13++ Anti money laundering regulations training requirements ideas

Home » about money loundering idea » 13++ Anti money laundering regulations training requirements ideasYour Anti money laundering regulations training requirements images are ready. Anti money laundering regulations training requirements are a topic that is being searched for and liked by netizens today. You can Find and Download the Anti money laundering regulations training requirements files here. Download all free photos.

If you’re searching for anti money laundering regulations training requirements pictures information linked to the anti money laundering regulations training requirements topic, you have pay a visit to the right site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Anti Money Laundering Regulations Training Requirements. Ad Learn Anti-Money Laundering online at your own pace. Created the High Intensity Money Laundering and Related Financial Crime Area HIFCA Task Forces to concentrate law enforcement efforts at the federal state and local levels in zones where money laundering. When we published the first edition of the Guide our intent was to provide clear and concise answers to basic questions that surfaced in our discussions with clients attorneys regulators and others both in the United States and other jurisdictions. Business relationship screening requirements.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

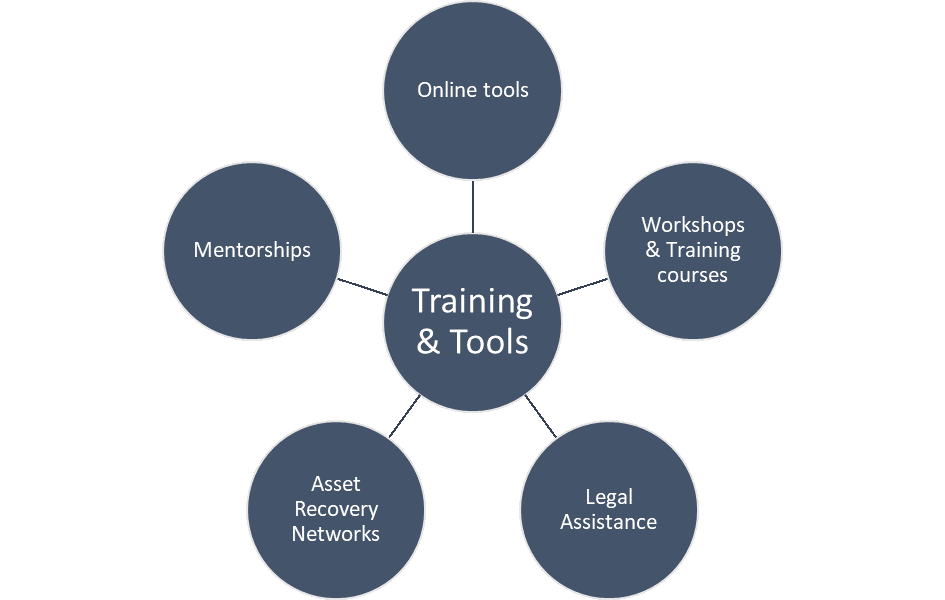

5318 h and its implementing regulations. The Anti-Money Laundering AML section of the 2021 Report on FINRAs Risk Monitoring and Examination Activities the Report informs member firms compliance programs by providing annual insights from FINRAs ongoing regulatory operations including 1 relevant regulatory obligations and related considerations 2 exam findings and effective practices and 3 additional resources. Created the High Intensity Money Laundering and Related Financial Crime Area HIFCA Task Forces to concentrate law enforcement efforts at the federal state and local levels in zones where money laundering. Required the Department of the Treasury and other agencies to develop a National Money Laundering Strategy. The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. Module 1Anti-Money Laundering Regulations and Training.

AML Refresher APAC Money laundering is a potential indicator of terrorist funding and other global crimes making AML training even more necessary.

ICLG - Anti-Money Laundering Laws and Regulations - USA covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. Required banking agencies to develop anti-money laundering training for examiners. When staff change roles in an organisation. Join millions of learners from around the world already learning on Udemy. Join millions of learners from around the world already learning on Udemy. However there are a number of factors that should trigger an additional need for training.

Source: bi.go.id

Source: bi.go.id

Training staff in preventing money laundering Larger and more complex businesses must appoint a member of the board or senior management to act as a compliance officer and. The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and. AML Refresher APAC Money laundering is a potential indicator of terrorist funding and other global crimes making AML training even more necessary. Join millions of learners from around the world already learning on Udemy. Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources.

Source: slideplayer.com

Source: slideplayer.com

The course will define money laundering and familiarizes the learner with the various aspects of AML including red flags customer due. This course introduces the learner to Anti-Money Laundering AML laws and regulations to which financial institutions must adhere. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the. Anti-Money Laundering Laws and Regulations 2021. Ad Learn Anti-Money Laundering online at your own pace.

Source: globale2c.com.sg

Source: globale2c.com.sg

An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the. Start today with a special offer. The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. ICLG - Anti-Money Laundering Laws and Regulations - USA covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. When staff change roles in an organisation.

Source: id.pinterest.com

Source: id.pinterest.com

Module 1Anti-Money Laundering Regulations and Training. At a minimum staff must be trained at least once every two years on money laundering. Start today with a special offer. It outlines the anti-money-laundering AML rules and regulations that MSBs must comply with and explores how these rules and regulations affect employees day-to-day roles. Created the High Intensity Money Laundering and Related Financial Crime Area HIFCA Task Forces to concentrate law enforcement efforts at the federal state and local levels in zones where money laundering.

Source: pinterest.com

Source: pinterest.com

Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the. New anti-money laundering training program requirements. Ad Learn Anti-Money Laundering online at your own pace. These include carrying out customer due diligence measures to check that your.

Source: pinterest.com

Source: pinterest.com

ICLG - Anti-Money Laundering Laws and Regulations - USA covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. Required the Department of the Treasury and other agencies to develop a National Money Laundering Strategy. 5318 h and its implementing regulations. When we published the first edition of the Guide our intent was to provide clear and concise answers to basic questions that surfaced in our discussions with clients attorneys regulators and others both in the United States and other jurisdictions. Training staff in preventing money laundering Larger and more complex businesses must appoint a member of the board or senior management to act as a compliance officer and.

Source: branddocs.com

Source: branddocs.com

The course will define money laundering and familiarizes the learner with the various aspects of AML including red flags customer due. This course introduces the learner to Anti-Money Laundering AML laws and regulations to which financial institutions must adhere. Created the High Intensity Money Laundering and Related Financial Crime Area HIFCA Task Forces to concentrate law enforcement efforts at the federal state and local levels in zones where money laundering. AML Refresher APAC Money laundering is a potential indicator of terrorist funding and other global crimes making AML training even more necessary. Anti-Money Laundering Laws and Regulations 2021.

Source: unodc.org

Source: unodc.org

Join millions of learners from around the world already learning on Udemy. Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources. Anti-Money Laundering Laws and Regulations 2021. Required the Department of the Treasury and other agencies to develop a National Money Laundering Strategy. Module 1Anti-Money Laundering Regulations and Training.

Source: in.pinterest.com

Source: in.pinterest.com

The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and. Training staff in preventing money laundering Larger and more complex businesses must appoint a member of the board or senior management to act as a compliance officer and. The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions FIs Guidelines is to provide guidance and assistance to supervised institutions that are FIs in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory. Required banking agencies to develop anti-money laundering training for examiners. New travel rule requirements.

Source: pinterest.com

Source: pinterest.com

Updates to identification methods and know-your-client checks. The Anti-Money Laundering AML section of the 2021 Report on FINRAs Risk Monitoring and Examination Activities the Report informs member firms compliance programs by providing annual insights from FINRAs ongoing regulatory operations including 1 relevant regulatory obligations and related considerations 2 exam findings and effective practices and 3 additional resources. An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the. Business relationship screening requirements. When we published the first edition of the Guide our intent was to provide clear and concise answers to basic questions that surfaced in our discussions with clients attorneys regulators and others both in the United States and other jurisdictions.

Source: pinterest.com

Source: pinterest.com

Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources. Start today with a special offer. Required banking agencies to develop anti-money laundering training for examiners. Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources. When staff move to a new job.

Source: vinciworks.com

Source: vinciworks.com

An insurance company may satisfy the training requirement under its anti-money laundering program with respect to its employees agents and brokers by directly training such persons or by verifying that those employees agents and brokers have received adequate training by another insurance company or by a competent third party with respect to the covered products offered by the. The Rules in the AML Rulebook should not be relied upon to interpret or determine the application of the criminal laws of the UAE. New travel rule requirements. Created the High Intensity Money Laundering and Related Financial Crime Area HIFCA Task Forces to concentrate law enforcement efforts at the federal state and local levels in zones where money laundering. Join millions of learners from around the world already learning on Udemy.

Source: fr.pinterest.com

Source: fr.pinterest.com

Anti-Money Laundering AML Training Requirements Anti-money Laundering Regulations and Compliance Money Laundering refers to any act or attempted act conducted to conceal or disguise the identity of illegally obtained funds so that they appear to have originated from legitimate sources. Start today with a special offer. When staff move to a new job. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. Start today with a special offer.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering regulations training requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information