18++ Anti money laundering technical scenario description info

Home » about money loundering idea » 18++ Anti money laundering technical scenario description infoYour Anti money laundering technical scenario description images are ready. Anti money laundering technical scenario description are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering technical scenario description files here. Get all free photos and vectors.

If you’re searching for anti money laundering technical scenario description pictures information linked to the anti money laundering technical scenario description keyword, you have visit the ideal site. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Anti Money Laundering Technical Scenario Description. Oracle Financial Services Anti Money Laundering provides regulators and key stakeholders a 360 view of financial activity and customer risk to transparently detect and investigate potential money laundering behavior. Challenges and Trends Abstract The inadvertent use of the banking system for money laundering activities is a key challenge facing the financial services industry. What is Money Laundering. Scenario SAS10007 functionality in SAS Anti Money Laundering Solution Posted 12-14-2016 0215 AM 3796 views In SAS Anti Money Laundering Solution there is an out-of-box scenario.

Pdf Anti Money Laundering Reporting And Investigation Sorting The Wheat From The Chaff From researchgate.net

Pdf Anti Money Laundering Reporting And Investigation Sorting The Wheat From The Chaff From researchgate.net

These alerts are then reviewed by a team of. Oracle Financial Services Anti Money Laundering provides regulators and key stakeholders a 360 view of financial activity and customer risk to transparently detect and investigate potential money laundering behavior. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Financial data collected from financial institutions by the Financial Crimes Enforcement Network under the Bank Secrecy Act BSA has proven to be of considerable value in money laundering terrorist financing and other financial crimes investigations by law enforcement. Criminals use money laundering to conceal their crimes and the money derived from them. Fraud Technical Scenario to Data Interface Specification DataMap.

Anti Money Laundering Technical Scenario Descriptions.

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions. Transaction monitoring systems TMS play a key role in a financial institutions antimoney laundering AML compliance program. Scenario SAS10007 functionality in SAS Anti Money Laundering Solution Posted 12-14-2016 0215 AM 3796 views In SAS Anti Money Laundering Solution there is an out-of-box scenario. These alerts are then reviewed by a team of. Broker Compliance Scenario to Data Interface Specification DataMap.

Source: pio-tech.com

Source: pio-tech.com

Broker Compliance Scenario to Data Interface Specification DataMap. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering. In response regulatory authorities have introduced anti-money laundering AML regulations to detect and prevent such activities. Currency Transaction Reporting Scenario.

Source: id.pinterest.com

Source: id.pinterest.com

The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Transaction monitoring systems TMS play a key role in a financial institutions antimoney laundering AML compliance program. Financial data collected from financial institutions by the Financial Crimes Enforcement Network under the Bank Secrecy Act BSA has proven to be of considerable value in money laundering terrorist financing and other financial crimes investigations by law enforcement. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Anti Money Laundering Scenario to Data Interface Specification DataMap.

Source: apnews.com

Source: apnews.com

Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions. Chapter 13 Technical Scenario Description - Anti-Money Laundering Solution on page 55 Chapter 14 Technical Scenario Description - Broker Compliance on page 59 Chapter 15 Technical Scenario Description - Currency Transaction Reporting on page 63. Trading Compliance Scenario to Data Interface Specification DataMap. Anti-Money LaunderingTechnical Scenario Description TSD Broker Compliance Technical Scenario Description TSD Trading Compliance Technical Scenario Description TSD Fraud Technical Scenario Description TSD Energy and Commodity Trading Compliance Technical Scenario Description TSD Scenario Wizard Includes workflow to create scenarios Scenario. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions.

Source: pinterest.com

Source: pinterest.com

Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Trading Compliance Scenario to Data Interface Specification DataMap. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Anti Money Laundering Scenario to Data Interface Specification DataMap. Anti-money laundering laws reflect an effort made the government to stop money laundering methods that involve financial institutions.

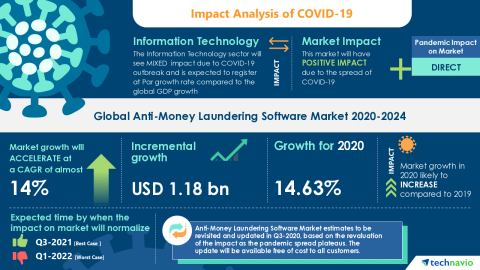

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Oracle Financial Services Anti Money Laundering provides regulators and key stakeholders a 360 view of financial activity and customer risk to transparently detect and investigate potential money laundering behavior. Anti Money Laundering Technical Scenario Descriptions. Fraud Technical Scenario to Data Interface Specification DataMap. Chapter 13 Technical Scenario Description - Anti-Money Laundering Solution on page 61 Chapter 14 Technical Scenario Description - Broker Compliance on page 65 Chapter 15 Technical Scenario Description - Currency Transaction Reporting on page 69.

Source: researchgate.net

Source: researchgate.net

Currency Transaction Reporting Scenario. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. Broker Compliance Scenario to Data Interface Specification DataMap. Trading Compliance Scenario to Data Interface Specification DataMap. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering.

Source: vensys.co.id

Source: vensys.co.id

Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. This is enabled by the industrys only unified compliance platform that covers banking capital markets and insurance. Anti-Money LaunderingTechnical Scenario Description TSD Broker Compliance Technical Scenario Description TSD Trading Compliance Technical Scenario Description TSD Fraud Technical Scenario Description TSD Energy and Commodity Trading Compliance Technical Scenario Description TSD Scenario Wizard Includes workflow to create scenarios Scenario. Broker Compliance Scenario to Data Interface Specification DataMap. Challenges and Trends Abstract The inadvertent use of the banking system for money laundering activities is a key challenge facing the financial services industry.

History of Anti-Money Laundering. Anti Money Laundering Technical Scenario Descriptions. Fraud Technical Scenario to Data Interface Specification DataMap. Oracle Financial Services Anti Money Laundering provides regulators and key stakeholders a 360 view of financial activity and customer risk to transparently detect and investigate potential money laundering behavior. Anti-Money LaunderingTechnical Scenario Description TSD Broker Compliance Technical Scenario Description TSD Trading Compliance Technical Scenario Description TSD Fraud Technical Scenario Description TSD Energy and Commodity Trading Compliance Technical Scenario Description TSD Scenario Wizard Includes workflow to create scenarios Scenario.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

Challenges and Trends Abstract The inadvertent use of the banking system for money laundering activities is a key challenge facing the financial services industry. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Based on your customer population and activity model billions of. In response regulatory authorities have introduced anti-money laundering AML regulations to detect and prevent such activities. Although valuable anti-money laundering transaction scenarios and their monitoring solutions should only be dedicated to financial firms operating in some specific industries and on a particular scale.

Source: youtube.com

Source: youtube.com

This is enabled by the industrys only unified compliance platform that covers banking capital markets and insurance. Fraud Technical Scenario to Data Interface Specification DataMap. Anti Money Laundering Technical Scenario Descriptions. Scenario SAS10007 functionality in SAS Anti Money Laundering Solution Posted 12-14-2016 0215 AM 3796 views In SAS Anti Money Laundering Solution there is an out-of-box scenario. The systems enable financial institutions to.

Source: slideserve.com

Source: slideserve.com

Anti-Money LaunderingTechnical Scenario Description TSD Broker Compliance Technical Scenario Description TSD Trading Compliance Technical Scenario Description TSD Fraud Technical Scenario Description TSD Energy and Commodity Trading Compliance Technical Scenario Description TSD Scenario Wizard Includes workflow to create scenarios Scenario. In response regulatory authorities have introduced anti-money laundering AML regulations to detect and prevent such activities. Scenario SAS10007 functionality in SAS Anti Money Laundering Solution Posted 12-14-2016 0215 AM 3796 views In SAS Anti Money Laundering Solution there is an out-of-box scenario. Although valuable anti-money laundering transaction scenarios and their monitoring solutions should only be dedicated to financial firms operating in some specific industries and on a particular scale. Anti-Money LaunderingTechnical Scenario Description TSD Broker Compliance Technical Scenario Description TSD Trading Compliance Technical Scenario Description TSD Fraud Technical Scenario Description TSD Energy and Commodity Trading Compliance Technical Scenario Description TSD Scenario Wizard Includes workflow to create scenarios Scenario.

Source: researchgate.net

Source: researchgate.net

Criminals use money laundering to conceal their crimes and the money derived from them. History of Anti-Money Laundering. Financial data collected from financial institutions by the Financial Crimes Enforcement Network under the Bank Secrecy Act BSA has proven to be of considerable value in money laundering terrorist financing and other financial crimes investigations by law enforcement. Anti-Money Laundering Technical Scenario Description Broker Compliance Technical Scenario Description Currency Transaction Reporting Technical Scenario Description. Although valuable anti-money laundering transaction scenarios and their monitoring solutions should only be dedicated to financial firms operating in some specific industries and on a particular scale.

Source: researchgate.net

Source: researchgate.net

Currency Transaction Reporting Scenario. An early effort to detect and prevent money laundering the BSA has since been amended and strengthened by additional anti-money laundering laws. Anti Money Laundering Scenario to Data Interface Specification DataMap. Fraud Technical Scenario to Data Interface Specification DataMap. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering technical scenario description by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information