19+ Axis bank tds declaration form info

Home » about money loundering Info » 19+ Axis bank tds declaration form infoYour Axis bank tds declaration form images are ready. Axis bank tds declaration form are a topic that is being searched for and liked by netizens now. You can Download the Axis bank tds declaration form files here. Download all free photos and vectors.

If you’re looking for axis bank tds declaration form images information linked to the axis bank tds declaration form topic, you have visit the right blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

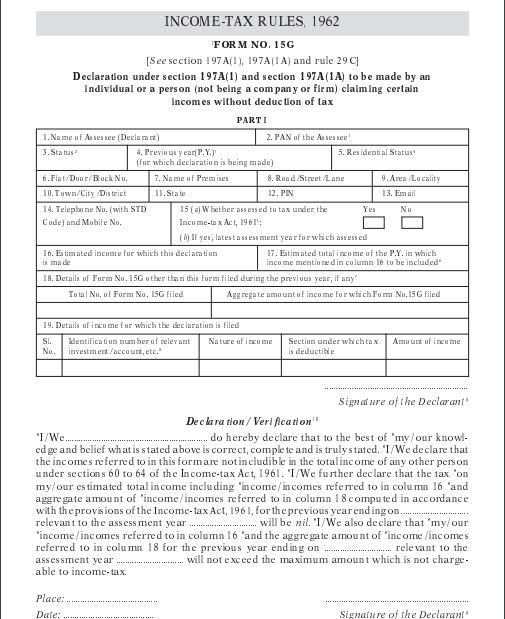

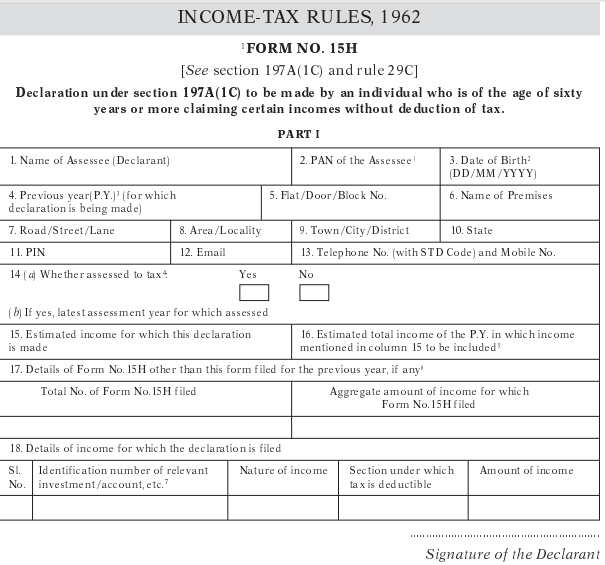

Axis Bank Tds Declaration Form. The bank in this case will not deduct any TDS on your interest income. Form 15GH are self-declaration forms required to be furnished by the assessee to the banker for nil deduction lower deduction of TDS tax deducted at source on interest income. You can also submit Form 15G and Form 15H to the bank if the total taxable income is below the total taxable limit. We also understand that submission of this e-Payment Request Form does not imply payment of tax which is subject to availability of funds in our Axis Bank Current Account as well as accessibility of TIN-NSDL Website.

Pin On Income Tax From pinterest.com

Pin On Income Tax From pinterest.com

Signature of person making payment Rs. Particulars of the TDS Return Forms. Form 15G can be submitted by the Individuals below 60 years HUFs Trusts and Associations. We understand that the Bank will make the CBDT e-Payment on our behalf based on this e-Payment Request Form submitted by us. Date of Birth2DDMMYYYY 4. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age.

In words drawn on Name of the Bank.

Name of Assessee Declarant 2. PAN of the Assessee 1 3. Signature of person making payment Rs. Type of TDS Return Forms. Stated above is coffect complete and is tmly stated LAVe declare that the incomes refeffed to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act 1961 IWe further declare that the tax on my our estimated total income including incomeincomes refe-ffed to in column 16 and. Statement for tax deducted at source from salaries.

Source: wisdomjobs.com

Source: wisdomjobs.com

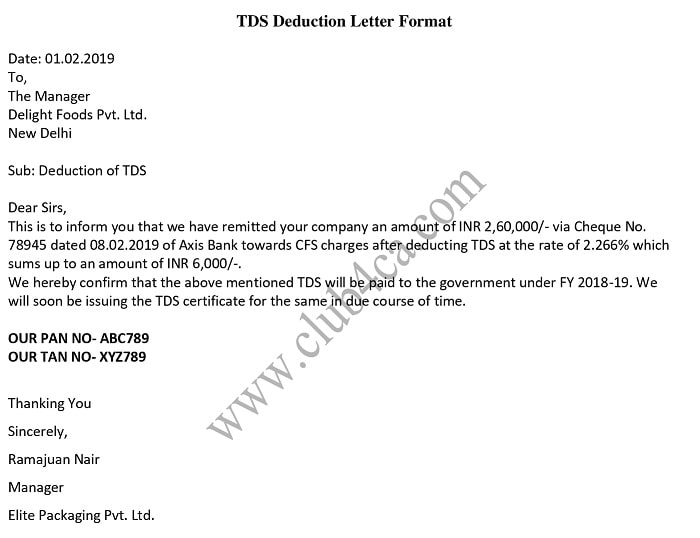

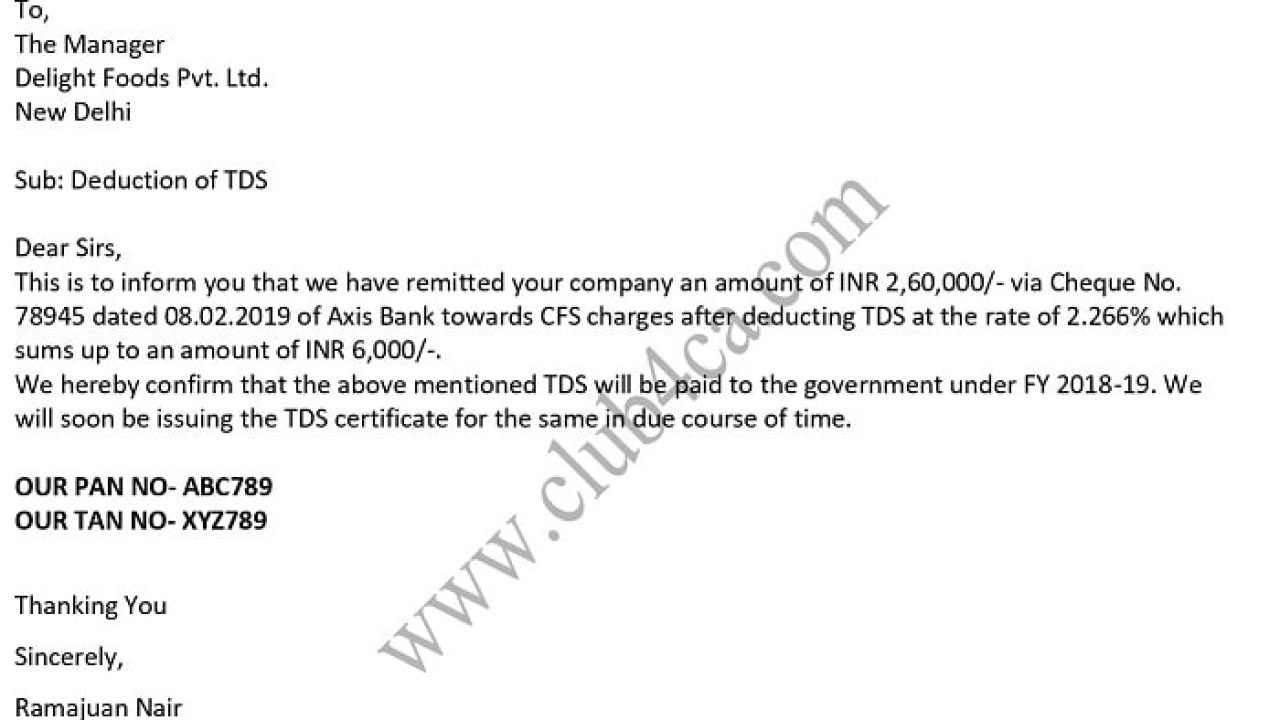

78945 dated 08022019 of Axis Bank towards CFS charges after deducting TDS at the rate of 2266 which sums up to an amount of INR 6000-. Particulars of the TDS Return Forms. One can submit these forms only when the tax on total income is nil and the aggregate of the interest received during an FY does not exceed the basic exemption slab of Rs 25 lakh and Rs 3. Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. Statement for tax deduction on income received from interest dividends or any other sum payable to non residents.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

Deduction of TDS Dear Sir This is to inform you that we have remitted your company an amount of INR 260000- via Cheque No. Statement for tax deduction on income received from interest dividends or any other sum payable to non residents. The bank in this case will not deduct any TDS on your interest income. Signature of person making payment Rs. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format.

Source: club4ca.com

Source: club4ca.com

The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format. Name of the Bank and Branch Date. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit. Deduction of TDS Dear Sir This is to inform you that we have remitted your company an amount of INR 260000- via Cheque No.

Source: groww.in

Source: groww.in

Signature of person making payment Rs. The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. Now you can reduce the TDS from your NRO Fixed Deposits if you submit the DTAA form and other relevant details. Previous yearPY3 for which declaration is being made 5. You can also submit Form 15G and Form 15H to the bank if the total taxable income is below the total taxable limit.

Source: paisabazaar.com

Source: paisabazaar.com

Form 15GH are self-declaration forms required to be furnished by the assessee to the banker for nil deduction lower deduction of TDS tax deducted at source on interest income. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age. How to avoid TDS You can submit a declaration Form 15G or 15H to avoid TDS on interest income. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format. Taxpayers Counterfoil To be filled up by taxpayer SPACE FOR BANK SEAL TAN Received from Name Cash Debit to Ac Cheque No.

Source: in.pinterest.com

Source: in.pinterest.com

Type of TDS Return Forms. If your total income is below Income tax slab then you can submit a Form 15G or 15H to the bank at the start of the year to avoid TDS deduction done by the bank. In words drawn on Name of the Bank. Now you can reduce the TDS from your NRO Fixed Deposits if you submit the DTAA form and other relevant details. 15H See section 197A1C and rule 29C Declaration under section 197A1C to be made by an individual who is of the age of sixty years or more claiming certain incomes without deduction of tax.

Source: paisabazaar.com

Source: paisabazaar.com

Generation of Form 15GH will not take place in case Constitution or Date of birth is not updated in Bank records. Form 15G can be submitted by the Individuals below 60 years HUFs Trusts and Associations. 15G Form for Axis Bank PDF. India has signed a Double Taxation Avoi. 15G Form for HDFC Bank PDF Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit.

Source: in.pinterest.com

Source: in.pinterest.com

Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for. Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format. The bank also offers services like updation of address email PAN linking of Aadhaar for Government and other such benefits. Senior Citizen customers 60 years and above can submit declaration in Form 15H duly signed in duplicate subject to eligibility under section 197A 1C of the Income Tax Act for non- deduction of TDS from interest on term deposits Senior Citizen rates are not applicable for NRI Customers A fresh declaration in Form 15G15H both for. In case you failed to submit the investment proof to your employer and the bank deducted the TDS you can file a return and claim a refund of it provided your total taxable income is below the total taxable limit.

Source: wisdomjobs.com

Source: wisdomjobs.com

Statement for tax deduction on income received from interest dividends or any other sum payable to non residents. If your total income is below Income tax slab then you can submit a Form 15G or 15H to the bank at the start of the year to avoid TDS deduction done by the bank. 15G Form for HDFC Bank PDF Generally Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. Form 15G individuals claiming income without tax deduction Form 15H for senior citizens claiming income without tax deduction Charge Dispute Form to report transaction dispute Form for settlement of claim in deceased depositors account with nomination of survivorship clause. 78945 dated 08022019 of Axis Bank towards CFS charges after deducting TDS at the rate of 2266 which sums up to an amount of INR 6000-.

Source: pinterest.com

Source: pinterest.com

Form 15G individuals claiming income without tax deduction Form 15H for senior citizens claiming income without tax deduction Charge Dispute Form to report transaction dispute Form for settlement of claim in deceased depositors account with nomination of survivorship clause. In words drawn on Name of the Bank. One can submit these forms only when the tax on total income is nil and the aggregate of the interest received during an FY does not exceed the basic exemption slab of Rs 25 lakh and Rs 3. You can also submit Form 15G and Form 15H to the bank if the total taxable income is below the total taxable limit. Date of Birth2DDMMYYYY 4.

Source:

Here Form 15G for Axis Bank is available and use the given link to download the Axis Bank Form 15G in PDF format. Name of the Bank and Branch Date. We also understand that submission of this e-Payment Request Form does not imply payment of tax which is subject to availability of funds in our Axis Bank Current Account as well as accessibility of TIN-NSDL Website. Signature of person making payment Rs. Stated above is coffect complete and is tmly stated LAVe declare that the incomes refeffed to in this form are not includible in the total income of any other person under sections 60 to 64 of the Income-tax Act 1961 IWe further declare that the tax on my our estimated total income including incomeincomes refe-ffed to in column 16 and.

Source: bemoneyaware.com

Source: bemoneyaware.com

78945 dated 08022019 of Axis Bank towards CFS charges after deducting TDS at the rate of 2266 which sums up to an amount of INR 6000-. Statement for tax deducted at source from salaries. How to avoid TDS You can submit a declaration Form 15G or 15H to avoid TDS on interest income. Statement for tax deducted at source on all payments other than salaries. We understand that the Bank will make the CBDT e-Payment on our behalf based on this e-Payment Request Form submitted by us.

Source: club4ca.com

Source: club4ca.com

We understand that the Bank will make the CBDT e-Payment on our behalf based on this e-Payment Request Form submitted by us. Now you can reduce the TDS from your NRO Fixed Deposits if you submit the DTAA form and other relevant details. PAN of the Assessee 1 3. We understand that the Bank will make the CBDT e-Payment on our behalf based on this e-Payment Request Form submitted by us. While Form 15G is for individuals below 60 years Form 15H is for individuals above 60 years of age.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title axis bank tds declaration form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas