13++ Anti money laundering life cycle info

Home » about money loundering idea » 13++ Anti money laundering life cycle infoYour Anti money laundering life cycle images are ready in this website. Anti money laundering life cycle are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering life cycle files here. Get all free photos.

If you’re looking for anti money laundering life cycle pictures information linked to the anti money laundering life cycle topic, you have come to the ideal blog. Our site frequently provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

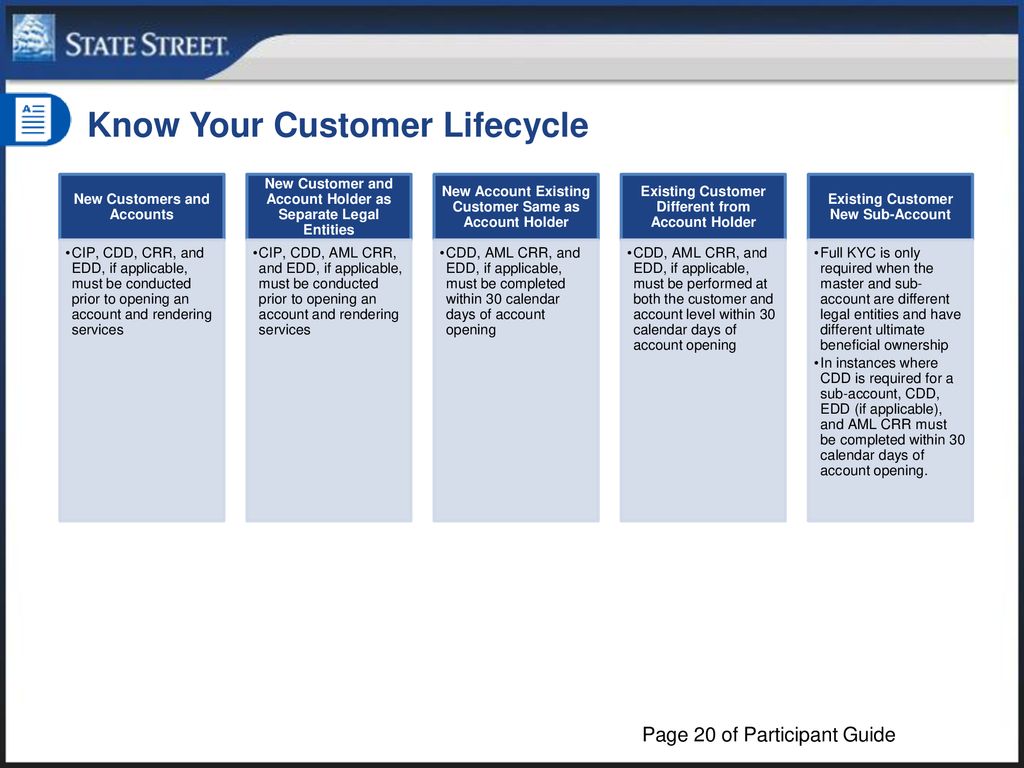

Anti Money Laundering Life Cycle. Placement The physical disposal of cash or other assets derived from criminal activity. Citi is committed to the fight against money laundering and leading the way in Responsible Finance. By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure. During the onboarding phase CIP is the first stage through which banks and other financial institutions identify and verify the true identity of new clients looking to open new accounts.

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq From advisoryhq.com

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq From advisoryhq.com

By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure. Risk Assessment Client Due Diligence. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world. Money laundering is the process by which the illegal origin of wealth is disguised to avoid the suspicion of law enforcement authorities. During the onboarding phase CIP is the first stage through which banks and other financial institutions identify and verify the true identity of new clients looking to open new accounts. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial.

However it is important to remember that money laundering is a single process.

Three Stages of Money Laundering Cycle. Money launderers and terrorists are identifying weak links in your AMLKYC Anti-Money LaunderingKnow Your Customer processes to help them hide the true source of funds and their connection to it. Three Stages of Money Laundering Cycle. The money laundering process is divided into 3 segments. The stages of money laundering include the. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world.

Source: advisoryhq.com

Source: advisoryhq.com

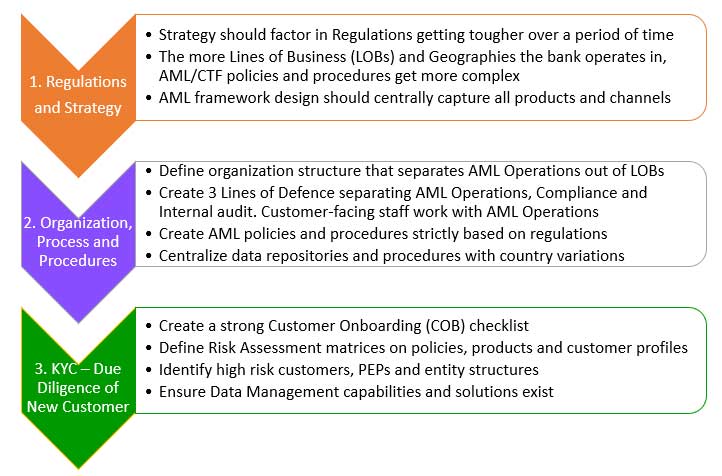

Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry. By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure. Ad Search For Life cycle. The 5th directive will require you to examine the background and purpose of a wider range of transactions. FINRA reviews a firms compliance with AML rules under FINRA Rule.

Source: finacus.co.in

Source: finacus.co.in

By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. However it is important to remember that money laundering is a single process. It proposes extra EDD measures for business relationships and transactions with high-risk 3rd countries. The money laundering cycle can be broken down into three distinct stages.

Source: digileap.net

Source: digileap.net

Citi is committed to the fight against money laundering and leading the way in Responsible Finance. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Anti-Money Laundering AML Lifecycle The Customer Identification Program is the first of many phases that make up the anti-money launderingknow your customer lifecycle. However it is important to remember that money laundering is a single process. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms.

Source: advisoryhq.com

Source: advisoryhq.com

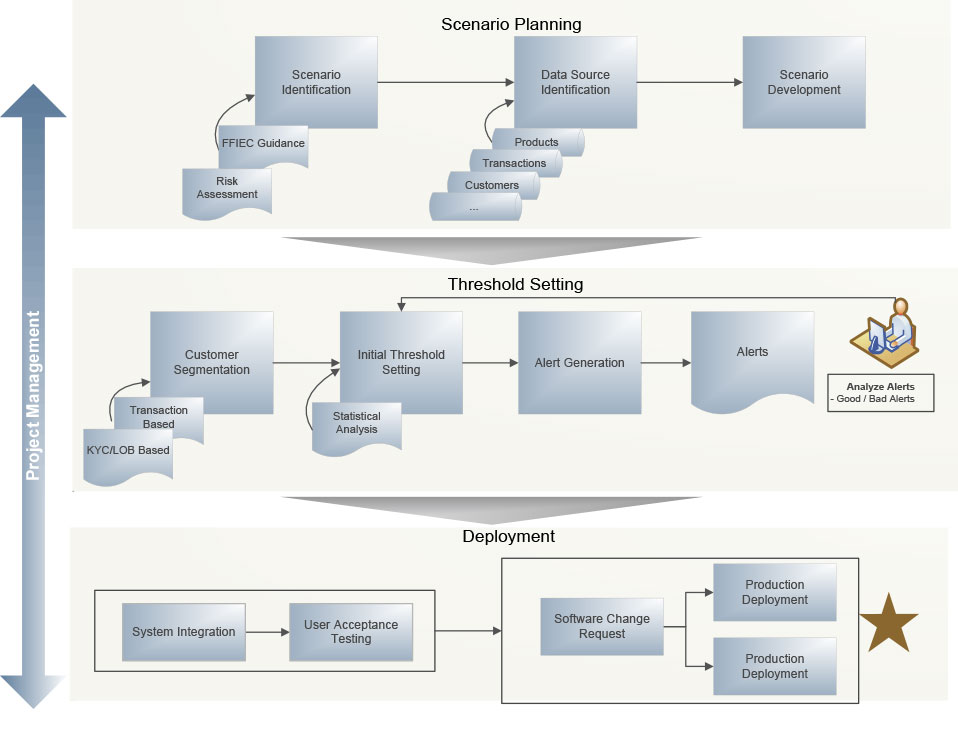

During the placement phase illicit proceeds are introduced by the money launderer into the financial system. The Placement Stage Filtering. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The money laundering cycle can be broken down into three distinct stages. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented.

Source: taxguru.in

Source: taxguru.in

Three Stages of Money Laundering Cycle. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms.

Source: bankinginfotech.com

Source: bankinginfotech.com

The stages of money laundering include the. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Three Stages of Money Laundering Cycle. Ad Search For Life cycle. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard.

Source: letstalkaml.com

Source: letstalkaml.com

Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Money laundering undermines confidence in the international financial system. The stages of money laundering include the. By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure.

Source: aitegroup.com

Source: aitegroup.com

During the placement phase illicit proceeds are introduced by the money launderer into the financial system. Fundamental concepts of Anti-Money Laundering and Terrorist Financing Have an overall understanding of AML Be aware of the relevant legal and regulatory frameworks The AML lifecycle Be familiar with the AML life cycle and know how to apply the AML life cycle in your industry. The stages of money laundering include the. What is an AML compliance program. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Source: acamstoday.org

Source: acamstoday.org

FINRA reviews a firms compliance with AML rules under FINRA Rule. While the state Insurance Department requests and reviews an authorized life insurers anti-money laundering program as part of the Departments examination cycle of authorized life insurers it is the federal Department of the Treasury and not this Department that. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. The Placement Stage Filtering. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard.

Source: slideplayer.com

Source: slideplayer.com

The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. The Placement Stage Filtering. Money launderers and terrorists are identifying weak links in your AMLKYC Anti-Money LaunderingKnow Your Customer processes to help them hide the true source of funds and their connection to it. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world. FINRA reviews a firms compliance with AML rules under FINRA Rule.

Source: piranirisk.com

Source: piranirisk.com

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Generally money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programmes. What is an AML compliance program. The stages of money laundering include the. Anti-Money Laundering AML Lifecycle The Customer Identification Program is the first of many phases that make up the anti-money launderingknow your customer lifecycle.

Source: advisoryhq.com

Source: advisoryhq.com

Risk Assessment Client Due Diligence. Money laundering undermines confidence in the international financial system. Money launderers and terrorists are identifying weak links in your AMLKYC Anti-Money LaunderingKnow Your Customer processes to help them hide the true source of funds and their connection to it. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. What is an AML compliance program.

Source: calert.info

Source: calert.info

This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Money laundering is the process by which the illegal origin of wealth is disguised to avoid the suspicion of law enforcement authorities. Risk Assessment Client Due Diligence. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Money laundering undermines confidence in the international financial system.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering life cycle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information