12+ Bank secrecy act record keeping requirements information

Home » about money loundering idea » 12+ Bank secrecy act record keeping requirements informationYour Bank secrecy act record keeping requirements images are ready in this website. Bank secrecy act record keeping requirements are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act record keeping requirements files here. Download all royalty-free images.

If you’re searching for bank secrecy act record keeping requirements images information connected with to the bank secrecy act record keeping requirements keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Bank Secrecy Act Record Keeping Requirements. A state or local government. A federal state or local government agency or instrumentality. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal.

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

Records of every request to transfer currency or monetary instruments in excess of 10000 to or from any person account or place outside of US. As required by Congress NCUA recently adopted a regulation requiring federally-insured credit unions to establish programs for compliance with the Bank Secrecy Act and Treasurys regulations. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. The BSA requires many financial institutions to create paper trails by keeping records and filing reports on certain. A federal state or local government agency or instrumentality. In general the BSA requires that.

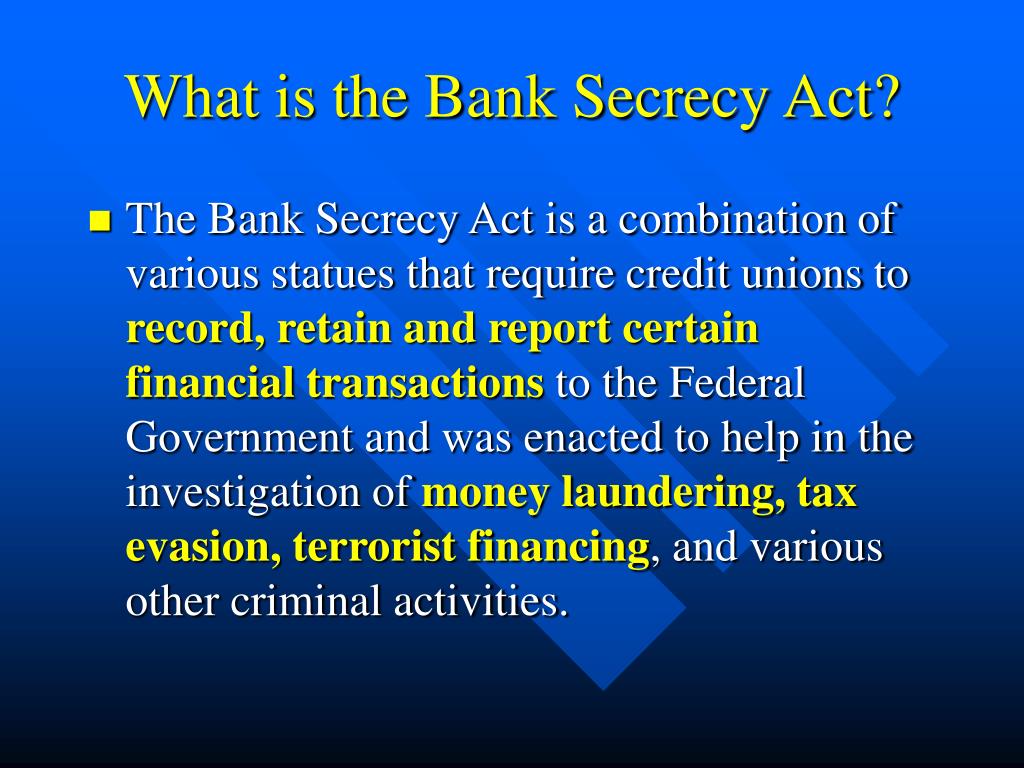

The Bank Secrecy Act The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes.

A bank is not required to keep a separate system of records for each of the BSA requirements. These records can be maintained in many forms including original microfilm electronic copy or a reproduction. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. Should be retained for 5 years Specific information as to wire transfers in excess of 3000 must be stored for 5 years after origination. This law affects your recordkeeping and reporting obligations under the Bank Secrecy Act and the Department of Treasurys regulations. Prior BSA filing history.

Source: slideserve.com

Source: slideserve.com

All reports and related records must be maintained for 5 years from the date of the transaction or the date of account closure. Speaker will also share essential tips to help reporting companies structure effective compliance programs. Section 10329 of the Bank Secrecy Act requires financial institutions to verify a persons identity and to retain records for five years of certain information when bank checks and drafts cashiers checks money orders or travelers checks are purchased with between 3000 and 10000 in cash. All reports and related records must be maintained for 5 years from the date of the transaction or the date of account closure. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Source: tookitaki.ai

Source: tookitaki.ai

Government agencies in detecting and preventing money laundering. In general the BSA requires that. Notification by the IRS including receipt of Letter 1052 Bank Secrecy Act Requirements Notification Letter prior BSA examinations and educational visits. This law affects your recordkeeping and reporting obligations under the Bank Secrecy Act and the Department of Treasurys regulations. It is a process by which soiled cash is converted into clean cash.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. Notification by the IRS including receipt of Letter 1052 Bank Secrecy Act Requirements Notification Letter prior BSA examinations and educational visits. In general the BSA requires that a bank maintain most records for at least five years. Government agencies in detecting and preventing money laundering.

![]() Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. These records can be maintained in many forms including original microfilm electronic copy or a reproduction. Records that document a banks compliance with the BSA. Government agencies in detecting and preventing money laundering. All reports and related records must be maintained for 5 years from the date of the transaction or the date of account closure.

Source: slideplayer.com

Source: slideplayer.com

Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. Records required to be retained under the Bank Secrecy Act must be retained for five years. The record keeping requirements are not required where the originator and beneficiary are any of the following. Section 10329 of the Bank Secrecy Act requires financial institutions to verify a persons identity and to retain records for five years of certain information when bank checks and drafts cashiers checks money orders or travelers checks are purchased with between 3000 and 10000 in cash. As required by Congress NCUA recently adopted a regulation requiring federally-insured credit unions to establish programs for compliance with the Bank Secrecy Act and Treasurys regulations.

Source: docplayer.net

Source: docplayer.net

As required by Congress NCUA recently adopted a regulation requiring federally-insured credit unions to establish programs for compliance with the Bank Secrecy Act and Treasurys regulations. A federal state or local government agency or instrumentality. These records can be maintained in many forms including original microfilm electronic copy or a reproduction. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years.

Source: present5.com

Source: present5.com

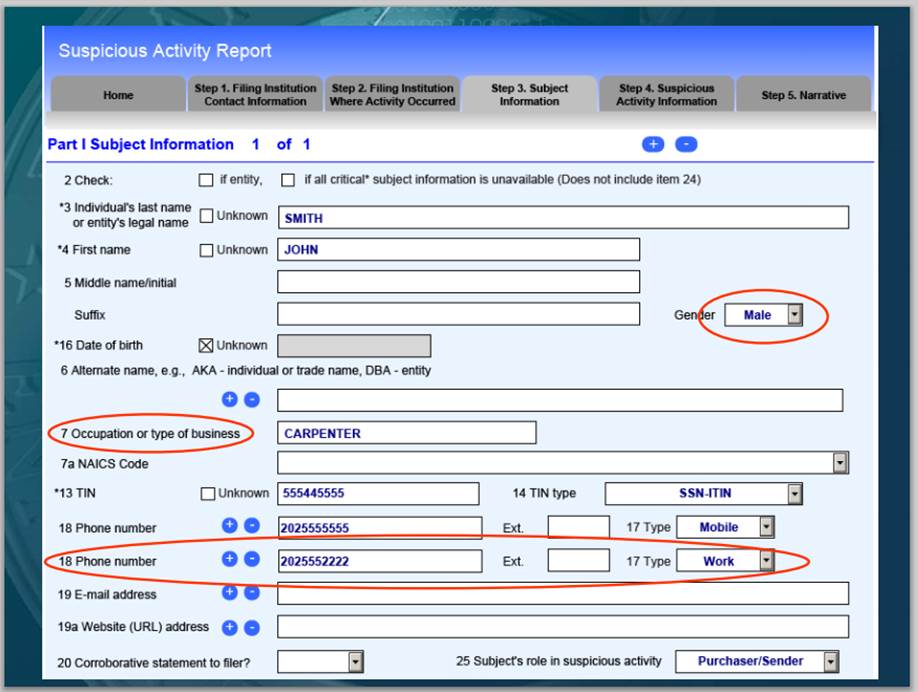

Notification by the IRS including receipt of Letter 1052 Bank Secrecy Act Requirements Notification Letter prior BSA examinations and educational visits. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. Topics include CTR SAR reporting MIL requirements Funds Transfer recordkeeping OFAC compliance Foreign Account requirements. This CLE course will provide an in-depth discussion of the recent trends and enforcement developments concerning the Bank Secrecy Act BSA Title 31 regulations. In general the BSA requires that.

Source: acamstoday.org

Source: acamstoday.org

Government agencies in detecting and preventing money laundering. A broker or dealer in securities. In general the BSA requires that. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. In general the BSA requires that a bank maintain most records for at least five years.

Source: slideplayer.com

Source: slideplayer.com

Records that document a banks compliance with the BSA. It is a process by which soiled cash is converted into clean cash. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. Speaker will also share essential tips to help reporting companies structure effective compliance programs. Government agencies in detecting and preventing money laundering.

Source: slideserve.com

Source: slideserve.com

Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. It is a process by which soiled cash is converted into clean cash. The collection of reports on the international transportation of prepaid devices will add to the estimated burden by 1467 hours. In general the BSA requires that a bank maintain most records for at least five years. Government agencies in detecting and preventing money laundering.

Source: securitiesanalytics.com

Source: securitiesanalytics.com

All reports and related records must be maintained for 5 years from the date of the transaction or the date of account closure. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. Section 10329 of the Bank Secrecy Act requires financial institutions to verify a persons identity and to retain records for five years of certain information when bank checks and drafts cashiers checks money orders or travelers checks are purchased with between 3000 and 10000 in cash. Should be retained for 5 years Specific information as to wire transfers in excess of 3000 must be stored for 5 years after origination. Records of every request to transfer currency or monetary instruments in excess of 10000 to or from any person account or place outside of US.

Source: forbes.com

Source: forbes.com

The collection of reports on the international transportation of prepaid devices will add to the estimated burden by 1467 hours. Government agencies in detecting and preventing money laundering. In general the BSA requires that a bank maintain most records for at least five years. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. Actions by the entity including development of an AML program previously filed reports registration with FinCEN.

Source: probank.com

Source: probank.com

Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector. All reports and related records must be maintained for 5 years from the date of the transaction or the date of account closure. Should be retained for 5 years Specific information as to wire transfers in excess of 3000 must be stored for 5 years after origination. A broker or dealer in securities. Records required to be retained under the Bank Secrecy Act must be retained for five years.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act record keeping requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information