15+ Anti money laundering high risk customer types info

Home » about money loundering Info » 15+ Anti money laundering high risk customer types infoYour Anti money laundering high risk customer types images are ready. Anti money laundering high risk customer types are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering high risk customer types files here. Find and Download all free photos and vectors.

If you’re searching for anti money laundering high risk customer types images information connected with to the anti money laundering high risk customer types keyword, you have visit the right site. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

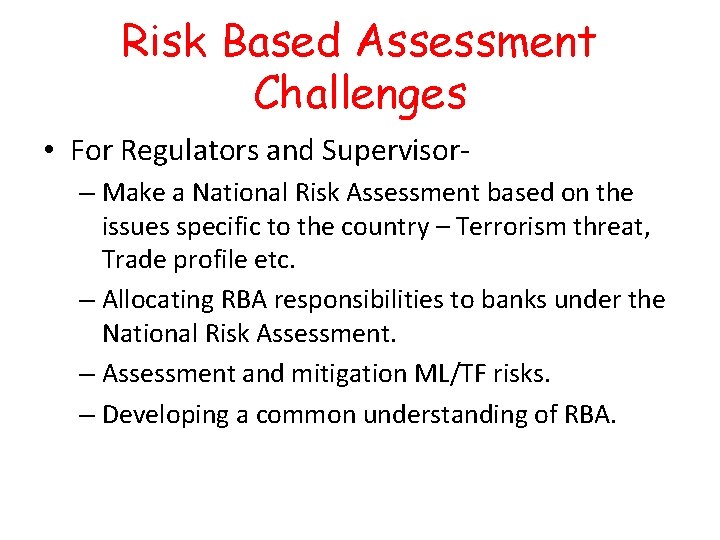

Anti Money Laundering High Risk Customer Types. The alternative risk range should generally be five levels. Many indicators are used such as customer types used during the risk assessment and geography risks. Similarly the following entities tend to be higher risk. This situation presents a higher risk of money laundering or terrorist financing because the money you receive will be a bulk transfer representing a collection of underlying transactions.

Https Www Anti Moneylaundering Org Document Default Aspx Documentuid F0eb992e 3a77 4395 A57b 1e64e85bb4e4 From

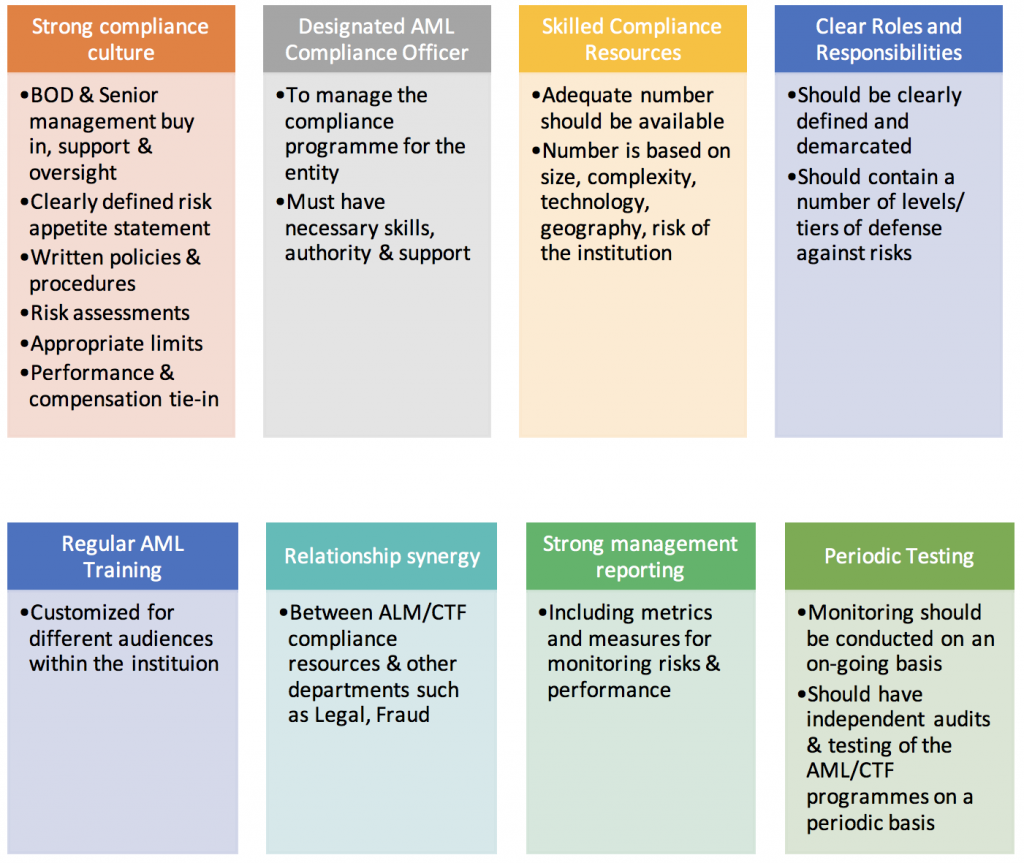

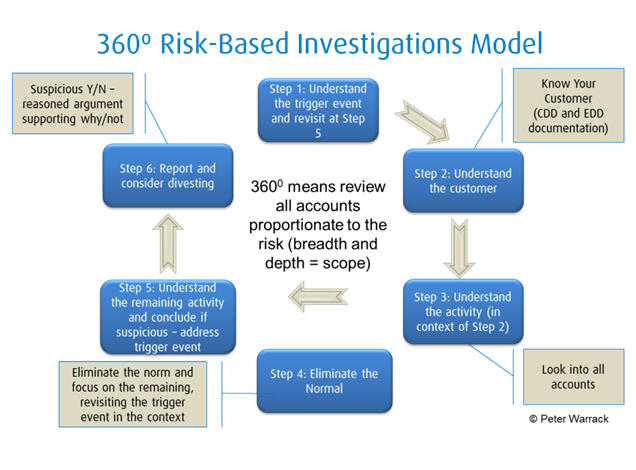

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. As a result the gaming and gambling industry can adapt to AML OFAC compatibility programs. Vulnerable to money laundering and terrorist financing MLTF risks and helps in the judicious and efficient allocation of resources to create a robust AML and CFT compliance programme. New customers carrying out large one-off transactions a customer whos been introduced to you - because. Similarly the following entities tend to be higher risk. This includes remote banking and payment services as well as currency exchanges and real estate transactions where the buyer is not present.

Financial institutions are directed to consider the following when assessing money-laundering risks of customers.

Many indicators are used such as customer types used during the risk assessment and geography risks. Risk classification is an important parameter of the risk based kyc approach. Occupation or nature of business. As a part of the assessment banks and FIs are required to carry out. Foreign financial institutions including not just banks but also other sources of foreign money such as foreign money services providers or foreign currency exchangers. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

These indicators can reduce money laundering and terrorist financing in gaming and gambling businesses. As a part of the assessment banks and FIs are required to carry out. Customer Due Diligence CDD. Some anti-money laundering controls include knowing your customers. Occupation or nature of business.

Source: en.ppt-online.org

Source: en.ppt-online.org

Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Foreign financial institutions including not just banks but also other sources of foreign money such as foreign money services providers or foreign currency exchangers. This includes remote banking and payment services as well as currency exchanges and real estate transactions where the buyer is not present. Occupation or nature of business. Smaller banks viewed as high risk by at least four countries and that have been investigated for material AML breaches in at least one may also qualify for AMLA oversight as may large money services business and other non-bank financial institutions that operate in at least 10 EU nations and engage in sufficiently risky commerce.

Source: ec.europa.eu

Source: ec.europa.eu

These indicators can reduce money laundering and terrorist financing in gaming and gambling businesses. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Nonresidents foreign customers or accounts for the benefit of people outside the country. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk.

Source: slideplayer.com

Source: slideplayer.com

As a result the gaming and gambling industry can adapt to AML OFAC compatibility programs. Customers in these categories can pose an inherently high risk for money laundering. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Occupation or nature of business. Foreign financial institutions including not just banks but also other sources of foreign money such as foreign money services providers or foreign currency exchangers.

Source: protiviti.com

Source: protiviti.com

Low medium and high. Customers that might pose a risk Your business might be at risk of money laundering from. Risk classification is an important parameter of the risk based kyc approach. These indicators can reduce money laundering and terrorist financing in gaming and gambling businesses. CDD is a basic type of KYC procedure where a customers data like proof of identity and address is collected and used to evaluate the customers risk profile.

Source: slidetodoc.com

Source: slidetodoc.com

Similarly the following entities tend to be higher risk. CDD may have identified a handful of customers perceived to have a higher risk for example. If the entity is a government organisation that has its own AML compliance processes in place it may be flagged as low risk whereas a business where a high-ranking politician has beneficial ownership may be flagged as high risk. Prior experience with and knowledge of customer and hisherits transactions. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Nonresidents foreign customers or accounts for the benefit of people outside the country. Financial institutions are directed to consider the following when assessing money-laundering risks of customers. High-risk customers including politically exposed persons. The premise behind the effort is clear. Nonresidents foreign customers or accounts for the benefit of people outside the country.

Source: acamstoday.org

Source: acamstoday.org

Customers identity Socialfinancial status Nature of. Method channel of account opening eg. Smaller banks viewed as high risk by at least four countries and that have been investigated for material AML breaches in at least one may also qualify for AMLA oversight as may large money services business and other non-bank financial institutions that operate in at least 10 EU nations and engage in sufficiently risky commerce. Crypto and virtual currencies have opened the door to new methods of laundering funds. Identifying the money laundering risks that are relevant to the business.

Source:

Cryptovirtual currency and money laundering. High-risk customers including politically exposed persons. Carrying out a detailed risk assessment of the business including delivery channels products and locations Completing a risk assessment of all customers including types transactions customer behaviour. Cryptovirtual currency and money laundering. This situation presents a higher risk of money laundering or terrorist financing because the money you receive will be a bulk transfer representing a collection of underlying transactions.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

These indicators can reduce money laundering and terrorist financing in gaming and gambling businesses. Some anti-money laundering controls include knowing your customers. Similarly the following entities tend to be higher risk. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Prior experience with and knowledge of customer and hisherits transactions.

Source: yumpu.com

Source: yumpu.com

As a part of the assessment banks and FIs are required to carry out. CDD is a basic type of KYC procedure where a customers data like proof of identity and address is collected and used to evaluate the customers risk profile. Some anti-money laundering controls include knowing your customers. Understanding risk within the Recommendation 12 context is important for two reasons. Smaller banks viewed as high risk by at least four countries and that have been investigated for material AML breaches in at least one may also qualify for AMLA oversight as may large money services business and other non-bank financial institutions that operate in at least 10 EU nations and engage in sufficiently risky commerce.

Source: veriff.com

Source: veriff.com

Firms should conduct enhanced due diligence EDD and enhanced ongoing monitoring in higher-risk situations. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management. The alternative risk range should generally be five levels. Prior experience with and knowledge of customer and hisherits transactions. Occupation or nature of business.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As a result the gaming and gambling industry can adapt to AML OFAC compatibility programs. Similarly the following entities tend to be higher risk. Customers that might pose a risk Your business might be at risk of money laundering from. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Some anti-money laundering controls include knowing your customers.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering high risk customer types by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas