11++ Anti money laundering in simple terms information

Home » about money loundering Info » 11++ Anti money laundering in simple terms informationYour Anti money laundering in simple terms images are ready. Anti money laundering in simple terms are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering in simple terms files here. Find and Download all royalty-free photos.

If you’re searching for anti money laundering in simple terms pictures information connected with to the anti money laundering in simple terms topic, you have come to the right blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Anti Money Laundering In Simple Terms. FINRA reviews a firms compliance with AML rules under FINRA Rule. The sources of the money in precise are criminal and the money is invested in a manner that makes it. From drug trafficking and making it seem that the proceeds are legal. AML laws require that financial instutions report any financial crime they detect to relevant regulators.

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

From drug trafficking and making it seem that the proceeds are legal. Terrorist financing means the financing and supporting of an act of terrorism and commissioning thereof. Criminals do money laundering to make it hard for the police to find out where the criminal got the money. What is Anti-Money Laundering in simple terms Anti-money laundering AML refers to a collection of policies rules and regulations aimed at preventing the illicit generation of profits. -Money laundering is essential for criminal organisations that wish to use illegally obtained money effectively. Anti-Money Laundering is when criminal proceeds are taken and their illegal source is disguised to fund legal or illegal activities.

Dealing in large amounts of illegal cash is inefficient and dangerous.

Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Money laundering in simple terms is the process of taking illegally-obtained proceeds acquired eg. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. The AMLA investigates money laundering and other financial crimes to protect financial institutions and deter criminals from making the Philippines a money laundering site for criminal proceeds. AML laws require that financial instutions report any financial crime they detect to relevant regulators. From drug trafficking and making it seem that the proceeds are legal.

Source: ssbm.ch

Source: ssbm.ch

The Anti-Money Laundering Act of 2001 AMLA is the primary AMLCFT law in the Philippines. Agustus 08 2021 The idea of money laundering is essential to be understood for those working within the financial sector. The Anti-Money Laundering Act of 2001 AMLA is the primary AMLCFT law in the Philippines. The taking of additional measures where appropriate to prevent money laundering or terrorist financing in relation to products and services that favour anonymity. Anti-Money Laundering AML Policy With Template Follow our expert advice on an effective AML strategy To defend the market from criminal enterprises drug dealers corrupt public officials and terrorists governments came up with a counter-move defensive regulatory AML and KYC policy that has to be adopted by all financial businesses.

Source: bi.go.id

Source: bi.go.id

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. Taking appropriate steps to assess and if necessary mitigate the risk of money laundering and. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Anti-Money Laundering AML Policy With Template Follow our expert advice on an effective AML strategy To defend the market from criminal enterprises drug dealers corrupt public officials and terrorists governments came up with a counter-move defensive regulatory AML and KYC policy that has to be adopted by all financial businesses.

Dealing in large amounts of illegal cash is inefficient and dangerous. Money laundering is where you have money from an illegitimate source eg sale of drugs or illegal arms kidnapping ransoms etc and you place it into the money system. What Is Anti Money Laundering In Simple Terms. Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act BSA of 1970 and the more recent USA Patriot Act. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering.

Source: youtube.com

Source: youtube.com

To learn more about 6AMLD you can read the blog Expected Changes For Sixth Anti-Money Laundering Directive 6AMLD FinCENs 2020 AML Updates. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. From drug trafficking and making it seem that the proceeds are legal.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The sources of the money in precise are criminal and the money is invested in a manner that makes it. Taking appropriate steps to assess and if necessary mitigate the risk of money laundering and. The Anti-Money Laundering Act of 2001 AMLA is the primary AMLCFT law in the Philippines. The taking of additional measures where appropriate to prevent money laundering or terrorist financing in relation to products and services that favour anonymity. Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act BSA of 1970 and the more recent USA Patriot Act.

Source: shuftipro.com

Source: shuftipro.com

Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act BSA of 1970 and the more recent USA Patriot Act. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. What Is Anti Money Laundering In Simple Terms. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect.

Source: bi.go.id

Source: bi.go.id

The sources of the money in precise are criminal and the money is invested in a manner that makes it. What is Anti-Money Laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Simultaneous puts and calls representing mirror-image bets on a particular securitys price action. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering.

Source: researchgate.net

Source: researchgate.net

Agustus 08 2021 The idea of money laundering is essential to be understood for those working within the financial sector. The taking of additional measures where appropriate to prevent money laundering or terrorist financing in relation to products and services that favour anonymity. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering.

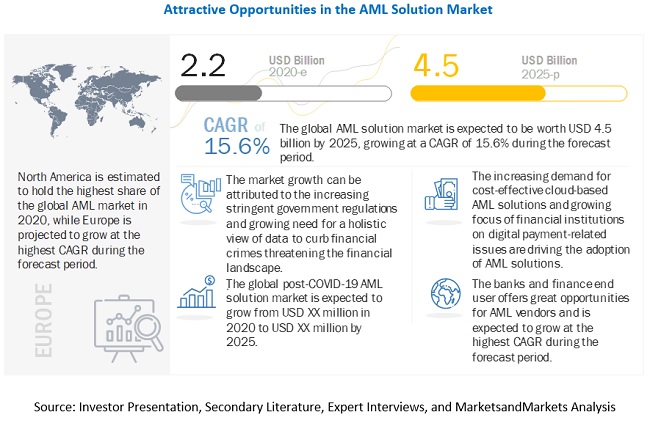

Source: marketsandmarkets.com

Source: marketsandmarkets.com

Its a course of by which soiled cash is transformed into clear cash. One way criminals launder money is by using the money earned from illegal activities to buy things like gold and silver shares or casino chips other legitimate business activities like food or. What Is Anti Money Laundering In Simple Terms. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. The sources of the money in precise are criminal and the money is invested in a manner that makes it.

Source: bi.go.id

Source: bi.go.id

Anti-Money Laundering is when criminal proceeds are taken and their illegal source is disguised to fund legal or illegal activities. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. What is Anti-Money Laundering in simple terms Anti-money laundering AML refers to a collection of policies rules and regulations aimed at preventing the illicit generation of profits. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering.

Source: efinancemanagement.com

Source: efinancemanagement.com

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act BSA of 1970 and the more recent USA Patriot Act. Anti-Money Laundering is when criminal proceeds are taken and their illegal source is disguised to fund legal or illegal activities. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. Taking appropriate steps to assess and if necessary mitigate the risk of money laundering and.

Source: letstalkaml.com

Source: letstalkaml.com

One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. What Is Anti Money Laundering In Simple Terms. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Agustus 08 2021 The idea of money laundering is essential to be understood for those working within the financial sector. Criminals do money laundering to make it hard for the police to find out where the criminal got the money.

Source: bi.go.id

Source: bi.go.id

What Is Anti Money Laundering In Simple Terms. The Anti-Money Laundering Act of 2001 AMLA is the primary AMLCFT law in the Philippines. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. What Is Anti Money Laundering In Simple Terms. Money laundering is something some criminals do to hide the money they make from crimes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering in simple terms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas