14++ Anti money laundering training life insurance ideas in 2021

Home » about money loundering idea » 14++ Anti money laundering training life insurance ideas in 2021Your Anti money laundering training life insurance images are ready. Anti money laundering training life insurance are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering training life insurance files here. Find and Download all royalty-free images.

If you’re looking for anti money laundering training life insurance images information related to the anti money laundering training life insurance topic, you have pay a visit to the ideal site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

Anti Money Laundering Training Life Insurance. Join millions of learners from around the world already learning on Udemy. Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws. This Anti-Money Laundering training course is for use ONLY by individuals who have contracted or intend to contract with American-Amicable Life Insurance Company of Texas IA American Life Insurance Company Occidental Life Insurance Company of North Carolina Pioneer American Insurance Company or Pioneer Security Life Insurance Company. Anti money laundering training for insurance agents.

Anti Money Laundering Regulations Compliance Process Policy Course From zoetalentsolutions.com

Anti Money Laundering Regulations Compliance Process Policy Course From zoetalentsolutions.com

Anti-money laundering compliance tools for insurers insurtechs brokers and re-insurers giving you a granular view of your customers risk thoughout the client lifecycle. Online anti-money laundering training WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Required no-cost training for agents selling life insurance. There are two very quick and simple ways to complete your AML training so you can keep selling life insurance with various insurance carriers.

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

This is proof of your Anti-Money Laundering Training. There are two very quick and simple ways to complete your AML training so you can keep selling life insurance with various insurance carriers. The course is designed to help insurance companies design anti-money laundering programs that effectively address the risks they face from money launderers and terrorists. In order to sell most life insurance and annuity products you need to complete Anti-Money Laundering AML training. Start today with a special offer. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US.

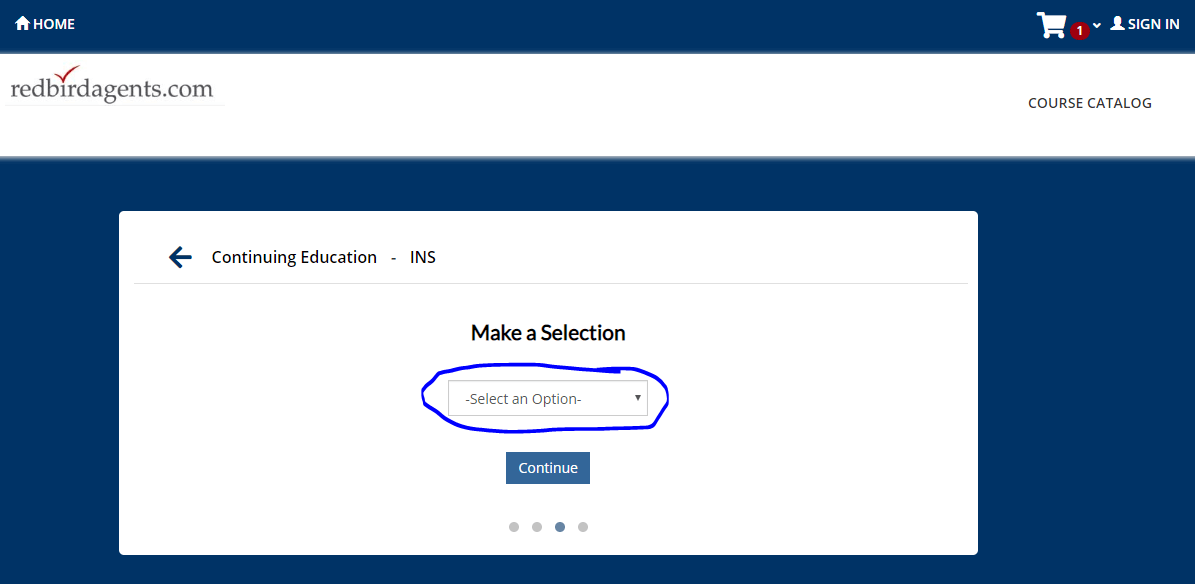

Source: redbirdagents.com

Source: redbirdagents.com

It is the responsibility of National Life Group the Company to establish Anti-Money Laundering AML policies procedures and controls for covered products and to integrate essential employees and agents into the program. Most insurers will accept this except National Life GroupInsurance Companies Must Establish Anti-Money Laundering Programs. Anti money laundering training for insurance agents. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. Join millions of learners from around the world already learning on Udemy.

Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. You can call us at 8015181956 with any questions or concerns. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Online anti-money laundering training WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers.

Source: pinterest.com

Source: pinterest.com

This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. This is proof of your Anti-Money Laundering Training. Ad Learn Anti-Money Laundering online at your own pace. They offer free anti-money laundering training courses and anti-money laundering certification online. This illegal money is derived from criminal activities such as the following.

Source: infopro.com.my

Source: infopro.com.my

They offer free anti-money laundering training courses and anti-money laundering certification online. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US. It is the responsibility of National Life Group the Company to establish Anti-Money Laundering AML policies procedures and controls for covered products and to integrate essential employees and agents into the program. Covered products include permanent life insurance and annuity products other than group and any other insurance product.

Source: infopro.com.my

Source: infopro.com.my

Anti money laundering training for insurance agents. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Anti-money laundering compliance tools for insurers insurtechs brokers and re-insurers giving you a granular view of your customers risk thoughout the client lifecycle. The course is designed to help insurance companies design anti-money laundering programs that effectively address the risks they face from money launderers and terrorists.

Source: zoetalentsolutions.com

Source: zoetalentsolutions.com

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Take the course successfuly a Company AML training course certificate will appear on your screen. AML training teaches you about the process of money laundering the laws that make it a crime and your responsibility to detect and stop it from happening. This Anti-Money Laundering training course is for use ONLY by individuals who have contracted or intend to contract with American-Amicable Life Insurance Company of Texas IA American Life Insurance Company Occidental Life Insurance Company of North Carolina Pioneer American Insurance Company or Pioneer Security Life Insurance Company. Start today with a special offer.

Source: zoetalentsolutions.com

Source: zoetalentsolutions.com

There are two very quick and simple ways to complete your AML training so you can keep selling life insurance with various insurance carriers. Ad Learn Anti-Money Laundering online at your own pace. Risk-based approach to combating money laundering and terrorist financing. AML training teaches you about the process of money laundering the laws that make it a crime and your responsibility to detect and stop it from happening. Anti money laundering training for insurance agents.

Source: yumpu.com

Source: yumpu.com

The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Anti-money laundering training for life insurance agents Life Insurance and Annuity Products To understand why anti-money laundering regulations encompass insurance companies it is imperative to understand how insurance companies and their products can be used for money laundering. Start today with a special offer. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Anti money laundering training for insurance agents.

Source: youtube.com

Source: youtube.com

Required no-cost training for agents selling life insurance. In order to sell most life insurance and annuity products you need to complete Anti-Money Laundering AML training. Anti-money laundering training online can be done with the help of The Life Insurance Marketing and Research Association LIMRA. There are two very quick and simple ways to complete your AML training so you can keep selling life insurance with various insurance carriers. Anti money laundering training for insurance agents.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

This illegal money is derived from criminal activities such as the following. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. Take the course successfuly a Company AML training course certificate will appear on your screen. The course is designed to help insurance companies design anti-money laundering programs that effectively address the risks they face from money launderers and terrorists. The other 60 attributed.

Source: nl.pinterest.com

Source: nl.pinterest.com

The STR reporting levels for the life insurance industry has decreased by about 37 over the period from 2004 and 2006. They offer free anti-money laundering training courses and anti-money laundering certification online. Start today with a special offer. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws.

Source: pinterest.com

Source: pinterest.com

Save a copy of the certificate. Required no-cost training for agents selling life insurance. They offer free anti-money laundering training courses and anti-money laundering certification online. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Anti-money laundering training online can be done with the help of The Life Insurance Marketing and Research Association LIMRA.

Source: limra.com

Source: limra.com

The STR reporting levels for the life insurance industry has decreased by about 37 over the period from 2004 and 2006. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in. Required no-cost training for agents selling life insurance. This course provides a thorough review of the anti-money laundering AML rules and guidelines as they pertain to insurance companies and insurance producers. Join millions of learners from around the world already learning on Udemy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering training life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information