17++ Bank secrecy act kyc requirements information

Home » about money loundering Info » 17++ Bank secrecy act kyc requirements informationYour Bank secrecy act kyc requirements images are available in this site. Bank secrecy act kyc requirements are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act kyc requirements files here. Find and Download all royalty-free vectors.

If you’re looking for bank secrecy act kyc requirements pictures information connected with to the bank secrecy act kyc requirements topic, you have come to the right site. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

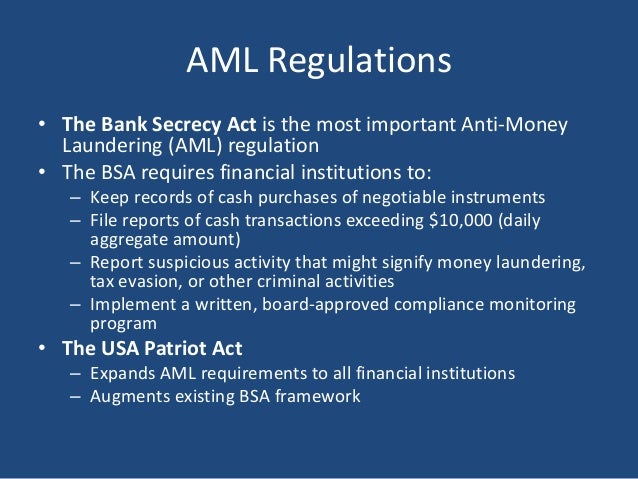

Bank Secrecy Act Kyc Requirements. KYC banking basics. Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as a. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. Ad Develop Your Skills With A Huge Range Of KYC Courses.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

In 1970 the US. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. Ad Develop Your Skills With A Huge Range Of KYC Courses. Governments 800-pound gorilla when it comes to regulating vir-tual currency. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Ad Develop Your Skills With A Huge Range Of KYC Courses.

The Patriot Act helped kickstart KYC requirements and develop them into what they are today.

It is enforced by the Financial Crimes Enforcement Network FinCEN a bureau of the US. Therefore Title III of the Patriot Act requires banks to employ the following. Part 3268b1 of the FDIC Rules and Regulations. In 1970 the US. Identify and verify the identity of customers. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program.

Source: acamstoday.org

Source: acamstoday.org

Department of the Treasury. Part 3268b1 of the FDIC Rules and Regulations. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The Patriot Act section introduced KYC laws added enforcement and requirements to the Bank Secrecy Act of 1970. Patriot Act of 2001 introduced KYC regulations and made KYC mandatory for all banks in the United States.

Source: present5.com

Source: present5.com

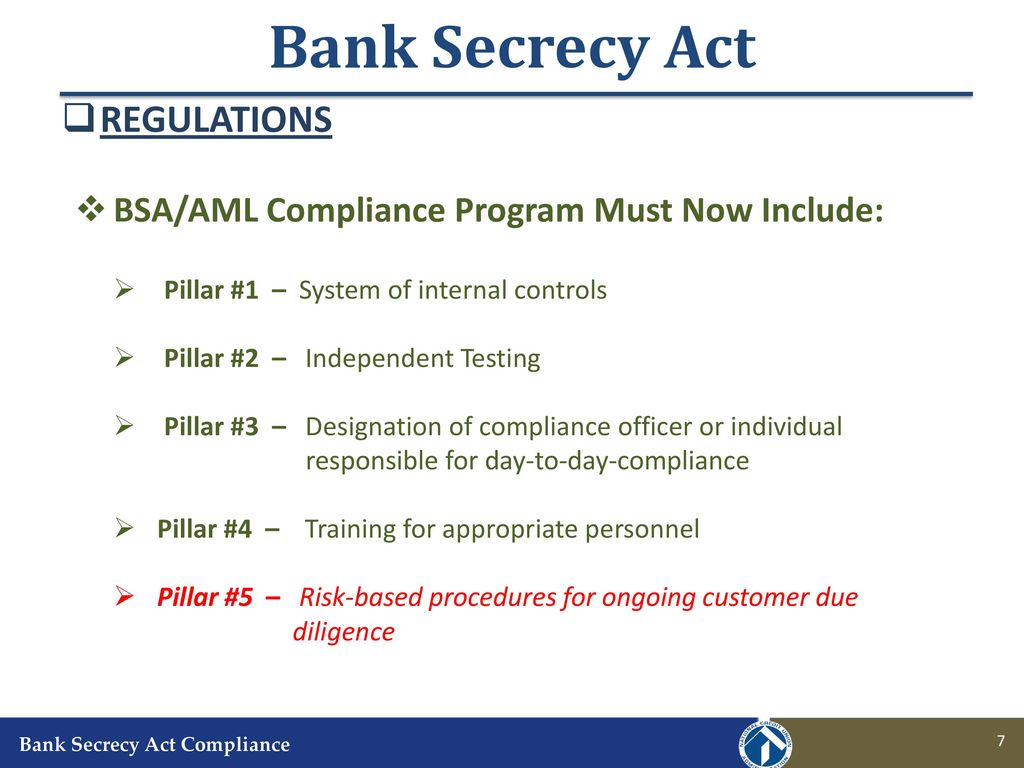

It has been expanded transformed and updated since its initial passage in 1970 to keep pace with new develop-. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Currency Transaction Report. KYC banking basics. KYC requirements for banks help them verify the identities of their clients.

Source: acamstoday.org

Source: acamstoday.org

Ad Develop Your Skills With A Huge Range Of KYC Courses. KYC laws were introduced in 2001 as part of the Patriot Act which was passed after 911 to provide a variety of means to deter terrorist behavior. The Patriot Act helped kickstart KYC requirements and develop them into what they are today. Department of the Treasury. Congress passed the Bank Secrecy Act also known as the Federal Deposit Insurance Act Amendments.

Source: pinterest.com

Source: pinterest.com

The Patriot Act section introduced KYC laws added enforcement and requirements to the Bank Secrecy Act of 1970. A Customer Identification Program CIP and Customer Due Diligence CDD. A bank must maintain a record of all Currency Transaction Reports CTR for a. Identify and verify the identity of customers. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Source: chaussureslouboutin-soldes.fr

Source: chaussureslouboutin-soldes.fr

Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as a. In 1970 the US. Identify and verify the identity of customers. Department of the Treasury. It is enforced by the Financial Crimes Enforcement Network FinCEN a bureau of the US.

Congress passed the Bank Secrecy Act also known as the Federal Deposit Insurance Act Amendments. It is also a way to assess any potential risks of forming a business relationship with them. Patriot Act of 2001 introduced KYC regulations and made KYC mandatory for all banks in the United States. KYC banking basics. The Patriot Act section introduced KYC laws added enforcement and requirements to the Bank Secrecy Act of 1970.

Source: yumpu.com

Source: yumpu.com

The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. The act also requires financial institutions to comply with stricter KYC rules including the Customer Identification Program CIP and Customer Due Diligence CDD. KYC laws were introduced in 2001 as part of the Patriot Act which was passed after 911 to provide a variety of means to deter terrorist behavior. Governments 800-pound gorilla when it comes to regulating vir-tual currency. Currency Transaction Report.

Source: pinterest.com

Source: pinterest.com

KYC laws were introduced in 2001 as part of the Patriot Act which was passed after 911 to provide a variety of means to deter terrorist behavior. Identify and verify the identity of the beneficial owners of companies opening accounts. The Patriot Act helped kickstart KYC requirements and develop them into what they are today. Part 3268b1 of the FDIC Rules and Regulations. The goal of KYC is to prevent banks from being used.

Source: tookitaki.ai

Source: tookitaki.ai

A Customer Identification Program CIP and Customer Due Diligence CDD. KYC banking basics. However KYC requirements for banks are often passed down to those with whom the banks do business. Ad Develop Your Skills With A Huge Range Of KYC Courses. KYC requirements for banks help them verify the identities of their clients.

Source: slideplayer.com

Source: slideplayer.com

While the BSA was passed in 1970 current provisions have been heavily influenced by amendments passed after the September 11 2001 terror attacks and the resulting USA Patriot Act. Therefore Title III of the Patriot Act requires banks to employ the following. The bill included a list of regulations that banks must comply with in order to remain insured by the FDIC forming the foundation of modern KYC laws. Fundamentals section and ensuing chapters address specific requirements of the Bank Secrecy Act BSA the USA PATRIOT Act and the Office of Foreign Assets Control OFAC. The section of the Act that pertained specifically to financial transactions added requirements and enforcement policies to the Bank Secrecy Act of 1970 that had thus far regulated banks and other institutions.

Source: complianceonline.com

Source: complianceonline.com

Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as a. Currency Transaction Report. KYC banking basics. KYC requirements for banks help them verify the identities of their clients. The goal of KYC is to prevent banks from being used.

Source: complyadvantage.com

Source: complyadvantage.com

Ad Develop Your Skills With A Huge Range Of KYC Courses. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. Part 3268b1 of the FDIC Rules and Regulations. However KYC requirements for banks are often passed down to those with whom the banks do business.

Source: slideplayer.com

Source: slideplayer.com

It is enforced by the Financial Crimes Enforcement Network FinCEN a bureau of the US. Start Your Learning Journey From The Comfort Of Your Home With Reedcouk. The CDD Rule has four core requirements. Governments 800-pound gorilla when it comes to regulating vir-tual currency. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act kyc requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas