17+ Bank secrecy act risk assessment information

Home » about money loundering idea » 17+ Bank secrecy act risk assessment informationYour Bank secrecy act risk assessment images are available. Bank secrecy act risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act risk assessment files here. Find and Download all royalty-free images.

If you’re searching for bank secrecy act risk assessment pictures information connected with to the bank secrecy act risk assessment keyword, you have come to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

Bank Secrecy Act Risk Assessment. The FFIEC Bank Secrecy Act Anti-Money Laundering Examination Manual further states there are many effective methods and formats used in completing a BSAAML Risk Assessment and that credit union management should decide the appropriate method and format. 0 denotes not applicable to the specific category. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq.

In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions. Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. Examiners assess the adequacy of a banks BSAAML compliance. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity.

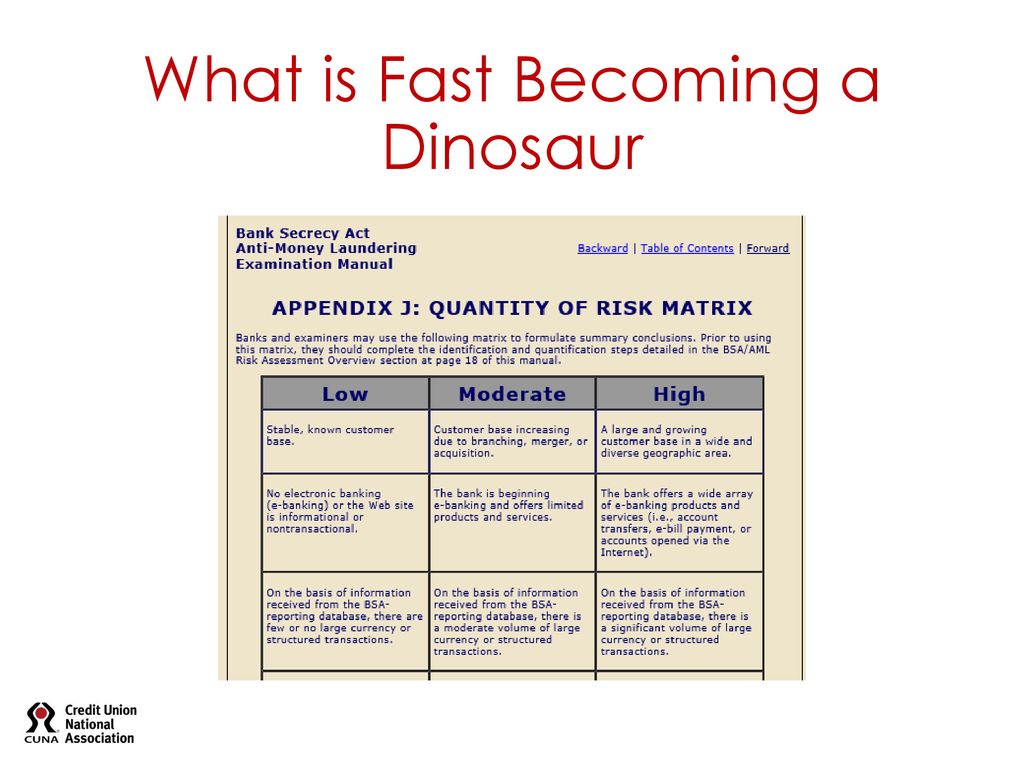

Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score High 61 to 75 Moderate 41 to 60 Low 25 to 40 31 HIDTAHIFCA High Intensity Drug Trafficking Area and High Intensity Financial Crime Area.

For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. Any institution may find this form helpful. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. JavaScript must be enabled in your browser in order to use some functions.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Examiners assess the adequacy of a banks BSAAML compliance. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions.

Source: capitalcomplianceexperts.com

Source: capitalcomplianceexperts.com

View the FFIEC Bank Secrecy ActAnti-Money Laundering Manual Appendix I Risk Assessment Link to the BSAAML Compliance Program page under the Appendices section. The BSA was designed to help identify the source volume and movement. This is one more risk assessment tool being distributed to national banks as part of the OCCs exam process. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool.

Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Examiners assess the adequacy of a banks BSAAML compliance. CSBS and a group of state BSAAML subject-matter experts developed the BSAAML Self-Assessment Tool to be used at the discretion of a financial institution to help in the BSAAML risk assessment process. The Summary form is a gauge to assist in BSA risk analysis as it pertains to your products geographies services and customersThe OCC was careful to note that a banks final risk profile is not driven by the numbers alone.

Source: pt.slideshare.net

Source: pt.slideshare.net

The Summary form is a gauge to assist in BSA risk analysis as it pertains to your products geographies services and customersThe OCC was careful to note that a banks final risk profile is not driven by the numbers alone. Input managements assessment of the level of risk to the bank associated with each category with 1 as low risk 3 as average risk and 5 high risk. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations.

Source:

The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations.

The recent Joint Statement on Risk-Focused Bank Secrecy ActAnti-Money Laundering Supervision July 22 2019 in the US reiterates the critical importance of a sound and comprehensive risk-assessment methodology for the establishment and maintenance of a risk-based regulatory-compliance program that identifies and reports potential money laundering terrorist financing and. Any institution may find this form helpful. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions. JavaScript must be enabled in your browser in order to use some functions.

Source: acamstoday.org

Source: acamstoday.org

This is one more risk assessment tool being distributed to national banks as part of the OCCs exam process. DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. Examiners assess the adequacy of a banks BSAAML compliance. An example of the risk assessment flow is located in Appendix I pages I-1 of the manual. Though the risk assessments of a few institutions are still not analytical andor detailed enough to enable a true assessment whether the AML Program is aligned to institutions risks the overall BSAAML risk assessments.

Source: probank.com

Source: probank.com

The recent Joint Statement on Risk-Focused Bank Secrecy ActAnti-Money Laundering Supervision July 22 2019 in the US reiterates the critical importance of a sound and comprehensive risk-assessment methodology for the establishment and maintenance of a risk-based regulatory-compliance program that identifies and reports potential money laundering terrorist financing and. An example of the risk assessment flow is located in Appendix I pages I-1 of the manual. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. The Summary form is a gauge to assist in BSA risk analysis as it pertains to your products geographies services and customersThe OCC was careful to note that a banks final risk profile is not driven by the numbers alone.

The recent Joint Statement on Risk-Focused Bank Secrecy ActAnti-Money Laundering Supervision July 22 2019 in the US reiterates the critical importance of a sound and comprehensive risk-assessment methodology for the establishment and maintenance of a risk-based regulatory-compliance program that identifies and reports potential money laundering terrorist financing and. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. Risk-focused BSAAML examinations consider a banks unique risk profile. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions.

Source:

The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. JavaScript must be enabled in your browser in order to use some functions. This is one more risk assessment tool being distributed to national banks as part of the OCCs exam process. Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations. Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score High 61 to 75 Moderate 41 to 60 Low 25 to 40 31 HIDTAHIFCA High Intensity Drug Trafficking Area and High Intensity Financial Crime Area.

Source: slideplayer.com

Source: slideplayer.com

Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score High 61 to 75 Moderate 41 to 60 Low 25 to 40 31 HIDTAHIFCA High Intensity Drug Trafficking Area and High Intensity Financial Crime Area. Examiners assess the adequacy of a banks BSAAML compliance. Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. Risk-focused BSAAML examinations consider a banks unique risk profile.

Source: slideplayer.com

Source: slideplayer.com

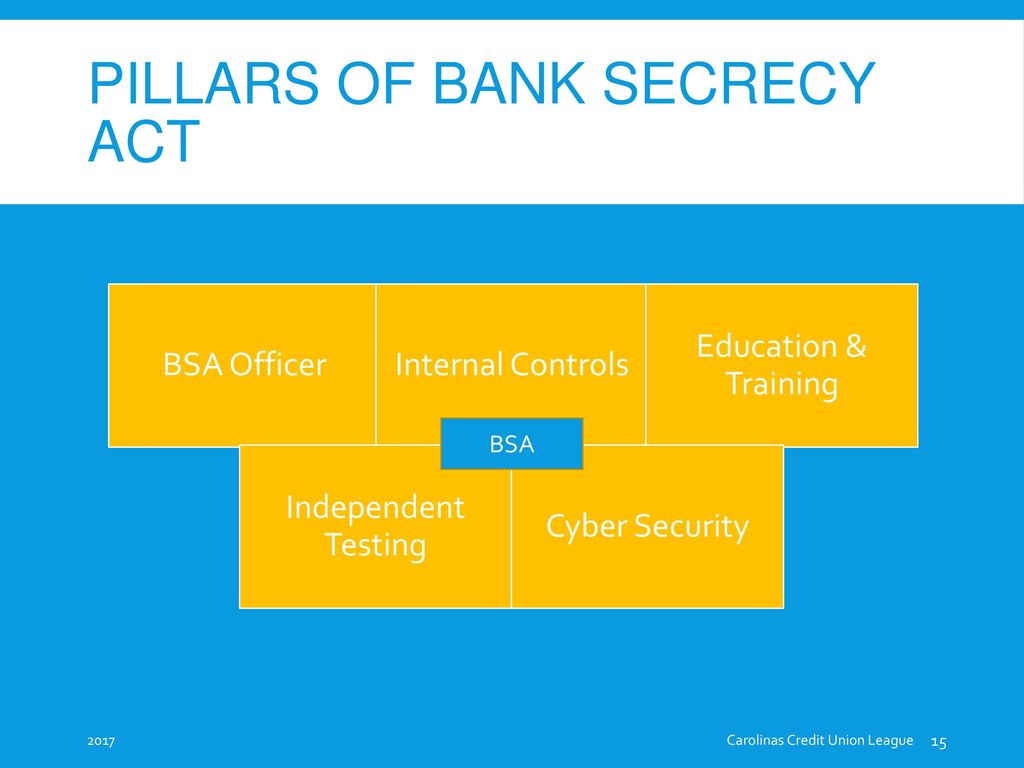

Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions. Examiners assess the adequacy of a banks BSAAML compliance. 0 denotes not applicable to the specific category.

Source:

Risk-focused BSAAML examinations consider a banks unique risk profile. Input managements assessment of the level of risk to the bank associated with each category with 1 as low risk 3 as average risk and 5 high risk. The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. The Bank Secrecy Act and its promulgating regulations require banks to identify risks assess the risks and create a compliance program based on the risk assessment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information