16+ Bank secrecy act requirements for wire transfers information

Home » about money loundering Info » 16+ Bank secrecy act requirements for wire transfers informationYour Bank secrecy act requirements for wire transfers images are ready. Bank secrecy act requirements for wire transfers are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act requirements for wire transfers files here. Get all royalty-free vectors.

If you’re looking for bank secrecy act requirements for wire transfers images information connected with to the bank secrecy act requirements for wire transfers topic, you have come to the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

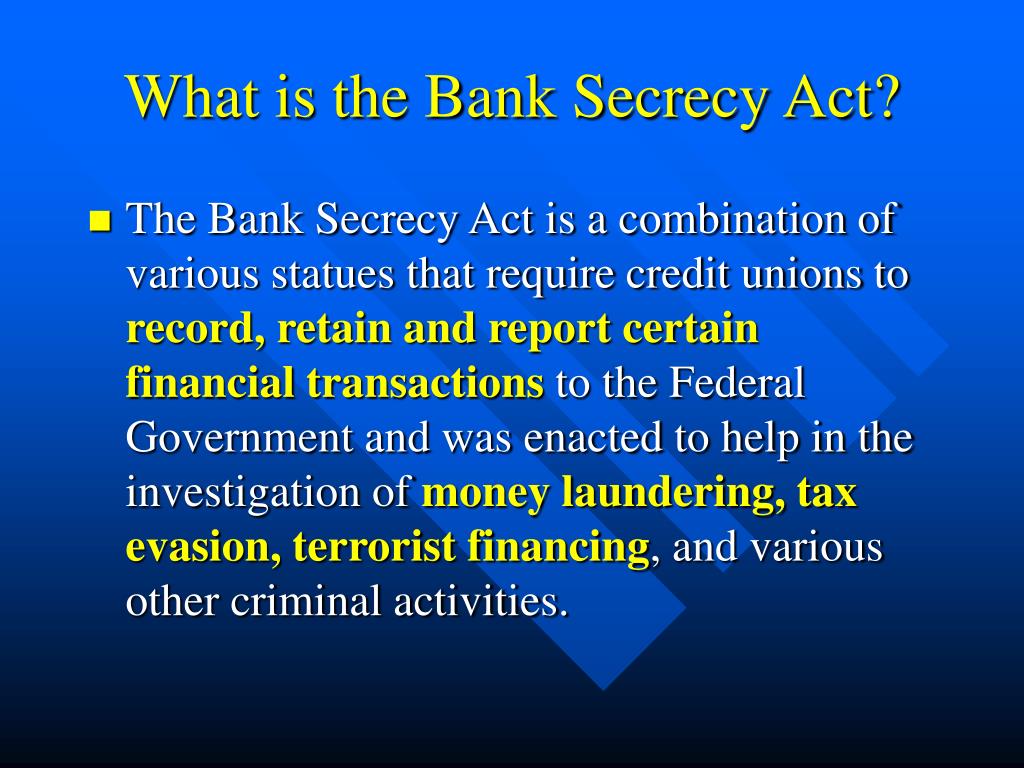

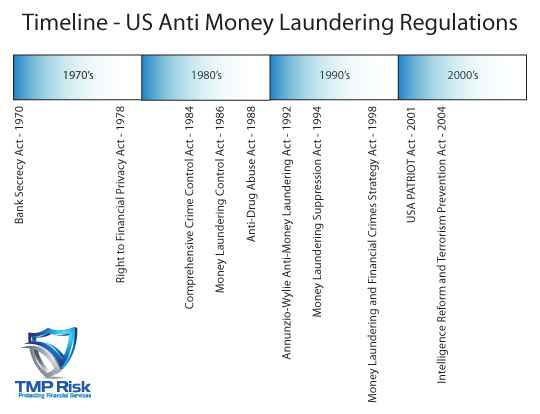

Bank Secrecy Act Requirements For Wire Transfers. Funds Transfers of 3000 or More. Annunzio-Wylie authorizes the Secretary and the Board to jointly issue regulations requiring insured depository institutions to maintain records of domestic funds transfers. The Department of the Treasurys Treasury amendments to the Bank Secrecy Act BSA which facilitate tracing funds through the funds transmittal process became effective May 28 1996. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers.

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download From slideplayer.com

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download From slideplayer.com

Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. Bank secrecy act requirements for wire transfers. Annunzio-Wylie authorizes the Secretary and the Board to jointly issue regulations requiring insured depository institutions to maintain records of domestic funds transfers. Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. For training courses on ACH And Wire Transfers go to ACH Training Courses Important Banking Acts And Other Requirements The Bank Secrecy Act Under the Bank Secrecy Act BSA financial institutions are required to assist US.

For transmittals of funds of 3000 or more brokerdealers are required to obtain and keep certain specified information concerning the transmittor and the.

Annunzio-Wylie authorizes the Secretary and the Board to jointly issue regulations requiring insured depository institutions to maintain records of domestic funds transfers. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. Government agencies in detecting and preventing money laundering fraud or terrorism. Six Things Every AML Person Needs to Know. The Bank Secrecy Act The Bank Secrecy Act BSA was enacted by Congress in.

Source: present5.com

Source: present5.com

The information to be collected and retained depends upon. Detailed discussion of requirements of both domestic and international wires including. Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. FINCEN enforces the Bank Secrecy Act which requires banks and money service businesses to retain and report information about international wire payments. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers.

Source: slideserve.com

Source: slideserve.com

Of those perhaps none is more important than the Bank Secrecy Act BSA. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers. Government agencies in detecting and preventing money laundering fraud or terrorism. Detailed discussion of requirements of both domestic and international wires including. Wire Transfer Reporting Requirements.

Source: acamstoday.org

Source: acamstoday.org

Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. For training courses on ACH And Wire Transfers go to ACH Training Courses Important Banking Acts And Other Requirements The Bank Secrecy Act Under the Bank Secrecy Act BSA financial institutions are required to assist US. 1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers. Six Things Every AML Person Needs to Know.

Source: nachomoneyhoney.weebly.com

Source: nachomoneyhoney.weebly.com

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The information to be collected and retained depends upon. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Bank Secrecy Act requirements for wires and recordkeeping. W hile anti-money laundering AML specialists are not expected to be Juris Doctors there are still many laws with which they should be intimately familiar.

Source: slideserve.com

Source: slideserve.com

Of those perhaps none is more important than the Bank Secrecy Act BSA. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Detailed discussion of requirements of both domestic and international wires including. Bank acting as an originators bank. 1 the type of financial institution 2 its role in the wire transfer originator intermediary or beneficiary 3 the amount of the wire transfer and 4 the.

Source: slideserve.com

Source: slideserve.com

3 The Secretary but not the Board is authorized to promulgate recordkeeping requirements for domestic wire transfers by nonbank financial institutions. However the requirements of the Bank Secrecy Act apply only to activities of financialinstitutions within the United States. Is this rule limited to wire transfers. In addition it enabled the Treasury to require financial institutions to report transactions including international wire transfers of funds with foreign financial. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers.

Source: slideplayer.com

Source: slideplayer.com

1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record. Identification and authentication requirements. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Source: blog.gao.gov

Source: blog.gao.gov

What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers. Bank Secrecy Act 101. Bank secrecy act requirements for wire transfers. For transmittals of funds of 3000 or more brokerdealers are required to obtain and keep certain specified information concerning the transmittor and the. 10333e and g for all wire funds transfers in the amount of 3000 or more.

Source: slideplayer.com

Source: slideplayer.com

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. However the requirements of the Bank Secrecy Act apply only to activities of financialinstitutions within the United States. Funds Transfers of 3000 or More. Bank acting as an originators bank.

Source: slideplayer.com

Source: slideplayer.com

In addition it enabled the Treasury to require financial institutions to report transactions including international wire transfers of funds with foreign financial. However the requirements of the Bank Secrecy Act apply only to activities of financialinstitutions within the United States. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. The Bank Secrecy Act The Bank Secrecy Act BSA was enacted by Congress in. Part 3268b1 of the FDIC Rules and Regulations.

Source: acamstoday.org

Source: acamstoday.org

Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. Identification and authentication requirements. Bank acting as an originators bank. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. 1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record.

Source: present5.com

Source: present5.com

Wire Transfer Reporting Requirements. Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. For transmittals of funds of 3000 or more brokerdealers are required to obtain and keep certain specified information concerning the transmittor and the. Detailed discussion of requirements of both domestic and international wires including.

Source: blog.gao.gov

Source: blog.gao.gov

Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Banks and other financial institutions are required by the Bank Secrecy Act BSA to maintain records for various types of transactions. Bank Secrecy Act 101. FINCEN enforces the Bank Secrecy Act which requires banks and money service businesses to retain and report information about international wire payments. For training courses on ACH And Wire Transfers go to ACH Training Courses Important Banking Acts And Other Requirements The Bank Secrecy Act Under the Bank Secrecy Act BSA financial institutions are required to assist US.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act requirements for wire transfers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas