published in September 2020. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Countries and their competent authorities practitioners in the banking sector and other financial and designated non-financial sectors that rely on the customer due diligence performed by accountantsThe guidance aims to support accounting professionals in the design of effective measures to manage their MLTF risks when. As such they have a significant role to play in ensuring their services. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy.

Source:

The guidance helps accountancy related businesses meet their obligations for money laundering supervision including customer due diligence. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Anti-Money Laundering and Counter-Terrorist Financing Guidance for the Accountancy Sector 2020. September 2020 saw the issue of the draft AMLGAS update pending final HM Treasury Approval. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing.

Source: aatcomment.org.uk

Source: aatcomment.org.uk

Issued by the Consultative Committee of Accountancy Bodies in August 2008. This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by The Institute of Certified Public Accountants in Ireland as Miscellaneous Technical Statement M42 Revised g Guidance Republic of Ireland Anti Money Launderin-to. As such they have a significant role to play in ensuring their services. Countries and their competent authorities practitioners in the banking sector and other financial and designated non-financial sectors that rely on the customer due diligence performed by accountantsThe guidance aims to support accounting professionals in the design of effective measures to manage their MLTF risks when. Anti-Money Laundering Guidance for the Accountancy Sector.

Source: sas.com

Source: sas.com

This guidance is aimed at practitioners in the accountancy profession. This guidance is aimed at practitioners in the accountancy profession. This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by The Institute of Certified Public Accountants in Ireland as Miscellaneous Technical Statement M42 Revised g Guidance Republic of Ireland Anti Money Launderin-to. September 2020 saw the issue of the draft AMLGAS update pending final HM Treasury Approval. Anti-money laundering guidance for the accountancy sector Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom including such firms providing trust or company services on the prevention of money laundering and the countering of.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

AMLCCs anti-money laundering solution for accountancy service providers was created in partnership with AML Supervisors accountants bookkeepers and tax advisers to solve the challenges that the accounting industry faces in complying with the latest anti-money laundering rules and regulations. The Guidance has been issued to provide the accountancy sector. Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector Central Bank of Ireland Page 7 13 Data Protection Firms shall comply with their obligations under Part 4 of the CJA 2010 having regard to. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. For the business itself.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

This is draft guidance pending approval from HM Treasury published in September 2020. 115 This guidance applies to businesses and individuals who fall within the provisions of the UK anti-money laundering regime because they are part of the regulated sector The. Driven by whats known as the 5th EU Money Laundering Directive 5MLD. As such they have a significant role to play in ensuring their services. Issued by the Consultative Committee of Accountancy Bodies in December 2007.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector Central Bank of Ireland Page 7 13 Data Protection Firms shall comply with their obligations under Part 4 of the CJA 2010 having regard to. Issued by the Consultative Committee of Accountancy Bodies in August 2008. Accountants - Complying with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 PDF 12MB Tax Transfers Explanatory Note September 2018 This explanatory note clarifies whether activities relating to tax transfers payments and refunds are captured activities for the purposes of the AMLCFT Act. Anti-Money Laundering and Counter-Terrorist Financing Guidance for the Accountancy Sector 2020. The Guidance has been issued to provide the accountancy sector.

Source: slideshare.net

Source: slideshare.net

Accountants - Complying with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 PDF 12MB Tax Transfers Explanatory Note September 2018 This explanatory note clarifies whether activities relating to tax transfers payments and refunds are captured activities for the purposes of the AMLCFT Act. The guidance helps accountancy related businesses meet their obligations for money laundering supervision including customer due diligence. This is draft guidance pending approval from HM Treasury published in September 2020. AMLCCs anti-money laundering solution for accountancy service providers was created in partnership with AML Supervisors accountants bookkeepers and tax advisers to solve the challenges that the accounting industry faces in complying with the latest anti-money laundering rules and regulations. Issued by the Consultative Committee of Accountancy Bodies in December 2007.

Source: researchgate.net

Source: researchgate.net

This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. Driven by whats known as the 5th EU Money Laundering Directive 5MLD. This is draft guidance pending approval from HM Treasury January 2020 ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering guidance for the accountancy sector by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information