20+ Bank secrecy act regulations fine up to information

Home » about money loundering idea » 20+ Bank secrecy act regulations fine up to informationYour Bank secrecy act regulations fine up to images are ready. Bank secrecy act regulations fine up to are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act regulations fine up to files here. Download all royalty-free images.

If you’re looking for bank secrecy act regulations fine up to images information connected with to the bank secrecy act regulations fine up to topic, you have come to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Bank Secrecy Act Regulations Fine Up To. Bank regulation news. Purpose 1 This transmits a revision to IRM 4267 Bank Secrecy Act Bank Secrecy Act Penalties. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to.

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

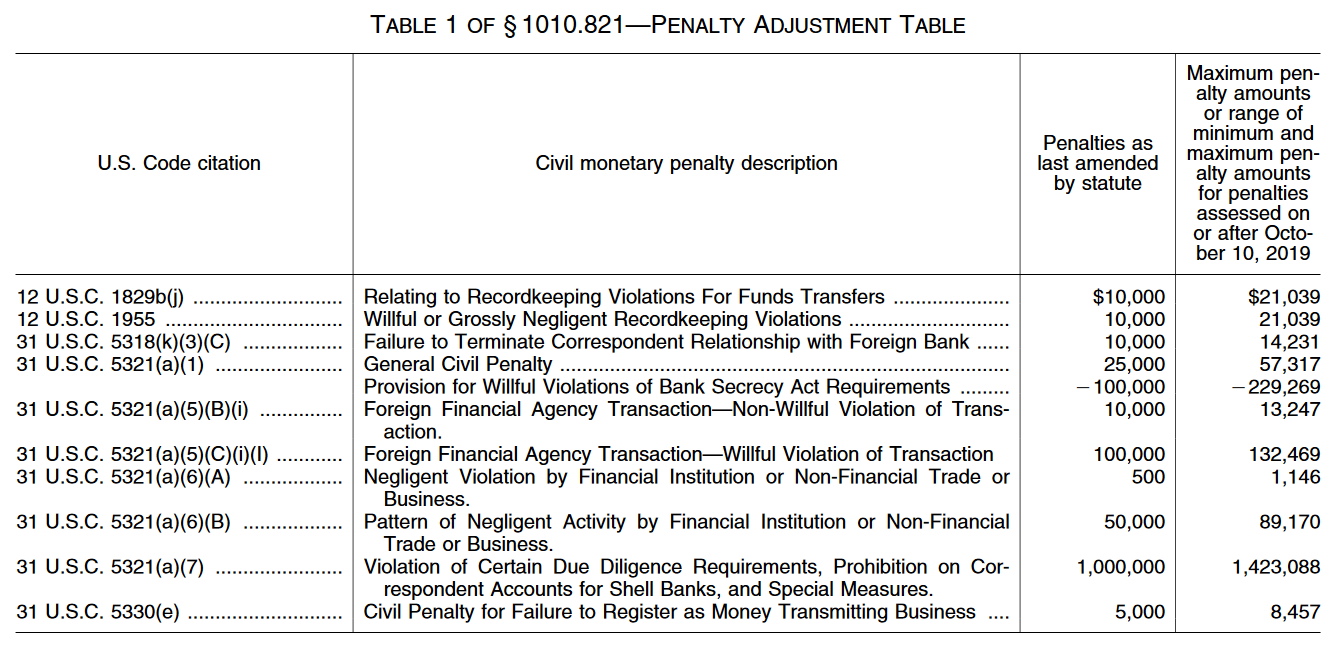

In addition to other available penalties a fine of up to three times the profit gained from the violation - or twice the maximum penalty with respect to the violation - can be imposed for repeat violators. What is the BSA. The sources of the money in actual are criminal and the money is invested in a approach that makes it. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Bank Secrecy Act BSA Penalties Penalties for BSA Violations Credit Union Penalties Cease and Desist Order Loss of charter Criminal money penalties up to the greater of 1 million or twice the value of the transaction Civil money penalties Negligence a fine up to 500 Practice of negligence an additional fine of 50000 per.

Purpose 1 This transmits a revision to IRM 4267 Bank Secrecy Act Bank Secrecy Act Penalties.

Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily. Law or engaging in a pattern of criminal activity is subject to a fine of up to. Apple Bank for Savings settled a 125 million fine with the Federal Deposit Insurance Corporation FDIC for violating the Bank Secrecy ActThe regulator asked the bank to improve and enhance its AML compliance program but Apple Bank for Savings failed to comply with that FDIC order in a timely manner. Provide for independent review to monitor and maintain an adequate program. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Material Changes 1 The text is revised to incorporate provisions of recent legislation and regulations.

Source: slidetodoc.com

Source: slidetodoc.com

And these penalties can be severe. Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US. Purpose 1 This transmits a revision to IRM 4267 Bank Secrecy Act Bank Secrecy Act Penalties. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which records cash transactions that exceed 10000.

Source: acamstoday.org

Source: acamstoday.org

Purpose 1 This transmits a revision to IRM 4267 Bank Secrecy Act Bank Secrecy Act Penalties. Any property involved in a transaction or. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which records cash transactions that exceed 10000. Government uses to fight drug trafficking money laundering and other crimes. 14 A person who commits such a violation while violating another US.

Source: complyadvantage.com

Source: complyadvantage.com

The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Law or engaging in a pattern of criminal activity is subject to a fine of up to. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Any property involved in a transaction or. Bank regulation news.

Source: complyadvantage.com

Source: complyadvantage.com

14 A person who commits such a violation while violating another US. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. And these penalties can be severe. Violation Bank Secrecy Act Regulations Fine Up To. Bank Secrecy Act BSA Penalties Penalties for BSA Violations Credit Union Penalties Cease and Desist Order Loss of charter Criminal money penalties up to the greater of 1 million or twice the value of the transaction Civil money penalties Negligence a fine up to 500 Practice of negligence an additional fine of 50000 per.

Source: acamstoday.org

Source: acamstoday.org

Bank regulation news. Violation Bank Secrecy Act Regulations Fine Up To. Its a course of by which soiled cash is converted into clean cash. Comptrollers Handbook 1 Bank Secrecy Act Bank Secrecy Act Anti-Money Laundering Introduction Background The Currency and Foreign Transactions Reporting Act1 also known as the Bank Secrecy Act BSA and its implementing regulation 31 CFR 103 is a tool the US. The Bank Secrecy Act regulations also require that any business that receives cash payments totaling over 10000 file what is called a Form 8300 with the IRS to account for that income.

Source: slideshare.net

Source: slideshare.net

The scope and frequency of the review shall be commensurate with the risk of the financial services. Additional information about compliance with the Bank Secrecy Act can be found on the IRS website. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. What is the BSA. Comptrollers Handbook 1 Bank Secrecy Act Bank Secrecy Act Anti-Money Laundering Introduction Background The Currency and Foreign Transactions Reporting Act1 also known as the Bank Secrecy Act BSA and its implementing regulation 31 CFR 103 is a tool the US.

Source: slideserve.com

Source: slideserve.com

The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Apple Bank for Savings. Regulations implementing Title II of the Bank Secrecy Act appear at 31 CFR 103. 5311 et seq is referred to as the Bank Secrecy Act BSA. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

Source: present5.com

Source: present5.com

The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. In addition to other available penalties a fine of up to three times the profit gained from the violation - or twice the maximum penalty with respect to the violation - can be imposed for repeat violators. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Law or engaging in a pattern of criminal activity is subject to a fine of up to. Bank regulation news.

Source: amazon.com

Source: amazon.com

4267 Bank Secrecy Act Penalties Manual Transmittal. Apple Bank for Savings settled a 125 million fine with the Federal Deposit Insurance Corporation FDIC for violating the Bank Secrecy ActThe regulator asked the bank to improve and enhance its AML compliance program but Apple Bank for Savings failed to comply with that FDIC order in a timely manner. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Purpose 1 This transmits a revision to IRM 4267 Bank Secrecy Act Bank Secrecy Act Penalties. For example a person including a bank employee willfully violating the BSA or its implementing regulations is subject to a criminal fine of up to 250000 or five years in prison or both.

Source: tookitaki.ai

Source: tookitaki.ai

Bank Secrecy Act Regulations August 08 2021 The concept of cash laundering is essential to be understood for those working in the monetary sector. Bank regulation news. The Act also creates new penalties for existing violations of the Bank Secrecy Act. 14 A person who commits such a violation while violating another US. Provide for independent review to monitor and maintain an adequate program.

Source: slideplayer.com

Source: slideplayer.com

What is the BSA. What is the BSA. Any property involved in a transaction or. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which records cash transactions that exceed 10000.

Source: complyadvantage.com

Source: complyadvantage.com

For example a person including a bank employee willfully violating the BSA or its implementing regulations is subject to a criminal fine of up to 250000 or five years in prison or both. Rather the relevant Bank Secrecy Act regulation requires money services businesses to establish anti-money laundering programs with written policies and procedures that. For example a person including a bank employee willfully violating the BSA or its implementing regulations is subject to a criminal fine of up to 250000 or five years in prison or both. The scope and frequency of the review shall be commensurate with the risk of the financial services. Regulations implementing Title II of the Bank Secrecy Act appear at 31 CFR 103.

Source: nafcu.org

Source: nafcu.org

Bank Secrecy Act BSA Penalties Penalties for BSA Violations Credit Union Penalties Cease and Desist Order Loss of charter Criminal money penalties up to the greater of 1 million or twice the value of the transaction Civil money penalties Negligence a fine up to 500 Practice of negligence an additional fine of 50000 per. The sources of the money in actual are criminal and the money is invested in a approach that makes it. Provide for independent review to monitor and maintain an adequate program. Bank Secrecy Act Regulations August 08 2021 The concept of cash laundering is essential to be understood for those working in the monetary sector. Any property involved in a transaction or.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act regulations fine up to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information