19++ Bank secrecy act ctr requirements ideas in 2021

Home » about money loundering Info » 19++ Bank secrecy act ctr requirements ideas in 2021Your Bank secrecy act ctr requirements images are ready in this website. Bank secrecy act ctr requirements are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act ctr requirements files here. Download all royalty-free images.

If you’re looking for bank secrecy act ctr requirements images information related to the bank secrecy act ctr requirements interest, you have visit the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

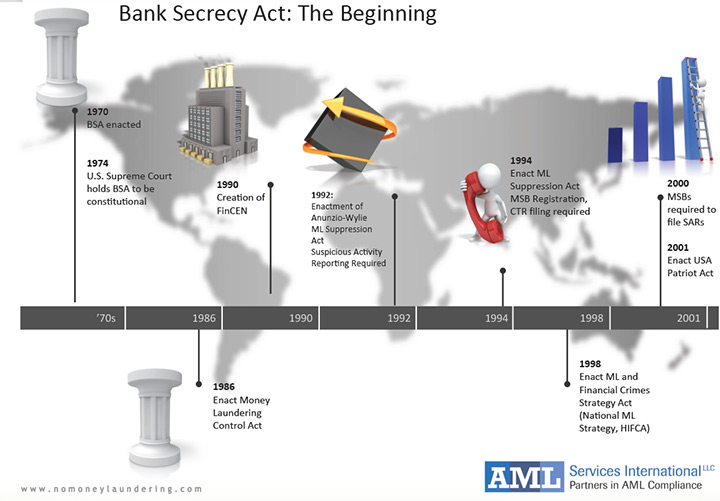

Bank Secrecy Act Ctr Requirements. The intended audience. FinCEN Form 104 - Currency Transaction Report CTR FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments CMIR Treasury Department Form 90221 - Report of Foreign Bank and Financial Accounts FBAR Suspicious Activity Report SAR 3 Currency Transaction Report. Understanding Its Reporting Requirements 2 What to Report under BSA. Bank Secrecy Act Requirements Compliance.

Bank Secrecy Act Bsa Youtube From youtube.com

Bank Secrecy Act Bsa Youtube From youtube.com

FinCEN Form 104 - Currency Transaction Report CTR FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments CMIR Treasury Department Form 90221 - Report of Foreign Bank and Financial Accounts FBAR Suspicious Activity Report SAR 3 Currency Transaction Report. According to the Internal Revenue Service there is a general rule that any person. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement.

According to the Internal Revenue Service there is a general rule that any person.

The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement. 8009492732 Monday thru Friday 800 am. The intended audience. For financial institutions wanting to report suspicious transactions that may relate to terrorist activity. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation. 1 Involves more than 10000 in either cash-in or cash-out and 1 Is conducted by or on behalf of the same person and 1 Is conducted on the same business day.

Source: youtube.com

Source: youtube.com

Government agencies in detecting and preventing money laundering. The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement. How the Bank Secrecy Act Works. 1 Involves more than 10000 in either cash-in or cash-out and 1 Is conducted by or on behalf of the same person and 1 Is conducted on the same business day. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase.

Source: present5.com

Source: present5.com

BSA Related Regulations. Bank Secrecy Act Requirements Compliance. MSBs must file a Currency Transaction Report CTR within 15 days whenever a transaction or series of transactions in currency. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12. The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement.

Source: acamstoday.org

Source: acamstoday.org

The credit union should remain alert to inconsistencies between the account activity and the members business. The most prominent BSA rule is perhaps what is commonly referred to as the 10000 Rule. Bank Secrecy Act Requirements Compliance. The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II.

Source: slideserve.com

Source: slideserve.com

The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000. FinCEN Form 104 - Currency Transaction Report CTR FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments CMIR Treasury Department Form 90221 - Report of Foreign Bank and Financial Accounts FBAR Suspicious Activity Report SAR 3 Currency Transaction Report. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12. This form must be filled out by a bank representative whenever a customer attempts a. 31 USC 5318a2 General Powers of the Secretary allows the Secretary of the Treasury to require a class of domestic financial institutions or nonfinancial trades or businesses to maintain appropriate procedures to ensure compliance with the Bank Secrecy Act and its regulations or to guard against money laundering.

For financial institutions with questions relating to Bank Secrecy Act and USA PATRIOT Act requirements and forms call. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12. Law requiring financial institutions in the United States to assist US. For financial institutions wanting to report suspicious transactions that may relate to terrorist activity. Report CTR Structuring BANK SECRECY ACT BSA - APPENDIX 18A Dun and Bradstreet reports.

Source: forbes.com

Source: forbes.com

Bank Secrecy Act Requirements Compliance. This form must be filled out by a bank representative whenever a customer attempts a. 1 Bank Secrecy Act. Credit unions must file the following as required by provisions of the BSA reporting requirements. Understanding Its Reporting Requirements 2 What to Report under BSA.

Source: slideserve.com

Source: slideserve.com

1 Involves more than 10000 in either cash-in or cash-out and 1 Is conducted by or on behalf of the same person and 1 Is conducted on the same business day. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000. MSBs must file a Currency Transaction Report CTR within 15 days whenever a transaction or series of transactions in currency. Law requiring financial institutions in the United States to assist US.

Source: blog.flexcutech.com

Source: blog.flexcutech.com

Government agencies in detecting and preventing money laundering. FinCEN Form 104 - Currency Transaction Report CTR FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments CMIR Treasury Department Form 90221 - Report of Foreign Bank and Financial Accounts FBAR Suspicious Activity Report SAR 3 Currency Transaction Report. Multiple cash transactions are considered to be one. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. Not all transactions over 10000 need to be.

Source: acamstoday.org

Source: acamstoday.org

1 Bank Secrecy Act. It is widely known that financial institutions will report transactions that are over 10000 - which under BSA regulations is partially true. According to the Internal Revenue Service there is a general rule that any person. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. The credit union should remain alert to inconsistencies between the account activity and the members business.

Source: slideplayer.com

Source: slideplayer.com

CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12. 31 USC 5318a2 General Powers of the Secretary allows the Secretary of the Treasury to require a class of domestic financial institutions or nonfinancial trades or businesses to maintain appropriate procedures to ensure compliance with the Bank Secrecy Act and its regulations or to guard against money laundering. The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000. The credit union should remain alert to inconsistencies between the account activity and the members business. Bank Secrecy Act Requirements Compliance.

Source: proprofs.com

Source: proprofs.com

- 500 pm Eastern. This topic will enumerate the specific requirements set for by the Bank Secrecy Act BSA for relationships with foreign financial institutions including correspondent foreign accounts certification and recertification verification of information and examination procedures. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Bank Secrecy Act Requirements Compliance.

Source: present5.com

Source: present5.com

For financial institutions with questions relating to Bank Secrecy Act and USA PATRIOT Act requirements and forms call. 1 Bank Secrecy Act. This topic will enumerate the specific requirements set for by the Bank Secrecy Act BSA for relationships with foreign financial institutions including correspondent foreign accounts certification and recertification verification of information and examination procedures. The most prominent BSA rule is perhaps what is commonly referred to as the 10000 Rule. Law requiring financial institutions in the United States to assist US.

Source: slideserve.com

Source: slideserve.com

For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. 1 Bank Secrecy Act. Regulations implementing Title II of the Bank Secrecy Act appear at 31 CFR 103. This topic will enumerate the specific requirements set for by the Bank Secrecy Act BSA for relationships with foreign financial institutions including correspondent foreign accounts certification and recertification verification of information and examination procedures. Multiple cash transactions are considered to be one.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act ctr requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas