19+ Anti money laundering high risk countries info

Home » about money loundering idea » 19+ Anti money laundering high risk countries infoYour Anti money laundering high risk countries images are available. Anti money laundering high risk countries are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering high risk countries files here. Find and Download all royalty-free images.

If you’re searching for anti money laundering high risk countries images information linked to the anti money laundering high risk countries keyword, you have pay a visit to the right site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Anti Money Laundering High Risk Countries. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. Per its February 25 2021 statement the FATFs February 2020 High-Risk Jurisdictions Subject to a Call for Action statement remains in effect5 The February 2020 statement called upon its members and urged all jurisdictions to impose countermeasures on Iran and the Democratic Peoples Republic of Korea DPRK to protect the international financial system from the significant strategic. Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. New delegated act on high-risk third countries.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

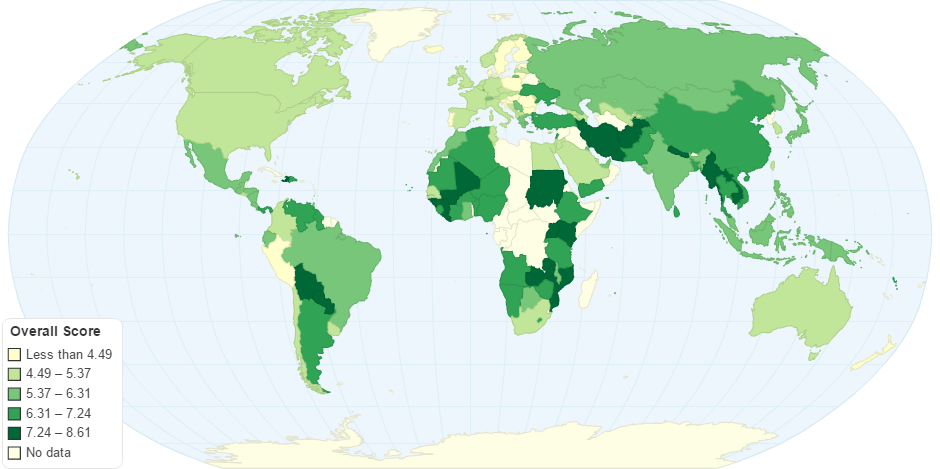

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. Ranking countries according to their risk of money laundering and terrorist financing MLTF. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. High-Risk Third Countries Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. Background and current high risk countries As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group.

The 24 high-risk third countries are. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing. Per its February 25 2021 statement the FATFs February 2020 High-Risk Jurisdictions Subject to a Call for Action statement remains in effect5 The February 2020 statement called upon its members and urged all jurisdictions to impose countermeasures on Iran and the Democratic Peoples Republic of Korea DPRK to protect the international financial system from the significant strategic. Of these 68 55 have since made the necessary reforms to address their AMLCFT weaknesses and have been removed from the process see also an overview of. As a result organizations must implement anti-money laundering AML and counter-terrorism financing CTF procedures to detect and prevent these illegal activities. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The high risk countries are. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. As of October 2018 the FATF has reviewed over 80 countries and publicly identified 68 of them.

Source: bi.go.id

Source: bi.go.id

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The top 10 countries with the highest AML risk are Afghanistan 816 Haiti 815 Myanmar 786 Laos 782 Mozambique 782 Cayman Islands 764 Sierra Leone 751 Senegal 730 Kenya 718 Yemen 712.

5AMLD 5th Anti-Money Laundering Directive. Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. New delegated act on high-risk third countries. Ranking countries according to their risk of money laundering and terrorist financing MLTF.

Source: thepaypers.com

Source: thepaypers.com

Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. Has listed Cambodia as one of 12 high-risk countries with deficient anti-money laundering and counter-terrorism financing efforts but the government on Friday said officials were working hard to get the nation off international watch lists. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders. It provides risk scores based on the quality of a countrys anti-money laundering and countering the financing of terrorism AMLCFT framework and related factors such as perceived levels of corruption financial. Per its February 25 2021 statement the FATFs February 2020 High-Risk Jurisdictions Subject to a Call for Action statement remains in effect5 The February 2020 statement called upon its members and urged all jurisdictions to impose countermeasures on Iran and the Democratic Peoples Republic of Korea DPRK to protect the international financial system from the significant strategic.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

Of these 68 55 have since made the necessary reforms to address their AMLCFT weaknesses and have been removed from the process see also an overview of. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. While money laundering and terrorist financing is a risk anytime money is exchanged there are industries where the risk is significantly higher. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing.

Ranking countries according to their risk of money laundering and terrorist financing MLTF. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. It provides risk scores based on the quality of a countrys anti-money laundering and countering the financing of terrorism AMLCFT framework and related factors such as perceived levels of corruption financial. 5AMLD 5th Anti-Money Laundering Directive. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018.

Source: bi.go.id

Source: bi.go.id

While money laundering and terrorist financing is a risk anytime money is exchanged there are industries where the risk is significantly higher. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing. As a result organizations must implement anti-money laundering AML and counter-terrorism financing CTF procedures to detect and prevent these illegal activities. The top 10 countries with the highest AML risk are Afghanistan 816 Haiti 815 Myanmar 786 Laos 782 Mozambique 782 Cayman Islands 764 Sierra Leone 751 Senegal 730 Kenya 718 Yemen 712. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders.

Source: ec.europa.eu

Source: ec.europa.eu

Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. It provides risk scores based on the quality of a countrys anti-money laundering and countering the financing of terrorism AMLCFT framework and related factors such as perceived levels of corruption financial. Ranking countries according to their risk of money laundering and terrorist financing MLTF. Has listed Cambodia as one of 12 high-risk countries with deficient anti-money laundering and counter-terrorism financing efforts but the government on Friday said officials were working hard to get the nation off international watch lists. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

5AMLD 5th Anti-Money Laundering Directive. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing. Of these 68 55 have since made the necessary reforms to address their AMLCFT weaknesses and have been removed from the process see also an overview of. Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. Background and current high risk countries As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

Source: complyadvantage.com

Source: complyadvantage.com

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. Per its February 25 2021 statement the FATFs February 2020 High-Risk Jurisdictions Subject to a Call for Action statement remains in effect5 The February 2020 statement called upon its members and urged all jurisdictions to impose countermeasures on Iran and the Democratic Peoples Republic of Korea DPRK to protect the international financial system from the significant strategic. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders.

Source: bi.go.id

Source: bi.go.id

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Institutions for example are prohibited entirely from engaging in financial transactions with North Korea under the North Korea Sanctions program Section 311 of the USA PATRIOT Act and several Executive Orders. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The top 10 countries with the highest AML risk are Afghanistan 816 Haiti 815 Myanmar 786 Laos 782 Mozambique 782 Cayman Islands 764 Sierra Leone 751 Senegal 730 Kenya 718 Yemen 712. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018.

Source: yumpu.com

Source: yumpu.com

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. As of October 2018 the FATF has reviewed over 80 countries and publicly identified 68 of them. For financial institutions operating in countries that are members of the FATF financial relationships with high-risk countries could result in legal action. The top 10 countries with the highest AML risk are Afghanistan 816 Haiti 815 Myanmar 786 Laos 782 Mozambique 782 Cayman Islands 764 Sierra Leone 751 Senegal 730 Kenya 718 Yemen 712. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing.

Source: pinterest.com

Source: pinterest.com

The 24 high-risk third countries are. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. Background and current high risk countries As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie. The 24 high-risk third countries are.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering high risk countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information