19+ Bank secrecy act cip requirements info

Home » about money loundering Info » 19+ Bank secrecy act cip requirements infoYour Bank secrecy act cip requirements images are available. Bank secrecy act cip requirements are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act cip requirements files here. Download all free vectors.

If you’re searching for bank secrecy act cip requirements images information related to the bank secrecy act cip requirements interest, you have come to the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

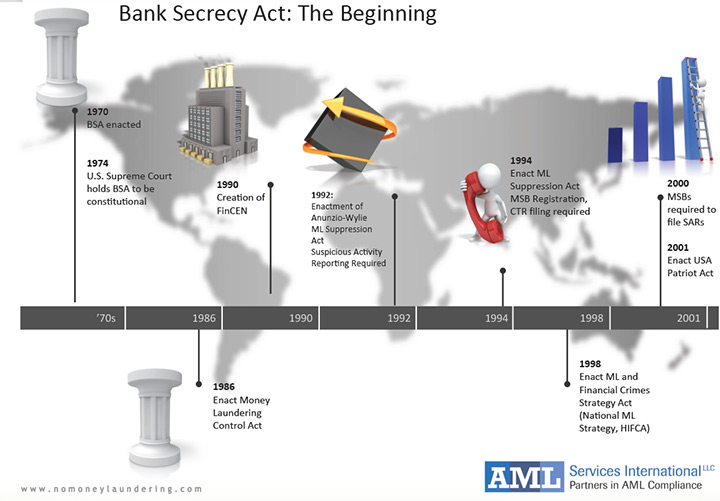

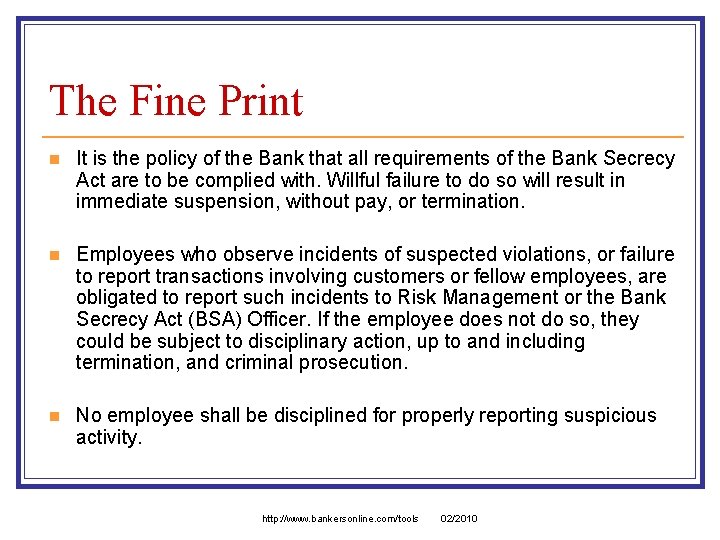

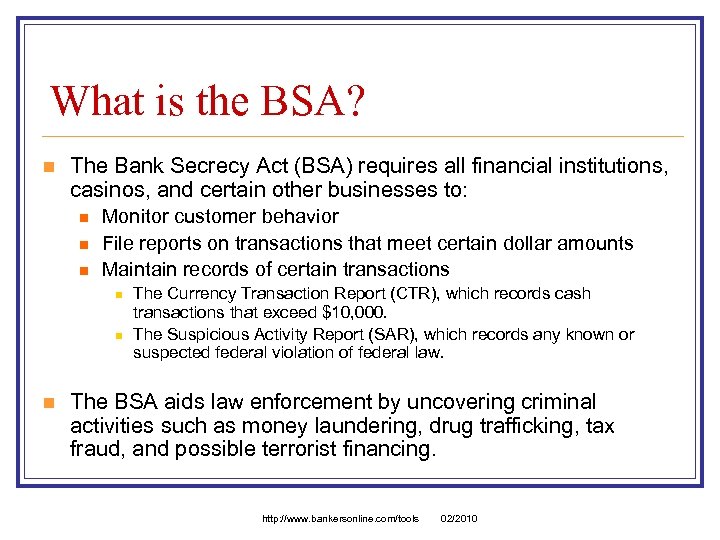

Bank Secrecy Act Cip Requirements. Of USA PATRIOT Act and Part 103121 of th e regulations under the Bank Secrecy Ac t Customer Identification Program CIP regulations. Dating back to 1970 the Bank Secrecy Act BSA requires financial institutions FIs to assist US. Prior to June 9 2003 the Bank Secrecy Act did not have a CIP component. The program must be part of the banks Bank Secrecy Act policy and each affected employee must receive training.

The Customer Identification Program was enacted as a mandatory component of the Bank Secrecy Act via an amendment implemented through the Patriot Act. In 1970 the US. Dating back to 1970 the Bank Secrecy Act BSA requires financial institutions FIs to assist US. Bank including certain domestic subsidiaries1 must have a written CIP2 that is appropriate for its size and type of business and that includes certain minimum requirements. Government agencies to detect and prevent money laundering. It can include multiple transactions.

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as.

Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. The CIP rule applies to any person who opens a new account. 1818s or 12 USC. However I believe most banks do apply their CIP requirements to authorized signers as well. The Order generally describes the CIP rules of the BSA which at a very high level require covered financial institutions to implement a CIP that includes risk-based verification procedures that enable the financial institution to form a reasonable belief that it knows the true identify of its customers. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to.

Source: youtube.com

Source: youtube.com

However I believe most banks do apply their CIP requirements to authorized signers as well. Look to your banks policy to see if requirements are defined for authorized signers. As for OFAC the FFIEC exam procedures tell us that a banks OFAC compliance program should be risk based. Government agencies to detect and prevent money laundering. The program must be part of the banks Bank Secrecy Act policy and each affected employee must receive training.

It requires banks to produce 5 types of reports to FinCEN and the Treasury Department. Compliance with the BSA includes FIs maintaining Customer Information Programs CIPs to prove that the identities of new customers have been verified at account opening. The reliance provision permits a bank to rely on another financial institution to perform any of the procedures of the banks CIP meaning any of the elements that the CIP rule requires to be in a banks CIP. Congress introduced the Bank Secrecy Act. 1 identity verification procedures which include collecting the required information from customers and using some or all of that information to verify the customers identities.

Source: slideserve.com

Source: slideserve.com

The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. Either a home or business address will do. Look to your banks policy to see if requirements are defined for authorized signers. 2 keeping records related. Compliance with the BSA includes FIs maintaining Customer Information Programs CIPs to prove that the identities of new customers have been verified at account opening.

Source: slideserve.com

Source: slideserve.com

Of USA PATRIOT Act and Part 103121 of th e regulations under the Bank Secrecy Ac t Customer Identification Program CIP regulations. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to. The continued application of CIP requirements to banks and bank-affiliated premium finance companies for such accounts despite FinCENs finding of negligible money laundering risk put these companies at a competitive disadvantage against non-bank affiliated premium finance lenders that are not subject to regulation under the BSA. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. The CIP rule applies to any person who opens a new account.

Source: acamstoday.org

Source: acamstoday.org

Dating back to 1970 the Bank Secrecy Act BSA requires financial institutions FIs to assist US. Each bank and credit union and other financial institutions must have a written Customer Identification Program CIP that is approved by the organizations Board of Directors. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The continued application of CIP requirements to banks and bank-affiliated premium finance companies for such accounts despite FinCENs finding of negligible money laundering risk put these companies at a competitive disadvantage against non-bank affiliated premium finance lenders that are not subject to regulation under the BSA. Updated information serves valuable but different purposes.

Source: slidetodoc.com

Source: slidetodoc.com

The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. Bank including certain domestic subsidiaries1 must have a written CIP2 that is appropriate for its size and type of business and that includes certain minimum requirements. Look to your banks policy to see if requirements are defined for authorized signers. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. 1818s or 12 USC.

Source: present5.com

Source: present5.com

The only exception is for Army Post Office boxes APO or Fleet Post Office FPO. As for OFAC the FFIEC exam procedures tell us that a banks OFAC compliance program should be risk based. The program must be designed for the size complexity and risk profile of. Compliance with the BSA includes FIs maintaining Customer Information Programs CIPs to prove that the identities of new customers have been verified at account opening. Each bank and credit union and other financial institutions must have a written Customer Identification Program CIP that is approved by the organizations Board of Directors.

Source: yumpu.com

Source: yumpu.com

Government agencies to detect and prevent money laundering. Regulations established under BSA mandate that banks and other financial institutions establish Customer identification programs CIPs to verify the identities of their customers. Of USA PATRIOT Act and Part 103121 of th e regulations under the Bank Secrecy Ac t Customer Identification Program CIP regulations. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. This contains any cash transaction that exceeds 10000 in one business day.

Source: slidetodoc.com

Source: slidetodoc.com

Of USA PATRIOT Act and Part 103121 of th e regulations under the Bank Secrecy Ac t Customer Identification Program CIP regulations. Congress introduced the Bank Secrecy Act. The Customer Identification Program was enacted as a mandatory component of the Bank Secrecy Act via an amendment implemented through the Patriot Act. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. 2 keeping records related.

Source: slideserve.com

Source: slideserve.com

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as. 1818s or 12 USC. 2 keeping records related. For the purpose of this compliance procedure the following definitions as outlined in the USA PATRIOT Act apply. Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP.

Source: slideplayer.com

Source: slideplayer.com

The CIP Rule requires a physical address. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. The Bank Secrecy Act BSA requires financial institutions to assist US. Person means an individual or a legal entity such as a corporation trust partnership etc. Each bank and credit union and other financial institutions must have a written Customer Identification Program CIP that is approved by the organizations Board of Directors.

Source: present5.com

Source: present5.com

The program must be designed for the size complexity and risk profile of. Who is a customer. The reliance provision permits a bank to rely on another financial institution to perform any of the procedures of the banks CIP meaning any of the elements that the CIP rule requires to be in a banks CIP. Compliance with the BSA includes FIs maintaining Customer Information Programs CIPs to prove that the identities of new customers have been verified at account opening. The Order generally describes the CIP rules of the BSA which at a very high level require covered financial institutions to implement a CIP that includes risk-based verification procedures that enable the financial institution to form a reasonable belief that it knows the true identify of its customers.

Source: slideserve.com

Source: slideserve.com

Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP. Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP. Of USA PATRIOT Act and Part 103121 of th e regulations under the Bank Secrecy Ac t Customer Identification Program CIP regulations. Currency Transaction Reports CTR. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act cip requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas