11++ Anti money laundering guidelines by rbi ideas

Home » about money loundering Info » 11++ Anti money laundering guidelines by rbi ideasYour Anti money laundering guidelines by rbi images are ready. Anti money laundering guidelines by rbi are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering guidelines by rbi files here. Download all free photos.

If you’re searching for anti money laundering guidelines by rbi images information related to the anti money laundering guidelines by rbi keyword, you have visit the ideal site. Our website always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

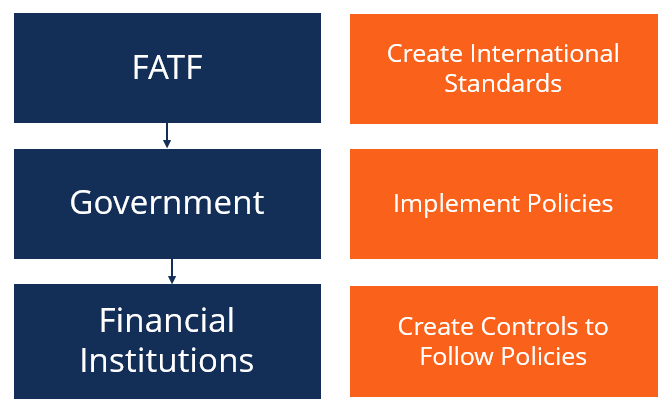

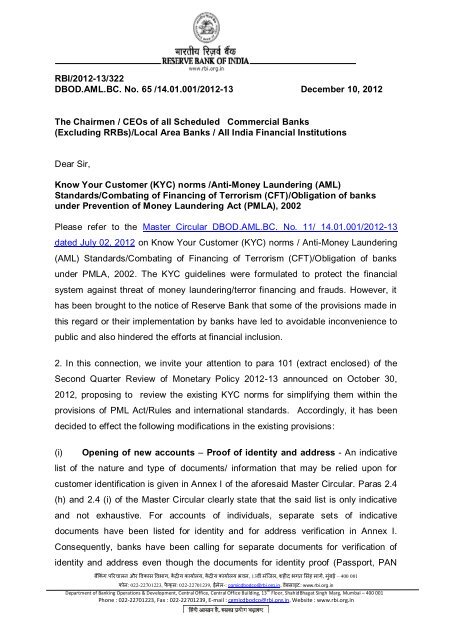

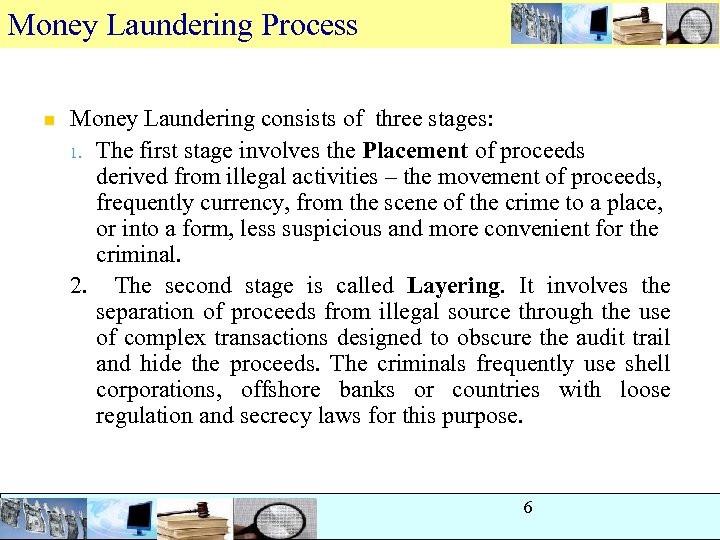

Anti Money Laundering Guidelines By Rbi. Previous instructions A list of circulars issued in this regard is given in Annex III. Similarly SEBI has also prescribed certain requirements relating to Know Your Customer KYC norms for the financial intermediaries in securities market to follow to combat money laundering. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and.

Anti Money Laundering Aml Learnings From Banks Ppt Video Online Download From slideplayer.com

Anti Money Laundering Aml Learnings From Banks Ppt Video Online Download From slideplayer.com

Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD. The policy was to lay down the systems and procedures to help control. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. 56 An intranet website on AML to share ideas experiences and case studies is in place.

The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board.

These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. Facilitating opening of bank accounts for flood affected persons. The Prevention of Money Laundering Act PMLA 2002 is an Act of the. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009. In view of the increased concerns regarding money laundering.

Source: slidetodoc.com

Source: slidetodoc.com

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. UBDPCBCirNo6 09161002005-06 dated August 3 2005. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. MoneyGram Compliance Manual and Xpress Money.

Source: authorstream.com

Source: authorstream.com

This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the. The Prevention of Money Laundering Act PMLA 2002 is an Act of the. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. Facilitating opening of bank accounts for flood affected persons.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Facilitating opening of bank accountsfor flood affected persons. Authorised Persons under Prevention of Money Laundering Act PMLA 2002 as amended by Prevention of Money Laundering Amendment Act 2009- Money changing activities Attention of Authorized persons is invited to the Anti-Money Laundering Guidelines governing money changing transactions issued vide AP. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. 56 An intranet website on AML to share ideas experiences and case studies is in place. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009.

Source: slideplayer.com

Source: slideplayer.com

Facilitating opening of bank accounts for flood affected persons. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the. Guidelines on Anti-Money Laundering AML Standards and Combating the Financing of Terrorism CFT Obligations of Securities Market Intermediaries under the Prevention of Money Laundering Act 2002 and Rules framed there under. Facilitating opening of bank accounts for flood affected persons.

Source: slidetodoc.com

Source: slidetodoc.com

In view of the increased concerns regarding money laundering. This Know Your Customer and Anti -Money Laundering P. The policy was to lay down the systems and procedures to help control. In view of the increased concerns regarding money laundering. Facilitating opening of bank accounts for flood affected persons.

RBI is one of such authority which lays down anti-money laundering guidelines for banks and other financial institutions to adhere to. Anti-Money Laundering training has been given the nature of the training and the names of the staff who have received the training. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. RBI is one of such authority which lays down anti-money laundering guidelines for banks and other financial institutions to adhere to. In view of the increased concerns regarding money laundering.

Source: yumpu.com

Source: yumpu.com

This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. UBDPCBCirNo6 09161002005-06 dated August 3 2005. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs.

UBDPCBCirNo6 09161002005-06 dated August 3 2005. Know Your Customer Guidelines - Anti-Money laundering Standards - UCBs. UBDPCBCirNo6 09161002005-06 dated August 3 2005. Know Your Customer Guidelines Anti-Money laundering Standards UCBs. Anti-Money Laundering training has been given the nature of the training and the names of the staff who have received the training.

Source: present5.com

Source: present5.com

UBDPCBCirNo6 09161002005-06 dated August 3 2005. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Know Your Customer KYC Guidelines Anti Money Laundering Standards Please refer to our circular DBOD. Customer and Anti-Money Laundering measures with the approval of the Board is formulated and put in place. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Guidelines on Anti-Money Laundering AML Standards and Combating the Financing of Terrorism CFT Obligations of Securities Market Intermediaries under the Prevention of Money Laundering Act 2002 and Rules framed there under. RBI is one of such authority which lays down anti-money laundering guidelines for banks and other financial institutions to adhere to. Know Your Customer Guidelines Anti-Money laundering Standards UCBs. Facilitating opening of bank accounts for flood affected persons. Similarly SEBI has also prescribed certain requirements relating to Know Your Customer KYC norms for the financial intermediaries in securities market to follow to combat money laundering.

UBDPCBCirNo6 09161002005-06 dated August 3 2005. Know Your Customer Guidelines Anti-Money laundering Standards UCBs. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. 56 An intranet website on AML to share ideas experiences and case studies is in place. The Prevention of Money Laundering Act PMLA 2002 is an Act of the.

Source: slideshare.net

Source: slideshare.net

This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. Facilitating opening of bank accounts for flood affected persons. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. These guidelines puts a duty on such intermediaries to enact policies and procedures to assist in the fight against money laundering which should include the communication of such group policies which relate to the anti-money laundering and illicit activities such as terrorist financing to all persons and employees involved in handling customer account information securities transactions client acceptance policy and CDD measures including requirements. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standardsPrevention of Money Laundering Act 2002 that are consolidated in the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering guidelines by rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas