11++ Bank secrecy act retention requirements ideas

Home » about money loundering idea » 11++ Bank secrecy act retention requirements ideasYour Bank secrecy act retention requirements images are ready in this website. Bank secrecy act retention requirements are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act retention requirements files here. Find and Download all free vectors.

If you’re searching for bank secrecy act retention requirements pictures information linked to the bank secrecy act retention requirements topic, you have visit the ideal blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

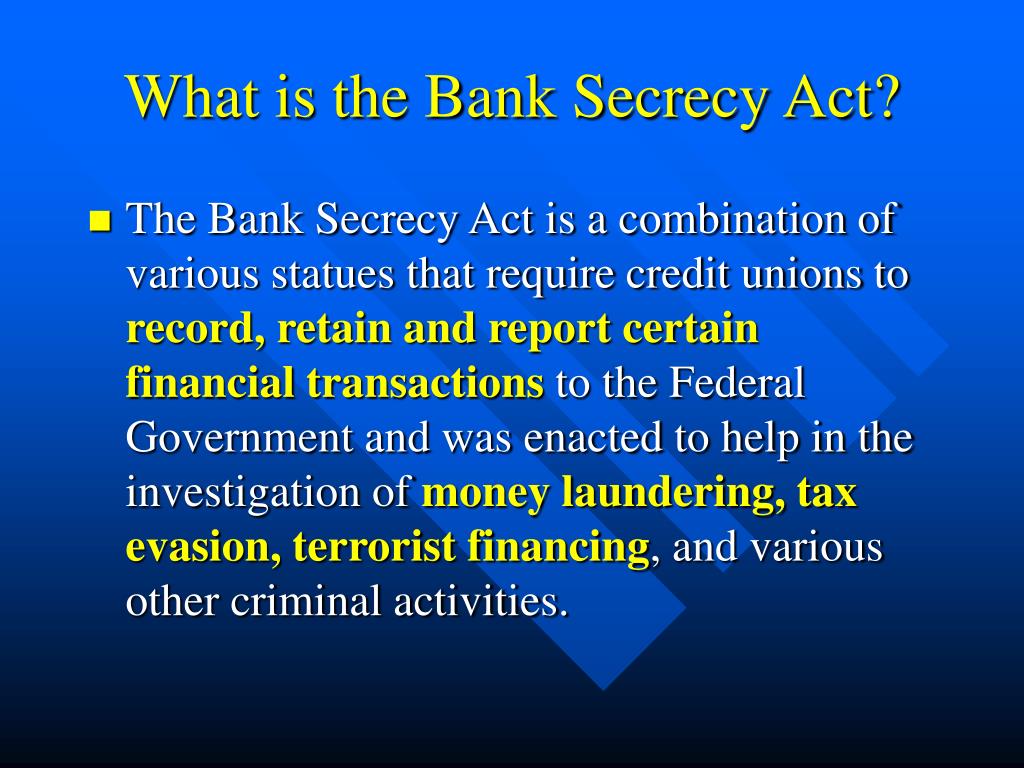

Bank Secrecy Act Retention Requirements. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Government agencies in detecting and preventing money laundering. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. Policies and procedures for compliance with applicable laws in the states in which it does business.

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

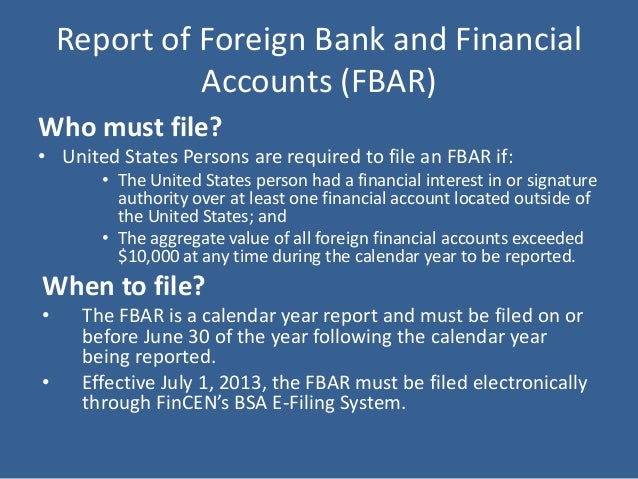

It is also referred to as the anti-money. All CTRs and SARs must be retained 5 years after filing. It is a process by which soiled cash is converted into clean cash. We initiated our review pursuant to your request at the conclusion of this Subcommittees. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. Five-Year Retention for Records as Specified Below The BSA establishes recordkeeping requirements related to various types of records including.

A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC.

A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. Policies and procedures for compliance with applicable laws in the states in which it does business. Each type of document has specific instructions with this act. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information.

Source: complyadvantage.com

Source: complyadvantage.com

BANK SECRECY ACTS REPORTING REQUIREMENTS J Mr. It is a process by which soiled cash is converted into clean cash. We initiated our review pursuant to your request at the conclusion of this Subcommittees. BANK SECRECY ACTS REPORTING REQUIREMENTS J Mr. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications.

Source: slideplayer.com

Source: slideplayer.com

Independent testing for compliance with the BSA and 31 C. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. Treasury FinCEN regulations found at 31 CFR Chapter X. Policies and procedures for compliance with applicable laws in the states in which it does business. Documents must be retained for 5 years under the BSAAML requirements.

Source: slideplayer.com

Source: slideplayer.com

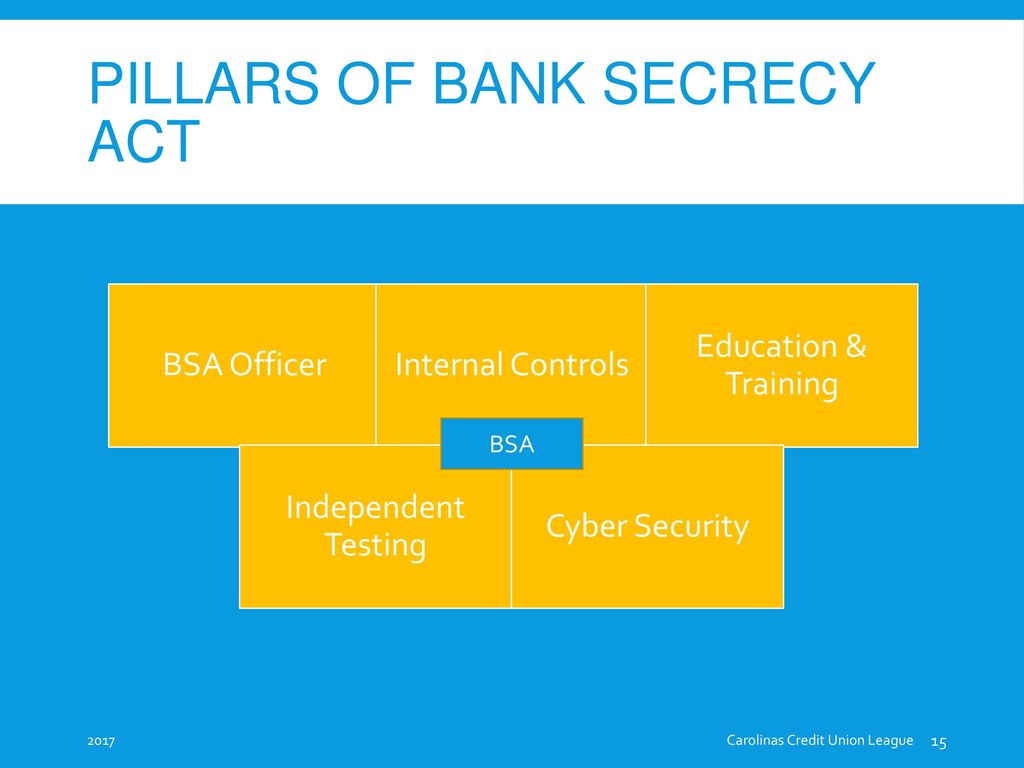

Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Independent testing for compliance with the BSA and 31 C. We are pleased to be here today to discuss our ongoing review of the implementation of the Bank Secrecy Acts reporting requirements.

Source: slideserve.com

Source: slideserve.com

A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. Yes independent testing of Bank Secrecy Act Compliance is required by each of the bank regulatory agencies. 200 Has the credit union received correspondence from law. Part 3268b1 of the FDIC Rules and Regulations. Government agencies in detecting and preventing money laundering.

Source: blog.gao.gov

Source: blog.gao.gov

These BSA record retention requirements are independent of and in addition to record retention requirements under other laws. An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. All CTRs and SARs must be retained 5 years after filing. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. 200 Has the credit union received correspondence from law.

51 Bank Secrecy Act The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. It is a process by which soiled cash is converted into clean cash. 51 Bank Secrecy Act The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved.

Source: slideserve.com

Source: slideserve.com

The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. 1786 q 1 must implement a written Customer Identification Program CIP appropriate for the banks size and type of business that at a minimum includes each of the requirements of paragraphs a 1 through 5 of this section. Documents must be retained for 5 years under the BSAAML requirements. Record-retention requirements under other laws.

Source: blog.gao.gov

Source: blog.gao.gov

5318 h 12 USC. All CTRs and SARs must be retained 5 years after filing. Record-retention requirements under other laws. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. 5318 h 12 USC.

Source: pinterest.com

Source: pinterest.com

BANK SECRECY ACTS REPORTING REQUIREMENTS J Mr. 5318 h 12 USC. Yes independent testing of Bank Secrecy Act Compliance is required by each of the bank regulatory agencies. The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants. Record-retention requirements under other laws.

Source: slideshare.net

Source: slideshare.net

Government agencies in detecting and preventing money laundering. Bank Secrecy Act. It is also referred to as the anti-money. BANK SECRECY ACTS REPORTING REQUIREMENTS J Mr. Government agencies in detecting and preventing money laundering.

Source: slideshare.net

Source: slideshare.net

5311 et seq is referred to as the Bank Secrecy Act BSA. Five-Year Retention for Records as Specified Below The BSA establishes recordkeeping requirements related to various types of records including. An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. Records of every cashier and other official check of 3000 or more must be stored for 5 years after issuance. Policies and procedures for compliance with applicable laws in the states in which it does business.

Source: proprofs.com

Source: proprofs.com

Records are required to be retained at least 5 years in most cases. Yes independent testing of Bank Secrecy Act Compliance is required by each of the bank regulatory agencies. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. It is also referred to as the anti-money. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years.

Source: slideplayer.com

Source: slideplayer.com

200 Has the credit union received correspondence from law. Detroit Computing Center Hotline 1-800-800-2877 FinCEN Regulatory Helpline 1-800-949-2732 To order free guidance materials 1-800-386-6329 To order BSA forms from the IRS Forms Distribution Center. Five-Year Retention for Records as Specified Below The BSA establishes recordkeeping requirements related to various types of records including. These BSA record retention requirements are independent of and in addition to record retention requirements under other laws. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act retention requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information