10+ Anti money laundering process flow information

Home » about money loundering Info » 10+ Anti money laundering process flow informationYour Anti money laundering process flow images are available. Anti money laundering process flow are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering process flow files here. Download all free images.

If you’re looking for anti money laundering process flow images information related to the anti money laundering process flow interest, you have come to the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

Anti Money Laundering Process Flow. Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. Under anti-money laundering AML guidelines both entities are considered suspicious and should be subjects of an investigation. Anti money laundering process flow. Notable money laundering scandal.

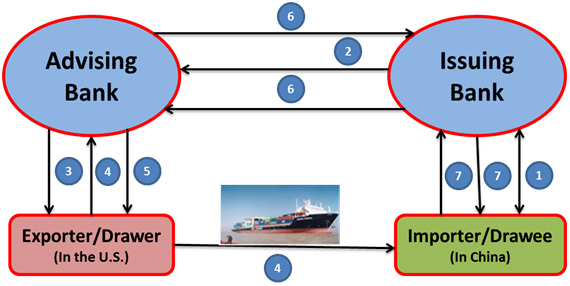

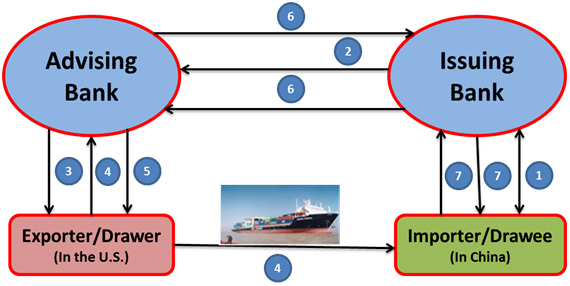

How Can Trade Finance Anti Money Laundering Monitoring Be Improved Acams Today From acamstoday.org

How Can Trade Finance Anti Money Laundering Monitoring Be Improved Acams Today From acamstoday.org

The stages of money laundering include the. Millions of financial transactions take place around the world a day. Money laundering became the concern for the banks when regulators imposed heavy fines on banks. In the third stage money flows back to the beneficiary. Operations are designed to take the proceeds of illegal activity such as profits from drug trafficking and cause them to appear to come from legitimate sources. Notable money laundering scandal.

Most notably HSBC for violating the Bank Secrecy Act.

The stages of money laundering include the. Money laundering is the process of concealing the illicit origin of proceeds of crimes. However it is important to remember that money laundering is a single process. The AML Transaction Monitoring process is a legal requirement for businesses under AML obligations. These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem. By using an account with a low risk the money launderer avoids to be detected by authorities.

Source: researchgate.net

Source: researchgate.net

Operations are designed to take the proceeds of illegal activity such as profits from drug trafficking and cause them to appear to come from legitimate sources. Notable money laundering scandal. For high-risk clients the average process is to conduct a know your customer review once a year or twice a year. The AML Transaction Monitoring process is a legal requirement for businesses under AML obligations. Placement layering and integration 9.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

At the first stage illegal money is placed at a bank account. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. The stages of money laundering include the. Depending on the risk classification of the client there should be an ongoingannual review of the clients transactional activities if you want to properly adhere to the AML KYC process flow. Enhanced due diligence EDD with respect to these transactions may result in escalation and the generation of a suspicious activity report SAR.

Source: equbecompliance.com

Source: equbecompliance.com

The regulations provide for cooperation between the supervisory authorities or for a single authority to take. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Anti money laundering process flow. These phases are called placement layering and integration. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

Source: scryanalytics.ai

Source: scryanalytics.ai

Terrorist financing is the collection or the provision of funds for terrorist purposes. At the first stage illegal money is placed at a bank account. The regulations provide for cooperation between the supervisory authorities or for a single authority to take. Money laundering is the process of concealing the illicit origin of proceeds of crimes. Though these laws cover a relatively limited range of transactions and.

Source: pinterest.com

Source: pinterest.com

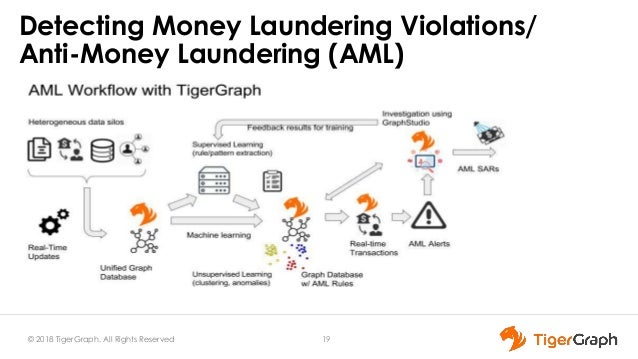

For high-risk clients the average process is to conduct a know your customer review once a year or twice a year. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Ad Lucidcharts process diagram software is quick easy to use. Financial Institutions can control billions of transactions instantly by automating the transaction monitoring process flow. Anti-money laundering AML refers to a set of laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income.

Source: kyc2020.com

Source: kyc2020.com

Anti-Money Laundering Money laundering is a process whereby the origin of funds generated by illegal means like corruption is concealed. These phases are called placement layering and integration. At the first stage illegal money is placed at a bank account. The money laundering cycle can be broken down into three distinct stages. Find out why pros choose Lucidcharts to make process diagrams.

Source: redhat.com

Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. What is The AML Transaction Monitoring Process. The AML Transaction Monitoring process is a legal requirement for businesses under AML obligations. Money laundering is the process of concealing the illicit origin of proceeds of crimes. In the case of money laundering the funds are always of illicit origin whereas in the case of terrorist financing funds can stem from both legal and illicit sources.

Source: redhat.com

Money laundering is the process by which criminals attempt to disguise illicit assets as legitimate assets that they have a right to possess and spend AUSTRAC 2011. The regulations provide for cooperation between the supervisory authorities or for a single authority to take. Millions of financial transactions take place around the world a day. Depending on the risk classification of the client there should be an ongoingannual review of the clients transactional activities if you want to properly adhere to the AML KYC process flow. The money laundering cycle can be broken down into three distinct stages.

Source:

Notable money laundering scandal. Most notably HSBC for violating the Bank Secrecy Act. Anti money laundering process flow. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. The regulations provide for cooperation between the supervisory authorities or for a single authority to take.

Source: acamstoday.org

Source: acamstoday.org

In the third stage money flows back to the beneficiary. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Anti-Money Laundering Money laundering is a process whereby the origin of funds generated by illegal means like corruption is concealed. Placement layering and integration 9.

Source: shuftipro.com

Source: shuftipro.com

Ad Lucidcharts process diagram software is quick easy to use. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Operations are designed to take the proceeds of illegal activity such as profits from drug trafficking and cause them to appear to come from legitimate sources. Terrorist financing is the collection or the provision of funds for terrorist purposes. In the case of money laundering the funds are always of illicit origin whereas in the case of terrorist financing funds can stem from both legal and illicit sources.

Source: slideteam.net

Source: slideteam.net

Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Millions of financial transactions take place around the world a day. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Operations are designed to take the proceeds of illegal activity such as profits from drug trafficking and cause them to appear to come from legitimate sources. These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem.

Source: slideshare.net

Source: slideshare.net

Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Depending on the risk classification of the client there should be an ongoingannual review of the clients transactional activities if you want to properly adhere to the AML KYC process flow. Because money laundering is a key part of terrorist organizations that are usually funded through illegal enterprises the FATF was also charged with directly fighting to cut off illegal cash flows to terrorists and terrorist groups. Anti-Money Laundering Money laundering is a process whereby the origin of funds generated by illegal means like corruption is concealed. These phases are called placement layering and integration.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering process flow by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas