18++ Anti money laundering in insurance sector ideas in 2021

Home » about money loundering idea » 18++ Anti money laundering in insurance sector ideas in 2021Your Anti money laundering in insurance sector images are available. Anti money laundering in insurance sector are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering in insurance sector files here. Find and Download all royalty-free vectors.

If you’re searching for anti money laundering in insurance sector pictures information connected with to the anti money laundering in insurance sector keyword, you have pay a visit to the right blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Anti Money Laundering In Insurance Sector. Most life insurance firms offer. Rules and Regulations in the Insurance Sector About Money Laundering The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. 44 hereinafter the Regulation which implements Legislative Decree n. Instant industry overview Market sizing forecast key players trends.

Kyc For Insurance Companies Prevent Fraud And Ensure Aml Compliance Getid From getid.ee

Kyc For Insurance Companies Prevent Fraud And Ensure Aml Compliance Getid From getid.ee

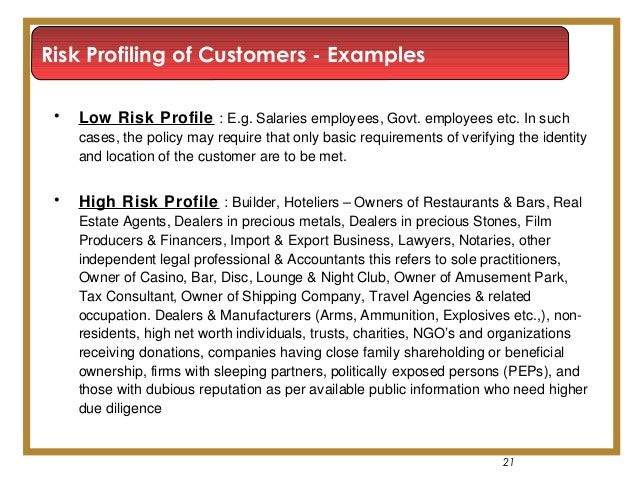

Money laundering in insurance sector. Life and General Insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Ad Unlimited access to Insurance market reports on 180 countries. Risk-based approach to combating money laundering and terrorist financing. An annuity contract other than a group annuity contract. 13 The obligation to establish an anti-money laundering program applies to an insurance company and not to its agents and other intermediaries.

5549 on prevention of laundering proceeds of crime The main components of this compliance program are the identification of the customers and reporting of suspicious transactions.

5549 on prevention of laundering proceeds of crime The main components of this compliance program are the identification of the customers and reporting of suspicious transactions. On 15 February 2019 the Italian Institute for Insurance Supervision IVASS published the Regulation n. Rules and Regulations in the Insurance Sector About Money Laundering The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. So they effectively laundered their money several times. They subsequently made a fraudulent claim against the policy. An annuity contract other than a group annuity contract.

Source:

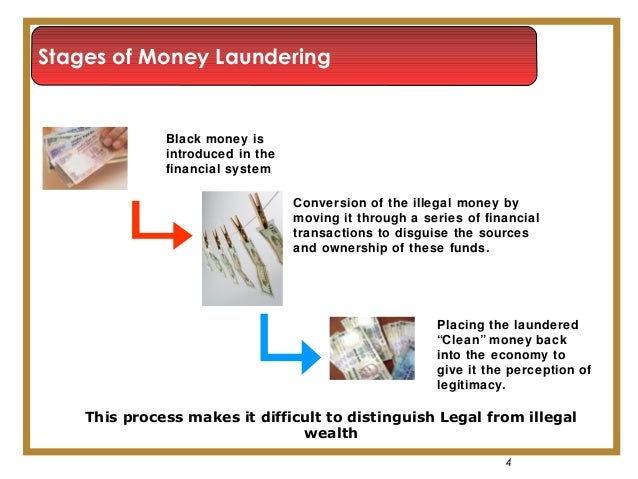

The process of money laundering involves going through different stages that may not be as highly associated with the insurance companies as compared to other financial sectors. Framework for identifying assessing and understanding MLTF risks within the insurance sector using a riskbased approach. Money laundering in insurance sector. Instant industry overview Market sizing forecast key players trends. Rules and Regulations in the Insurance Sector About Money Laundering The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place.

Source: slideshare.net

Source: slideshare.net

Anti Money Laundering AML in the Insurance Sector. Money Laundering in the Insurance Industry. The AML regulations involve both transaction monitoring and sanctions screening obligation. Anti Money Laundering AML in the Insurance Sector. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem.

Source: acamstoday.org

Source: acamstoday.org

In this white paper we explore key risks mitigating measures and critical considerations for the design implementation and improvement of. Anti Money Laundering AML in the Insurance Sector. That language also authorises countries to permit life insurance companies and intermediaries to use a risk-based approach to discharging certain of their anti-money laundering. 5549 on prevention of laundering proceeds of crime The main components of this compliance program are the identification of the customers and reporting of suspicious transactions. Notwithstanding decades of legislative and regulatory focus on anti-money laundering AML and combating the financing of terrorism CFT across the globe financial institutions continue to struggle to meet compliance expectations.

Source: getid.ee

Source: getid.ee

That being said firms in the insurance sector still have a responsibility to implement measures against financial crime and they are subject to the Proceeds of Crime Act 2002. That being said firms in the insurance sector still have a responsibility to implement measures against financial crime and they are subject to the Proceeds of Crime Act 2002. Globally the insurance sector has reported exposure to financial crime. Rules and Regulations in the Insurance Sector About Money Laundering The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. Anti Money Laundering AML in the Insurance Sector.

Source: slideshare.net

Source: slideshare.net

An annuity contract other than a group annuity contract. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Money laundering in insurance sector. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Ad Unlimited access to Insurance market reports on 180 countries.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

That being said firms in the insurance sector still have a responsibility to implement measures against financial crime and they are subject to the Proceeds of Crime Act 2002. Is the insurance sector subject to money laundering regulations. In a case involving general insurance the criminals used dirty money to purchase a general insurance policy to insure some high-value goods. Money laundering in insurance sector. A study conducted by PWC in 2018 revealed that 62 of the examinees had been vulnerable to financial fraud in the previous two years.

Source: slideshare.net

Source: slideshare.net

A covered product includes. In the UK insurers and insurance brokers are not lawfully subject to official money laundering regulations. In order to mitigate the risk of money laundering the insurance sector in Turkey is implementing the compliance program of Turkish Law No. The AML regulations involve both transaction monitoring and sanctions screening obligation. Instant industry overview Market sizing forecast key players trends.

Source: slideshare.net

Source: slideshare.net

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Is the insurance sector subject to money laundering regulations. That language also authorises countries to permit life insurance companies and intermediaries to use a risk-based approach to discharging certain of their anti-money laundering. Insurance companies are defined as a. Hence the responsibility for guarding against insurance products being used to launder unlawfully derived funds or to finance terrorist acts lies on the insurance company which develops and bears the risks of its products.

Source: infopro.com.my

Source: infopro.com.my

The process of money laundering involves going through different stages that may not be as highly associated with the insurance companies as compared to other financial sectors. 5549 on prevention of laundering proceeds of crime The main components of this compliance program are the identification of the customers and reporting of suspicious transactions. Money Laundering in the Insurance Industry. Life and General Insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Next to banks or deposit institutions the insurance sector was implicated in 64 of the cases reviewed6.

Source: slideshare.net

Source: slideshare.net

Money laundering in insurance sector. Life and General Insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Ad Unlimited access to Insurance market reports on 180 countries. Hence the responsibility for guarding against insurance products being used to launder unlawfully derived funds or to finance terrorist acts lies on the insurance company which develops and bears the risks of its products. Notwithstanding decades of legislative and regulatory focus on anti-money laundering AML and combating the financing of terrorism CFT across the globe financial institutions continue to struggle to meet compliance expectations.

Source: researchgate.net

Source: researchgate.net

So they effectively laundered their money several times. Risk-based approach to combating money laundering and terrorist financing. In this white paper we explore key risks mitigating measures and critical considerations for the design implementation and improvement of. An annuity contract other than a group annuity contract. A study conducted by PWC in 2018 revealed that 62 of the examinees had been vulnerable to financial fraud in the previous two years.

Source: infopro.com.my

Source: infopro.com.my

Notwithstanding decades of legislative and regulatory focus on anti-money laundering AML and combating the financing of terrorism CFT across the globe financial institutions continue to struggle to meet compliance expectations. Globally the insurance sector has reported exposure to financial crime. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Risk-based approach to combating money laundering and terrorist financing.

Source: alten.com

Source: alten.com

In a case involving general insurance the criminals used dirty money to purchase a general insurance policy to insure some high-value goods. On 15 February 2019 the Italian Institute for Insurance Supervision IVASS published the Regulation n. In the Insurance Sector. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. To counter the persistence of the crimes global anti-money laundering AML regulations have been forced to adapt faster than ever before.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering in insurance sector by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information