12++ Anti money laundering training how often ideas in 2021

Home » about money loundering Info » 12++ Anti money laundering training how often ideas in 2021Your Anti money laundering training how often images are available in this site. Anti money laundering training how often are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering training how often files here. Find and Download all royalty-free images.

If you’re searching for anti money laundering training how often images information linked to the anti money laundering training how often keyword, you have visit the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

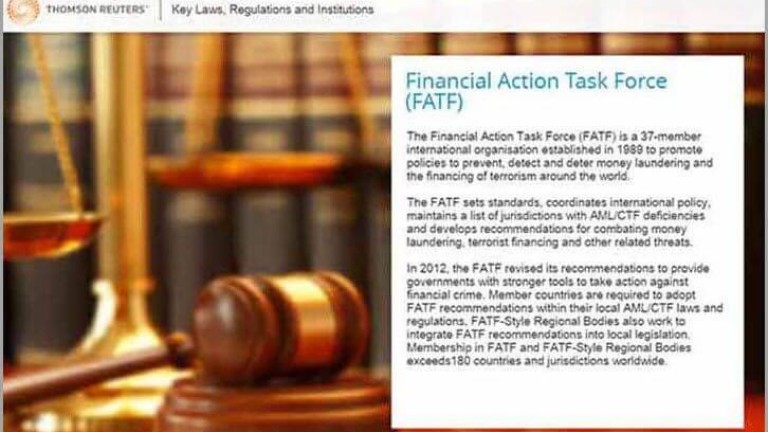

Anti Money Laundering Training How Often. Train online at your own pace with a full audio voiceover. Join millions of learners from around the world already learning on Udemy. Identify Canadian government organizations involved in anti-money laundering AML and counter-terrorist financing CTF. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of.

Guide To Anti Money Laundering Training Requirements Vinciworks Blog From vinciworks.com

Guide To Anti Money Laundering Training Requirements Vinciworks Blog From vinciworks.com

Firstly the aspirants need to earn at least 40 credits of college coursework. All these courses allow producers to finish the core training at once and documentation is sent to every carrier they represent. Each member must review and if necessary update the information regarding a change to its AML compliance person within 30 days following the change and verify such information within 17 business days after the end of each calendar year. Yes all Anti-Money Laundering Certifications are valid for 2 years. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury. Money laundering is a potential indicator of terrorist funding and other global crimes making anti-money-laundering AML training even more necessary.

Does Anti-Money Laundering Certification training expire.

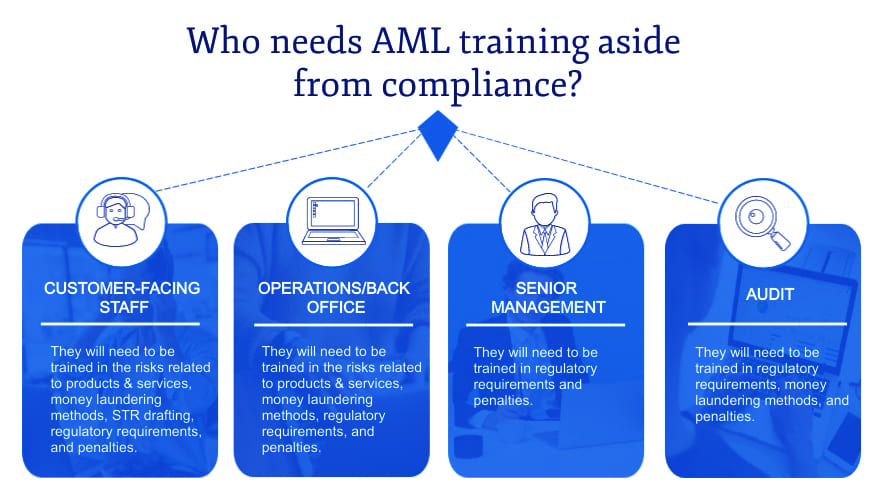

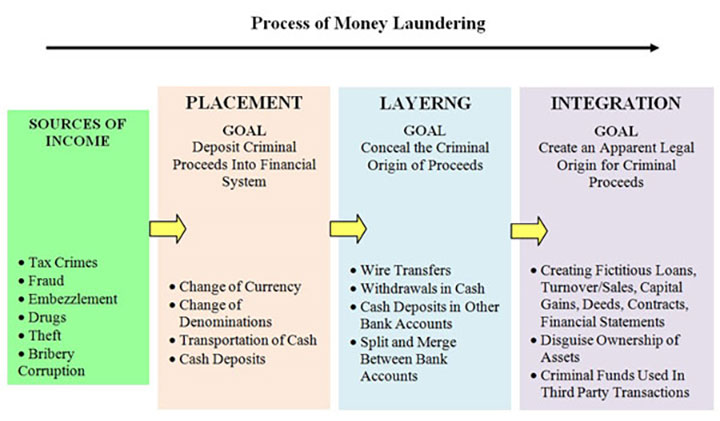

Ad Learn Anti-Money Laundering online at your own pace. When staff change roles in an organisation. Getting your employees up to speed on the latest regulations and how to spot money laundering is. This is why anti-money laundering education has become an essential part of employee training. Join millions of learners from around the world already learning on Udemy. This AML refresher course is intended to remind employees about the process of money launderingthe criminal business used to disguise the true origin and ownership of illegal cashand the laws that make it a crime.

Source: pideeco.be

Source: pideeco.be

Yes all Anti-Money Laundering Certifications are valid for 2 years. There are many more requirements before financial experts can enroll to take the CAM exam. LIMRA offers a list of multiple courses and tutorials on Anti-Money Laundering AML training explicitly designed to meet industry training requirements. First exam applicants need to earn at least 40 credits of college coursework. Fortunately the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits.

Source: ssbm.ch

Source: ssbm.ch

There are many more requirements before financial experts can enroll to take the CAM exam. When staff join the business. This is why anti-money laundering education has become an essential part of employee training. When staff change roles in an organisation. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

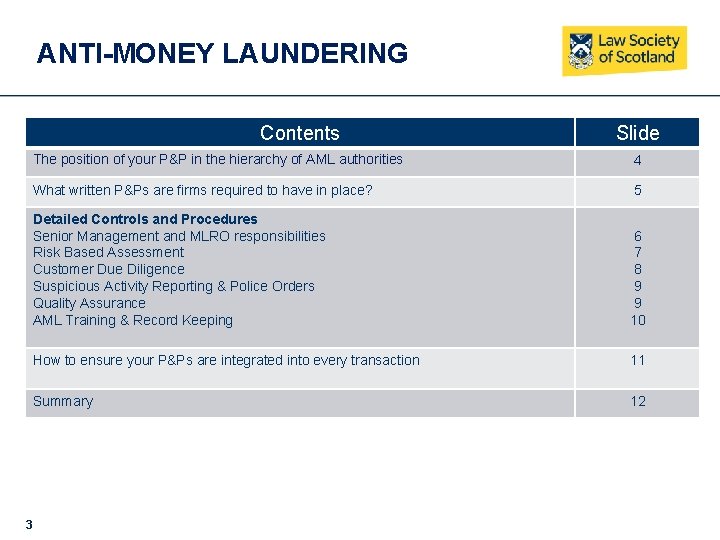

Provide ongoing training for. LIMRA offers a list of multiple courses and tutorials on Anti-Money Laundering AML training explicitly designed to meet industry training requirements. When staff change roles in an organisation. The recommended frequency of AML training organised by an MLRO Money Laundering Report Officer is dependent upon several factors that we will cover below but it is recommended by the Academy that training takes part at least annually. This Act requires insurance companies to establish anti-money laundering programs that comply with the minimum standards set by the Department of the Treasury.

Source: vinciworks.com

Source: vinciworks.com

When staff change roles in an organisation. Certificate on successful completion. Provide ongoing training for. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits.

Source: unodc.org

Source: unodc.org

When staff join the business. Ad Learn Anti-Money Laundering online at your own pace. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. When staff join the business. Ad Learn Anti-Money Laundering online at your own pace.

Source: unodc.org

Source: unodc.org

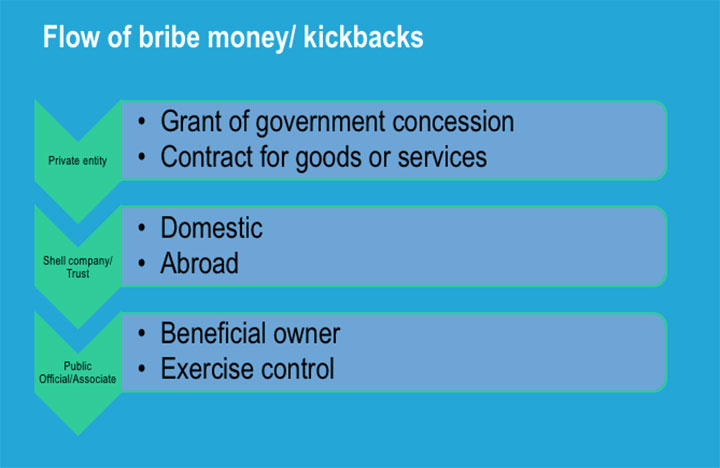

Money laundering is a potential indicator of terrorist funding and other global crimes making anti-money-laundering AML training even more necessary. In fact there are new strategies for money laundering created all the time some much more complex that we realize. Ad Learn Anti-Money Laundering online at your own pace. When staff change roles in an organisation. Money laundering is a potential indicator of terrorist funding and other global crimes making anti-money-laundering AML training even more necessary.

Source: redbirdagents.com

Source: redbirdagents.com

You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. This is why anti-money laundering education has become an essential part of employee training. According to this the financial institution should provide ongoing training for appropriate personnel concerning their responsibilities under the program including training in the detection of suspicious transactions. Provide ongoing training for. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits.

Source: zoetalentsolutions.com

Source: zoetalentsolutions.com

Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. RegEd is known for offering Anti-Money Laundering AML training that makes aware of the insurance producers and brokers regarding anti-money laundering AML responsibilities. These include carrying out customer due diligence measures to. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. The recommended frequency of AML training organised by an MLRO Money Laundering Report Officer is dependent upon several factors that we will cover below but it is recommended by the Academy that training takes part at least annually.

Source: pinterest.com

Source: pinterest.com

Does Anti-Money Laundering Certification training expire. Money laundering is a potential indicator of terrorist funding and other global crimes making anti-money-laundering AML training even more necessary. Define money laundering and terrorist financing. These include carrying out customer due diligence measures to. This program empowers makers to satisfy AML training prerequisites and afterward share.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

Anti-Money Laundering Compliance - Understanding The Laws This anti-money laundering training program delves deeper into what money laundering is and provides a more detailed explanation of the AML rules and regulations. Each member must review and if necessary update the information regarding a change to its AML compliance person within 30 days following the change and verify such information within 17 business days after the end of each calendar year. Ad Learn Anti-Money Laundering online at your own pace. Identify the client requirements and records required to open a DC Bank account. Start today with a special offer.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Youll also discover how to identify the various red flags that often indicate the occurrence of money laundering. Fortunately the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. This course will provide a thorough awareness of the key facts to do with the act of money laundering the stages of money laundering and how companies can be in line with the legislations. Train online at your own pace with a full audio voiceover. In fact there are new strategies for money laundering created all the time some much more complex that we realize.

Source: pinterest.com

Source: pinterest.com

These include carrying out customer due diligence measures to. Join millions of learners from around the world already learning on Udemy. Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. This includes establishing an ongoing training program for anti-money laundering. Getting your employees up to speed on the latest regulations and how to spot money laundering is.

Source: slidetodoc.com

Source: slidetodoc.com

Start today with a special offer. An email is sent to the address on your account to advise that your certification is due to expire within 60 days. Recognize and understand the importance of Know Your Client KYC rules. Certificate on successful completion. When staff join the business.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering training how often by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas