16++ Anti money laundering simple definition information

Home » about money loundering Info » 16++ Anti money laundering simple definition informationYour Anti money laundering simple definition images are available in this site. Anti money laundering simple definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering simple definition files here. Get all free photos and vectors.

If you’re searching for anti money laundering simple definition pictures information connected with to the anti money laundering simple definition keyword, you have visit the right site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Anti Money Laundering Simple Definition. From Simple English Wikipedia the free encyclopedia Money laundering is something some criminals do to hide the money they make from crimes. Identify and verify the identity of clients monitor transactions and report suspicious transactions. What Is Anti Money Laundering In Simple Terms. Money Laundering Definition Simple August 08 2021 The idea of money laundering is essential to be understood for those working within the monetary sector.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

AML is a worldwide term to prevent money laundering. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Its very easy to define but involves multiple techniques. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money.

Simultaneous puts and calls representing mirror-image bets on a particular securitys price action.

Money Laundering is an act of act of disguising the illegal source of income. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Money Laundering is the process of changing the colors of the money. The sources of the money in precise are criminal and the money is invested in a manner that makes it. AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

AML is a worldwide term to prevent money laundering. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. This Act shall be known as the Anti-Money Laundering Act of 2001 SEC.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Generally money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programmes. Identify and verify the identity of clients monitor transactions and report suspicious transactions. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. From Simple English Wikipedia the free encyclopedia Money laundering is something some criminals do to hide the money they make from crimes. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Source: shuftipro.com

Source: shuftipro.com

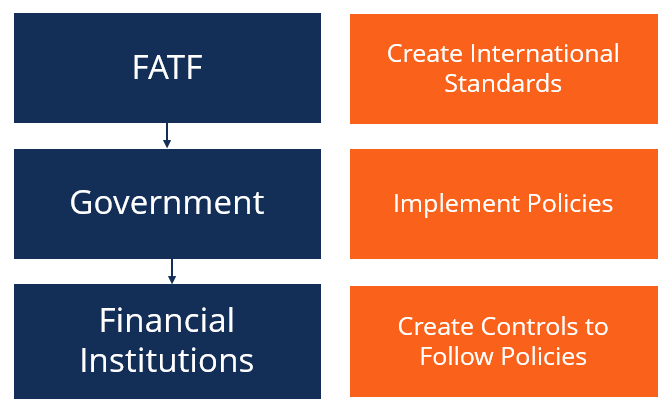

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Its a course of by which soiled cash is transformed into clear cash. Money laundering is a way to conceal illegally obtained funds. Global and local regulators are established around the world to prevent financial crimes and these regulators create AML policies. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Source: bi.go.id

Money laundering works by transferring money in elaborate and complicated financial transactions which mislead anyone who. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. AML is a worldwide term to prevent money laundering. One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. Global and local regulators are established around the world to prevent financial crimes and these regulators create AML policies.

Source: letstalkaml.com

Source: letstalkaml.com

Money Laundering Definition Simple August 08 2021 The idea of money laundering is essential to be understood for those working within the monetary sector. Simultaneous puts and calls representing mirror-image bets on a particular securitys price action. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world. The sources of the money in precise are criminal and the money is invested in a manner that makes it.

Source: sas.com

Source: sas.com

Global and local regulators are established around the world to prevent financial crimes and these regulators create AML policies. The sources of the money in precise are felony and the money is invested in a means that makes it look like clear cash and. What is Anti-Money Laundering. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Its a course of by which soiled cash is transformed into clear cash.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Global and local regulators are established around the world to prevent financial crimes and these regulators create AML policies. It is implemented within government systems and large financial institutions to monitor potentially fraudulent activity. Be it enacted by the Senate and the House of Representatives of the Philippines in Congress assembled. AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Source: bi.go.id

Source: bi.go.id

Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect. Money Laundering is the process of changing the colors of the money. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. AML laws require that financial instutions report any financial crime they detect to relevant regulators.

Source: quora.com

Source: quora.com

What Is Anti Money Laundering In Simple Terms. Anti-Money Laundering AML includes policies laws and regulations to prevent financial crimes. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms. Anti-money laundering laws reflect an effort made the government to stop money laundering methods that involve financial institutions. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Source: bi.go.id

Source: bi.go.id

One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. Agustus 08 2021 The idea of money laundering is essential to be understood for those working within the financial sector. Its very easy to define but involves multiple techniques. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. It is a process by which soiled cash is converted into clear cash.

Source: bi.go.id

Source: bi.go.id

Criminals do money laundering to make it hard for the police to find out where the criminal got the money. What is Anti-Money Laundering. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Anti-Money Laundering AML includes policies laws and regulations to prevent financial crimes. As money laundering is a consequence of almost all profit generating crime it can occur practically anywhere in the world.

Source: pinterest.com

Source: pinterest.com

Its a course of by which soiled cash is transformed into clear cash. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. Generally money launderers tend to seek out countries or sectors in which there is a low risk of detection due to weak or ineffective anti-money laundering programmes. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions.

Source: mintos.com

Source: mintos.com

What is Anti-Money Laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Its a course of by which soiled cash is transformed into clear cash. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering simple definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas