13+ Anti money laundering uk tax information

Home » about money loundering idea » 13+ Anti money laundering uk tax informationYour Anti money laundering uk tax images are ready in this website. Anti money laundering uk tax are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering uk tax files here. Find and Download all free photos and vectors.

If you’re searching for anti money laundering uk tax images information linked to the anti money laundering uk tax interest, you have visit the right site. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

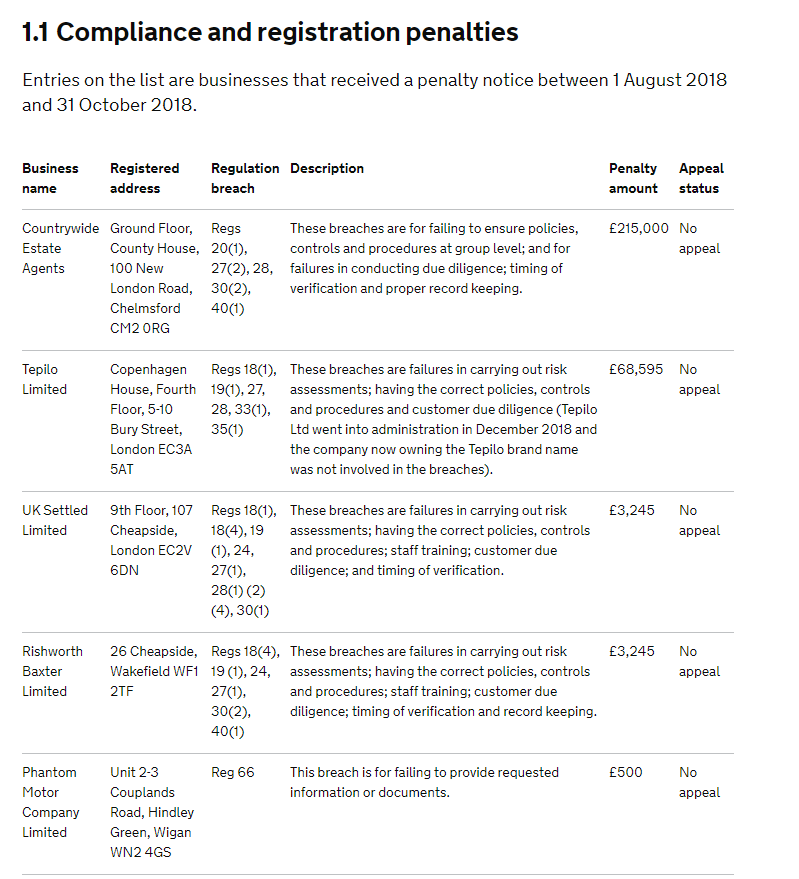

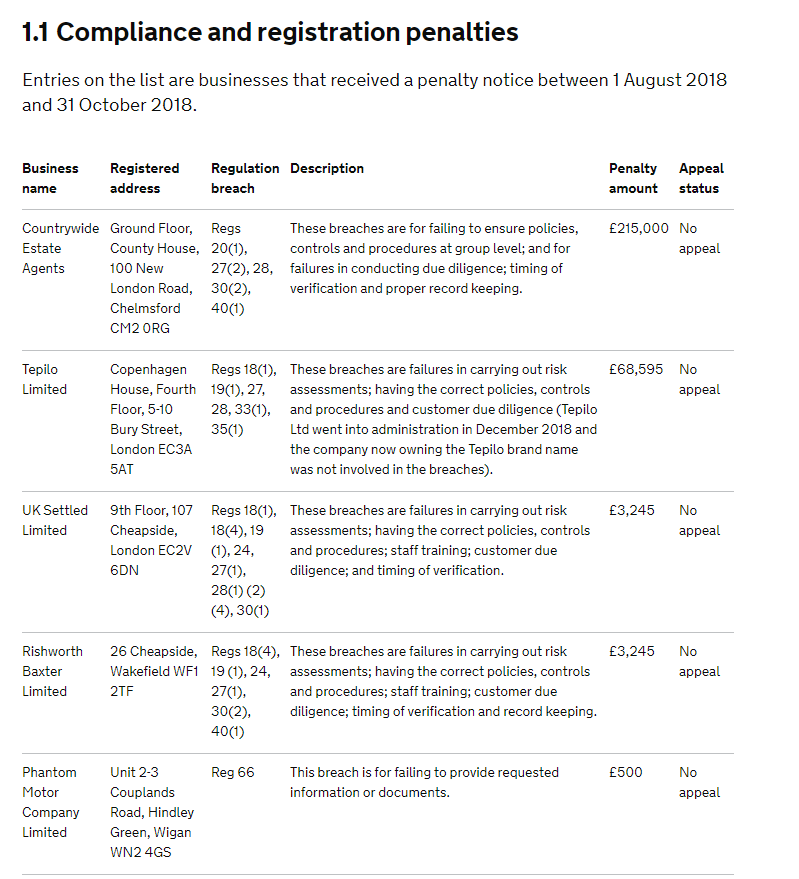

Anti Money Laundering Uk Tax. What tax advisers need to know. Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of. A consultation has already been issued by HM Treasury and a response to the consultation is awaited. Compliance checks penalties and appeals.

Estate Agents Hit With Surprise Hmrc Inspections Vinciworks Blog From vinciworks.com

Estate Agents Hit With Surprise Hmrc Inspections Vinciworks Blog From vinciworks.com

This guidance assumes that many businesses will find it easier. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Youll need to sign in to your account to read them. The Fifth Anti Money Laundering Directive 5AMLD for the UK The Fifth Anti Money Laundering Directive 5AMLD entered into force on 10 January 2020 for the EU Member States. HMRC sends messages to your anti-money laundering supervision account not your business tax account. You will need to enter your Data Protection Registration Number when registering to use TaxCalc Anti-Money Laundering Identity Checking Service.

The 5th EU Anti-Money Laundering Directive 5MLD must be law in the UK by 10 January 2020.

The comprehensive Anti Money Laundering AML and Tax Accounting has been designed by industry experts to provide learners with everything they need to enhance their skills and knowledge in their chosen area of study. Last year the money laundering regulations changed and so did the definition of tax advisers. How HMRC checks on businesses registered for money laundering. What changes can tax professionals expect. 114 The UK anti-money laundering regime applies only to defined services carried out by designated businesses. This guidance assumes that many businesses will find it easier.

Source:

The UK is a member of FATF and accordingly the UK anti-money laundering legislation meets. For a legal entity the maximum penalty is an unlimited fine. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The UK anti-money laundering legislation is dictated by the Proceeds of Crime Act 2002 POCA the Terrorism Act 2000 and the Money Laundering Terrorist Financing and Transfer of Funds 2017. Last year the money laundering regulations changed and so did the definition of tax advisers.

Source: researchgate.net

Source: researchgate.net

The UK is a member of FATF and accordingly the UK anti-money laundering legislation meets. Anti-money laundering and counter-terrorist financing If you are carrying on a business in the tax and accountancy sector you or your firm must be supervised. The 5th EU AML directive is an update to the 4th EU AML directive 4MLD. 114 The UK anti-money laundering regime applies only to defined services carried out by designated businesses. In essence this means sole practitioners and principals in partnershipslimited liability partnerships and companies operating in that sector.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

What changes can tax professionals expect. How HMRC checks on businesses registered for money laundering. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. In essence this means sole practitioners and principals in partnershipslimited liability partnerships and companies operating in that sector. Report changes for anti-money laundering supervision or deregister your business.

Source:

HMRC sends messages to your anti-money laundering supervision account not your business tax account. For a legal entity the maximum penalty is an unlimited fine. Youll need to sign in to your account to read them. To their anti-money laundering supervisory authority including why they consider them compliant with law and regulation. Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of.

Source: researchgate.net

Source: researchgate.net

This guidance assumes that many businesses will find it easier. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of. It is intended to be read by anyone who provides audit accountancy tax advisory insolvency or trust and company services in the United Kingdom and has been approved and adopted by the UK accountancy AML supervisory bodies. HMRC sends messages to your anti-money laundering supervision account not your business tax account.

Source: vinciworks.com

Source: vinciworks.com

Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of. HMRC sends messages to your anti-money laundering supervision account not your business tax account. Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of. This guidance assumes that many businesses will find it easier. 114 The UK anti-money laundering regime applies only to defined services carried out by designated businesses.

Source: lawsociety.org.uk

Source: lawsociety.org.uk

Youll need to sign in to your account to read them. The 5th EU Anti-Money Laundering Directive 5MLD must be law in the UK by 10 January 2020. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. SUPPLEMENTARY ANTI MONEY LAUNDERING GUIDANCE FOR TAX PRACTITIONERS Guidance for those providing tax services in the United Kingdom on the prevention of money laundering and the countering of terrorist financing. Enrol on the Anti Money Laundering AML and Tax Accounting today and learn from the very best the industry has to offer.

Source: researchgate.net

Source: researchgate.net

This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. Britains tax authority has slapped a record 238 million pound 324 million fine on MT Global Ltd a private money services business for significant breaches of. As efforts to stamp out money laundering and the financing of terrorist activity are stepped up throughout the UK tax preparation specialist David Redfern Managing Director of DSR Tax Refunds Ltd has issued his guidance to small businesses and. Compliance checks penalties and appeals. Welcome to the Anti-Money Laundering Guide previously named Money Laundering Handbook.

Source: researchgate.net

Source: researchgate.net

Guidance to Assist Small Businesses and Sole Traders in Meeting 2017 Anti-Money Laundering Regulations. The UK anti-money laundering legislation is dictated by the Proceeds of Crime Act 2002 POCA the Terrorism Act 2000 and the Money Laundering Terrorist Financing and Transfer of Funds 2017. The 5th EU AML directive is an update to the 4th EU AML directive 4MLD. As efforts to stamp out money laundering and the financing of terrorist activity are stepped up throughout the UK tax preparation specialist David Redfern Managing Director of DSR Tax Refunds Ltd has issued his guidance to small businesses and. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

Source: researchgate.net

Source: researchgate.net

The UK anti-money laundering legislation is dictated by the Proceeds of Crime Act 2002 POCA the Terrorism Act 2000 and the Money Laundering Terrorist Financing and Transfer of Funds 2017. HMRC sends messages to your anti-money laundering supervision account not your business tax account. This webinar looks at the background of the changes and the useful guidance weve published to. A consultation has already been issued by HM Treasury and a response to the consultation is awaited. This guidance assumes that many businesses will find it easier.

Source: fortesestates.co.uk

Source: fortesestates.co.uk

It is intended to be read by anyone who provides audit accountancy tax advisory insolvency or trust and company services in the United Kingdom and has been approved and adopted by the UK accountancy AML supervisory bodies. In essence this means sole practitioners and principals in partnershipslimited liability partnerships and companies operating in that sector. The 5th EU AML directive is an update to the 4th EU AML directive 4MLD. Last year the money laundering regulations changed and so did the definition of tax advisers. This Guidance is issued by Chartered Institute of Taxation Association of Taxation Technicians.

Source:

The UK is a member of FATF and accordingly the UK anti-money laundering legislation meets. Youll need to sign in to your account to read them. Anti-money laundering and counter-terrorist financing If you are carrying on a business in the tax and accountancy sector you or your firm must be supervised. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The Fifth Anti Money Laundering Directive 5AMLD for the UK The Fifth Anti Money Laundering Directive 5AMLD entered into force on 10 January 2020 for the EU Member States.

Source: napier.ai

Source: napier.ai

Guidance to Assist Small Businesses and Sole Traders in Meeting 2017 Anti-Money Laundering Regulations. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. This webinar looks at the background of the changes and the useful guidance weve published to. Compliance checks penalties and appeals. We would like to show you a description here but the site wont allow us.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering uk tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information