12+ Bank negara malaysia bond yield ideas in 2021

Home » about money loundering idea » 12+ Bank negara malaysia bond yield ideas in 2021Your Bank negara malaysia bond yield images are available in this site. Bank negara malaysia bond yield are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank negara malaysia bond yield files here. Download all royalty-free photos.

If you’re searching for bank negara malaysia bond yield images information related to the bank negara malaysia bond yield interest, you have come to the ideal site. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Bank Negara Malaysia Bond Yield. Bank Negara Malaysias BNM unexpected overnight policy rate OPR cut and the Covid-19 outbreak have pushed Malaysian bond yields. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. Successful bidders are determined according to the lowest yields offered and the coupon rate is fixed at the weighted average yield of successful bids. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method.

The Malaysian Bond Market Bank Negara Malaysia From bnm.gov.my

The Malaysian Bond Market Bank Negara Malaysia From bnm.gov.my

The yields of 10-year Malaysia Government Securities spiked to 358 on Thursday from 284 at end-February according to RAM Rating Services Bhd RAM as investors flee to safe-haven assets on fears of a global recession even as central banks continue to cut rates and ease monetary policy. BNM revised conventional overnight tender from RM322 billion to RM329 billion. For conventional investors the structuring of the bonds by the issuer is immaterial. The role of Bank Negara Malaysia is to promote monetary and financial stability. Economic and Financial Developments in the Malaysian Economy in the First Quarter of 2012 International Reserves of BNM as at 15 May 2012 Memorandum of Understanding between Bank Negara Malaysia and Central Bank of the Republic of Turkey. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018.

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009.

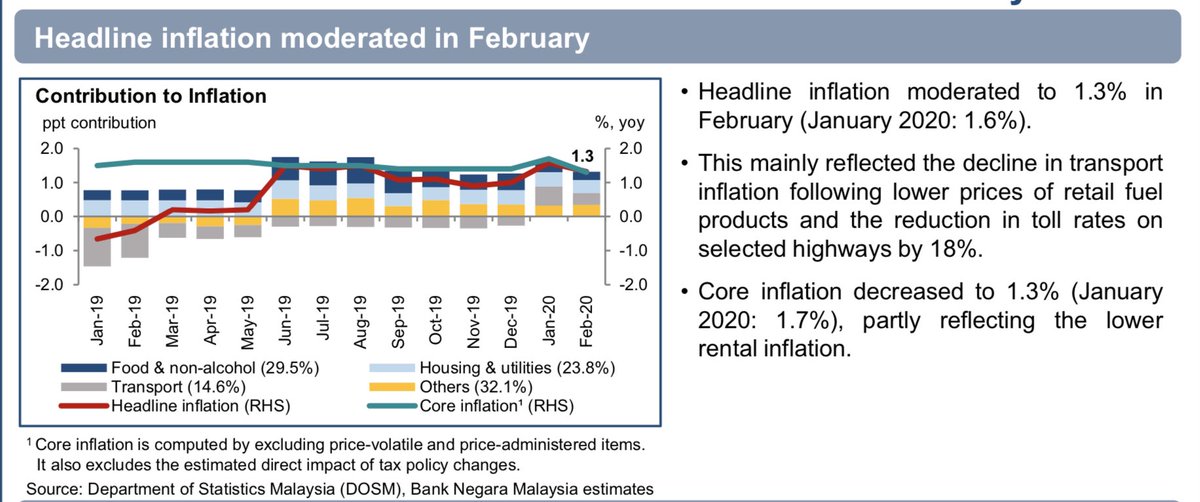

Cumulative NR outflows which. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. Bloomberg Barclays Global Aggregate Index. Successful bidders are determined according to the lowest yields offered and the coupon rate is fixed at the weighted average yield of successful bids. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029 fell one basis point to close at 263 yesterday July 21. The domestic bond market experienced a temporary spike in bond yields with 10-year Malaysian Government Securities MGS and 10-year AAA corporate bond yields rising by 84 bps and 59 bps respectively amid significant NR outflows RM224 billion or USD52 billion between February and April.

Source: ceicdata.com

Bloomberg Barclays Global Aggregate Index. Total Volume RM million Daily change bps Tenure. Even as central banks continue to cut rates and ease monetary policy a flight to safe-haven assets prevailed setting off a rapid spike in 10-year MGS yields to 358 on 19 March from 284 at end-February. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. RM15700 mil for 3 days.

Source: malaywallpaper.blogspot.com

Source: malaywallpaper.blogspot.com

RM15700 mil for 3 days. The inaugural issuance of RM400 million Bank Negara Malaysia Sukuk Ijarah which is a new Islamic monetary instrument based on the Al-Ijarah or sale and lease back concept that is globally accepted. Morgan Government Bond Index Emerging Markets GBI-EM. BNM revised conventional overnight tender from RM322 billion to RM329 billion. Cumulative NR outflows which.

Source: bloomberg.com

Source: bloomberg.com

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. RM15700 mil for 3 days. BNM likely to cut OPR again. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029 fell one basis point to close at 263 yesterday July 21. The issuance of sukuk Ijarah added diversity of monetary instruments used by Bank Negara Malaysia in managing liquidity in the Islamic Money Market.

Source: centralbanking.com

Source: centralbanking.com

For conventional investors the structuring of the bonds by the issuer is immaterial. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. Investing in banks capital bonds and sukuk can be a good start as everyone knows what the bank does lend money at higher interest rates from deposits collected and each of us normally has at least one bank account other than the importance of. RM32900 mil for 3 days. BNM revised conventional overnight tender from RM322 billion to RM329 billion.

Source: twitter.com

Source: twitter.com

BNM likely to cut OPR again. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. RM32900 mil for 3 days. Total Volume RM million Daily change bps Tenure. Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009.

Source: researchgate.net

Source: researchgate.net

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. The yields of 10-year Malaysia Government Securities spiked to 358 on Thursday from 284 at end-February according to RAM Rating Services Bhd RAM as investors flee to safe-haven assets on fears of a global recession even as central banks continue to cut rates and ease monetary policy. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. All offers must be submitted before 1630hrs. Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959.

Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. BNM likely to cut OPR again. Economic and Financial Developments in the Malaysian Economy in the First Quarter of 2012 International Reserves of BNM as at 15 May 2012 Memorandum of Understanding between Bank Negara Malaysia and Central Bank of the Republic of Turkey. Bloomberg Barclays Global Aggregate Index. All offers must be submitted before 1630hrs.

Source: pdfprof.com

The Security Industry Act 1983 regulates all matters related to dealing of securities in MalaysiaIn addition various rules and regulations were issued by Bank Negara Malaysia and Securities Commission to facilitate the smooth. 14 rows Bank Negara Malaysia. Malaysia rate outlook split amid lockdown. Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method.

Source: researchgate.net

Source: researchgate.net

Introduction Malaysia has a well-developed regulatory framework that governed both the primary market issuance and secondary market trading of debt securities. KUALA LUMPUR March 20. The move to safety so far. Cumulative NR outflows which. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018.

Source: centralbanking.com

Source: centralbanking.com

Economic and Financial Developments in the Malaysian Economy in the First Quarter of 2012 International Reserves of BNM as at 15 May 2012 Memorandum of Understanding between Bank Negara Malaysia and Central Bank of the Republic of Turkey. For conventional investors the structuring of the bonds by the issuer is immaterial. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. The domestic bond market experienced a temporary spike in bond yields with 10-year Malaysian Government Securities MGS and 10-year AAA corporate bond yields rising by 84 bps and 59 bps respectively amid significant NR outflows RM224 billion or USD52 billion between February and April. Malaysia rate outlook split amid lockdown.

Source: nst.com.my

Source: nst.com.my

The yields of 10-year Malaysia Government Securities spiked to 358 on Thursday from 284 at end-February according to RAM Rating Services Bhd RAM as investors flee to safe-haven assets on fears of a global recession even as central banks continue to cut rates and ease monetary policy. 21 rows Trading Yields. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. MGS are issued via competitive auction by Bank Negara Malaysia on behalf of the Government. Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond.

Source: bnm.gov.my

Source: bnm.gov.my

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. Bloomberg Barclays Global Aggregate Index. RM32900 mil for 3 days. Click here to view the Government Securities Yield for various tenures 2006-2018. 14 rows Bank Negara Malaysia.

Source: malaymail.com

Source: malaymail.com

BNM likely to cut OPR again. Due to Malaysias investment grade credit rating progressive and inclusive financial market policies developed infrastructure and ample secondary market liquidity Malaysian bonds have been included in various global bond indices. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029 fell one basis point to close at 263 yesterday July 21. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. Successful bidders are determined according to the lowest yields offered and the coupon rate is fixed at the weighted average yield of successful bids.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank negara malaysia bond yield by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information