19+ Bank secrecy act amendments ideas

Home » about money loundering idea » 19+ Bank secrecy act amendments ideasYour Bank secrecy act amendments images are ready in this website. Bank secrecy act amendments are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act amendments files here. Download all royalty-free photos.

If you’re looking for bank secrecy act amendments pictures information connected with to the bank secrecy act amendments keyword, you have visit the ideal site. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Bank Secrecy Act Amendments. The Bank Secrecy Act treats all bank deposits as absolutely confidential and these may not be inquired into except. BSA Related Regulations. Letter to Credit Unions No. Part 3268b1 of the FDIC Rules and Regulations.

![]() Bank Secrecy Act Anti Money Laundering Bsa Aml Adi Consulting From adiconsulting.com

Bank Secrecy Act Anti Money Laundering Bsa Aml Adi Consulting From adiconsulting.com

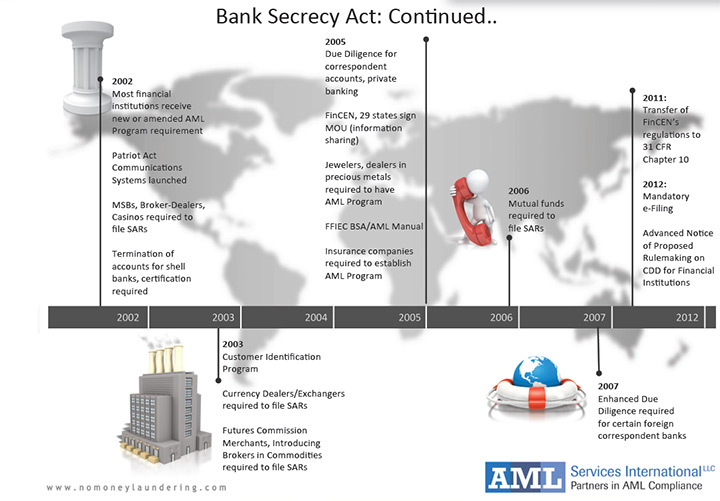

The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. 1 upon permission of the depositor 2 in cases of impeachment 3 upon order of a competent court in cases involving bribery or dereliction of duty or 4 in case the money deposited or invested is the subject matter of litigation. The Anti-Drug Abuse Act 1988 The Anti-Drug Abuse Act of 1988 was enacted as part of the USs so-called War on Drugs The Act amended the Bank Secrecy Act in expanding the definition of financial institutions to include auto dealers and real estate entities who were thereafter required to disclose the transaction of large sums. Letter to Credit Unions No. The BSA was amended to incorporate the. The events of September 11 2001 ultimately gave rise to the USA Patriot Act which resulted in significant amendments to the Bank Secrecy Act.

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Part 3268b1 of the FDIC Rules and Regulations. Technical Amendments to Various Bank Secrecy Act Regulations. The Bank Secrecy Act treats all bank deposits as absolutely confidential and these may not be inquired into except. The provisions of the Patriot Act represented sweeping changes in existing BSA requirements and identified a variety of entities and industries beyond traditional financial institutions that would be. The proposed amendments to the Bank Secrecy Law primarily aim to assist other supervisors and law enforcement agencies as the AMLC is already exempt from the effects of the bank secrecy law Mr. This final rule revises the BSA regulations by updating them to reflect the names of the new reports.

Source: complyadvantage.com

Source: complyadvantage.com

The final rule simplifies the regulation allowing credit unions to exempt transactions of certain persons from the requirement to report currency transactions in excess of 10000. The proposed amendments to the Bank Secrecy Law primarily aim to assist other supervisors and law enforcement agencies as the AMLC is already exempt from the effects of the bank secrecy law Mr. The proposed amendments included amendments to 31 CFR 10322 d and e that would require banks to obtain signed statements from their. The Anti-Drug Abuse Act 1988 The Anti-Drug Abuse Act of 1988 was enacted as part of the USs so-called War on Drugs The Act amended the Bank Secrecy Act in expanding the definition of financial institutions to include auto dealers and real estate entities who were thereafter required to disclose the transaction of large sums. Part 3268b1 of the FDIC Rules and Regulations.

Source:

The proposed amendments included amendments to 31 CFR 10322 d and e that would require banks to obtain signed statements from their. FinCEN has also replaced the five industry-specific suspicious activity reports with a combined suspicious activity report the Bank Secrecy Act Suspicious Activity Report which is now used by various financial industry segments. The final rule simplifies the regulation allowing credit unions to exempt transactions of certain persons from the requirement to report currency transactions in excess of 10000. The Anti-Drug Abuse Act 1988 The Anti-Drug Abuse Act of 1988 was enacted as part of the USs so-called War on Drugs The Act amended the Bank Secrecy Act in expanding the definition of financial institutions to include auto dealers and real estate entities who were thereafter required to disclose the transaction of large sums. The provisions of the Patriot Act represented sweeping changes in existing BSA requirements and identified a variety of entities and industries beyond traditional financial institutions that would be.

Source:

It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized loans to assist in the economic development of the country. The proposed amendments to the Bank Secrecy Law primarily aim to assist other supervisors and law enforcement agencies as the AMLC is already exempt from the effects of the bank secrecy law Mr. The final rule simplifies the regulation allowing credit unions to exempt transactions of certain persons from the requirement to report currency transactions in excess of 10000. The Full Facts on the Bank Secrecy Act of 1970 The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that may occur. BSA Related Regulations.

Source: acamstoday.org

Source: acamstoday.org

The Full Facts on the Bank Secrecy Act of 1970 The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that may occur. It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized loans to assist in the economic development of the country. The Securities and Exchange Commission SEC supports amending Republic Act 1405 or the Secrecy of Bank Deposits Law to strengthen the fight against financial crimes in the. Thursday July 22 2021 SEC backs amendments to Bank Secrecy Law Follow us. Technical Amendments to Various Bank Secrecy Act Regulations.

Source: complyadvantage.com

Source: complyadvantage.com

Letter to Credit Unions No. The proposed amendments to the Bank Secrecy Law primarily aim to assist other supervisors and law enforcement agencies as the AMLC is already exempt from the effects of the bank secrecy law Mr. Part 3268b1 of the FDIC Rules and Regulations. Congress is now considering amendments to the Bank Secrecy Act that will introduce one tool that has proven effective in many other arenas. Bank Secrecy Act Amendments Funds Transfers DEAR BOARD OF DIRECTORS.

Source: amazon.com

Source: amazon.com

The proposed amendments included amendments to 31 CFR 10322 d and e that would require banks to obtain signed statements from their. Thursday July 22 2021 SEC backs amendments to Bank Secrecy Law Follow us. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Government agencies in detecting and preventing money laundering. It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized loans to assist in the economic development of the country.

![]() Source: adiconsulting.com

Source: adiconsulting.com

This final rule revises the BSA regulations by updating them to reflect the names of the new reports. Financial incentives for whistleblowers to come forward and report wrongdoing. BSA Related Regulations. The Financial Crimes Enforcement Network FinCEN recently issued a final rule amending the Bank Secrecy Act BSA. The Full Facts on the Bank Secrecy Act of 1970 The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that may occur.

Government agencies in detecting and preventing money laundering. Letter to Credit Unions No. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Financial incentives for whistleblowers to come forward and report wrongdoing. The events of September 11 2001 ultimately gave rise to the USA Patriot Act which resulted in significant amendments to the Bank Secrecy Act.

Source: slideplayer.com

Source: slideplayer.com

Financial incentives for whistleblowers to come forward and report wrongdoing. The Financial Crimes Enforcement Network FinCEN recently issued a final rule amending the Bank Secrecy Act BSA. 1 upon permission of the depositor 2 in cases of impeachment 3 upon order of a competent court in cases involving bribery or dereliction of duty or 4 in case the money deposited or invested is the subject matter of litigation. The events of September 11 2001 ultimately gave rise to the USA Patriot Act which resulted in significant amendments to the Bank Secrecy Act. FinCEN has also replaced the five industry-specific suspicious activity reports with a combined suspicious activity report the Bank Secrecy Act Suspicious Activity Report which is now used by various financial industry segments.

This final rule revises the BSA regulations by updating them to reflect the names of the new reports. Thursday July 22 2021 SEC backs amendments to Bank Secrecy Law Follow us. The comment period has now been extended to December 24 1986. The Full Facts on the Bank Secrecy Act of 1970 The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that may occur. Meanwhile the Chamber of Thrift Banks CTB expressed concern over the proposed amendments to the Bank Secrecy Law.

Source:

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. This final rule revises the BSA regulations by updating them to reflect the names of the new reports. The provisions of the Patriot Act represented sweeping changes in existing BSA requirements and identified a variety of entities and industries beyond traditional financial institutions that would be. Bank Secrecy Act Amendments Funds Transfers DEAR BOARD OF DIRECTORS. Part 3268b1 of the FDIC Rules and Regulations.

Source: lysisgroup.com

Source: lysisgroup.com

Part 3268b1 of the FDIC Rules and Regulations. This final rule revises the BSA regulations by updating them to reflect the names of the new reports. The proposed amendments to the Bank Secrecy Law primarily aim to assist other supervisors and law enforcement agencies as the AMLC is already exempt from the effects of the bank secrecy law Mr. 1 upon permission of the depositor 2 in cases of impeachment 3 upon order of a competent court in cases involving bribery or dereliction of duty or 4 in case the money deposited or invested is the subject matter of litigation. The final rule simplifies the regulation allowing credit unions to exempt transactions of certain persons from the requirement to report currency transactions in excess of 10000.

Source: tookitaki.ai

Source: tookitaki.ai

FinCEN has also replaced the five industry-specific suspicious activity reports with a combined suspicious activity report the Bank Secrecy Act Suspicious Activity Report which is now used by various financial industry segments. Part 3268b1 of the FDIC Rules and Regulations. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. The Bank Secrecy Act treats all bank deposits as absolutely confidential and these may not be inquired into except. The Anti-Drug Abuse Act 1988 The Anti-Drug Abuse Act of 1988 was enacted as part of the USs so-called War on Drugs The Act amended the Bank Secrecy Act in expanding the definition of financial institutions to include auto dealers and real estate entities who were thereafter required to disclose the transaction of large sums.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act amendments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information