16++ Bank secrecy act reporting requirements info

Home » about money loundering Info » 16++ Bank secrecy act reporting requirements infoYour Bank secrecy act reporting requirements images are available in this site. Bank secrecy act reporting requirements are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act reporting requirements files here. Find and Download all royalty-free vectors.

If you’re searching for bank secrecy act reporting requirements images information related to the bank secrecy act reporting requirements topic, you have pay a visit to the ideal site. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

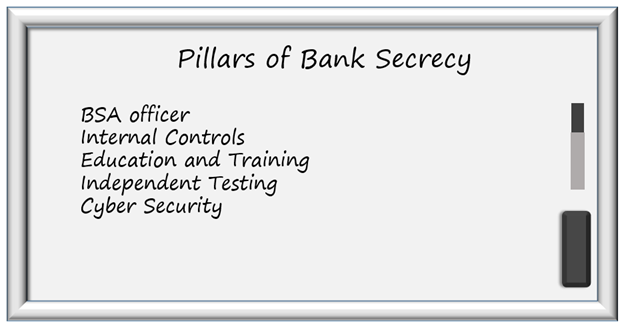

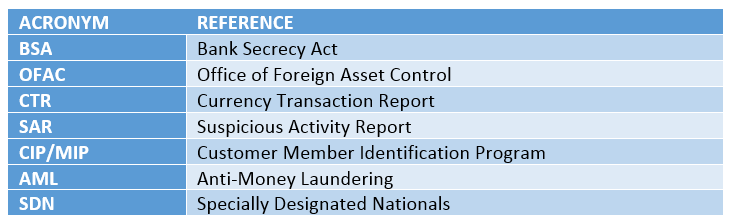

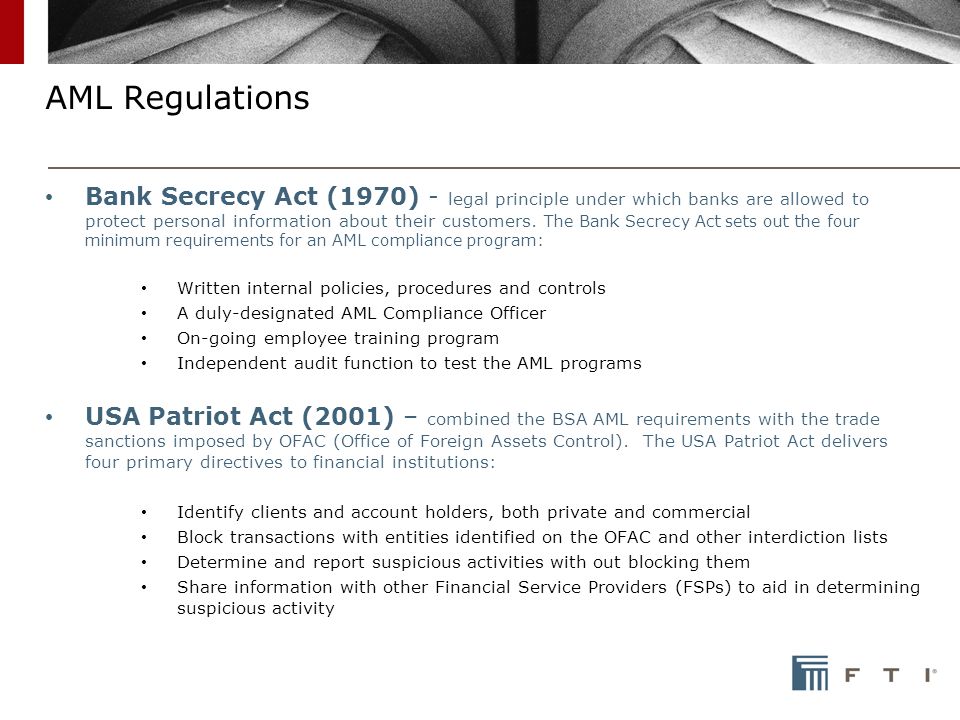

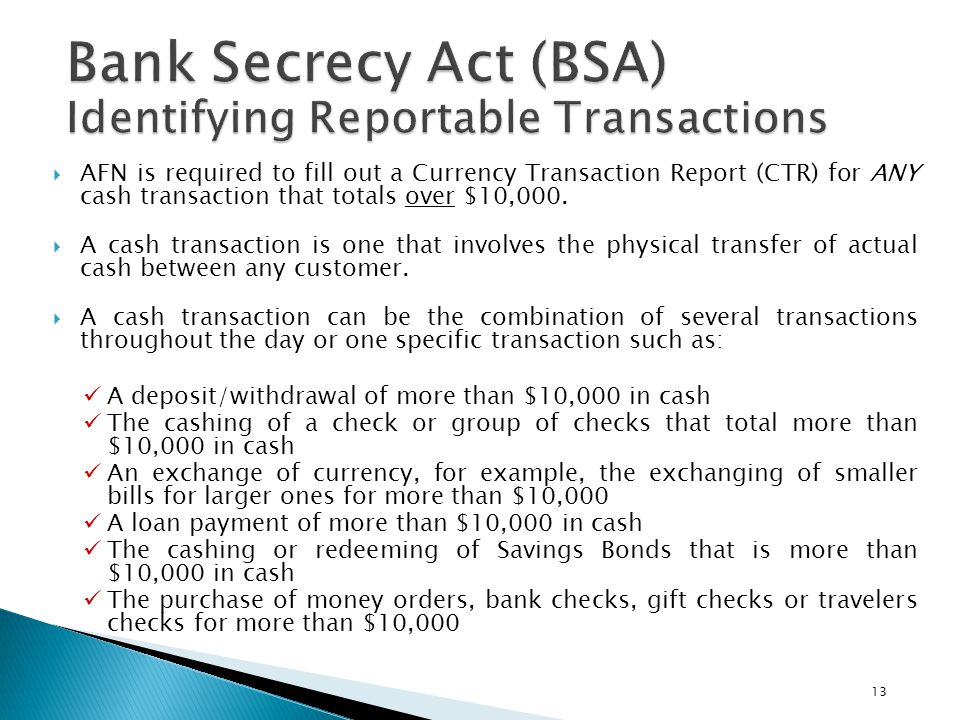

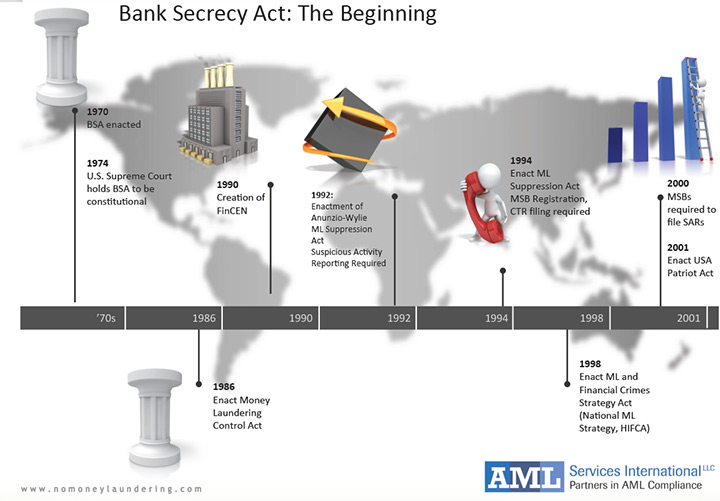

Bank Secrecy Act Reporting Requirements. Bank Secrecy Act Understanding Its Reporting Requirements. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Part 3268b1 of the FDIC Rules and Regulations. Law used to detect deter and disrupt money laundering and terrorist financing networks.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies From complianceonline.com

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies From complianceonline.com

BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. 9 rows The Bank Secrecy Act BSA is the primary US.

Financial institutions use the.

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Law requiring financial institutions in the United States to assist US. Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds.

Bank Secrecy Act requirements for wires and recordkeeping. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Part 3268b1 of the FDIC Rules and Regulations. Specifically this anti-money laundering law requires regulated financial institutions to keep records of. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970.

![]() Source: slideplayer.com

Source: slideplayer.com

While most of the provisions under the Bank Secrecy Act were created as requirements for foreign banks to comply with the Fbar is an individual filing requirement. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Part 3268b1 of the FDIC Rules and Regulations. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today.

Source: blog.gao.gov

Source: blog.gao.gov

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. 9 rows The Bank Secrecy Act BSA is the primary US. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970.

Source: slideplayer.com

Source: slideplayer.com

And special standards of diligence. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov. BSA Statute and Regulations establish program recordkeeping and reporting requirements for financial institutions Section 3268 Bank Secrecy Act Compliance establishes requirements for a BSA monitoring program to reasonably assure compliance with the BSA statute and regulations. Bank Secrecy Act Understanding Its Reporting Requirements. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970.

Source: slideplayer.com

Source: slideplayer.com

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Department of the Treasurys Financial Crimes Enforcement Network FinCEN. Part 3268b1 of the FDIC Rules and Regulations. Bank Secrecy Act.

Source: slideplayer.com

Source: slideplayer.com

Specifically this anti-money laundering law requires regulated financial institutions to keep records of. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov.

Source: acamstoday.org

Source: acamstoday.org

The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. With the Bank Secrecy Acts reporting requirements 2 dis- semination to law enforcement agencies of reports generated pursuant to the Act and 3 use and usefulness of these reports to law enforcement agencies in carrying out their investigative responsibilities. Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986.

Source: complianceonline.com

Source: complianceonline.com

BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov. Bank Secrecy Act. For all other transactions that may qualify for exemption a credit union must file a special form to designate the person or organization as exempt. Bank Secrecy Act Bsa Office Of Foreign Assets Control Ofac Ppt Video Online Download. While most of the provisions under the Bank Secrecy Act were created as requirements for foreign banks to comply with the Fbar is an individual filing requirement.

Source: blog.gao.gov

Source: blog.gao.gov

The documents filed by businesses under the BSA requirements. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The Bank Secrecy Act BSA is US. Law used to detect deter and disrupt money laundering and terrorist financing networks. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov.

Source: irs.gov

Source: irs.gov

Wire Transfer Reporting Requirements. Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers. And special standards of diligence. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Source: tier1fin.com

Source: tier1fin.com

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Government agencies in detecting and preventing money laundering. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Special information sharing procedures.

Source: probank.com

Source: probank.com

The law requires financial institutions to provide. Bank Secrecy Act requirements for wires and recordkeeping. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. With the Bank Secrecy Acts reporting requirements 2 dis- semination to law enforcement agencies of reports generated pursuant to the Act and 3 use and usefulness of these reports to law enforcement agencies in carrying out their investigative responsibilities. Exemptions from Bank Secrecy Act Reporting Requirements Only cash transactions with a Federal Reserve Bank are automatically exempt from BSA reporting requirements.

Source: slideplayer.com

Source: slideplayer.com

Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Financial institutions use the. Law requiring financial institutions in the United States to assist US. The documents filed by businesses under the BSA requirements.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act reporting requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas