17+ Bank secrecy act recordkeeping requirements ideas in 2021

Home » about money loundering idea » 17+ Bank secrecy act recordkeeping requirements ideas in 2021Your Bank secrecy act recordkeeping requirements images are available. Bank secrecy act recordkeeping requirements are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act recordkeeping requirements files here. Get all royalty-free photos and vectors.

If you’re looking for bank secrecy act recordkeeping requirements pictures information related to the bank secrecy act recordkeeping requirements interest, you have come to the right blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

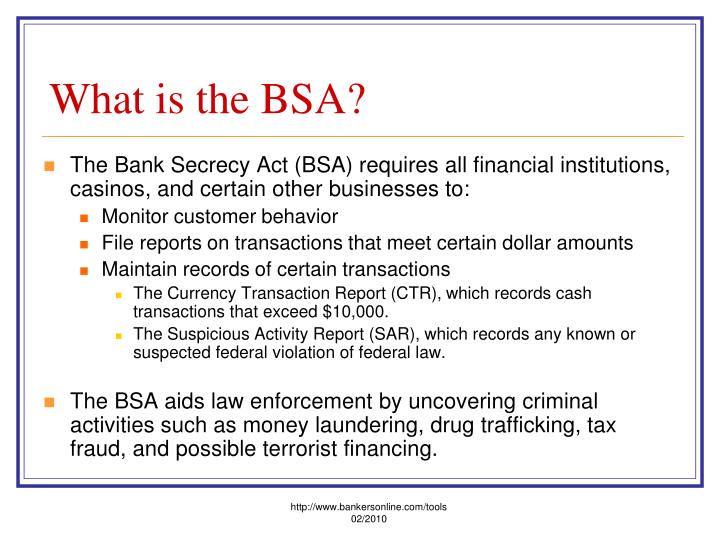

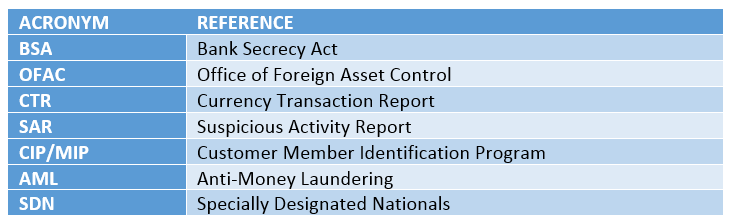

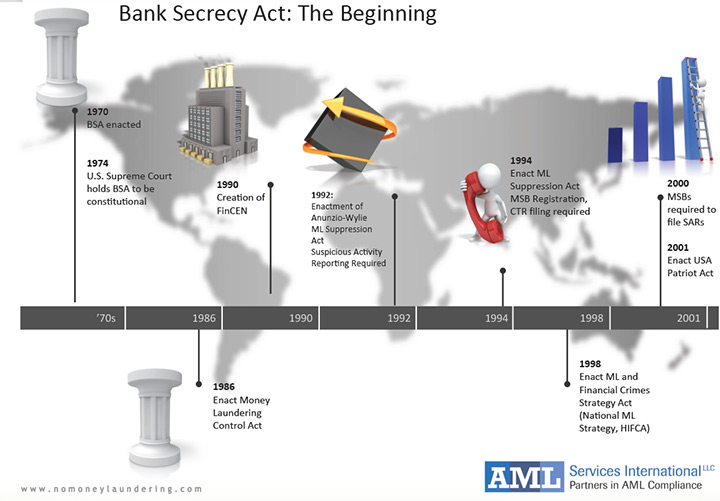

Bank Secrecy Act Recordkeeping Requirements. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The recordkeeping requirements under Section 21 of the Federal Deposit Insurance Act and Section 123 of Public Law 91-508. This section requires financial institutions to verify a customers identity and retain records of certain information prior to issuing or selling bank. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA for at least five years.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

A Customer Identification Program. Part 3268b1 of the FDIC Rules and Regulations. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The recordkeeping requirements under Section 21 of the Federal Deposit Insurance Act and Section 123 of Public Law 91-508. On October 27 2020 in the midst of all the COVID-19 chaos FinCEN and the Board of Governors of the Federal Reserve System issued a joint advance notice of proposed rulemaking ANPRM to lower the thresholds under the Recordkeeping Rule and the Travel Rule from 3000 for.

Amount of the payment order.

Recordkeeping Requirements CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Topics include CTR SAR reporting MIL requirements Funds Transfer recordkeeping OFAC compliance Foreign Account requirements. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA for at least five years. The BSA establishes recordkeeping requirements related to various types of records including.

Source: sygna.io

The BSA establishes recordkeeping requirements related to various types of records including. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA for at least five years. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Date of the payment.

![]() Source: slideplayer.com

Source: slideplayer.com

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Recordkeeping requirements may differ depending on the type of transaction and the role of the institution in the particular transaction. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. Name and address of the originator.

Source: acamstoday.org

Source: acamstoday.org

Part 3268b1 of the FDIC Rules and Regulations. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. Records must be kept in a way that makes them accessible in a reasonable period of time. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information.

Source: probank.com

Source: probank.com

Name and address of the originator. In general the BSA requires that. As originally enacted the Bank Secrecy Act established recordkeeping and reporting requirements with particular emphasis on allowing the federal government to. The Financial Crimes Enforcement Network FinCEN receives numerous questions concerning compliance with the Bank Secrecy Act BSA recordkeeping requirement found in 31 CFR. Name and address of the originator.

Source: probank.com

Source: probank.com

As originally enacted the Bank Secrecy Act established recordkeeping and reporting requirements with particular emphasis on allowing the federal government to. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. Records must be kept in a way that makes them accessible in a reasonable period of time. The BSA requires financial institutions to record and retain various types of records including. Topics include CTR SAR reporting MIL requirements Funds Transfer recordkeeping OFAC compliance Foreign Account requirements.

Source: slideserve.com

Source: slideserve.com

1818s or 12 USC. Minimum requirements - 1 In general. Congress outlined recordkeeping and reporting requirements for banks allowing federal authorities to use the information for investigations. Date of the payment. This section requires financial institutions to verify a customers identity and retain records of certain information prior to issuing or selling bank.

Source: slideplayer.com

Source: slideplayer.com

On October 27 2020 in the midst of all the COVID-19 chaos FinCEN and the Board of Governors of the Federal Reserve System issued a joint advance notice of proposed rulemaking ANPRM to lower the thresholds under the Recordkeeping Rule and the Travel Rule from 3000 for. Recordkeeping Requirements CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Are you ready for FinCENs proposal to amend the recordkeeping and travel rules under the Bank Secrecy Act. 1786q1 must implement a written Customer Identification Program CIP appropriate for the banks size and type of business that at a minimum includes each of.

Source: blog.gao.gov

Source: blog.gao.gov

Recordkeeping requirements for transmittal of funds at 3000 and above additional records to be made by a dealer in foreign exchange at 1000 and above and records to be made by casinos and card clubs. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. The Bank Secrecy Act BSA requires financial institutions banks to maintain records and report information to federal authorities. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information.

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Minimum requirements - 1 In general. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121.

Source:

This section requires financial institutions to verify a customers identity and retain records of certain information prior to issuing or selling bank. Recordkeeping requirements for transmittal of funds at 3000 and above additional records to be made by a dealer in foreign exchange at 1000 and above and records to be made by casinos and card clubs. Recordkeeping requirements may differ depending on the type of transaction and the role of the institution in the particular transaction. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. The recordkeeping requirements under Section 21 of the Federal Deposit Insurance Act and Section 123 of Public Law 91-508.

Source: slideserve.com

Source: slideserve.com

The Financial Crimes Enforcement Network FinCEN receives numerous questions concerning compliance with the Bank Secrecy Act BSA recordkeeping requirement found in 31 CFR. The name refers to the purpose of the law which is to avoid bank secrecy. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA for at least five years. RECORDKEEPING REQUIREMENTS Money Transfers of 3000 or More MSBs that provide money transfer services must obtain and record specific information for each money transfer of 3000 or more regardless of the method of payment. A Customer Identification Program.

Source: acamstoday.org

Source: acamstoday.org

Recordkeeping Requirements CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA for at least five years. Records must be kept in a way that makes them accessible in a reasonable period of time. The BSA establishes recordkeeping requirements related to various types of records including. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Source: tookitaki.ai

Source: tookitaki.ai

Topics include CTR SAR reporting MIL requirements Funds Transfer recordkeeping OFAC compliance Foreign Account requirements. RECORDKEEPING REQUIREMENTS Money Transfers of 3000 or More MSBs that provide money transfer services must obtain and record specific information for each money transfer of 3000 or more regardless of the method of payment. The Bank Secrecy Act BSA requires financial institutions banks to maintain records and report information to federal authorities. On October 27 2020 in the midst of all the COVID-19 chaos FinCEN and the Board of Governors of the Federal Reserve System issued a joint advance notice of proposed rulemaking ANPRM to lower the thresholds under the Recordkeeping Rule and the Travel Rule from 3000 for. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act recordkeeping requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information