14++ Anti money laundering uk gov info

Home » about money loundering Info » 14++ Anti money laundering uk gov infoYour Anti money laundering uk gov images are ready in this website. Anti money laundering uk gov are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering uk gov files here. Find and Download all free images.

If you’re searching for anti money laundering uk gov pictures information linked to the anti money laundering uk gov topic, you have come to the ideal site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

Anti Money Laundering Uk Gov. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering. Sanctions and Anti-Money Laundering Act 2018. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Money laundering and terrorist financing.

The Money Laundering Regulations 2007 Explanatory Memorandum From legislation.gov.uk

The Money Laundering Regulations 2007 Explanatory Memorandum From legislation.gov.uk

Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. Private sector engagement is critical to an effective response to money laundering. 85 UK Statutory Instruments. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. This page highlights some specific new areas that firms need to comply with. Register or renew your money laundering supervision with HMRC Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval.

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

Amendment of Part 2. In December 2018 the Financial Action Task. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. Some businesses and individuals in the UK must. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. The UKs anti-money laundering AML and counter-terrorist financing CTF supervisory regime is comprehensive seeking to regulate and supervise those firms most at risk from money laundering and terrorist financing.

Source: legislation.gov.uk

Source: legislation.gov.uk

In December 2018 the Financial Action Task. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. Money laundering and terrorist financing. The Sanctions and Anti-Money Laundering Act 2018 Commencement No. Sanctions and Anti-Money Laundering Act 2018.

Source: sfo.gov.uk

Source: sfo.gov.uk

Youll need to sign in to your account to read them. Explanatory Notes were introduced in 1999 and accompany all Public Acts except Appropriation. The Oversight of Professional Body Anti-Money Laundering and Counter Terrorist Financing Supervision Regulations 2017. The UK is a member of FATF and accordingly the UK anti-money laundering legislation meets FATFs global standards. Sanctions and Anti-Money Laundering Act 2018.

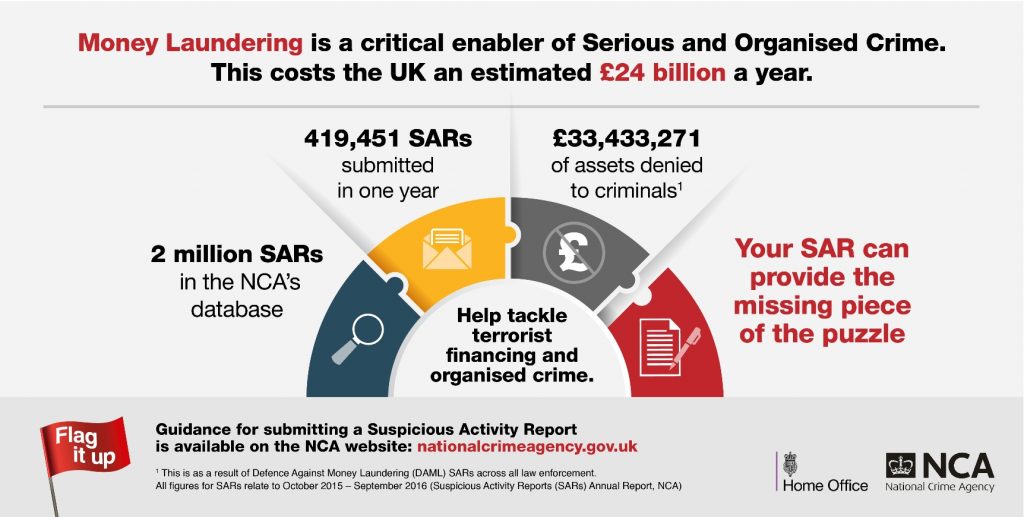

Source: nationalcrimeagency.gov.uk

Source: nationalcrimeagency.gov.uk

The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. Working alongside major financial institutions enables us to detect and disrupt money laundering activities in the UK and around the world. A the institutional structure and broad procedures of the United Kingdoms anti-money laundering and counter-terrorist financing regime including the role of the financial intelligence unit tax. In December 2018 the Financial Action Task. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified.

Source: researchgate.net

Source: researchgate.net

The Oversight of Professional Body Anti-Money Laundering and Counter Terrorist Financing Supervision Regulations 2017. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. In December 2018 the Financial Action Task. The NCA works in cooperation with domestic and international partners to tackle the global threat of money laundering. Private sector engagement is critical to an effective response to money laundering.

Source:

Register or renew your money laundering supervision with HMRC Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval. Amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. In December 2018 the Financial Action Task. Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. Register or renew your money laundering supervision with HMRC Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval.

Source: legislation.gov.uk

Source: legislation.gov.uk

This page highlights some specific new areas that firms need to comply with. Register or renew your money laundering supervision with HMRC Fees youll pay for money laundering supervision Apply for the fit and proper test and HMRC approval. Money laundering and terrorist financing. In December 2018 the Financial Action Task. Explanatory Notes were introduced in 1999 and accompany all Public Acts except Appropriation.

Source: researchgate.net

Source: researchgate.net

ICLG - Anti-Money Laundering Laws and Regulations - United Kingdom covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. Working alongside major financial institutions enables us to detect and disrupt money laundering activities in the UK and around the world. Amendment of Part 3. Anti-money laundering registration If you run a business in the financial sector you may need to register with an anti-money laundering scheme. ICLG - Anti-Money Laundering Laws and Regulations - United Kingdom covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions.

Source:

They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. ICLG - Anti-Money Laundering Laws and Regulations - United Kingdom covers issues including criminal enforcement regulatory and administrative enforcement and requirements for financial institutions and other designated businesses in 29 jurisdictions. Anti-money laundering registration If you run a business in the financial sector you may need to register with an anti-money laundering scheme. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. This page highlights some specific new areas that firms need to comply with.

Source: slideshare.net

Source: slideshare.net

Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. Amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. Money laundering and terrorist financing.

Source: 16trinity.co.uk

Source: 16trinity.co.uk

Amendment of Part 2. Sanctions and Anti-Money Laundering Act 2018. A the institutional structure and broad procedures of the United Kingdoms anti-money laundering and counter-terrorist financing regime including the role of the financial intelligence unit tax. Amendment of Part 2. HMRC sends messages to your anti-money laundering supervision account not your business tax account.

Source: researchgate.net

Source: researchgate.net

In December 2018 the Financial Action Task. The NCA works in cooperation with domestic and international partners to tackle the global threat of money laundering. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. The UK is a member of FATF and accordingly the UK anti-money laundering legislation meets FATFs global standards. As the gambling supervisory body we have a duty to ensure adequate controls are in place to prevent casinos in this country being used for money laundering or.

Source: legislation.gov.uk

Source: legislation.gov.uk

Anti-money laundering registration If you run a business in the financial sector you may need to register with an anti-money laundering scheme. Amendment of Part 1. Money laundering and terrorist financing. This page highlights some specific new areas that firms need to comply with. The NCA works in cooperation with domestic and international partners to tackle the global threat of money laundering.

Source: pdfprof.com

Source: pdfprof.com

Call HMRC if your business is covered by the Money Laundering Regulations and you need advice or information on how to report suspicious transactions. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. The NCA works in cooperation with domestic and international partners to tackle the global threat of money laundering. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering uk gov by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas