20+ Bank secrecy act exemptions ideas in 2021

Home » about money loundering Info » 20+ Bank secrecy act exemptions ideas in 2021Your Bank secrecy act exemptions images are available. Bank secrecy act exemptions are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act exemptions files here. Find and Download all free photos.

If you’re looking for bank secrecy act exemptions images information related to the bank secrecy act exemptions keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

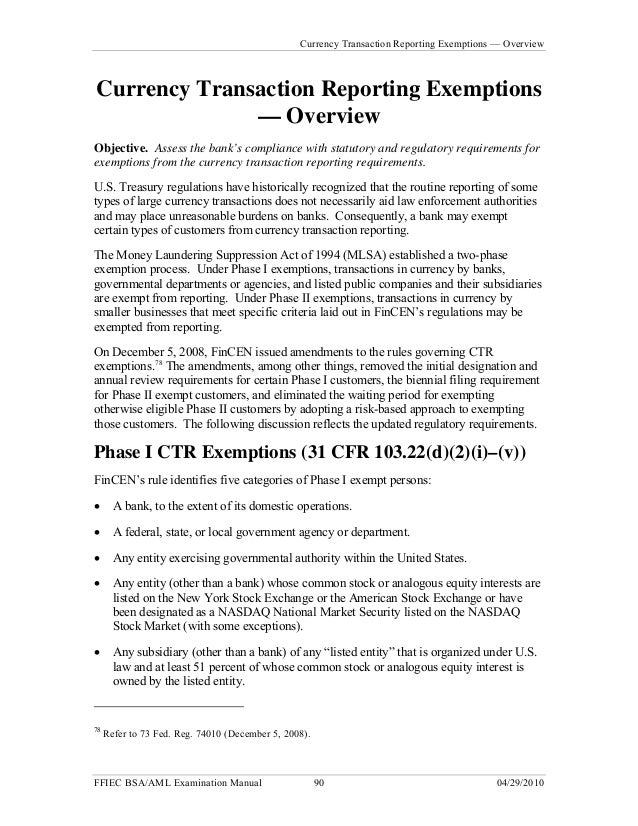

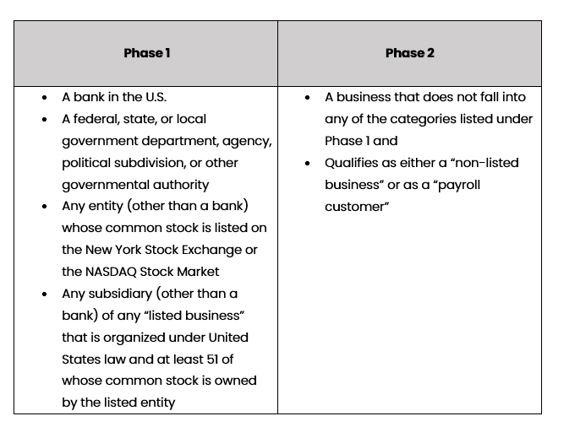

Bank Secrecy Act Exemptions. For all other transactions that may qualify for exemption a credit union must file a special form to designate the person or organization as exempt. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. 4 The regulations in the Bank Secrecy Act also provide banks with the ability to exempt certain customers from currency transaction reporting.

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

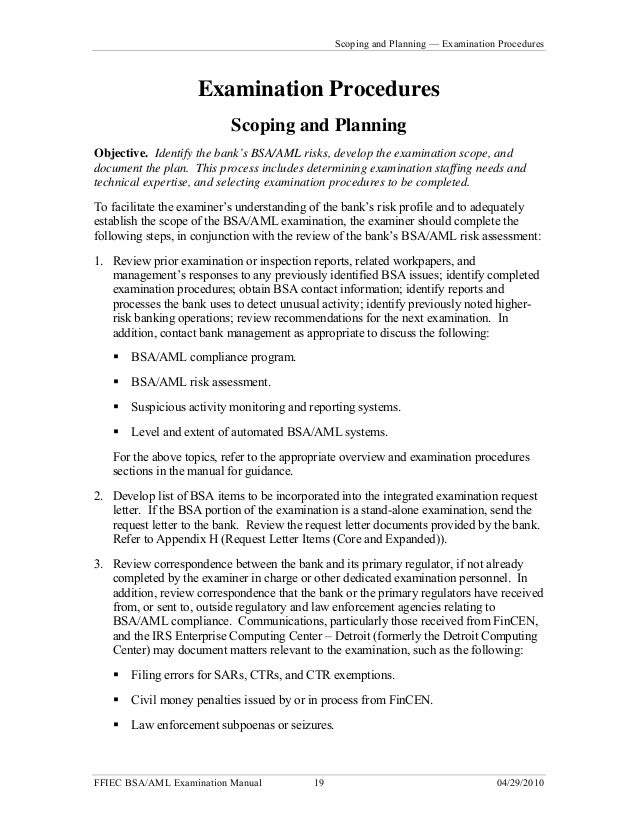

This bulletin replaces OCC Bulletin 2018-35 Bank Secrecy ActAnti-Money Laundering. Note for Community Banks. The final rule is effective January 5 2009. Law requiring financial institutions in the United States to assist US. Only cash transactions with a Federal Reserve Bank are automatically exempt from BSA reporting requirements. Order Granting Exemption from Customer Identification Program Requirements for Premium Finance Lending The order conveyed under OCC Bulletin 2018-35 limited the exemption to commercial customers.

How safe is our banking system.

Government agencies in detecting and preventing money laundering. A payroll customer which includes any other person. Government agencies in detecting and preventing money laundering such as. Banks may exempt to the extent of its domestic operations customers who are either non-listed businesses that regularly withdraw or deposit more than 10000 or payroll customers that regularly withdraw more than 10000 to meet payroll. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 also be incorporated or organized under US. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US.

Source: slideshare.net

Source: slideshare.net

Further observing that under 31 CFR. Exemptions from Bank Secrecy Act Reporting Requirements. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Order Granting Exemption from Customer Identification Program Requirements for Premium Finance Lending The order conveyed under OCC Bulletin 2018-35 limited the exemption to commercial customers. See 31 CFR 1020315e8 Ineligible businesses.

Source: slideshare.net

Source: slideshare.net

Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. Comments must be received by February 22 2021. And may only be exempted to the extent of its domestic operations.

Source: slidetodoc.com

Source: slidetodoc.com

It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized. Banks also use this form every two years to renew any present exemptions for their customers who may be eligible for ongoing exemptions. The appropriate federal functional regulator with the concurrence of FinCEN on behalf of the Secretary of the Treasury may by order or regulation exempt any bank or type of account from the requirements of this section. 1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. Designation of Exempt Person Report Bank Secrecy Act regulations dictate that banks must file this form if one of their customers is exempt from being reported on the Currency Transaction Report for any reason.

Source: slideserve.com

Source: slideserve.com

The Secretarys authority under this provision has been delegated to FinCEN. The proposed rule would amend the NCUAs SARs regulation to allow the Board to issue exemptions from the requirements of that regulation in order to grant relief to FICUs that develop innovative solutions to meet the requirements of the Bank Secrecy Act BSA. Government agencies in detecting and preventing money laundering such as. Government agencies in detecting and preventing money laundering. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase.

Source: amlrightsource.com

Source: amlrightsource.com

1020220 b the appropriate FBA with the concurrence of the Secretary of the Treasury may by order or regulation exempt any bank or type of account from the requirements of the CIP rules. AN ACT PROHIBITING DISCLOSURE OF OR INQUIRY INTO DEPOSITS WITH ANY BANKING INSTITUTION AND PROVIDING PENALTY THEREFOR. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. 1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized.

1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. The final rule is effective January 5 2009. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 also be incorporated or organized under US. Government agencies in detecting and preventing money laundering such as.

Source: slideserve.com

Source: slideserve.com

And may only be exempted to the extent of its domestic operations. How safe is our banking system. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. 44 31 CFR 1020220b. Note for Community Banks.

Source: present5.com

Source: present5.com

For all other transactions that may qualify for exemption a credit union must file a special form to designate the person or organization as exempt. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Under 31 CFR. Government agencies in detecting and preventing money laundering. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: slidetodoc.com

Source: slidetodoc.com

The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000. The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000. 1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. The Secretarys authority under this provision has been delegated to FinCEN. Comments must be received by February 22 2021.

Source: present5.com

Source: present5.com

Under 31 CFR. Law requiring financial institutions in the United States to assist US. Laws and be eligible to do business in the US. The final rule simplifies the regulation allowing credit unions to exempt transactions of certain persons from the requirement to report currency transactions in excess of 10000. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II.

Source: proprofs.com

Source: proprofs.com

Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. The Financial Crimes Enforcement Network FinCEN recently issued a final rule amending the Bank Secrecy Act BSA. Order Granting Exemption from Customer Identification Program Requirements for Premium Finance Lending The order conveyed under OCC Bulletin 2018-35 limited the exemption to commercial customers. Law requiring financial institutions in the United States to assist US. Under 31 CFR.

![]() Source: slideplayer.com

Source: slideplayer.com

Government agencies in detecting and preventing money laundering such as. Currency and Foreign Transactions Reporting Act Exemption Handbook Section 5010 Bank Secrecy Act Manual September 1997 Page 1. It is hereby declared to be the policy of the Government to give encouragement to the people to deposit their money in banking institutions and to discourage private hoarding so that the same may be properly utilized by banks in authorized. 44 31 CFR 1020220b. And may only be exempted to the extent of its domestic operations.

Source: slideserve.com

Source: slideserve.com

For all other transactions that may qualify for exemption a credit union must file a special form to designate the person or organization as exempt. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Exemptions from Bank Secrecy Act Reporting Requirements. Under 31 CFR. Under the Bank Secrecy ActBSA financial institutions are required to assist US.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act exemptions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas