10++ Bank secrecy act bsa compliance program info

Home » about money loundering Info » 10++ Bank secrecy act bsa compliance program infoYour Bank secrecy act bsa compliance program images are ready in this website. Bank secrecy act bsa compliance program are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act bsa compliance program files here. Download all royalty-free images.

If you’re searching for bank secrecy act bsa compliance program images information connected with to the bank secrecy act bsa compliance program interest, you have visit the right site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

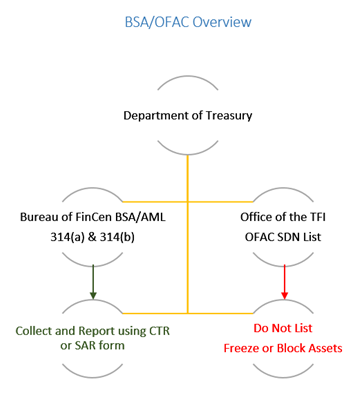

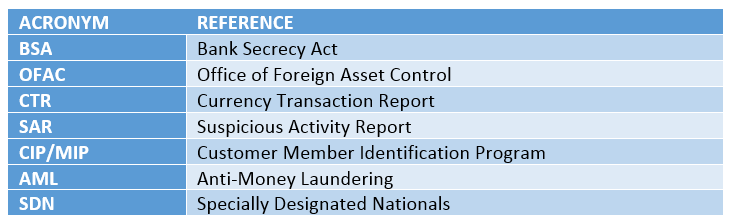

Bank Secrecy Act Bsa Compliance Program. Screen against Office of Foreign Assets Control OFAC and. As with similar programs created in the Securities and Exchange Commission and other federal agencies this new reward program may lead to a surge. Bank Secrecy Act BSA Anti Money Laundering AML regulations used to apply to banks and credit unions but over the past three decades the law has been expanded to cover a very wide array of financial institutions maybe even yours. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Bankers Compliance Training The Bank Secrecy Act Bsa From bankerscompliance.com

Bankers Compliance Training The Bank Secrecy Act Bsa From bankerscompliance.com

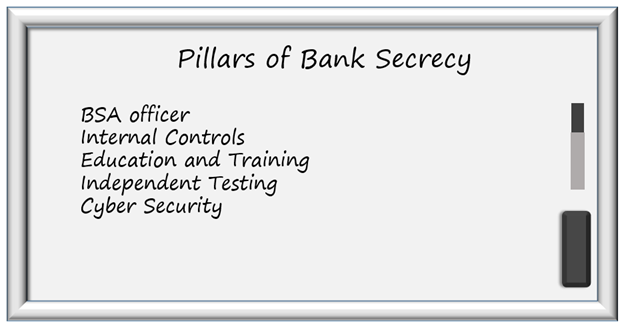

Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Determine that the bank has implemented a compliance program designed to assure and monitor compliance with the recordkeeping and reporting requirements of the Bank Secrecy Act BSA and its. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Establish effective BSA compliance programs. It also allows members of filing organizations to send and receive secure messages to and from FinCEN. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

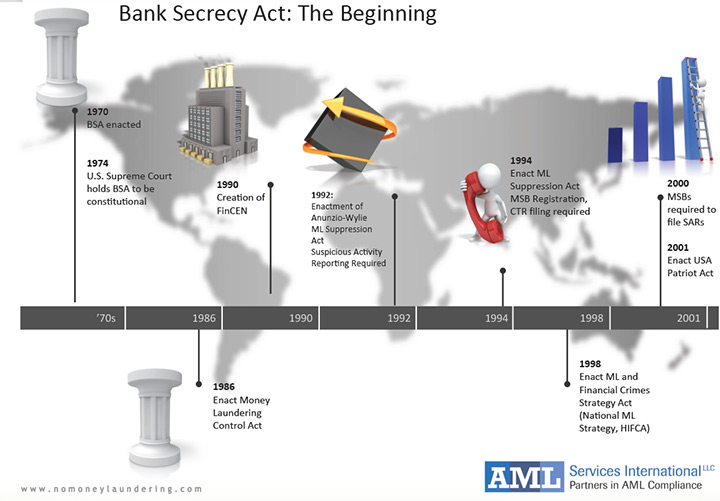

The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities. 1 creates a new whistleblower reward program in the Treasury Department to encourage insider reporting of financial institutions violations of the Bank Secrecy Act BSA. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. First the SBA indicated that all PPP-approved lenders must comply with their existing BSA requirements signalling that while expediting loans is absolutely critical lenders must still be cognizant of and account for financial crime risks. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

Source: acamstoday.org

Source: acamstoday.org

Special information sharing procedures. First the SBA indicated that all PPP-approved lenders must comply with their existing BSA requirements signalling that while expediting loans is absolutely critical lenders must still be cognizant of and account for financial crime risks. 1 creates a new whistleblower reward program in the Treasury Department to encourage insider reporting of financial institutions violations of the Bank Secrecy Act BSA. Establish effective customer due diligence systems and monitoring programs. BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations.

Source: amltrainer.com

Source: amltrainer.com

The Anti-Money Laundering Act of 2020 AMLA which took effect Jan. Law requiring financial institutions in the United States to assist US. Program that ensures and monitors compliance with the Bank Secrecy Act anti-money laundering regulations. Bank Secrecy ActAnti-Money Laundering. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Source: complianceonline.com

Source: complianceonline.com

Bank Secrecy ActAnti-Money Laundering. Establish effective customer due diligence systems and monitoring programs. As part of its requirements for lenders the SBA provided instructions regarding compliance with the Bank Secrecy Act BSA in connection with PPP loans. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US.

Source: youtube.com

Source: youtube.com

It also allows members of filing organizations to send and receive secure messages to and from FinCEN. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Establish effective customer due diligence systems and monitoring programs. BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

Establish effective BSA compliance programs. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities. Special information sharing procedures. It also allows members of filing organizations to send and receive secure messages to and from FinCEN.

Source: blog.gao.gov

Source: blog.gao.gov

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Banks and other financial institutions must ensure they meet the compliance obligations it involves. As part of its requirements for lenders the SBA provided instructions regarding compliance with the Bank Secrecy Act BSA in connection with PPP loans. Updated Sections of the FFIEC BSAAML Examination Manual. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation.

The BSA E-Filing system supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches by a filing organization to the BSA database through a FinCEN secure network. Bank Secrecy ActAnti-Money Laundering. 1 creates a new whistleblower reward program in the Treasury Department to encourage insider reporting of financial institutions violations of the Bank Secrecy Act BSA. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Determine that the bank has implemented a compliance program designed to assure and monitor compliance with the recordkeeping and reporting requirements of the Bank Secrecy Act BSA and its.

Source: probank.com

Source: probank.com

Determine that the bank has implemented a compliance program designed to assure and monitor compliance with the recordkeeping and reporting requirements of the Bank Secrecy Act BSA and its. First the SBA indicated that all PPP-approved lenders must comply with their existing BSA requirements signalling that while expediting loans is absolutely critical lenders must still be cognizant of and account for financial crime risks. CUNAs BSA Compliance Guide 2 May 2018 What is the Bank Secrecy Act. As with similar programs created in the Securities and Exchange Commission and other federal agencies this new reward program may lead to a surge. Establish effective BSA compliance programs.

Source: complianceonline.com

Source: complianceonline.com

First the SBA indicated that all PPP-approved lenders must comply with their existing BSA requirements signalling that while expediting loans is absolutely critical lenders must still be cognizant of and account for financial crime risks. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. As part of its requirements for lenders the SBA provided instructions regarding compliance with the Bank Secrecy Act BSA in connection with PPP loans. Establish effective BSA compliance programs. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Source: bankerscompliance.com

Source: bankerscompliance.com

Establish effective BSA compliance programs. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities.

Source: compliancealert.org

Source: compliancealert.org

And special standards of diligence. The Anti-Money Laundering Act of 2020 AMLA which took effect Jan. CUNAs BSA Compliance Guide 2 May 2018 What is the Bank Secrecy Act. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Government agencies in detecting and preventing money laundering.

Bank Secrecy Act BSA Anti Money Laundering AML regulations used to apply to banks and credit unions but over the past three decades the law has been expanded to cover a very wide array of financial institutions maybe even yours. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations. Updated Sections of the FFIEC BSAAML Examination Manual.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

It also allows members of filing organizations to send and receive secure messages to and from FinCEN. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations. Interagency Statement on Model Risk Management for Bank Systems Supporting BSAAML Compliance and Request for Information. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act bsa compliance program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas