19+ Bank secrecy act loan purpose ideas

Home » about money loundering Info » 19+ Bank secrecy act loan purpose ideasYour Bank secrecy act loan purpose images are ready. Bank secrecy act loan purpose are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act loan purpose files here. Find and Download all free photos.

If you’re searching for bank secrecy act loan purpose pictures information linked to the bank secrecy act loan purpose keyword, you have come to the right blog. Our website always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

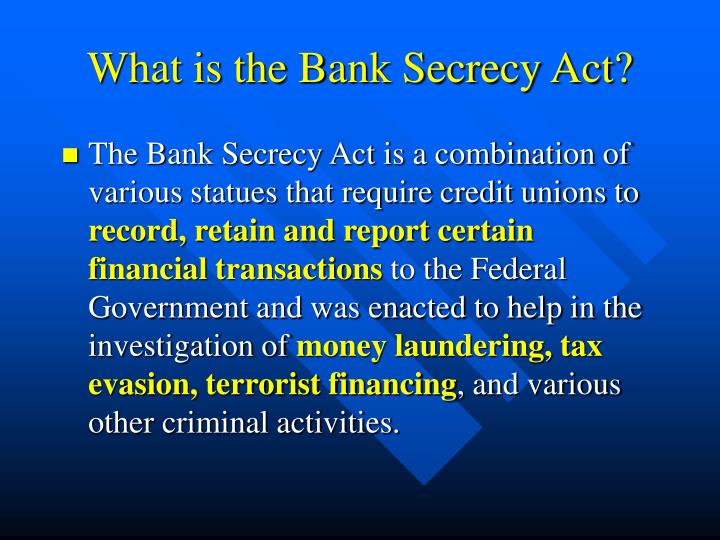

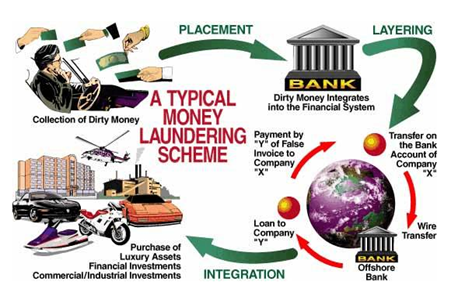

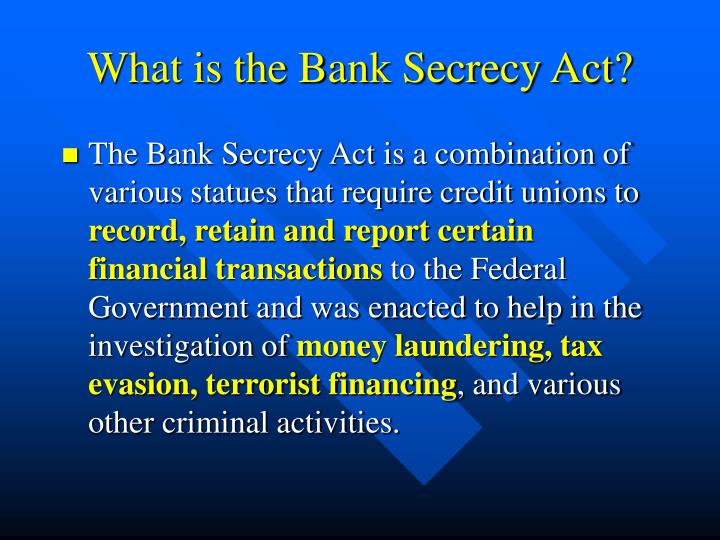

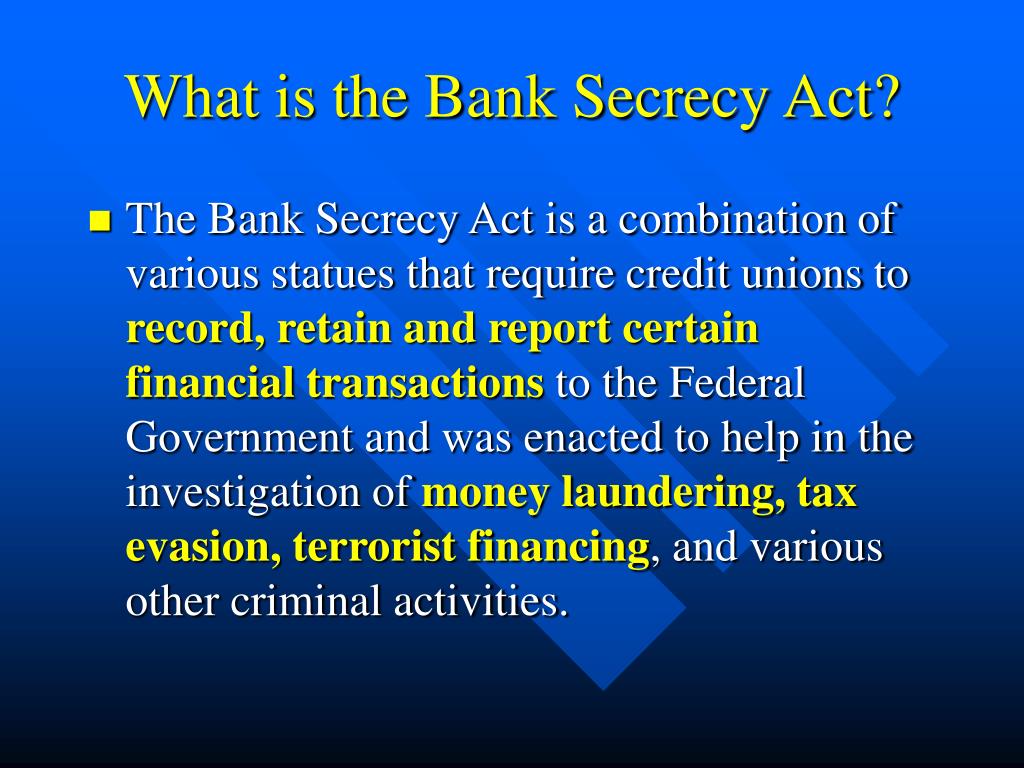

Bank Secrecy Act Loan Purpose. These funds were primarily the proceeds of illegal narcotic activity and tax evasion. While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule the Agencies recognize that this document does not answer every question that may arise in connection with the rule. 5311 et seq is referred to as the Bank Secrecy Act BSA. The Bank Secrecy Act BSA is US.

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

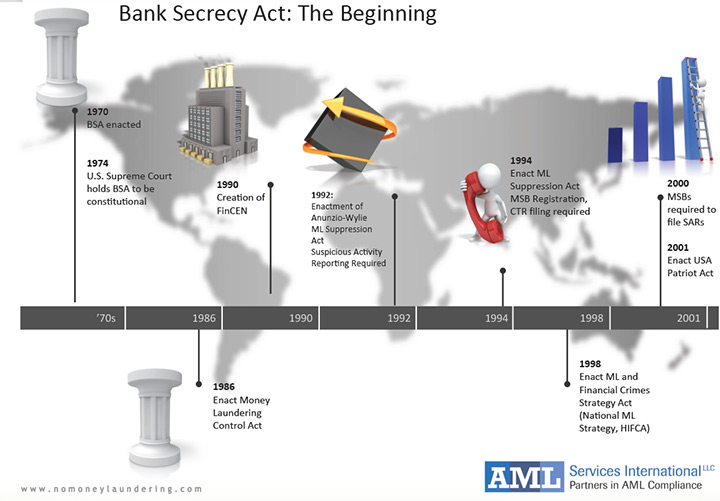

While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule the Agencies recognize that this document does not answer every question that may arise in connection with the rule. For purposes of this rule covered financial institutions are federally regulated banks and federally insured credit unions mutual funds brokers or dealers in securities futures commission merchants and introducing brokers in commodities. The BSA establishes recordkeeping requirements related to various types of records including. Bank Secrecy Act of 1970 The Bank Secrecy Act of 1970 is the foundation upon which the current version of the BSA was built. 1051 et seq is often referred to as The Bank Secrecy Act BSA. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax or regulatory.

While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule the Agencies recognize that this document does not answer every question that may arise in connection with the rule.

Under the Bank Secrecy Act BSA financial institutions are required to assist US. At the time I found a really clear outline of expectations in the BSA Manual. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. For the purposes of this paragraph 1010100lll the term loan or finance company shall include a sole proprietor acting as a loan or finance company and shall not include. See 31 CFR Section 5312 a 2. The Financial Crimes Enforcement Network FinCEN is issuing this Ruling to clarify the requirements under FinCENs regulations for loan and finance companies that are subsidiaries of financial institutions subject to the same regulations applicable to the parent financial institution and examinations of a Federal functional regulator for compliance with the anti-money laundering and counter-terrorist financing obligations under the laws generally known as the Bank Secrecy Act.

![]() Source: slideplayer.com

Source: slideplayer.com

The purpose of this Anti-Money Laundering AML Policy Template Loan Mortgage or Finance Company Version is to address a loan mortgage or finance companys written Anti-Money Laundering AML Program that is reasonably designed to prevent a company from being used to facilitate money laundering and the financing of terrorist activities under the Bank Secrecy Act BSA. The BSA establishes recordkeeping requirements related to various types of records including. In short the primary purpose of this law was to prevent financial institutionsincluding credit unionsfrom being used as intermediaries in currency transactions that might be linked to money. The purpose of the BSA is to require United States US. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that.

Source: acamstoday.org

Source: acamstoday.org

Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax or regulatory. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Agencies encourage banks to use the basic principles set forth in the CIP rule as articulated in these answers to address variations on these questions that may arise and expect banks. The Bank Secrecy Act BSA is US. The purpose of the BSA is to require United States US.

Source: blog.gao.gov

Source: blog.gao.gov

The purpose of this Anti-Money Laundering AML Policy Template Loan Mortgage or Finance Company Version is to address a loan mortgage or finance companys written Anti-Money Laundering AML Program that is reasonably designed to prevent a company from being used to facilitate money laundering and the financing of terrorist activities under the Bank Secrecy Act BSA. 5311 et seq is referred to as the Bank Secrecy Act BSA. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. For purposes of this rule covered financial institutions are federally regulated banks and federally insured credit unions mutual funds brokers or dealers in securities futures commission merchants and introducing brokers in commodities. The Agencies encourage banks to use the basic principles set forth in the CIP rule as articulated in these answers to address variations on these questions that may arise and expect banks.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA is a group of federalstatutes that require certain persons to keeprecords and file reportsthat have a high degreeof usefulness in criminal tax or regulatoryinvestigations or proceedings Part of the BSA requires these certain persons todevelop anti. The purpose of this Anti-Money Laundering AML Policy Template Loan Mortgage or Finance Company Version is to address a loan mortgage or finance companys written Anti-Money Laundering AML Program that is reasonably designed to prevent a company from being used to facilitate money laundering and the financing of terrorist activities under the Bank Secrecy Act BSA. At the time I found a really clear outline of expectations in the BSA Manual. For the purposes of this paragraph 1010100lll the term loan or finance company shall include a sole proprietor acting as a loan or finance company and shall not include. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money.

Source: complianceonline.com

Source: complianceonline.com

While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule the Agencies recognize that this document does not answer every question that may arise in connection with the rule. 1051 et seq is often referred to as The Bank Secrecy Act BSA. The Financial Crimes Enforcement Network FinCEN is issuing this Ruling to clarify the requirements under FinCENs regulations for loan and finance companies that are subsidiaries of financial institutions subject to the same regulations applicable to the parent financial institution and examinations of a Federal functional regulator for compliance with the anti-money laundering and counter-terrorist financing obligations under the laws generally known as the Bank Secrecy Act. For the purposes of this paragraph 1010100lll the term loan or finance company shall include a sole proprietor acting as a loan or finance company and shall not include. The Bank Secrecy Act BSA is a group of federalstatutes that require certain persons to keeprecords and file reportsthat have a high degreeof usefulness in criminal tax or regulatoryinvestigations or proceedings Part of the BSA requires these certain persons todevelop anti.

Source: qsstudy.com

Source: qsstudy.com

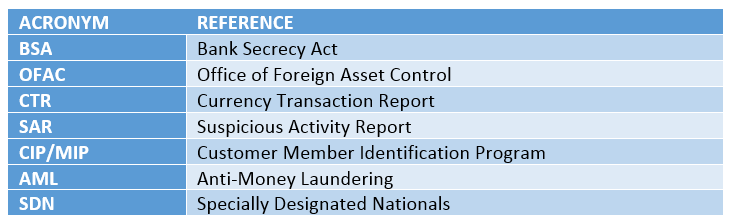

Under the Bank Secrecy Act BSA financial institutions are required to assist US. A bank a person registered with and functionally regulated or examined by the Securities and Exchange Commission or the Commodity Futures Trading Commission any government sponsored enterprise regulated by the Federal. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. The BSA establishes recordkeeping requirements related to various types of records including. I started in BSA a few years ago and I built an Enhance Due Diligence program for higher risk customers with monthly transaction review and then yearly comprehensive review of the business and its expected vs actual activity.

Source: tookitaki.ai

Source: tookitaki.ai

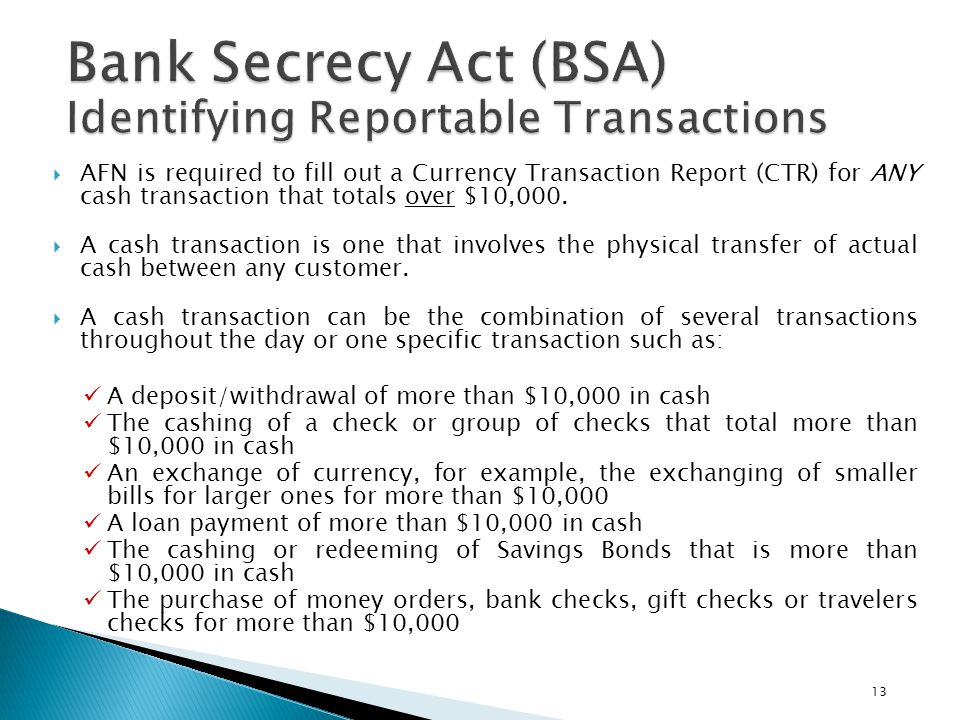

Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax or regulatory. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. The Bank Secrecy Act is a law that was implemented in 1970 as a means to detect and prevent the movement of illicit funds through the legitimate banking system. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Customer Due Diligence rules require bankers to know who their customers are the purpose of their accounts and the expected transaction activity.

Source: slideserve.com

Source: slideserve.com

Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. 1051 et seq is often referred to as The Bank Secrecy Act BSA. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax or regulatory. While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule the Agencies recognize that this document does not answer every question that may arise in connection with the rule. In short the primary purpose of this law was to prevent financial institutionsincluding credit unionsfrom being used as intermediaries in currency transactions that might be linked to money.

Source: slideserve.com

Source: slideserve.com

Under the Bank Secrecy Act BSA financial institutions are required to assist US. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. See 31 CFR Section 5312 a 2. I started in BSA a few years ago and I built an Enhance Due Diligence program for higher risk customers with monthly transaction review and then yearly comprehensive review of the business and its expected vs actual activity. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA.

I started in BSA a few years ago and I built an Enhance Due Diligence program for higher risk customers with monthly transaction review and then yearly comprehensive review of the business and its expected vs actual activity. In general the BSA requires that a bank. The Bank Secrecy Act BSA is US. For purposes of this rule covered financial institutions are federally regulated banks and federally insured credit unions mutual funds brokers or dealers in securities futures commission merchants and introducing brokers in commodities. Government agencies in detecting and preventing money laundering such as.

Source: probank.com

Source: probank.com

The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. For purposes of this rule covered financial institutions are federally regulated banks and federally insured credit unions mutual funds brokers or dealers in securities futures commission merchants and introducing brokers in commodities. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA.

Source:

Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Bank Secrecy Act BSA is a group of federalstatutes that require certain persons to keeprecords and file reportsthat have a high degreeof usefulness in criminal tax or regulatoryinvestigations or proceedings Part of the BSA requires these certain persons todevelop anti. The Bank Secrecy Act BSA is US. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: slideserve.com

Source: slideserve.com

The law requires financial institutions to provide. True If a customer requests a wire be sent to an. In short the primary purpose of this law was to prevent financial institutionsincluding credit unionsfrom being used as intermediaries in currency transactions that might be linked to money. These funds were primarily the proceeds of illegal narcotic activity and tax evasion. A bank a person registered with and functionally regulated or examined by the Securities and Exchange Commission or the Commodity Futures Trading Commission any government sponsored enterprise regulated by the Federal.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act loan purpose by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas