18+ Bank secrecy act of 1970 requirements ideas in 2021

Home » about money loundering idea » 18+ Bank secrecy act of 1970 requirements ideas in 2021Your Bank secrecy act of 1970 requirements images are ready. Bank secrecy act of 1970 requirements are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act of 1970 requirements files here. Download all free photos and vectors.

If you’re looking for bank secrecy act of 1970 requirements images information related to the bank secrecy act of 1970 requirements topic, you have visit the ideal blog. Our website always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

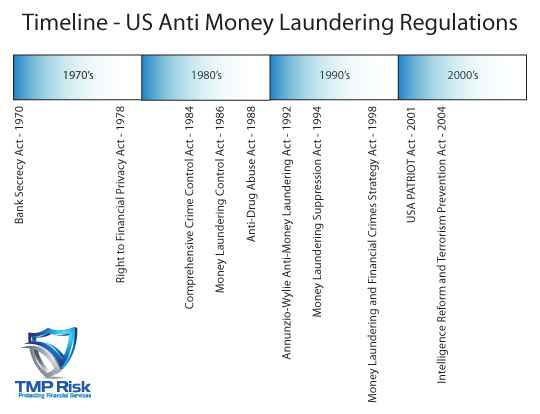

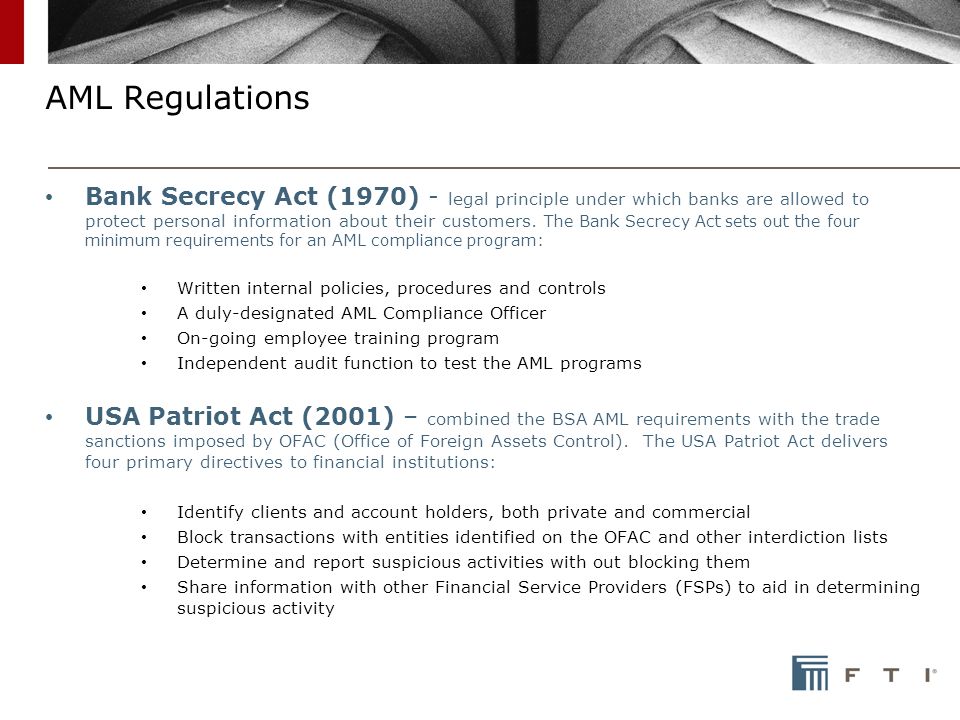

Bank Secrecy Act Of 1970 Requirements. 1051 et seq is often referred to as The Bank Secrecy Act BSA. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Financial institutions to assist US. Neither the Company nor to the Companys knowledge assuming reasonable inquiry any Insider has violated the Bank Secrecy Act of 1970 as amended or Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism USA PATRIOT ACT Act of 2001 andor the rules and regulations promulgated under any such law or any successor law.

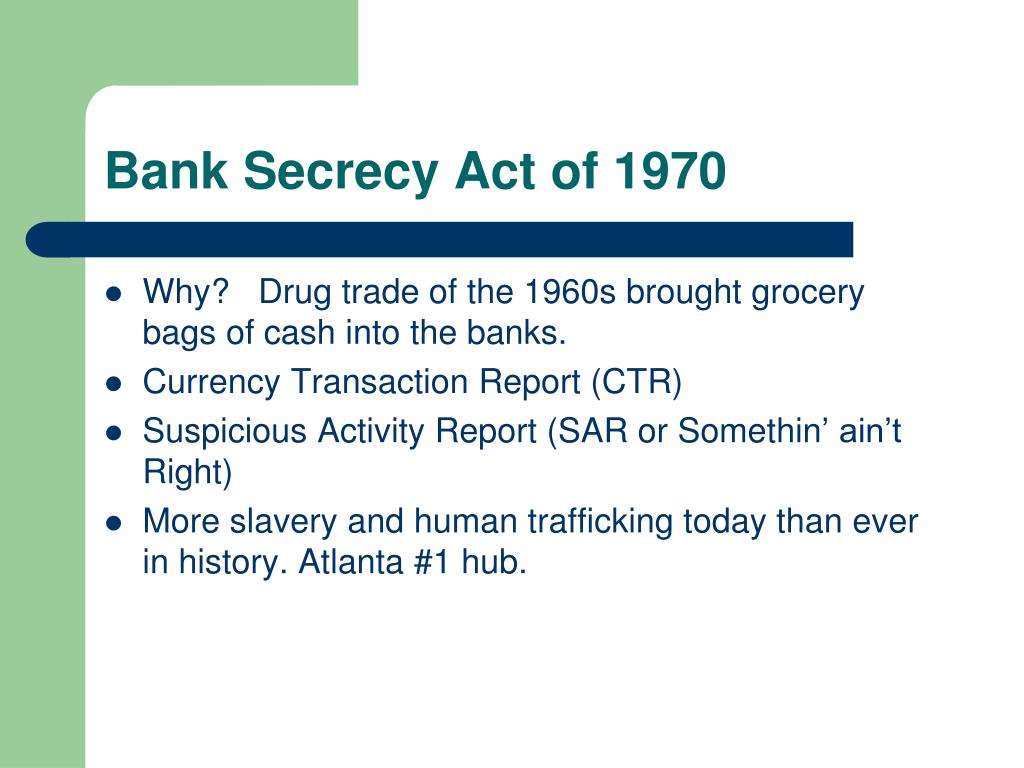

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. The law requires financial institutions to provide. The subtitle has several sections that prohibit or restrict the use of certain accounts held at financial institutions. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. In the Bank Secrecy Act of 1970 Congress required that law enforcement agencies have a court order before they access the financial records of any US. The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US.

Law used to detect deter and disrupt money laundering and terrorist financing networks.

Congress introduced the Bank Secrecy Act. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. Or that is not subject to supervision by a banking authority in a non-US. Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. In the Bank Secrecy Act of 1970 Congress required that law enforcement agencies have a court order before they access the financial records of any US.

Source: acamstoday.org

Source: acamstoday.org

These records include the names of depositors and photocopies of all transactions. 5311 et seq is referred to as the Bank Secrecy Act BSA. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The purpose of the BSA is to require United States US. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that.

Source: nachomoneyhoney.weebly.com

Source: nachomoneyhoney.weebly.com

The subtitle has several sections that prohibit or restrict the use of certain accounts held at financial institutions. The BSA is an amendment to the Federal Deposit Insurance Act. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Section 313 prohibits foreign shell banks that are not an affiliate of a bank that has a physical presence in the US. In the Bank Secrecy Act of 1970 Congress required that law enforcement agencies have a court order before they access the financial records of any US.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Financial institutions to assist US. Establish effective customer due diligence systems and monitoring programs. Law requiring financial institutions in the United States to assist US. Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US.

Source: compliancealert.org

Source: compliancealert.org

Screen against Office of Foreign Assets Control OFAC and other government lists. The subtitle has several sections that prohibit or restrict the use of certain accounts held at financial institutions. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. Or that is not subject to supervision by a banking authority in a non-US. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must.

Source: slideserve.com

Source: slideserve.com

5311 et seq is referred to as the Bank Secrecy Act BSA. Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. Legislation signed into law in 1970 by Pres. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source: complyadvantage.com

Source: complyadvantage.com

1051 et seq is often referred to as The Bank Secrecy Act BSA. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. Screen against Office of Foreign Assets Control OFAC and other government lists. Law used to detect deter and disrupt money laundering and terrorist financing networks. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that.

Source: tookitaki.ai

Source: tookitaki.ai

The purpose of the BSA is to require United States US. 1051 et seq is often referred to as The Bank Secrecy Act BSA. Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. The Bank Secrecy Act BSA is US. The BSA is an amendment to the Federal Deposit Insurance Act.

Legislation signed into law in 1970 by Pres. In 1970 the US. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax or regulatory investigations or proceedings. Law requiring financial institutions in the United States to assist US. Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US.

Source: mdtaxattorney.com

Source: mdtaxattorney.com

The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Section 313 prohibits foreign shell banks that are not an affiliate of a bank that has a physical presence in the US. The law requires financial institutions to provide. Screen against Office of Foreign Assets Control OFAC and other government lists.

Source: cutimes.com

Source: cutimes.com

The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Or that is not subject to supervision by a banking authority in a non-US. The subtitle has several sections that prohibit or restrict the use of certain accounts held at financial institutions. The Bank Secrecy Act BSA is US. Bank Secrecy Act US.

Source: complyadvantage.com

Source: complyadvantage.com

Financial institutions to assist US. Establish effective BSA compliance programs. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Section 313 prohibits foreign shell banks that are not an affiliate of a bank that has a physical presence in the US.

Source: slideplayer.com

Source: slideplayer.com

Country regulating the affiliated depository institution credit union or foreign bank. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. Financial institutions to assist US.

Source: thefinancialcrimenews.com

Source: thefinancialcrimenews.com

Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US. Government agencies in detecting and preventing money laundering. Country regulating the affiliated depository institution credit union or foreign bank. The BSA is an amendment to the Federal Deposit Insurance Act.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act of 1970 requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information