10+ Anti money laundering insurance companies info

Home » about money loundering Info » 10+ Anti money laundering insurance companies infoYour Anti money laundering insurance companies images are ready in this website. Anti money laundering insurance companies are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering insurance companies files here. Download all free photos and vectors.

If you’re looking for anti money laundering insurance companies images information linked to the anti money laundering insurance companies interest, you have come to the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Anti Money Laundering Insurance Companies. Emirates Insurance Cosc Anti Money Laundering Policy. The Commission has responsibility for the AML supervision of licensees. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Hence the responsibility for guarding against insurance products being used to launder unlawfully derived funds or to finance terrorist acts lies on the insurance company.

Aml Fraud Flags Best Practices For Insurers Thomson Reuters From legal.thomsonreuters.com

Aml Fraud Flags Best Practices For Insurers Thomson Reuters From legal.thomsonreuters.com

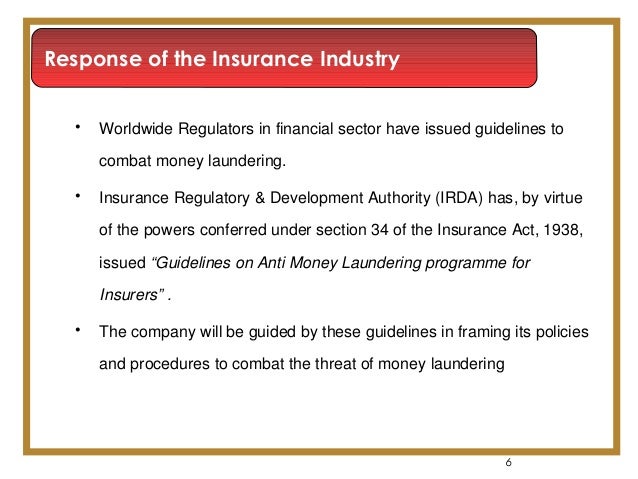

In some cases such agents and brokers have even joined criminals against insurers to facilitate money laundering. Department of the Treasury under the USA PATRIOT Act the Financial Crimes Enforcement Network FinCEN has issued two final rules requiring certain insurance companies to implement anti-money laundering AML compliance programs and file Suspicious Activity Reports as of May 2 2006. Most life insurance firms offer. Published by Lee Chee Keong at August 25 2020. Emirates Insurance Cosc Anti Money Laundering Policy. Emirates Insurance Company PSC.

A regulation with regard to these requirements has not yet been promulgated for insurance companies.

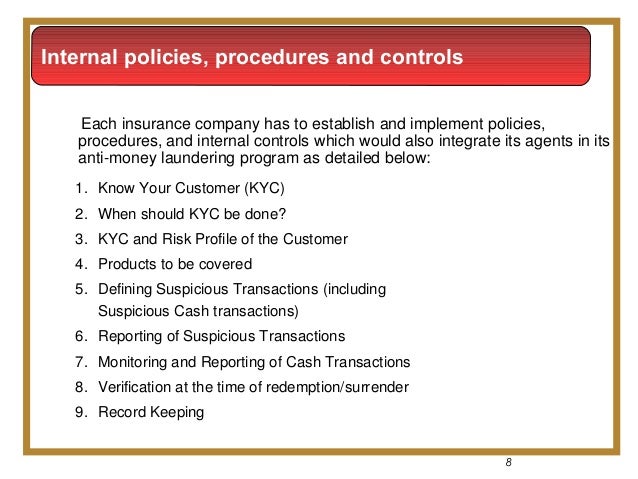

The anti-money laundering rules for insurance companies highlight that each insurance company - like other financial institutions subject to anti-money laundering program requirements - must develop a risk-based anti-money laundering program that identifies assesses and mitigates any risks of money laundering terrorist financing and other financial crime associated with their particular business. Emirates Insurance Company PSC. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. A regulation with regard to these requirements has not yet been promulgated for insurance companies. However FinCEN guidance published May 31 2006 states that an insurance company must obtain all relevant and appropriate customer-related information necessary to administer an effective anti-money laundering program.

Source: slideshare.net

Source: slideshare.net

Insurance companies are defined as a financial institution under the Bank Secrecy Act. In other words money laundering in the insurance sector is a growing global problem. Pursuant to expanded oversight granted the US. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. These new rules also affect a companys corporate.

Source: infopro.com.my

Source: infopro.com.my

Around 62 of the global insurance firms have been exposed to fraud or financial crimes in the past 24 months. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. A covered product includes. Emirates Insurance Company PSC.

Source: slideshare.net

Source: slideshare.net

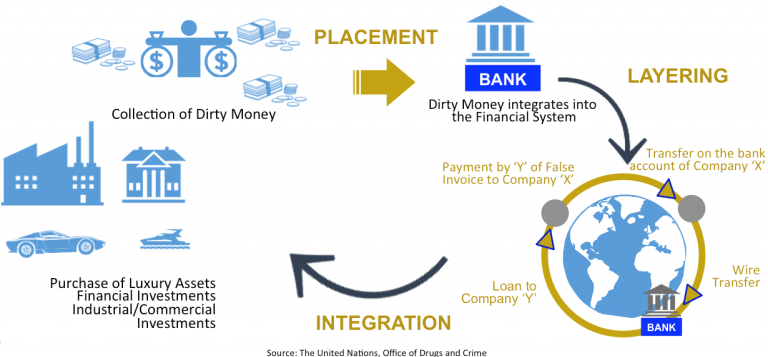

In the Insurance Sector. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. What is Money Laundering. The Anti-Money Laundering Council warns the public against fraudulant commercial documents being sold or traded by individuals or companies and are allegedly issued secured or guaranteed by the Bangko Sentral ng Pilipinas BSP or the then Central Bank of the Philippines.

Source: rsmus.com

Source: rsmus.com

This places several regulations on insurance companies. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Published by Lee Chee Keong at August 25 2020. In other words money laundering in the insurance sector is a growing global problem. A permanent life insurance policy other than a group life insurance.

Source: blog.cubeiq.gr

Source: blog.cubeiq.gr

Anti-Money Laundering In The Insurance Industry. 1 Introduction Put simply money laundering involves concealing the identity of illegally obtained money so that it appears to have come from a legal source. Money Laundering Policy March 2014frIUoLiIJ UIiLcUIapb. A covered product includes. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. A covered product includes. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. 1 Introduction Put simply money laundering involves concealing the identity of illegally obtained money so that it appears to have come from a legal source. The definition of a Reporting Company generally includes all private for-profit entities that are not otherwise required to register with the Securities and Exchange Commission the SEC the Commodity Futures Trading Commission or a state insurance authority and that employ fewer than 20 full-time employees and report less than 5 million in revenue on their federal income tax returns.

Source: infopro.com.my

Source: infopro.com.my

Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. A regulation with regard to these requirements has not yet been promulgated for insurance companies. A permanent life insurance policy other than a group life insurance. These are the Anti-Money Laundering ALM Policy and Procedures adopted by Klapton Insurance Company in compliance with Klaptons internal policies and regulatory obligations and The business will actively prevent and take measures to guard against being used as a medium for money laundering activities and terrorism financing activities and any other activity that facilitates money laundering or. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place.

Source: letstalkaml.com

Source: letstalkaml.com

A covered product includes. Anti-Money Laundering In The Insurance Industry. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. What is Money Laundering. Published by Lee Chee Keong at August 25 2020.

Source:

Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place. This places several regulations on insurance companies. These new rules also affect a companys corporate. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism.

Source: alten.com

Source: alten.com

A permanent life insurance policy other than a group life insurance. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements. An annuity contract other than a group annuity contract. Department of the Treasury under the USA PATRIOT Act the Financial Crimes Enforcement Network FinCEN has issued two final rules requiring certain insurance companies to implement anti-money laundering AML compliance programs and file Suspicious Activity Reports as of May 2 2006. The Department of the Treasury and Financial Crimes Enforcement Networks requires insurance companies to have an anti-money laundering program in place.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

13 The obligation to establish an anti-money laundering program applies to insurance companies and insurance broking companies. 13 The obligation to establish an anti-money laundering program applies to insurance companies and insurance broking companies. The final rules apply to insurance companies that issue or underwrite certain products that present a high degree of risk for money laundering or the financing of terrorism. However FinCEN guidance published May 31 2006 states that an insurance company must obtain all relevant and appropriate customer-related information necessary to administer an effective anti-money laundering program. Emirates Insurance Cosc Anti Money Laundering Policy.

Source: acamstoday.org

Source: acamstoday.org

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. A covered product includes. In the Insurance Sector. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. In other words money laundering in the insurance sector is a growing global problem.

Source:

The Anti-Money Laundering Council warns the public against fraudulant commercial documents being sold or traded by individuals or companies and are allegedly issued secured or guaranteed by the Bangko Sentral ng Pilipinas BSP or the then Central Bank of the Philippines. The new rules require insurance companies to implement anti-money laundering programs AMLPs and file suspicious transaction reports SARs effective as of May 2 2006. An annuity contract other than a group annuity contract. Insurance companies subject to these rules must establish an anti-money laundering program and start filing Suspicious Activity Reports 180 days after the date of the publication of the final rules in the Federal Register. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas