10+ Bank secrecy act ofac requirements ideas

Home » about money loundering idea » 10+ Bank secrecy act ofac requirements ideasYour Bank secrecy act ofac requirements images are available. Bank secrecy act ofac requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act ofac requirements files here. Download all free photos and vectors.

If you’re searching for bank secrecy act ofac requirements images information linked to the bank secrecy act ofac requirements keyword, you have visit the right site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Bank Secrecy Act Ofac Requirements. Based on the banks risk profile develop a risk-focused examination scope and document the Bank Secrecy Actanti-money laundering BSAAML examination plan. Establish effective customer due diligence systems and monitoring programs. WASHINGTONThe Federal Reserve Board the Federal Deposit Insurance Corporation the Financial Crimes Enforcement Network the National Credit Union Administration and the Office of the Comptroller of the Currency today issued a joint statement clarifying that Bank Secrecy Act BSA due diligence requirements for customers who may be considered politically exposed persons. The OCC is required by 12 USC 1818 u to publicly disclose certain types of agency actions.

Risk Based Bank Secrecy Act Anti Money Laundering Examinations Rgs Global Advisors From rgsglobaladvisors.com

Risk Based Bank Secrecy Act Anti Money Laundering Examinations Rgs Global Advisors From rgsglobaladvisors.com

8009492732 Monday thru Friday 800 am. The BSA regulations establish four regulatory requirements. Are by or on behalf of a blocked individual or entity. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. The enforcement actions are posted and available.

9 rows The Bank Secrecy Act BSA is the primary US.

Examiners assess the adequacy of the banks Bank Secrecy Actanti-money laundering BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Multiple currency transactions totaling more than 10000 during any one business day are treated as a single. For financial institutions wanting to report suspicious transactions that may relate to terrorist activity. Government agencies in detecting and preventing money laundering. - 500 pm Eastern.

Source: present5.com

Source: present5.com

Are by or on behalf of a blocked individual or entity. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. WASHINGTONThe Federal Reserve Board the Federal Deposit Insurance Corporation the Financial Crimes Enforcement Network the National Credit Union Administration and the Office of the Comptroller of the Currency today issued a joint statement clarifying that Bank Secrecy Act BSA due diligence requirements for customers who may be considered politically exposed persons. It specifically requires financial institutions to. Once a month the OCCs Communications Division publishes a list of formal enforcement actions that includes the name of the person or bank involved the type of action and the date of the action.

Source: complianceonline.com

Source: complianceonline.com

For financial institutions wanting to report suspicious transactions that may relate to terrorist activity. Are by or on behalf of a blocked individual or entity. The BSA requires financial institutions such as credit unions banks thrifts money service businesses some insurance carriers etc to comply with certain reporting recordkeeping and identity verification requirements. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Government agencies in detecting and preventing money laundering.

Source: probank.com

Source: probank.com

Screen against Office of Foreign Assets Control OFAC and other government lists. - 500 pm Eastern. Examiners assess the adequacy of the banks Bank Secrecy Actanti-money laundering BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Or Are in connections with a transaction in which a. Are by or on behalf of a blocked individual or entity.

Source: complianceonline.com

Source: complianceonline.com

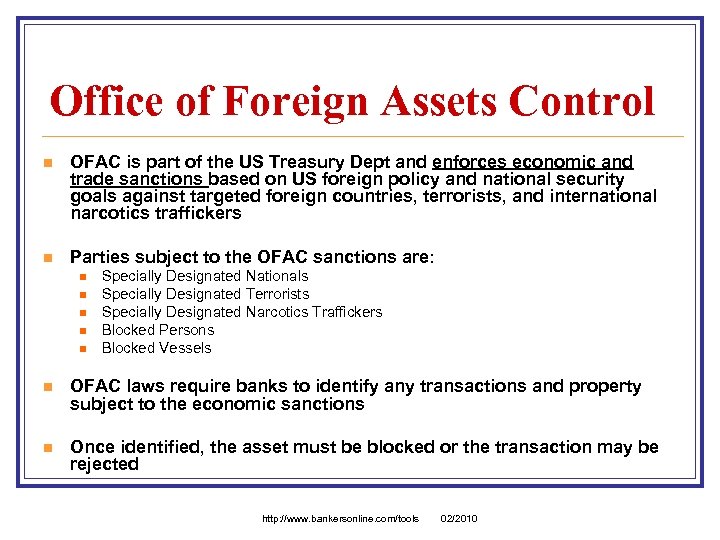

Office of Foreign Assets Control OFAC Blocked Transactions Credit unions are required to block freeze assets from transactions that. The Act is designed to aid federal government in detecting illegal activity. Are by or on behalf of a blocked individual or entity. The Company is not aware of has not been advised of and to the Companys Knowledge has no reason to believe that any facts or circumstances exist that would cause it or any Company Subsidiary to be deemed to be i not operating in compliance in all material respects with the Bank Secrecy Act of 1970 as amended the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 also known as the USA PATRIOT Act. 9 rows The Bank Secrecy Act BSA is the primary US.

Source: complianceonline.com

Source: complianceonline.com

For financial institutions wanting to report suspicious transactions that may relate to terrorist activity. The FBAs expect US. Anti-money laundering AML law. Establish effective BSA compliance programs. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US.

The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act. Screen against Office of Foreign Assets Control OFAC and other government lists. What must credit unions do to comply with the Bank Secrecy Act. WASHINGTONThe Federal Reserve Board the Federal Deposit Insurance Corporation the Financial Crimes Enforcement Network the National Credit Union Administration and the Office of the Comptroller of the Currency today issued a joint statement clarifying that Bank Secrecy Act BSA due diligence requirements for customers who may be considered politically exposed persons. Anti-money laundering AML law.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

Screen against Office of Foreign Assets Control OFAC and other government lists. The record retention requirements eg five-year requirement to retain relevant OFAC records. For financial institutions with questions relating to Bank Secrecy Act and USA PATRIOT Act requirements and forms call. Screen against Office of Foreign Assets Control OFAC and other government lists. What must credit unions do to comply with the Bank Secrecy Act.

Source: slidetodoc.com

Source: slidetodoc.com

Basics Reporting Recordkeeping Currency Transaction Reports CTRs Credit Unions are required to file CTRs for each transaction in currency cash of more than 10000. Screen against Office of Foreign Assets Control OFAC and other government lists. Office of Foreign Assets Control OFAC Blocked Transactions Credit unions are required to block freeze assets from transactions that. The Company is not aware of has not been advised of and to the Companys Knowledge has no reason to believe that any facts or circumstances exist that would cause it or any Company Subsidiary to be deemed to be i not operating in compliance in all material respects with the Bank Secrecy Act of 1970 as amended the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 also known as the USA PATRIOT Act. A cash transaction is one that involves the physical transfer of actual cash between Bank personnel and any customer.

Source: slideserve.com

Source: slideserve.com

WASHINGTONThe Federal Reserve Board the Federal Deposit Insurance Corporation the Financial Crimes Enforcement Network the National Credit Union Administration and the Office of the Comptroller of the Currency today issued a joint statement clarifying that Bank Secrecy Act BSA due diligence requirements for customers who may be considered politically exposed persons. The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act. Anti-money laundering AML law. The FBAs expect US. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US.

Source: bankingblog.accenture.com

Source: bankingblog.accenture.com

Establish effective customer due diligence systems and monitoring programs. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Or Are in connections with a transaction in which a. Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Once a month the OCCs Communications Division publishes a list of formal enforcement actions that includes the name of the person or bank involved the type of action and the date of the action.

Source: present5.com

Source: present5.com

Office of Foreign Assets Control OFAC Blocked Transactions Credit unions are required to block freeze assets from transactions that. Multiple currency transactions totaling more than 10000 during any one business day are treated as a single. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Screen against Office of Foreign Assets Control OFAC and other government lists. 9 rows The Bank Secrecy Act BSA is the primary US.

Source: slidetodoc.com

Source: slidetodoc.com

Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Bank Secrecy Act BSA Identifying Reportable Transactions The Bank is required to fill out a Currency Transaction Report CTR for ANY cash transaction that totals over 10000. Or Are in connections with a transaction in which a. The record retention requirements eg five-year requirement to retain relevant OFAC records. Are by or on behalf of a blocked individual or entity.

Establish effective BSA compliance programs. What must credit unions do to comply with the Bank Secrecy Act. 9 rows The Bank Secrecy Act BSA is the primary US. Are to or go through a blocked entity. The OCC is required by 12 USC 1818 u to publicly disclose certain types of agency actions.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act ofac requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information