13++ Anti money laundering guidelines insurance ideas in 2021

Home » about money loundering idea » 13++ Anti money laundering guidelines insurance ideas in 2021Your Anti money laundering guidelines insurance images are available in this site. Anti money laundering guidelines insurance are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering guidelines insurance files here. Download all free images.

If you’re searching for anti money laundering guidelines insurance pictures information connected with to the anti money laundering guidelines insurance keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

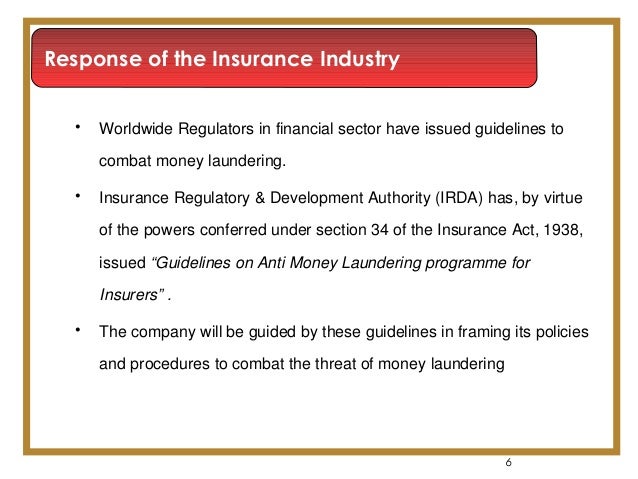

Anti Money Laundering Guidelines Insurance. Page 2 of 35 IAIS Guidance paper on anti-money laundering and 10. Supervise and develop the insurance industry has developed guidelines to combat money laundering and financing of terrorism in the insurance industry. March 31 2016 Revised. PURPOSE AND OVERVIEW OF THE GUIDELINES Money laundering ML has been defined as the process whereby criminals attempt.

Revised Central Bank Amla Guidelines Anti Money Laundering From yumpu.com

Revised Central Bank Amla Guidelines Anti Money Laundering From yumpu.com

Internationally initiatives to prevent the misuse of financial systems by persons laundering money and financing terrorism led. Each insurance supervisor should consider whether to issue this guidance paper andor its own guidance at least equivalent to the standards in this paper to insurers in its own jurisdiction. With compliance penalties including fines and prison terms life insurance firms should ensure they understand their obligations and how to implement them as part of their AML policy. An annuity contract other than a group annuity contract. To provide a further guide and to avoid ambiguity the Guideline on KYC is also provided to assist insurance practitioners in their implementation of these Guidelines. Accordingly governments and international authorities implement a range of anti-money laundering life insurance regulations and issue life insurance sanctions lists.

The program must be approved by senior management and made available to the Department of the Treasury or.

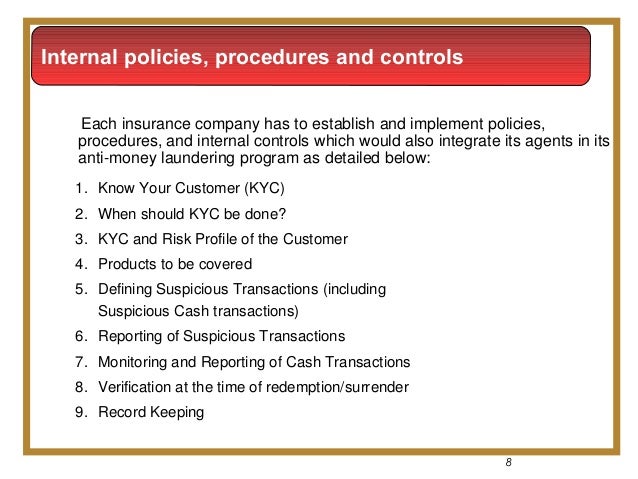

12 Insurers offer a variety of products aimed at transferring the financial risk of a certain event from the insured to the insurer. Guidelines on Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Insurance and Takaful Sector Page 3 PART A OVERVIEW 1. Each insurance supervisor should consider whether to issue this guidance paper andor its own guidance at least equivalent to the standards in this paper to insurers in its own jurisdiction. The final rule requires an insurance company that issues or underwrites covered products to develop and implement a written anti-money laundering program applicable to its covered products that is reasonably designed to prevent the insurance company from being used to facilitate money laundering. PURPOSE AND OVERVIEW OF THE GUIDELINES Money laundering ML has been defined as the process whereby criminals attempt. Page 2 of 35 IAIS Guidance paper on anti-money laundering and 10.

Source: slideshare.net

Source: slideshare.net

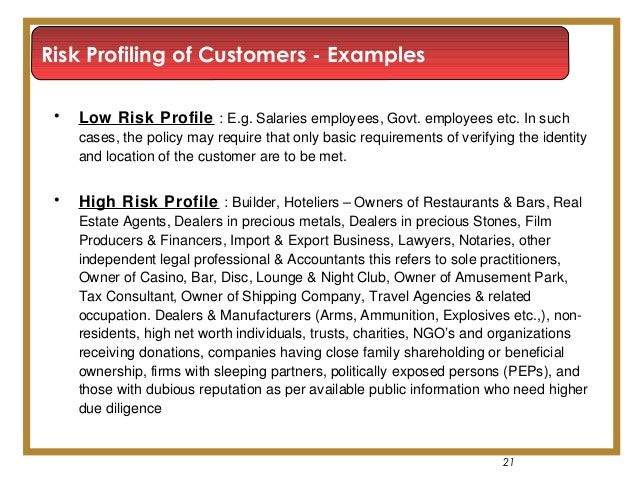

An annuity contract other than a group annuity contract. This places several. The FATF RBA Guidance for the Life Insurance Sector aims to support the. This approach enables them to focus their resources where the risks are higher. Provide guidance on the prevention of money laundering and countering the financing of terrorism.

Source: bi.go.id

Source: bi.go.id

12 Insurers offer a variety of products aimed at transferring the financial risk of a certain event from the insured to the insurer. Best practices on Anti-Money Laundering and the Combating of the Financing of TerrorismAMLCFT. These products include life insurance contracts annuity contracts non-life insurance. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. Supervise and develop the insurance industry has developed guidelines to combat money laundering and financing of terrorism in the insurance industry.

Source: yumpu.com

Source: yumpu.com

An annuity contract other than a group annuity contract. A permanent life insurance policy other than a group life insurance. The Financial Task Force FATF an intergovernmental regulatory body responsible for eradicating money laundering notes that even though most of the products under insurance companies may not be the initial target for money laundererscriminals they are still at risk of being a vehicle for laundering the money. PURPOSE AND OVERVIEW OF THE GUIDELINES Money laundering ML has been defined as the process whereby criminals attempt. A covered product includes.

Source:

This approach enables them to focus their resources where the risks are higher. A permanent life insurance policy other than a group life insurance. With compliance penalties including fines and prison terms life insurance firms should ensure they understand their obligations and how to implement them as part of their AML policy. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. PURPOSE AND OVERVIEW OF THE GUIDELINES Money laundering ML has been defined as the process whereby criminals attempt.

Source: slideshare.net

Source: slideshare.net

Introduction 11 Money laundering and terrorism financing MLTF continues to be an on-going threat which has the potential to adversely affect the. Intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. The FATF RBA Guidance for the Life Insurance Sector aims to support the. 12 Insurers offer a variety of products aimed at transferring the financial risk of a certain event from the insured to the insurer. Best practices on Anti-Money Laundering and the Combating of the Financing of TerrorismAMLCFT.

Source: infopro.com.my

Source: infopro.com.my

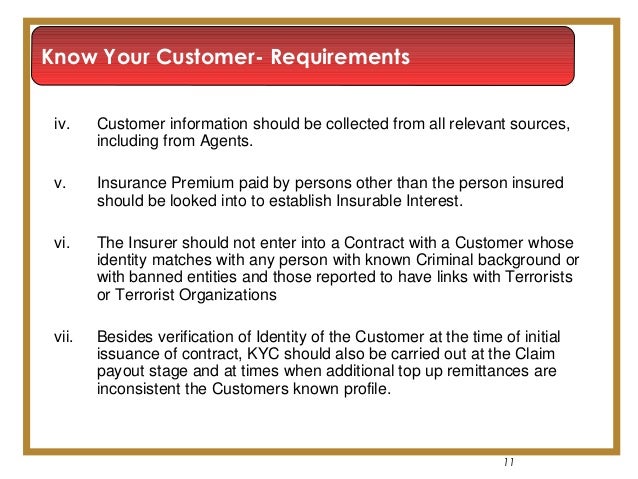

To provide a further guide and to avoid ambiguity the Guideline on KYC is also provided to assist insurance practitioners in their implementation of these Guidelines. Decided to put in place the following regulatory guidelinesinstructions to the Insurers and Brokers as part of an Anti Money Laundering Programme AML for the insurance sector. PURPOSE AND OVERVIEW OF THE GUIDELINES Money laundering ML has been defined as the process whereby criminals attempt. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. Hence the responsibility for guarding against insurance products being used to launder unlawfully derived funds or to finance terrorist acts lies on the insurance company which develops and bears the risks of its products.

Source: infopro.com.my

Source: infopro.com.my

Supervise and develop the insurance industry has developed guidelines to combat money laundering and financing of terrorism in the insurance industry. This approach enables them to focus their resources where the risks are higher. Introduction 11 Money laundering and terrorism financing MLTF continues to be an on-going threat which has the potential to adversely affect the. Decided to put in place the following regulatory guidelinesinstructions to the Insurers and Brokers as part of an Anti Money Laundering Programme AML for the insurance sector. Each insurance supervisor should consider whether to issue this guidance paper andor its own guidance at least equivalent to the standards in this paper to insurers in its own jurisdiction.

Source: slideshare.net

Source: slideshare.net

Intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. March 31 2016 Revised. A permanent life insurance policy other than a group life insurance. Guidelines on Anti-Money Laundering and Counter Financing of Terrorism AMLCFT Insurance and Takaful Sector Page 3 PART A OVERVIEW 1. Accordingly governments and international authorities implement a range of anti-money laundering life insurance regulations and issue life insurance sanctions lists.

Source: slideshare.net

Source: slideshare.net

This approach enables them to focus their resources where the risks are higher. Each insurance supervisor should consider whether to issue this guidance paper andor its own guidance at least equivalent to the standards in this paper to insurers in its own jurisdiction. Insurance companies are defined as a financial institution under the Bank Secrecy Act. These products include life insurance contracts annuity contracts non-life insurance. Intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

This places several. Decided to put in place the following regulatory guidelinesinstructions to the Insurers and Brokers as part of an Anti Money Laundering Programme AML for the insurance sector. Intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. The FATF RBA Guidance for the Life Insurance Sector aims to support the. To provide a further guide and to avoid ambiguity the Guideline on KYC is also provided to assist insurance practitioners in their implementation of these Guidelines.

Source: slideshare.net

Source: slideshare.net

Best practices on Anti-Money Laundering and the Combating of the Financing of TerrorismAMLCFT. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. Certain of their anti-money laundering AML and counter-terrorist financing CFT obligations. Hence the responsibility for guarding against insurance products being used to launder unlawfully derived funds or to finance terrorist acts lies on the insurance company which develops and bears the risks of its products. Page 2 of 35 IAIS Guidance paper on anti-money laundering and 10.

Source: slideplayer.com

Source: slideplayer.com

To provide a further guide and to avoid ambiguity the Guideline on KYC is also provided to assist insurance practitioners in their implementation of these Guidelines. Intermediaries identify assess and understand the money laundering and terrorist financing MLTF risks to which they are exposed and implement the most appropriate mitigation measures. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. An annuity contract other than a group annuity contract. The final rule requires an insurance company that issues or underwrites covered products to develop and implement a written anti-money laundering program applicable to its covered products that is reasonably designed to prevent the insurance company from being used to facilitate money laundering.

Source:

Each supervisor is responsible for issuing appropriate AMLCFT guidance. This approach enables them to focus their resources where the risks are higher. Best practices on Anti-Money Laundering and the Combating of the Financing of TerrorismAMLCFT. A permanent life insurance policy other than a group life insurance. These products include life insurance contracts annuity contracts non-life insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering guidelines insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information