11+ Bank secrecy act compliance program info

Home » about money loundering idea » 11+ Bank secrecy act compliance program infoYour Bank secrecy act compliance program images are ready. Bank secrecy act compliance program are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act compliance program files here. Download all royalty-free images.

If you’re looking for bank secrecy act compliance program pictures information linked to the bank secrecy act compliance program topic, you have visit the right site. Our website always gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

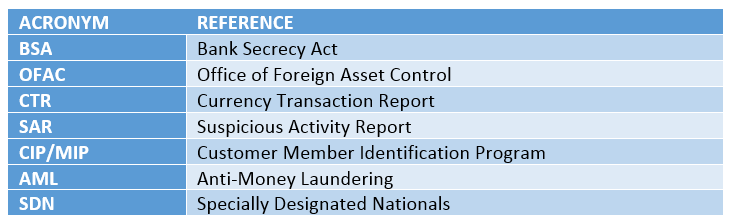

Bank Secrecy Act Compliance Program. This online manual contains CUNA. The Bank Secrecy ActAnti-Money Laundering BSAAML rules and regulations as stated in 31 Code of Federal Regulations CFR Chapter X apply to all financial institutionsincluding certain. 1 93a 1462a 1463 1464 1818 1881-1884 and 3401-3422. CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements.

Bank Secrecy Act Bsa Youtube From youtube.com

Bank Secrecy Act Bsa Youtube From youtube.com

Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Establish effective BSA compliance programs. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Regulations on Bank Secrecy Act Compliance Programs Subchapter II of chapter 53 of Title 31 United States Code commonly known as the Bank Secrecy Act generally requires financial institutions to among other things keep records and make reports that have a high degree of usefulness in criminal tax or regulatory proceedings. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

The purpose of the BSA is to require United States US.

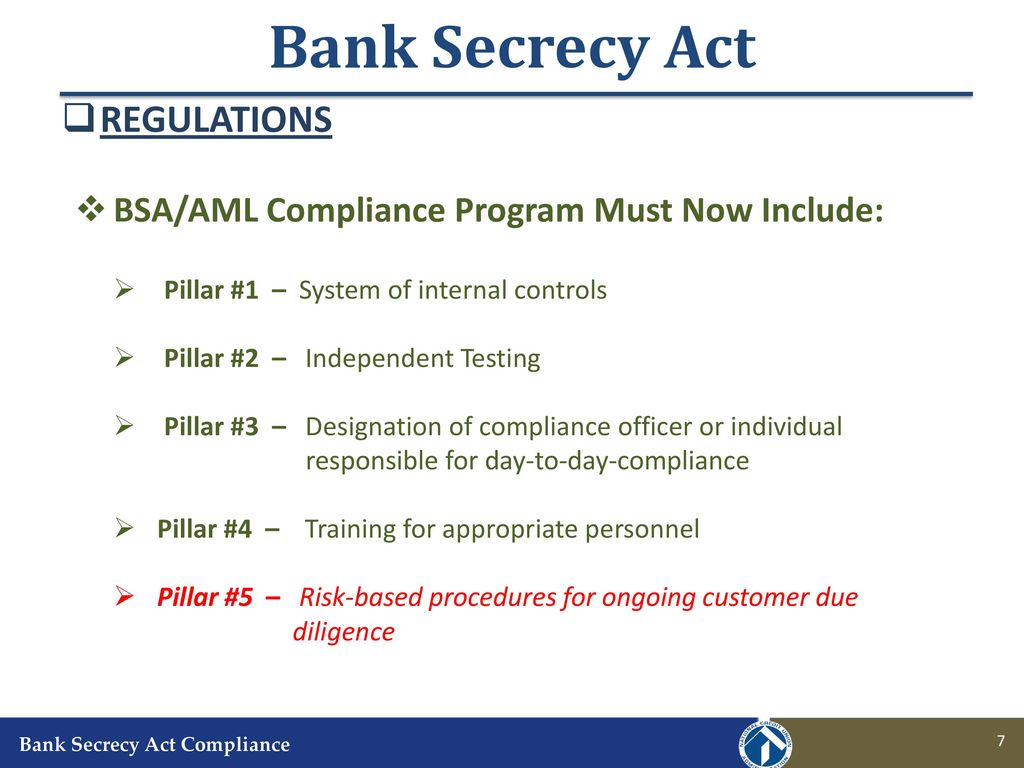

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. While considering a Bank Secrecy Act compliance program credit unions must first and foremost use a risk-based approach to developing a sound compliance program. Part 21 - minimum security devices and procedures reports of suspicious activities and bank secrecy act compliance program Authority. The BSA AML OFAC Compliance Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program and for assuring that the bank is in compliance with the Bank Secrecy Act USA Patriot Act OFAC and all other applicable laws. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime.

Source: amltrainer.com

Source: amltrainer.com

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Part 21 - Minimum Security Devices And Procedures Reports Of Suspicious Activities And Bank Secrecy Act Compliance Program. Regulations on Bank Secrecy Act Compliance Programs Subchapter II of chapter 53 of Title 31 United States Code commonly known as the Bank Secrecy Act generally requires financial institutions to among other things keep records and make reports that have a high degree of usefulness in criminal tax or regulatory proceedings. Here learn key compliance requirements growing fintech companies should be aware of steps to implement an effective compliance program and more. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

The BSA AML OFAC Compliance Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program and for assuring that the bank is in compliance with the Bank Secrecy Act USA Patriot Act OFAC and all other applicable laws. Establish effective BSA compliance programs. The identity of the individual or entity subject to be blocking should be clearly identified. Establish effective customer due diligence systems and monitoring programs. 1 93a 1462a 1463 1464 1818 1881-1884 and 3401-3422.

Source: youtube.com

Source: youtube.com

Establish effective BSA compliance programs. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Audit Program Bank Secrecy Act and Anti-money Laundering Confirmation that the funds have been deposited into a blocked account. The purpose of the BSA is to require United States US. Establish effective customer due diligence systems and monitoring programs.

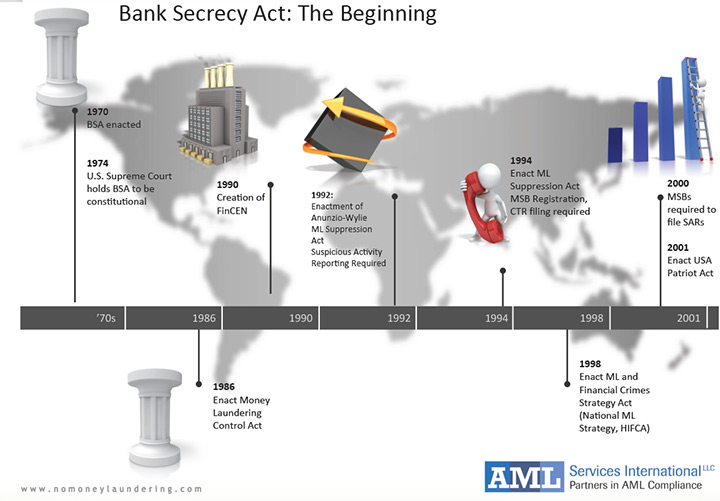

Banks and other financial institutions must ensure they meet the compliance obligations it involves. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. PART 21 - MINIMUM SECURITY DEVICES AND PROCEDURES REPORTS OF SUSPICIOUS ACTIVITIES AND BANK SECRECY ACT COMPLIANCE PROGRAM Authority. Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial.

Source: bankerscompliance.com

Source: bankerscompliance.com

Establish effective BSA compliance programs. While considering a Bank Secrecy Act compliance program credit unions must first and foremost use a risk-based approach to developing a sound compliance program. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. CUNA is not engaged in rendering legal or other professional advice in presenting this information. Establish effective BSA compliance programs.

Source: complianceonline.com

Source: complianceonline.com

The BSA AML OFAC Compliance Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program and for assuring that the bank is in compliance with the Bank Secrecy Act USA Patriot Act OFAC and all other applicable laws. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. This online manual contains CUNA. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The identity of the individual or entity subject to be blocking should be clearly identified.

Source: acamstoday.org

Source: acamstoday.org

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Regulations on Bank Secrecy Act Compliance Programs Subchapter II of chapter 53 of Title 31 United States Code commonly known as the Bank Secrecy Act generally requires financial institutions to among other things keep records and make reports that have a high degree of usefulness in criminal tax or regulatory proceedings. This online manual contains CUNA. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. While considering a Bank Secrecy Act compliance program credit unions must first and foremost use a risk-based approach to developing a sound compliance program.

Part 21 - minimum security devices and procedures reports of suspicious activities and bank secrecy act compliance program Authority. What Qualifies as a Financial Institution. Name and phone number of compliance personnel at the bank who has knowledge of the transaction. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. Banks and other financial institutions must ensure they meet the compliance obligations it involves.

Source: blog.gao.gov

Source: blog.gao.gov

Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Establish effective BSA compliance programs. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. The BSA AML OFAC Compliance Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program and for assuring that the bank is in compliance with the Bank Secrecy Act USA Patriot Act OFAC and all other applicable laws.

Source: abrigo.com

Banks and other financial institutions must ensure they meet the compliance obligations it involves. Part 21 - Minimum Security Devices And Procedures Reports Of Suspicious Activities And Bank Secrecy Act Compliance Program. 5311 et seq is referred to as the Bank Secrecy Act BSA. The Bank Secrecy ActAnti-Money Laundering BSAAML rules and regulations as stated in 31 Code of Federal Regulations CFR Chapter X apply to all financial institutionsincluding certain. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Source: probank.com

Source: probank.com

While considering a Bank Secrecy Act compliance program credit unions must first and foremost use a risk-based approach to developing a sound compliance program. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Audit Program Bank Secrecy Act and Anti-money Laundering Confirmation that the funds have been deposited into a blocked account. Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Source: slideplayer.com

Source: slideplayer.com

Examiners assess the adequacy of the banks Bank Secrecy Actanti-money laundering BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. The BSA AML OFAC Compliance Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program and for assuring that the bank is in compliance with the Bank Secrecy Act USA Patriot Act OFAC and all other applicable laws. Screen against Office of Foreign Assets Control OFAC and other government lists. The Bank Secrecy ActAnti-Money Laundering BSAAML rules and regulations as stated in 31 Code of Federal Regulations CFR Chapter X apply to all financial institutionsincluding certain. Establish effective BSA compliance programs.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Part 21 - minimum security devices and procedures reports of suspicious activities and bank secrecy act compliance program Authority. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The identity of the individual or entity subject to be blocking should be clearly identified. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial. Here learn key compliance requirements growing fintech companies should be aware of steps to implement an effective compliance program and more.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act compliance program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information