16++ Bank secrecy act sar filing requirements info

Home » about money loundering Info » 16++ Bank secrecy act sar filing requirements infoYour Bank secrecy act sar filing requirements images are available in this site. Bank secrecy act sar filing requirements are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act sar filing requirements files here. Find and Download all free photos and vectors.

If you’re searching for bank secrecy act sar filing requirements pictures information linked to the bank secrecy act sar filing requirements keyword, you have come to the right site. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

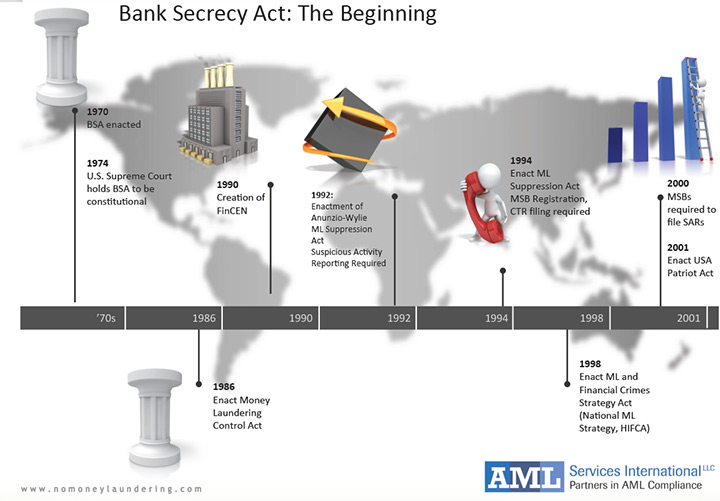

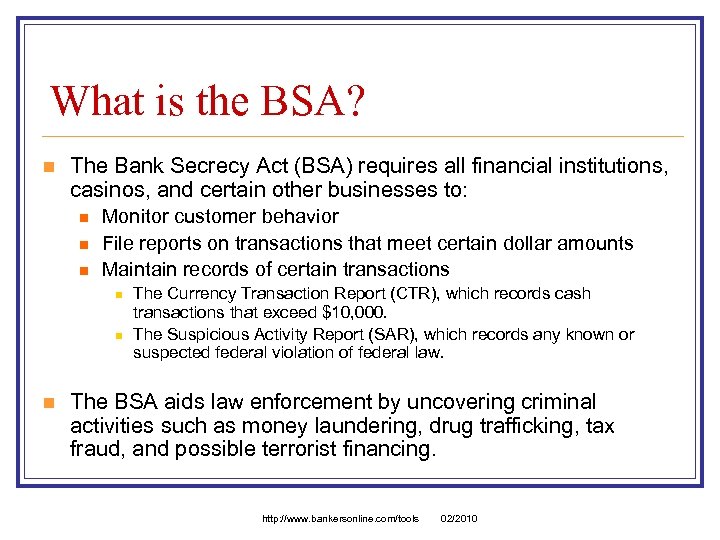

Bank Secrecy Act Sar Filing Requirements. Bank Secrecy Act Including Failures in AML and SAR Filing Programs This article was prepared by the Commodity Futures Trading Commissions Whistleblower Office. This section addresses Title 31 Bank Secrecy Act BSA law and regulations as they relate to structuring. Suspicious Activity Reporting SAR Filing Requirements Below are the key Suspicious Activity Reporting SAR filing requirements as stipulated by the Financial Crimes Enforcement Network FinCEN. This IRM is for BSA managers examiners and technical support personnel.

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

FinCEN SAR Electronic Filing. The Bank Secrecy Act requires financial institutions to file a Currency Transaction Report CTR whenever a currency transaction exceeds 10000. Suspicious Activity Reporting SAR Filing Requirements Below are the key Suspicious Activity Reporting SAR filing requirements as stipulated by the Financial Crimes Enforcement Network FinCEN. If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect. A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR. Banks may also file SARs on continuing activity earlier than the 120 day deadline if the bank believes the activity warrants earlier review by law enforcement.

If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect.

Currency transaction reports must be filed to FinCEN within 15 calendar days of the reported transaction s using the Bank Secrecy Act BSA E-Filing System. Director SBSE Specialty Examination Policy. For situations requiring immediate attention in addition to filing a timely SAR a bank must immediately notify by telephone an appropriate law enforcement authority and as necessary the banks primary regulator. Notifying law enforcement of a suspicious activity does not relieve a bank of its obligation to file. Requirements for Bank Secrecy Act Suspicious Activity Report BSA SAR to FinCEN Suspicious Activity Report FinCEN SAR Electronic Filing Requirements and replaces BSA SAR with FinCEN SAR through the document. The SAR rules require that a SAR be filed no later than 30 calendar days from the date of the initial detection of the suspicious activity unless no suspect can be identified in which case the time period for filing a SAR is extended to 60 days.

Source: slideserve.com

Source: slideserve.com

A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR. Bank Secrecy Act Including Failures in AML and SAR Filing Programs This article was prepared by the Commodity Futures Trading Commissions Whistleblower Office. 155-179 Description and. This article is provided for general informational purposes only and does not provide legal or investment advice to any individual or entity. Updates Part IV TIN Item 80 2A record pos.

Source: slideserve.com

Source: slideserve.com

Filers are required to save a printed or electronic copy of the report for at least five years. Currency transaction reports must be filed to FinCEN within 15 calendar days of the reported transaction s using the Bank Secrecy Act BSA E-Filing System. This section addresses Title 31 Bank Secrecy Act BSA law and regulations as they relate to structuring. For situations requiring immediate attention in addition to filing a timely SAR a bank must immediately notify by telephone an appropriate law enforcement authority and as necessary the banks primary regulator. Electronic filing of this report will be through the BSA E-Filing System operated by the Financial Crimes Enforcement Network FinCEN.

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a. Electronic filing of this report will be through the BSA E-Filing System operated by the Financial Crimes Enforcement Network FinCEN. Notifying law enforcement of a suspicious activity does not relieve a bank of its obligation to file. For this initial notification an appropriate law enforcement authority would generally be the local office of the IRS Criminal Investigation Division or the FBI. FinCEN is a bureau of the US Department of Treasury that is responsible for managing and enforcing Anti-Money Laundering and Bank Secrecy Act rules and regulations.

Updates Part IV TIN Item 80 2A record pos. Suspicious Activity Reporting SAR Filing Requirements Below are the key Suspicious Activity Reporting SAR filing requirements as stipulated by the Financial Crimes Enforcement Network FinCEN. Banks may also file SARs on continuing activity earlier than the 120 day deadline if the bank believes the activity warrants earlier review by law enforcement. Requirements for Bank Secrecy Act Suspicious Activity Report BSA SAR to FinCEN Suspicious Activity Report FinCEN SAR Electronic Filing Requirements and replaces BSA SAR with FinCEN SAR through the document. Bank Secrecy Act Including Failures in AML and SAR Filing Programs This article was prepared by the Commodity Futures Trading Commissions Whistleblower Office.

Source: amazon.com

Source: amazon.com

The SAR rules require that a SAR be filed no later than 30 calendar days from the date of the initial detection of the suspicious activity unless no suspect can be identified in which case the time period for filing a SAR is extended to 60 days. If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect. It covers the components of a SAR monitoring and reporting system and how to answer the essential questions that comprise the basis of the SAR narrative. For situations requiring immediate attention in addition to filing a timely SAR a bank must immediately notify by telephone an appropriate law enforcement authority and as necessary the banks primary regulator. The Bank Secrecy Act BSA implementing regulations at 31 CFR Chapter X require covered financial institutions to file reports of suspicious transactions with the Department of the Treasurys Financial Crimes Enforcement Network FinCEN in circumstances where the bank knows suspects or has reason to suspect that the transaction involves funds from illegal activities.

Source: forbes.com

Source: forbes.com

This IRM is for BSA managers examiners and technical support personnel. The Bank Secrecy Act requires financial institutions to file a Currency Transaction Report CTR whenever a currency transaction exceeds 10000. FinCEN SAR Electronic Filing. This IRM is for BSA managers examiners and technical support personnel. It covers the components of a SAR monitoring and reporting system and how to answer the essential questions that comprise the basis of the SAR narrative.

Source: slideserve.com

Source: slideserve.com

The SAR rules require that a SAR be filed no later than 30 calendar days from the date of the initial detection of the suspicious activity unless no suspect can be identified in which case the time period for filing a SAR is extended to 60 days. 155-179 Description and. Part 3268b1 of the FDIC Rules and Regulations. A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR. FinCEN SAR Electronic Filing.

Source: blog.flexcutech.com

Source: blog.flexcutech.com

The section will assist in identification of potentially structured transactions and the development of a structuring violation issue. This course describes the Bank Secrecy Act BSA requirements for a bank to file a Suspicious Activity Report SAR and why federal law limits sharing information about SARs. For this initial notification an appropriate law enforcement authority would generally be the local office of the IRS Criminal Investigation Division or the FBI. It covers the components of a SAR monitoring and reporting system and how to answer the essential questions that comprise the basis of the SAR narrative. Electronic filing of this report will be through the BSA E-Filing System operated by the Financial Crimes Enforcement Network FinCEN.

Source: slideplayer.com

Source: slideplayer.com

Subsequent guidance permits banks with SAR requirements to file SARs for continuing activity after a 90 day review with the filing deadline being 120 calendar days after the date of the previously related SAR filing. Filers are required to save a printed or electronic copy of the report for at least five years. Director SBSE Specialty Examination Policy. If a currency transaction exceeds 10000 and is otherwise reportable as suspicious activity the institution must file both a CTR and a SAR. Subsequent guidance permits banks with SAR requirements to file SARs for continuing activity after a 90 day review with the filing deadline being 120 calendar days after the date of the previously related SAR filing.

Source: acamstoday.org

Source: acamstoday.org

This IRM is for BSA managers examiners and technical support personnel. Suspicious Activity Reports SARs Banks have a responsibility to monitor identify and report suspicious activity If made aware of unusual or suspicious activity a bank must investigate to determine if a SAR should be filed Banks are not responsible for finding evidence or proving crime. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a. The section will assist in identification of potentially structured transactions and the development of a structuring violation issue. Filers are required to save a printed or electronic copy of the report for at least five years.

Source: present5.com

Source: present5.com

Updates Part IV TIN Item 80 2A record pos. The purpose of this document is to provide the requirements and conditions for electronically filing the Bank Secrecy Act Suspicious Activity Report BSA SAR. Suspicious Activity Reports SARs Banks have a responsibility to monitor identify and report suspicious activity If made aware of unusual or suspicious activity a bank must investigate to determine if a SAR should be filed Banks are not responsible for finding evidence or proving crime. For situations requiring immediate attention in addition to filing a timely SAR a bank must immediately notify by telephone an appropriate law enforcement authority and as necessary the banks primary regulator. Bank Secrecy Act Including Failures in AML and SAR Filing Programs This article was prepared by the Commodity Futures Trading Commissions Whistleblower Office.

Source: proprofs.com

Source: proprofs.com

Suspicious Activity Reports SARs Banks have a responsibility to monitor identify and report suspicious activity If made aware of unusual or suspicious activity a bank must investigate to determine if a SAR should be filed Banks are not responsible for finding evidence or proving crime. On June 29 2020 the US Treasury Departments Financial Crimes Enforcement Network FinCEN issued guidance the 2020 Guidance clarifying requirements under the Bank Secrecy Act BSA for financial institutions providing services to hemp-related businesses. The purpose of this document is to provide the requirements and conditions for electronically filing the Bank Secrecy Act Suspicious Activity Report BSA SAR. For this initial notification an appropriate law enforcement authority would generally be the local office of the IRS Criminal Investigation Division or the FBI. Notifying law enforcement of a suspicious activity does not relieve a bank of its obligation to file.

Source: tookitaki.ai

Source: tookitaki.ai

Currency transaction reports must be filed to FinCEN within 15 calendar days of the reported transaction s using the Bank Secrecy Act BSA E-Filing System. If a currency transaction exceeds 10000 and is otherwise reportable as suspicious activity the institution must file both a CTR and a SAR. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. FinCEN is a bureau of the US Department of Treasury that is responsible for managing and enforcing Anti-Money Laundering and Bank Secrecy Act rules and regulations. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act sar filing requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas