11++ Bank secrecy act filing requirements ideas in 2021

Home » about money loundering Info » 11++ Bank secrecy act filing requirements ideas in 2021Your Bank secrecy act filing requirements images are available. Bank secrecy act filing requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act filing requirements files here. Download all royalty-free vectors.

If you’re searching for bank secrecy act filing requirements pictures information linked to the bank secrecy act filing requirements interest, you have visit the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

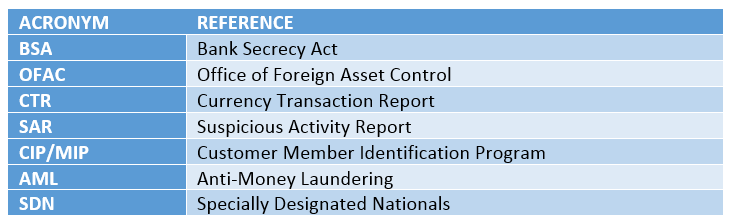

Bank Secrecy Act Filing Requirements. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. Understanding Its Reporting Requirements 2 What to Report under BSA. Establish effective BSA compliance programs. Filers are required to save a printed or electronic copy of the report for at least five years.

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

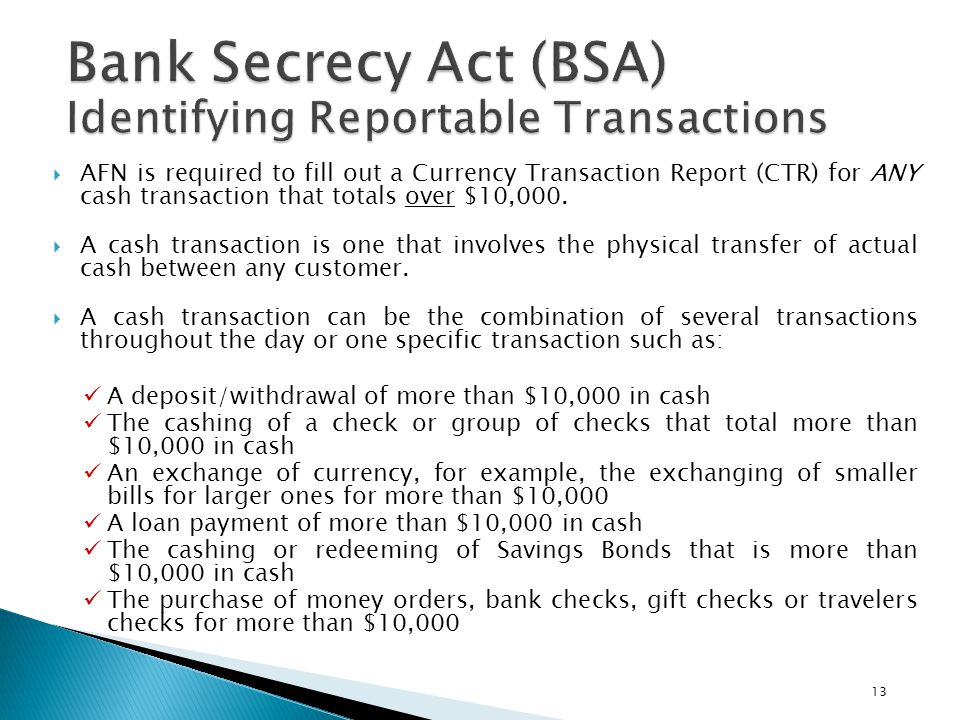

Establish effective BSA compliance programs. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. Form 110 Designation of Exempt Person. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States. Bank Secrecy Act. Currency Transaction Reports CTRs and Suspicious Activity.

Seq is referred to as the Bank Secrecy Act BSA.

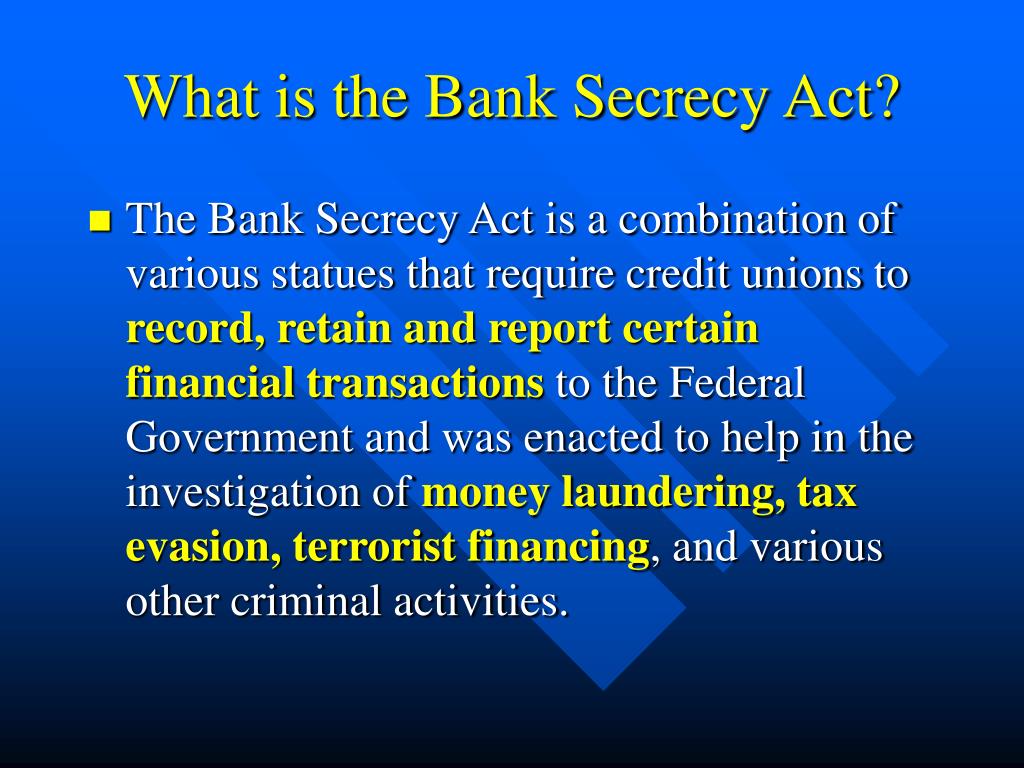

Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States.

Source: blog.gao.gov

Source: blog.gao.gov

Understanding Its Reporting Requirements 2 What to Report under BSA. While most of the provisions under the Bank Secrecy Act were created as requirements for foreign banks to comply with the Fbar is an individual filing requirement. Establish effective BSA compliance programs. Terms like Bank Secrecy Act or BSA are frequently used in connec - tion with the compliance duties of finan - cial institutions but they do not usually refer to a single statute although as we will discuss there is a federal law called the Bank Secrecy Act. If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect.

Source: acamstoday.org

Source: acamstoday.org

A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR. The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. The authority of the Secretary to administer Title II of the BSA. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. Law requiring financial institutions in the United States to assist US.

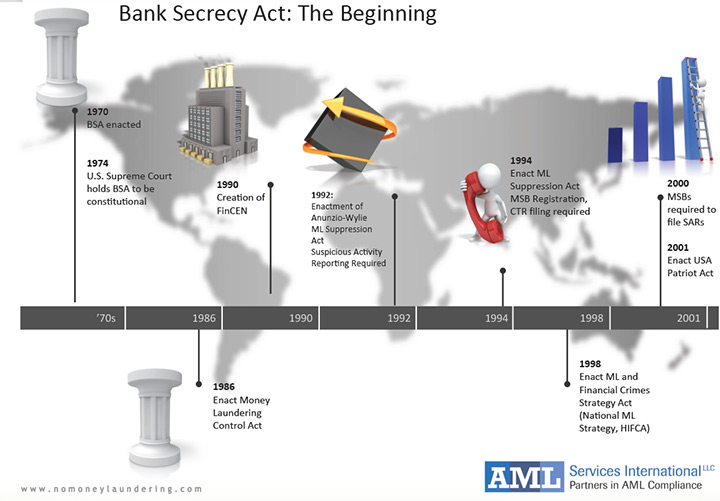

Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. Prior BSA filing history. FEDERAL DEPOSIT INSURANCE CORPORATION Evolution Of The BSA Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act 2001. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Seq is referred to as the Bank Secrecy Act BSA.

Source: slideserve.com

Source: slideserve.com

Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. Terms like Bank Secrecy Act or BSA are frequently used in connec - tion with the compliance duties of finan - cial institutions but they do not usually refer to a single statute although as we will discuss there is a federal law called the Bank Secrecy Act. Not all financial institutions are allowed to exempt customers using Form 110 banks are the only financial institutions allowed to do so. According to the Internal Revenue Service there is a general rule that any person in a. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States.

Source: blog.gao.gov

Source: blog.gao.gov

Government agencies in detecting and preventing money laundering. The authority of the Secretary to administer Title II of the BSA. The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. Terms like Bank Secrecy Act or BSA are frequently used in connec - tion with the compliance duties of finan - cial institutions but they do not usually refer to a single statute although as we will discuss there is a federal law called the Bank Secrecy Act. Law requiring financial institutions in the United States to assist US.

![]() Source: slideplayer.com

Source: slideplayer.com

A bank must retain the information relied on methods used to verify identity and resolution of discrepancies for a period of five years after the record is made. Exemptions from Bank Secrecy Act Reporting Requirements Only cash transactions with a Federal Reserve Bank are automatically exempt from BSA reporting requirements. Filers are required to save a printed or electronic copy of the report for at least five years. The documents filed by businesses under the BSA requirements. This form is filed when a bank customer meets the BSA criteria that qualify the customer to have an exempt status from CTR filings.

Source: slideplayer.com

Source: slideplayer.com

The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. Actually a number of laws and regulations come. Currency transaction reports must be filed to FinCEN within 15 calendar days of the reported transaction s using the Bank Secrecy Act BSA E-Filing System. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Establish effective BSA compliance programs.

Source: complianceonline.com

Source: complianceonline.com

FEDERAL DEPOSIT INSURANCE CORPORATION Evolution Of The BSA Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act 2001. The documents filed by businesses under the BSA requirements. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States. Actually a number of laws and regulations come. According to the Internal Revenue Service there is a general rule that any person in a.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. FEDERAL DEPOSIT INSURANCE CORPORATION Evolution Of The BSA Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act 2001. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. The documents filed by businesses under the BSA requirements. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report.

Source: slideplayer.com

Source: slideplayer.com

As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Currency transaction reports must be filed to FinCEN within 15 calendar days of the reported transaction s using the Bank Secrecy Act BSA E-Filing System. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Source: slideserve.com

Source: slideserve.com

Establish effective BSA compliance programs. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Filers are required to save a printed or electronic copy of the report for at least five years. Actually a number of laws and regulations come. According to the Internal Revenue Service there is a general rule that any person in a.

Source: probank.com

Source: probank.com

This form is filed when a bank customer meets the BSA criteria that qualify the customer to have an exempt status from CTR filings. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. Filers are required to save a printed or electronic copy of the report for at least five years.

Source: probank.com

Source: probank.com

Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States. The documents filed by businesses under the BSA requirements. If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect. A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act filing requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas