20++ Bank secrecy act financial institution definition info

Home » about money loundering idea » 20++ Bank secrecy act financial institution definition infoYour Bank secrecy act financial institution definition images are ready. Bank secrecy act financial institution definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act financial institution definition files here. Download all free vectors.

If you’re looking for bank secrecy act financial institution definition pictures information connected with to the bank secrecy act financial institution definition keyword, you have pay a visit to the right blog. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

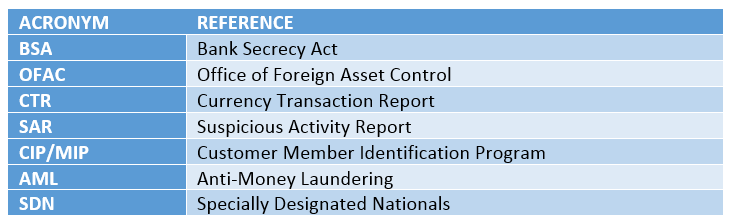

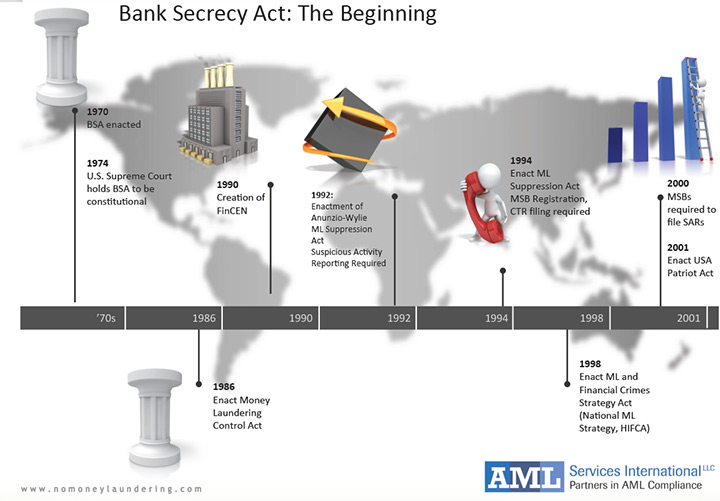

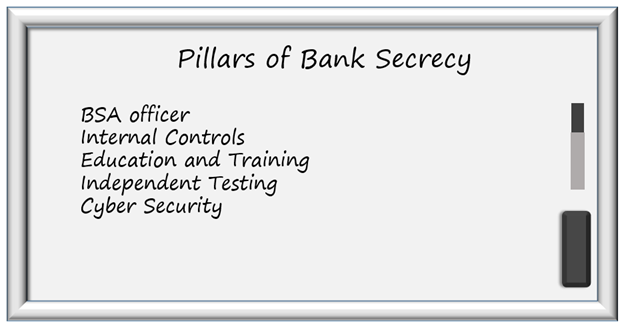

Bank Secrecy Act Financial Institution Definition. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000. Government agencies in detecting and preventing money laundering such as. The Bank Secrecy Act BSA is US. Supreme Court holds BSA to be constitutional.

Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Bank Secrecy Act BSA enacted. The Bank Secrecy Act BSA is US. Interagency Guidance on Beneficial Ownership Summary. An insured bank as defined in section 3h of the FDI Act 12 USC 1813h.

The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to.

Financial agency means a person acting for a person except for a country a monetary or financial authority acting as a monetary or financial authority or an international financial institution of which the United States Government is a member as a financial institution bailee depository trustee or agent or acting in a similar way related to money credit securities gold a transaction in money credit. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. As defined in the BSA 31 USC 5312a2 the term financial institution includes the following. Financial agency means a person acting for a person except for a country a monetary or financial authority acting as a monetary or financial authority or an international financial institution of which the United States Government is a member as a financial institution bailee depository trustee or agent or acting in a similar way related to money credit securities gold a transaction in money credit. The term recipients financial institution includes a beneficiarys. Large currency deposits of illicit profits.

Source: slideserve.com

Source: slideserve.com

A commercial bank or trust company. Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Person acting outside the United States for a person except for a country a monetary or financial authority acting as a monetary or financial authority or an international financial institution of which the United States Government is a member as a financial institution bailee depository trustee or agent or acting in a similar way related to money credit securities gold or a transaction in money credit. FIL-8-2010 March 5 2010 Bank Secrecy Act. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source:

Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash. An insured bank as defined in section 3h of the FDI Act 12 USC 1813h. The term recipients financial institution includes a beneficiarys. Recipients financial institution-1010100qq The financial institution or foreign financial agency identified in a transmittal order in which an account of the recipient is to be credited pursuant to the transmittal order or which otherwise is to make payment to the recipient if the order does not provide for payment to an account. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000.

Source: acamstoday.org

Source: acamstoday.org

The Bank Secrecy Act BSA is US. Constitutionality of Bank Secrecy Act questioned. FIL-8-2010 March 5 2010 Bank Secrecy Act. Financial institution except as provided in section 3414 of this title means any office of a bank savings bank card issuer as defined in section 1602n of title 15 industrial loan company trust company savings association building and loan or homestead association including cooperative banks credit union or consumer finance institution located in any State or territory of the United States the District. Person acting outside the United States for a person except for a country a monetary or financial authority acting as a monetary or financial authority or an international financial institution of which the United States Government is a member as a financial institution bailee depository trustee or agent or acting in a similar way related to money credit securities gold or a transaction in money credit.

Source: complyadvantage.com

Source: complyadvantage.com

Interagency Guidance on Beneficial Ownership Summary. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. A commercial bank or trust company. Constitutionality of Bank Secrecy Act questioned.

Source: in.pinterest.com

Source: in.pinterest.com

FIL-8-2010 March 5 2010 Bank Secrecy Act. Bank Secrecy Act BSA enacted. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

Source: tookitaki.ai

Source: tookitaki.ai

An insured bank as defined in section 3h of the FDI Act 12 USC 1813h. Supreme Court holds BSA to be constitutional. Financial institution except as provided in section 3414 of this title means any office of a bank savings bank card issuer as defined in section 1602n of title 15 industrial loan company trust company savings association building and loan or homestead association including cooperative banks credit union or consumer finance institution located in any State or territory of the United States the District. 5311 et seq is referred to as the Bank Secrecy Act BSA. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000. The FDIC the other federal banking agencies FBAs the Financial Crimes Enforcement Network FinCEN and the Securities and Exchange Commission SEC in consultation with staff of the. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000. Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash. The term recipients financial institution includes a beneficiarys.

Source: mortgagesanalyzed.com

Source: mortgagesanalyzed.com

A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Government agencies in detecting and preventing money laundering such as. Constitutionality of Bank Secrecy Act questioned. An insured bank as defined in section 3h of the FDI Act 12 USC 1813h. Recipients financial institution-1010100qq The financial institution or foreign financial agency identified in a transmittal order in which an account of the recipient is to be credited pursuant to the transmittal order or which otherwise is to make payment to the recipient if the order does not provide for payment to an account.

Source: proprofs.com

Source: proprofs.com

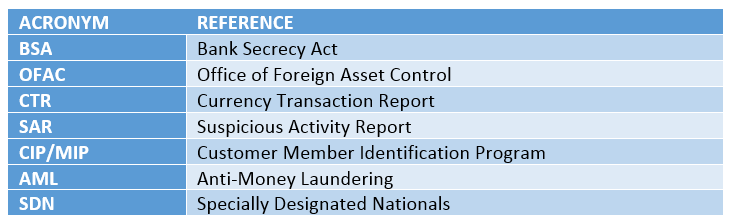

Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. As defined in the BSA 31 USC 5312a2 the term financial institution includes the following. The Act requires the Secretary in consultation with federal law enforcement and federal and state banking regulators to conduct a formal review of the financial institution reporting requirements relating to CTRs and SARs and to propose changes to reduce unnecessarily burdensome regulatory requirements and ensure the continued usefulness of such reports against statutory requirements. Financial institution except as provided in section 3414 of this title means any office of a bank savings bank card issuer as defined in section 1602n of title 15 industrial loan company trust company savings association building and loan or homestead association including cooperative banks credit union or consumer finance institution located in any State or territory of the United States the District. A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution.

Source: mossadams.com

Source: mossadams.com

Financial institution except as provided in section 3414 of this title means any office of a bank savings bank card issuer as defined in section 1602n of title 15 industrial loan company trust company savings association building and loan or homestead association including cooperative banks credit union or consumer finance institution located in any State or territory of the United States the District. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. An insured bank as defined in section 3h of the FDI Act 12 USC 1813h. 5311 et seq is referred to as the Bank Secrecy Act BSA. The law requires financial institutions to provide.

Source: complianceonline.com

Source: complianceonline.com

FIL-8-2010 March 5 2010 Bank Secrecy Act. As defined in the BSA 31 USC 5312a2 the term financial institution includes the following. 5311 et seq is referred to as the Bank Secrecy Act BSA. A commercial bank or trust company. Financial Institutions and Businesses Regulated by Bank Secrecy Act.

Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. See 31 CFR Section 5312 a 2. The Act requires the Secretary in consultation with federal law enforcement and federal and state banking regulators to conduct a formal review of the financial institution reporting requirements relating to CTRs and SARs and to propose changes to reduce unnecessarily burdensome regulatory requirements and ensure the continued usefulness of such reports against statutory requirements. The law requires financial institutions to provide.

Source: sygna.io

The law requires financial institutions to provide. United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. Financial Institutions and Businesses Regulated by Bank Secrecy Act. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act financial institution definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information