18++ Anti money laundering guidelines rbi information

Home » about money loundering idea » 18++ Anti money laundering guidelines rbi informationYour Anti money laundering guidelines rbi images are available. Anti money laundering guidelines rbi are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering guidelines rbi files here. Get all royalty-free vectors.

If you’re searching for anti money laundering guidelines rbi images information connected with to the anti money laundering guidelines rbi keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

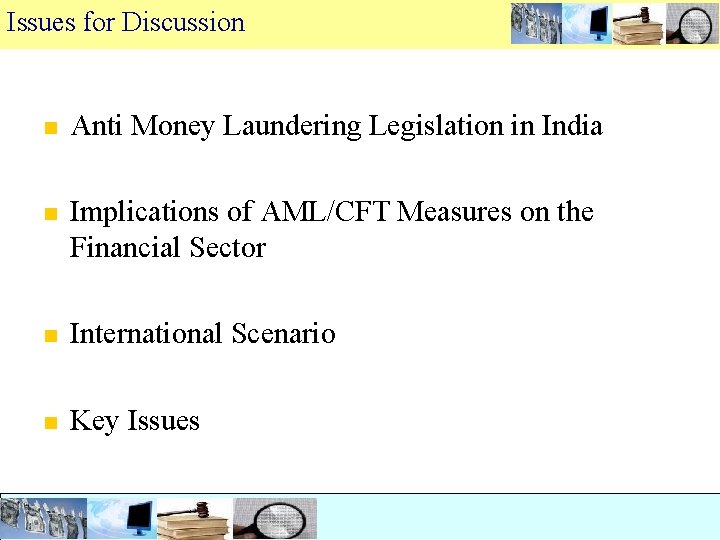

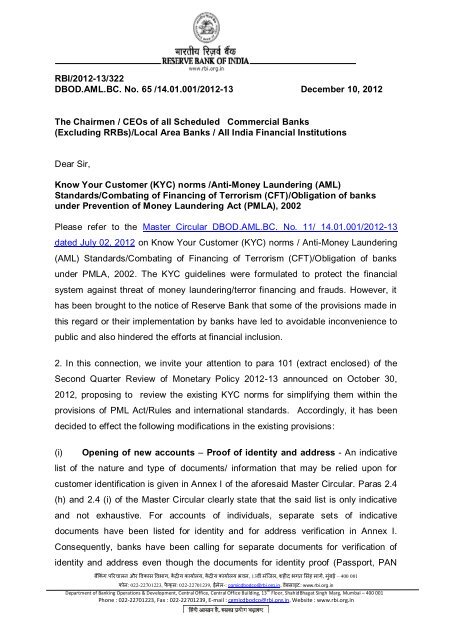

Anti Money Laundering Guidelines Rbi. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. Know Your Customer and Anti-Money Laundering measures is formulated and put in place with the approval of the Board within three months of the date of this circular. This Know Your Customer and Anti -Money Laundering P.

CAME professionals are the first line of defense to combat money laundering. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. This Master Circular consolidates all the guidelines issued by Reserve Bank of India on KYCAMLCFT norms up to June 30 2008. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. The policy was to lay down the systems and procedures to help control.

Previous instructions A list of circulars issued in this regard is given in Annex III.

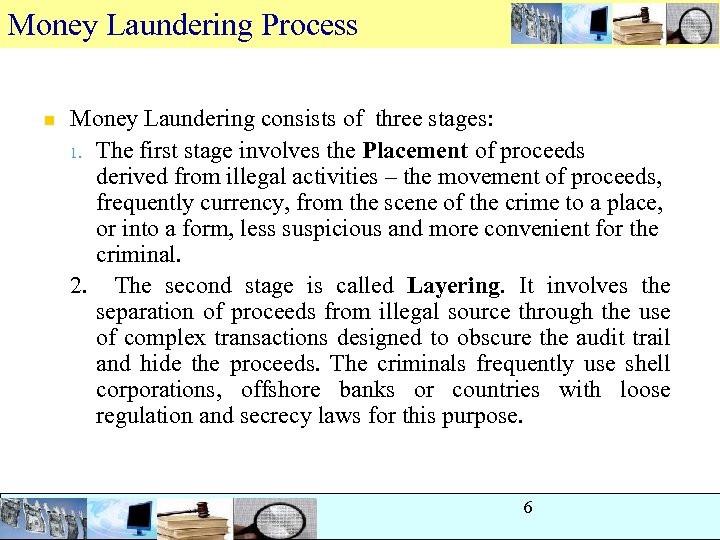

The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment. Anti-Money Laundering AML Fraud Management Cybercrime How RBI Plans to Curb Money Laundering EYs Vikram Babbar on RBIs Guidelines to Tackle Money Laundering Suparna Goswami gsuparna June 10 2021. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. The SEBI anti money laundering Guidelines have been.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Facilitating opening of bank accountsfor flood affected persons. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. RBI ANTI-MONEY LAUNDERING GUIDELINES FOR AMCs MONEY CHANGING BUSINESS Reserve Bank of India has brought out detailed Anti-Money Laundering AML Guidelines to enable the AMCs to put in place the policy framework and systems for prevention of money laundering while undertaking money changing transactions. Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs.

Source: slideshare.net

Source: slideshare.net

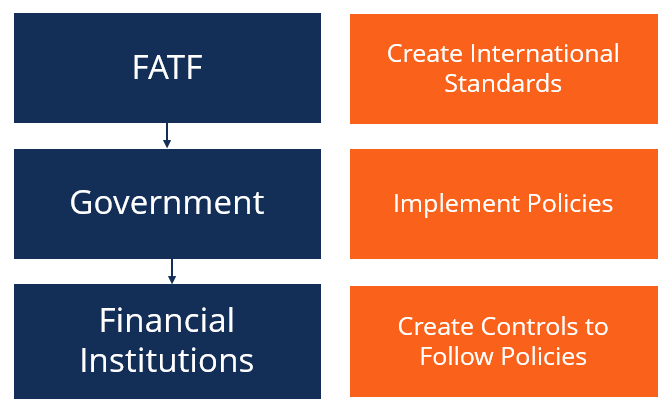

Know Your Customer KYC Guidelines - Anti-Money Laundering Standards - UCBs. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. Financial Institutions should remain compliant with guidelines laid down by Financial Action Task Force FATF. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009. This Master Circular consolidates all the guidelines issued by Reserve Bank of India on KYCAMLCFT norms up to June 30 2008.

Reserve Bank of India has issued regulatory guidelines on Know Your Customer KYC norms Anti Money Laundering AML Standards Combating of Financing of Terrorism CFT from time to time. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. This Master Circular consolidates all the guidelines issued by Reserve Bank of India on KYCAMLCFT norms up to June 30 2008. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Source: slidetodoc.com

Source: slidetodoc.com

With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD CC No. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. ANTI-MONEY LAUNDERING Prevention of Money Laundering Act 2002 KNOW YOUR CUSTOMER KYC Policy GUIDELINES IN BANK 3 4. This Master Circular consolidates all the guidelines issued by Reserve Bank of India on KYCAMLCFT norms up to June 30 2008. This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standardsCombating Financing of Terrorism CFTObligations of banks under PMLA 2002. The SEBI anti money laundering Guidelines have been. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. CAME professionals are the first line of defense to combat money laundering. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1.

Source: authorstream.com

Source: authorstream.com

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. NBFCs were advised to ensure that they are fully compliant with the instructions before December 31 2005. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1.

Source: slideserve.com

Source: slideserve.com

This policy document gives an overview on the standards issued by the Reserve Bank of India RBI on the Know your Customer and Anti Money Laundering for Non-Banking Financial Companies thereby setting standards for prevention of money laundering activities and corporate practises while dealing with their customers. Reserve Bank of India has issued regulatory guidelines on Know Your Customer KYC norms Anti Money Laundering AML Standards Combating of Financing of Terrorism CFT from time to time. This Master Circular consolidates all the guidelines issued by Reserve Bank of India on KYCAMLCFT norms up to June 30 2008. The policy was to lay down the systems and procedures to help control. This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards.

Source: slidetodoc.com

Source: slidetodoc.com

The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. The Reserve Bank of India RBI in consultation with the relevant government portfolios is in charge of prescribing the relevant procedure and manner for providing and maintaining the above-mentioned information. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1. NBFCs were advised to ensure that they are fully compliant with the instructions before December 31 2005.

Source: slideplayer.com

Source: slideplayer.com

The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. Reserve Bank of India has issued regulatory guidelines on Know Your Customer KYC norms Anti Money Laundering AML Standards Combating of Financing of Terrorism CFT from time to time. There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India. This has resulted in the implementation of rules on top of the statute.

This has resulted in the implementation of rules on top of the statute. With a view to preventing NBFCs from being used intentionally or unintentionally by criminal elements for money laundering or terrorist financing activities Reserve Bank of India had issued guidelines on Know Your Customer KYC normsAnti-Money Laundering AML standards Prevention of Money Laundering Act 2002 that are consolidated in the Master Circular DNBS PD CC No. In view of the increased concerns regarding money laundering. This has resulted in the implementation of rules on top of the statute. The SEBI anti money laundering Guidelines have been.

Source: present5.com

Source: present5.com

There square measure 3 major steps in concealment placement layering and integration and varied controls square measure place in situ to watch suspicious activity that might be concerned in concealment. Anti-Money Laundering AML Fraud Management Cybercrime How RBI Plans to Curb Money Laundering EYs Vikram Babbar on RBIs Guidelines to Tackle Money Laundering Suparna Goswami gsuparna June 10 2021. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. The policy was to lay down the systems and procedures to help control.

Source: yumpu.com

Source: yumpu.com

This Master Circular aims at consolidating all the instructionsguidelines issued by RBI on Know Your Customer KYC normsAnti-Money Laundering AML standards. This Know Your Customer and Anti -Money Laundering P. In view of the increased concerns regarding money laundering. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1.

Source: slidetodoc.com

Source: slidetodoc.com

Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money. Know Your Customer and Anti-Money Laundering measures is formulated and put in place with the approval of the Board within three months of the date of this circular. In this regard banks may use for guidance in their own risk assessment a Report on Parameters for Risk-Based Transaction Monitoring RBTM dated March 30 2011 issued by Indian Banks Association on May 18 2011 as a supplement to their guidance note on Know Your Customer KYC norms Anti-Money Laundering AML standards issued in July 2009. Guidelines on Know Your Customer norms And Anti-Money Laundering Measures Know Your Customer Standards 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering guidelines rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information