14++ Bank secrecy act know your customer rules ideas in 2021

Home » about money loundering idea » 14++ Bank secrecy act know your customer rules ideas in 2021Your Bank secrecy act know your customer rules images are ready. Bank secrecy act know your customer rules are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act know your customer rules files here. Download all royalty-free vectors.

If you’re looking for bank secrecy act know your customer rules pictures information linked to the bank secrecy act know your customer rules keyword, you have come to the right site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

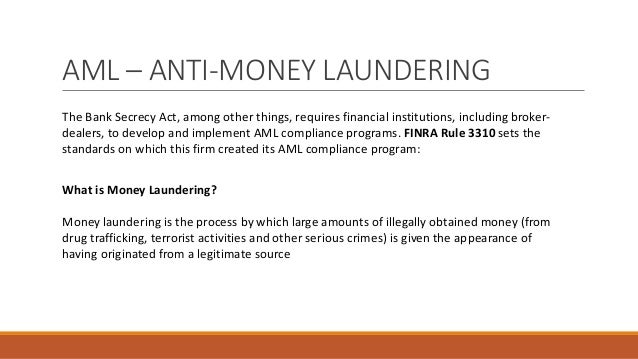

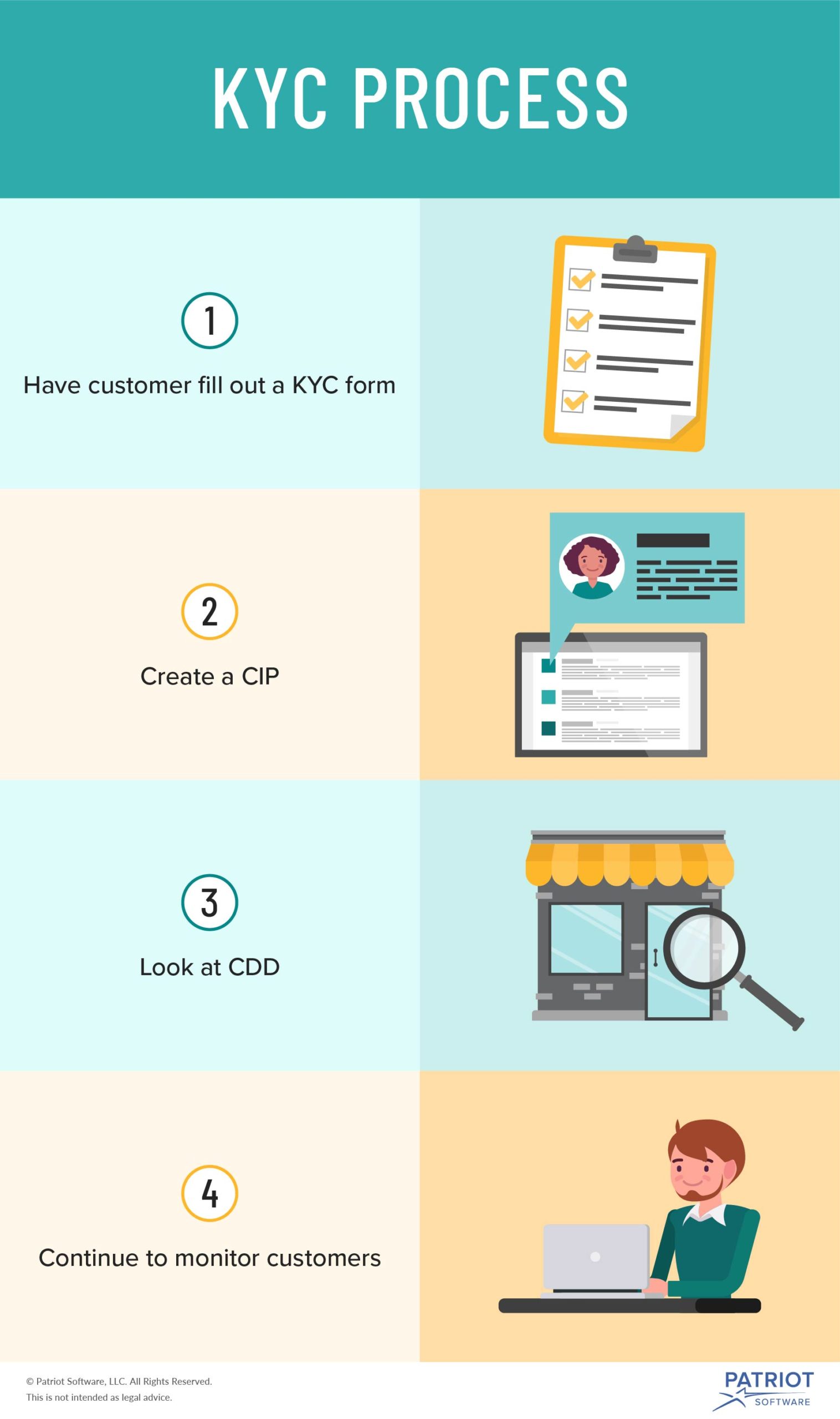

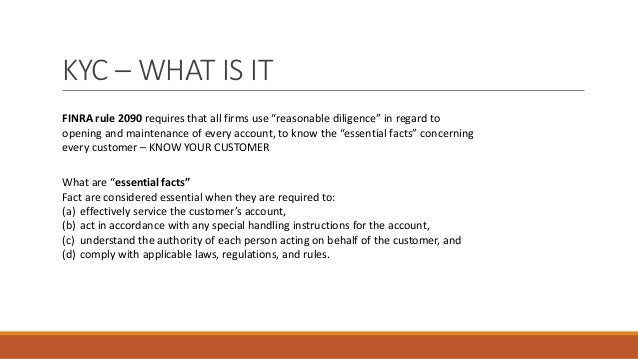

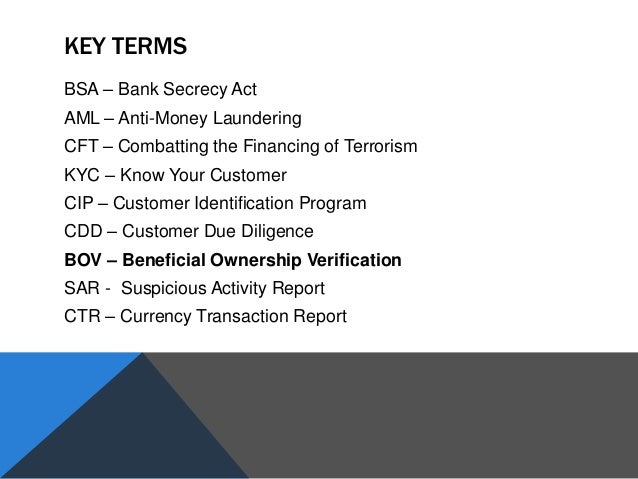

Bank Secrecy Act Know Your Customer Rules. A Customer Identification Program CIP and Customer Due Diligence CDD. A closer look at how Know Your Customer rules workand how they impact the financial system by Iza Wojciechowska March 01 2019 4 min read Recently the government has been holding financial institutions to ever higher standards when it comes to Know Your Customer KYC lawsbut established finance firms dont bear that burden alone. Therefore Title III of the Patriot Act requires banks to employ the following. The Bank Secrecy Act of 1970 for example specifically requires financial institutions to keep certain records eg cash transactions exceeding 10000 and to report financial transactions that might signify money laundering tax evasion or other criminal activities.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Identity documents and information like names and social security numbers. The Customer Identification Program is intended to enable the bank to form a reasonable belief that it knows the true identity of each customer. Cash financial transactions above 10000. The Bank Secrecy Act of 1970 for example specifically requires financial institutions to keep certain records eg cash transactions exceeding 10000 and to report financial transactions that might signify money laundering tax evasion or other criminal activities. As part of its efforts to implement provisions of the Anti-Money Laundering Act of 2021the first significant changes to Bank Secrecy Actanti-money laundering rules in almost two decadesthe Financial Crimes Enforcement Network is seeking public input on the creation of a national beneficial ownership database. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC.

1786 q 1 must implement a written Customer Identification Program CIP appropriate for the banks size and type of business that at a minimum includes each of the requirements of paragraphs a 1 through 5 of this section.

For example if a customer makes a habit of making transfers of 9500 once a day throughout the week this activity could be highly suspicious. Currency Transaction Report CTR for cash transactions that exceed 10000 in one business day. A closer look at how Know Your Customer rules workand how they impact the financial system by Iza Wojciechowska March 01 2019 4 min read Recently the government has been holding financial institutions to ever higher standards when it comes to Know Your Customer KYC lawsbut established finance firms dont bear that burden alone. The BSA is an amendment to the Federal Deposit Insurance Act. The BSA requires banks to file five types of reports with the Financial Crimes Enforcement Network and Treasury Department. The goal of KYC is to prevent banks from being used intentionally or not for money laundering and other illegal activities.

Source: slideshare.net

Source: slideshare.net

Bank Secrecy Act Manual Supplement 1September 1997 The following is a summary of the revisions andor additions that have been made to the Federal Reserves Bank Secrecy Act Exam-ination Manual since its initial distribution in January 1995. You may replace the entire con-tents according to Tabs. TAB 100WORKPROGRAM Anti-Money Laundering Procedures. Cash financial transactions above 10000. A Customer Identification Program CIP and Customer Due Diligence CDD.

Source: patriotsoftware.com

Source: patriotsoftware.com

Oversight bodies across the globe have begun using mandates to bring digital identity verification and Know Your Customer to the forefront of the minds of businesses. 5311 et seq is referred to as the Bank Secrecy Act BSA. Know Your Customer processes include the collecting or monitoring of. As part of its efforts to implement provisions of the Anti-Money Laundering Act of 2021the first significant changes to Bank Secrecy Actanti-money laundering rules in almost two decadesthe Financial Crimes Enforcement Network is seeking public input on the creation of a national beneficial ownership database. Congress passed the Bank Secrecy Act.

Source: processmaker.com

Source: processmaker.com

Congress passed the Bank Secrecy Act. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. 5318 h 12 USC. And Foreign Transactions Act of 1970 31 USC. Oversight bodies across the globe have begun using mandates to bring digital identity verification and Know Your Customer to the forefront of the minds of businesses.

Source: slideplayer.com

Source: slideplayer.com

A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. And Foreign Transactions Act of 1970 31 USC. The Bank Secrecy Act of 1970 for example specifically requires financial institutions to keep certain records eg cash transactions exceeding 10000 and to report financial transactions that might signify money laundering tax evasion or other criminal activities. A Customer Identification Program CIP and Customer Due Diligence CDD. Oversight bodies across the globe have begun using mandates to bring digital identity verification and Know Your Customer to the forefront of the minds of businesses.

Source: present5.com

Source: present5.com

The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. These are the types of documents typically requested. The Bank Secrecy Act of 1970 for example specifically requires financial institutions to keep certain records eg cash transactions exceeding 10000 and to report financial transactions that might signify money laundering tax evasion or other criminal activities. OBJECTIVES OF KNOW YOUR CUSTOMER POLICY A know your customer policy should increase the likelihood that the financial insti-tution is in compliance with all statutes and regulations and adheres to sound and recog-nized banking practices. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source: slideshare.net

Source: slideshare.net

5311 et seq is referred to as the Bank Secrecy Act BSA. As part of its efforts to implement provisions of the Anti-Money Laundering Act of 2021the first significant changes to Bank Secrecy Actanti-money laundering rules in almost two decadesthe Financial Crimes Enforcement Network is seeking public input on the creation of a national beneficial ownership database. The new rules which have gone out for public comment until January 4 2021 propose that convertible virtual currency and legal tender digital assets be classified as monetary instruments and are therefore subject to the requirements of the Bank Secrecy Act BSA. 5318 h 12 USC. In the United States KYC and AML mandates and their associated CDD requirements stem from the 1970 Bank Secrecy Act and the 2001 Patriot Act.

Source: acamstoday.org

Source: acamstoday.org

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. The new rules which have gone out for public comment until January 4 2021 propose that convertible virtual currency and legal tender digital assets be classified as monetary instruments and are therefore subject to the requirements of the Bank Secrecy Act BSA. Identity documents and information like names and social security numbers. OBJECTIVES OF KNOW YOUR CUSTOMER POLICY A know your customer policy should increase the likelihood that the financial insti-tution is in compliance with all statutes and regulations and adheres to sound and recog-nized banking practices.

Source: acamstoday.org

Source: acamstoday.org

A closer look at how Know Your Customer rules workand how they impact the financial system by Iza Wojciechowska March 01 2019 4 min read Recently the government has been holding financial institutions to ever higher standards when it comes to Know Your Customer KYC lawsbut established finance firms dont bear that burden alone. The BSA requires banks to file five types of reports with the Financial Crimes Enforcement Network and Treasury Department. The new rules which have gone out for public comment until January 4 2021 propose that convertible virtual currency and legal tender digital assets be classified as monetary instruments and are therefore subject to the requirements of the Bank Secrecy Act BSA. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Source: yumpu.com

Source: yumpu.com

TAB 100WORKPROGRAM Anti-Money Laundering Procedures. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. These are the types of documents typically requested. 1818 s or 12 USC. To meet CIP requirements they must ask their customers for specific documents related to identifying information.

Source: slideshare.net

Source: slideshare.net

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. Bank Secrecy Act Manual Supplement 1September 1997 The following is a summary of the revisions andor additions that have been made to the Federal Reserves Bank Secrecy Act Exam-ination Manual since its initial distribution in January 1995. Organizations are required to file a Currency Transaction Report for cash transactions exceeding 10000 and by limiting his deposits to 9500 this customer may be trying to avoid having his activity reported. For example if a customer makes a habit of making transfers of 9500 once a day throughout the week this activity could be highly suspicious. Identity documents and information like names and social security numbers.

Source: slideshare.net

Source: slideshare.net

The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. For example if a customer makes a habit of making transfers of 9500 once a day throughout the week this activity could be highly suspicious. A closer look at how Know Your Customer rules workand how they impact the financial system by Iza Wojciechowska March 01 2019 4 min read Recently the government has been holding financial institutions to ever higher standards when it comes to Know Your Customer KYC lawsbut established finance firms dont bear that burden alone. The goal of KYC is to prevent banks from being used intentionally or not for money laundering and other illegal activities. TAB 100WORKPROGRAM Anti-Money Laundering Procedures.

Source: slideshare.net

Source: slideshare.net

The goal of KYC is to prevent banks from being used intentionally or not for money laundering and other illegal activities. The CIP must include new account opening procedures that specify the identifying information that will be obtained from each customer. The BSA requires banks to file five types of reports with the Financial Crimes Enforcement Network and Treasury Department. These are the types of documents typically requested. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Source: processmaker.com

Source: processmaker.com

For example if a customer makes a habit of making transfers of 9500 once a day throughout the week this activity could be highly suspicious. The new rules which have gone out for public comment until January 4 2021 propose that convertible virtual currency and legal tender digital assets be classified as monetary instruments and are therefore subject to the requirements of the Bank Secrecy Act BSA. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. The Customer Identification Program is intended to enable the bank to form a reasonable belief that it knows the true identity of each customer. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act know your customer rules by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information