12++ At which stages of the money laundering process are capital markets most vulnerable info

Home » about money loundering idea » 12++ At which stages of the money laundering process are capital markets most vulnerable infoYour At which stages of the money laundering process are capital markets most vulnerable images are available in this site. At which stages of the money laundering process are capital markets most vulnerable are a topic that is being searched for and liked by netizens today. You can Download the At which stages of the money laundering process are capital markets most vulnerable files here. Get all free vectors.

If you’re looking for at which stages of the money laundering process are capital markets most vulnerable pictures information related to the at which stages of the money laundering process are capital markets most vulnerable keyword, you have come to the ideal blog. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

At Which Stages Of The Money Laundering Process Are Capital Markets Most Vulnerable. The next stage of money laundering attempts to separate the money from its original illegal source. This part of the process is often complicated. This is the first stage in the washing cycle. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials.

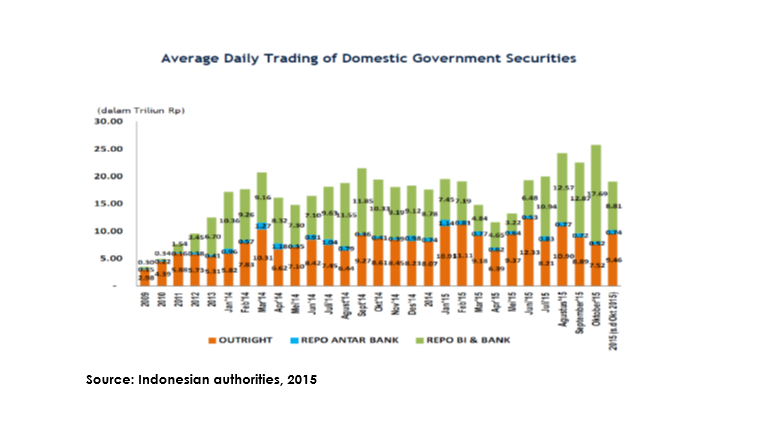

Lessons On Building Robust Capital Markets Through Smart Regulation And Innovation From worldbank.org

Lessons On Building Robust Capital Markets Through Smart Regulation And Innovation From worldbank.org

The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area. The end result is legal funds. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. This is the first stage in the washing cycle. Process of Money Laundering Placement.

3 Money laundering in the capital markets can take place in all the three stages as capital markets are no longer predominantly cash based they are more likely to be used in the layering stage rather than placement stage of money laundering.

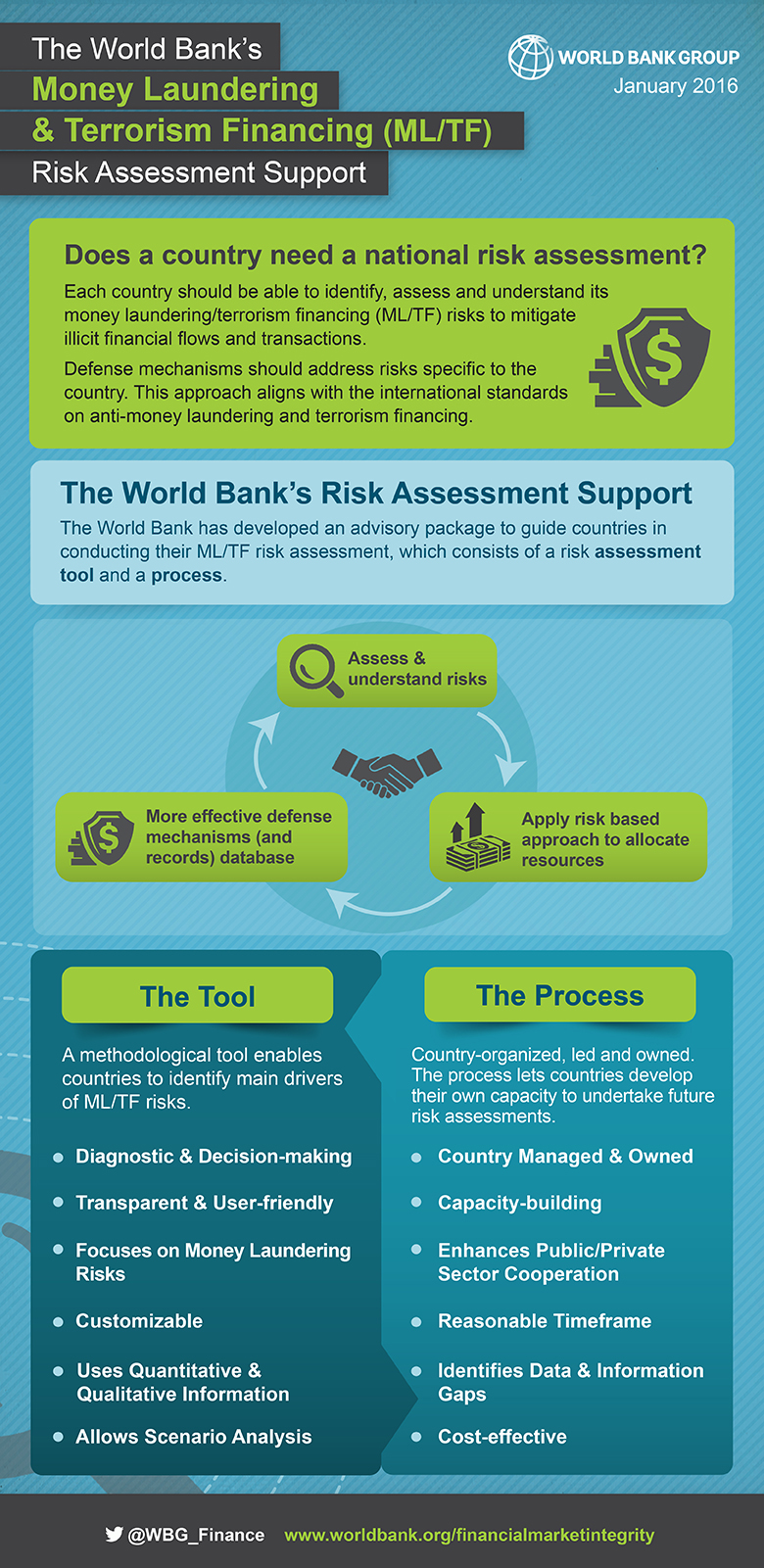

When criminals are in physical possession of cash that can directly link them to predicate criminal conduct they are at their most vulnerable. There are many. Vast sums moving between jurisdictions in fractions of a second present an attractive target for money launderers. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. For deployment in legal avenues it is inducted in financial system. While the 2015 UK National Risk Assessment of Money Laundering and Terrorist Financing Report made no mention of vulnerabilities associated with capital markets the 2017 assessment acknowledged that capital markets raising and trading equity and debt and trading derivatives currency and commodities are assessed as to be exposed to high risks of money laundering in.

Source: worldbank.org

Source: worldbank.org

Layering is conversion and movement of their illegal fund to hide their source. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. While the 2015 UK National Risk Assessment of Money Laundering and Terrorist Financing Report made no mention of vulnerabilities associated with capital markets the 2017 assessment acknowledged that capital markets raising and trading equity and debt and trading derivatives currency and commodities are assessed as to be exposed to high risks of money laundering in. Vast sums moving between jurisdictions in fractions of a second present an attractive target for money launderers.

Source: researchgate.net

Source: researchgate.net

The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area. The correct answer is A Countries can suffer reputational risk if they are known as a haven for money laundering they may be forced to make adverse fiscal tax and budget policy to compensate for the tax revenue lost to criminal laundering and they may lose control of monetary policy as currency flows are directed by launderers out of the country. During this stage the money may be transferred between multiple countries. By moving the money quickly and to different areas the money may be transformed so that it is not detected through audits. Money laundering typically includes three stages.

Source: worldbank.org

Source: worldbank.org

The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier. This is the first stage in the washing cycle. It is during the placement stage that money launderers are the most vulnerable to being caught. When criminals are in physical possession of cash that can directly link them to predicate criminal conduct they are at their most vulnerable. Four methods of money launderingcash smuggling casinos and other gambling venues insurance.

Source: worldbank.org

Source: worldbank.org

This part of the process is often complicated. Such criminals need to place the cash into the financial system usually through the use of bank accounts in order to commence the laundering process. It is during the placement stage that money launderers are the most vulnerable to being caught. It is during the placement stage that money launderers are the most vulnerable to being caught. To ensure you understand the stages of money laundering lets delve into the most frequently asked questions about what money laundering is the three stages of money laundering and what to do if you have been accused of money laundering.

Source: worldbank.org

Source: worldbank.org

It is during the placement stage that money launderers are the most vulnerable to being caught. It is during the placement stage that money launderers are the most vulnerable to being caught. However where the transactions are in cash there is still the risk of capital markets being used at the placement stage. It is during the placement stage that money launderers are the most vulnerable to being caught. Money laundering typically occurs in three stages placement layering and integration.

Source: worldbank.org

Source: worldbank.org

It is during the placement stage that money launderers are the most vulnerable to being caught. Typical money laundering process has three stages shown in Figure 1 on the next page. The end result is legal funds. Layering is conversion and movement of their illegal fund to hide their source. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials.

Source: worldbank.org

Source: worldbank.org

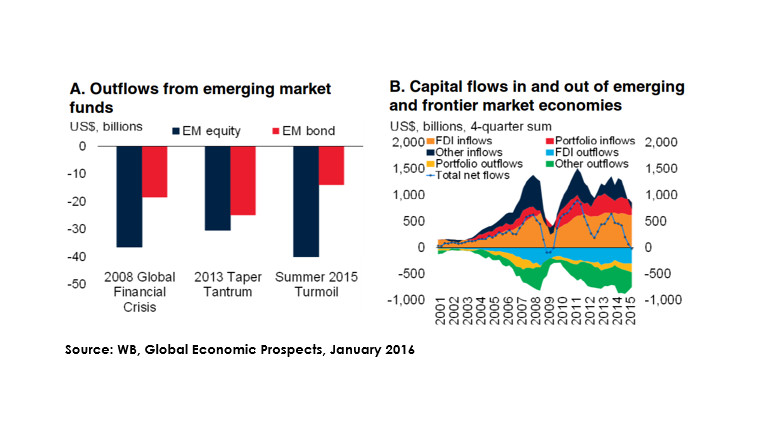

Capital markets are vulnerable to money laundering too Capital markets are globally interconnected and predominantly highly liquid. Capital markets are vulnerable to money laundering too Capital markets are globally interconnected and predominantly highly liquid. Layering is conversion and movement of their illegal fund to hide their source. For deployment in legal avenues it is inducted in financial system. Financial institutions including banks broker-dealers money managers and fiduciaries are trained to identify suspicious transactions such as cash or travelers check deposits.

Source: worldbank.org

Source: worldbank.org

Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. Placement layering and integration stage. Such criminals need to place the cash into the financial system usually through the use of bank accounts in order to commence the laundering process. There are many. The next stage of money laundering attempts to separate the money from its original illegal source.

Source: academia.edu

Source: academia.edu

Financial institutions including banks broker-dealers money managers and fiduciaries are trained to identify suspicious transactions such as cash or travelers check deposits. This part of the process is often complicated. The end result is legal funds. By moving the money quickly and to different areas the money may be transformed so that it is not detected through audits. Four methods of money launderingcash smuggling casinos and other gambling venues insurance.

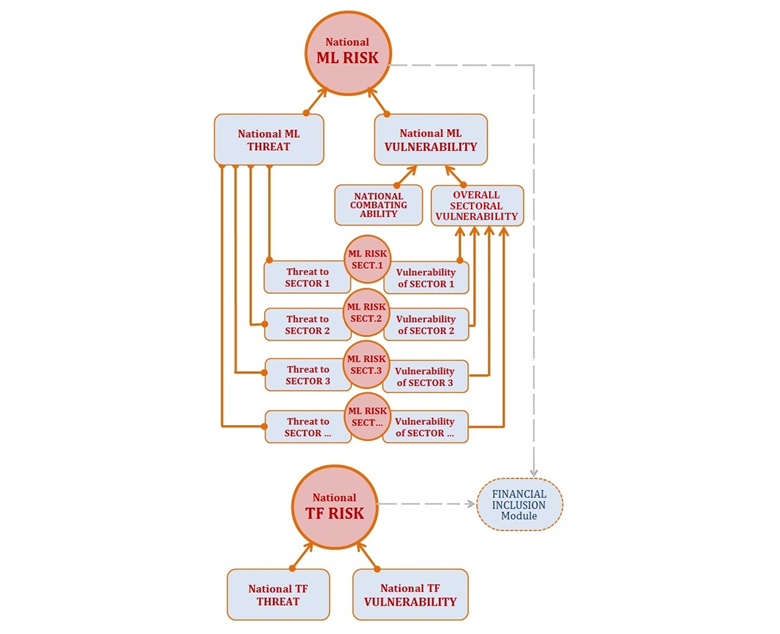

Source: researchgate.net

Source: researchgate.net

3 Money laundering in the capital markets can take place in all the three stages as capital markets are no longer predominantly cash based they are more likely to be used in the layering stage rather than placement stage of money laundering. Vast sums moving between jurisdictions in fractions of a second present an attractive target for money launderers. Money laundering is one of the most common forms of organised crime in the UK. At this stage cash derived from criminal activity is infused into the financial system. The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier.

Source: researchgate.net

Source: researchgate.net

This part of the process is often complicated. In particular the review found that participants were generally at the early stages of their thinking in relation to money-laundering risk in the capital markets. Vast sums moving between jurisdictions in fractions of a second present an attractive target for money launderers. The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier. And at the same time hiding its source.

Source: worldbank.org

Source: worldbank.org

For deployment in legal avenues it is inducted in financial system. It is during the placement stage that money launderers are the most vulnerable to being caught. Such criminals need to place the cash into the financial system usually through the use of bank accounts in order to commence the laundering process. For deployment in legal avenues it is inducted in financial system. It is during the placement stage that money launderers are the most vulnerable to being caught.

Source:

The placement makes the funds more liquid since by depositing cash into a bank account can be transfer and manipulated easier. It is during the placement stage that money launderers are the most vulnerable to being caught. Placement layering and integration stage. When criminals are in physical possession of cash that can directly link them to predicate criminal conduct they are at their most vulnerable. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title at which stages of the money laundering process are capital markets most vulnerable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information