14++ Bank secrecy act south africa ideas in 2021

Home » about money loundering Info » 14++ Bank secrecy act south africa ideas in 2021Your Bank secrecy act south africa images are available. Bank secrecy act south africa are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act south africa files here. Get all free photos and vectors.

If you’re looking for bank secrecy act south africa images information linked to the bank secrecy act south africa interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Bank Secrecy Act South Africa. This is a very critical part of all orientation programs. Burns 1914 CPD 452. Bank means a bank as defined in section 11 of the Banks Act 1990 Act 94 of 1990 and for the purposes of section 10A includes a mutual bank. This is because it has become increasingly difficult to balance the interests of customers who may be perpetrators or bona fide victims of financial crime against the interests of society as a whole.

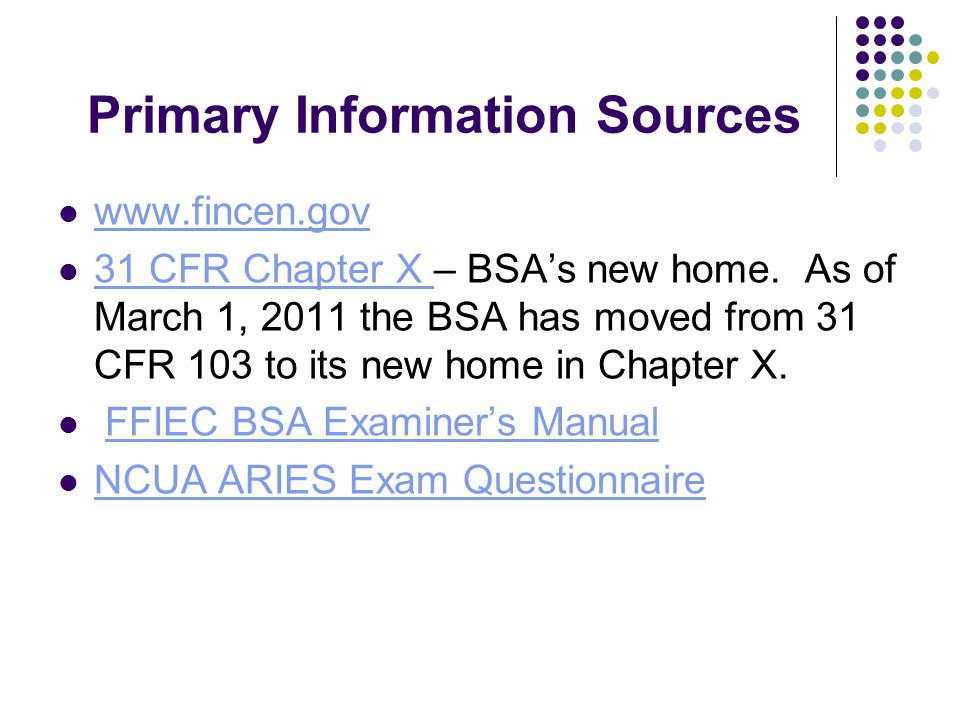

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

The BSA regulations require every bank to file a Suspicious Activity Report SAR when they detect certain known or suspected violations of federal law or suspicious transactions related to a money laundering activity or a violation of the BSA. This duty is also contractual in nature and is to be implied by a banker and customer relationship. This is because it has become increasingly difficult to balance the interests of customers who may be perpetrators or bona fide victims of financial crime against the interests of society as a whole. Bank means a bank as defined in section 11 of the Banks Act 1990 Act 94 of 1990 and for the purposes of section 10A includes a mutual bank. The oath is always administered by a Legal Officer in the Bank and the signed documents securely filed for the records. Banking institution rep by s 1b of Act 10 of 1993.

262 But it is possible for X to represent or act on behalf of Z with the latters consent for the purpose of bringing Z into legal.

19 In the South African context this duty of confidentiality or secrecy as it is sometimes referred to was recognised inter alia in Abrahams v. The common law laid the. 262 But it is possible for X to represent or act on behalf of Z with the latters consent for the purpose of bringing Z into legal. The new legislation would permit financial institutions such as the Postbank and the Land Bank to be licensed as fully operational banks. SARBs guideline at the moment is a penalty of between 20 40 of the Excon contravention amount. This is because it has become increasingly difficult to balance the interests of customers who may be perpetrators or bona fide victims of financial crime against the interests of society as a whole.

Source:

At the core of their framework in efforts to combat money laundering and. At the core of their framework in efforts to combat money laundering and. Where there is no identifiable suspect and. Burns 1914 CPD 452. No set-off of the unutilised portion of the R4 million Foreign Investment Allowance is however allowed.

Source: globallegalinsights.com

Source: globallegalinsights.com

Burns 1914 CPD 452. But why do bankers have to bother with this seemingly unnecessary procedure. SARBs guideline at the moment is a penalty of between 20 40 of the Excon contravention amount. It will not include any analysis on the Islamic Financial Institution Act 2013. Subs by s 1a of Act 2 of 1996 banking institution.

Source: acamstoday.org

Source: acamstoday.org

Banking institution rep by s 1b of Act 10 of 1993. THE BANKS ACT 1990 To provide for the regulation and supervision of the business of public companies taking deposits from the public. Banks have a ritual of ensuring that all new employees sign an oath of secrecy. Casinos with gross revenues over 1000000 must file Suspicious Activity Reports if a transaction involves or aggregates at least 5000 in funds and if it meets one of the four categories described above. The ratio underlying this judgment was overruled by the Appellate Division as it then was in Densam.

Source: researchgate.net

Source: researchgate.net

The provisions of subsection 1 shall not be construed as preventing any director officer or employee of the Bank who is responsible for exercising any power or performing any function or duty under the Exchange Control Regulations 1961 issued in terms of section 9 of the Currency and Exchanges Act 1933 Act 9 of 1933 from disclosing to the Commissioner for the South African Revenue Service. Banks have a ritual of ensuring that all new employees sign an oath of secrecy. The ratio underlying this judgment was overruled by the Appellate Division as it then was in Densam. To register as a bank in South Africa Section 11 of the Banks Act provides that the applicant must be a public company incorporated under the Companies Act 71 of 2008 the Companies Act. The new legislation would permit financial institutions such as the Postbank and the Land Bank to be licensed as fully operational banks.

Source: slideplayer.com

Source: slideplayer.com

No set-off of the unutilised portion of the R4 million Foreign Investment Allowance is however allowed. Subs by s 1a of Act 2 of 1996 banking institution. _____ BE IT ENACTED by the State President and the Parliament of the Republic of South Africa as follows - ARRANGEMENT OF SECTIONS CHAPTER I. Burns 1914 CPD 452. The provisions of subsection 1 shall not be construed as preventing any director officer or employee of the Bank who is responsible for exercising any power or performing any function or duty under the Exchange Control Regulations 1961 issued in terms of section 9 of the Currency and Exchanges Act 1933 Act 9 of 1933 from disclosing to the Commissioner for the South African Revenue Service.

Source: sia-partners.com

Source: sia-partners.com

And to provide for matters connected therewith. On the tax front there is currently not a formal VDP available. As an outcome the duty of secrecy imposed on banking institutions has become more controversial. Bank means a bank as defined in section 11 of the Banks Act 1990 Act 94 of 1990 and for the purposes of section 10A includes a mutual bank. A banker owes a duty of secrecy to its customers at all times including a duty to keep information concerning its customers affairs confidential.

Source: slideplayer.com

Source: slideplayer.com

Burns 1914 CPD 452. This is popularly known as bank secrecy. The new legislation would permit financial institutions such as the Postbank and the Land Bank to be licensed as fully operational banks. 262 But it is possible for X to represent or act on behalf of Z with the latters consent for the purpose of bringing Z into legal. Bank ins by s 1a of Act 10 of 1993.

Source: slideplayer.com

Source: slideplayer.com

Bank ins by s 1a of Act 10 of 1993. Banks have a ritual of ensuring that all new employees sign an oath of secrecy. The ratio underlying this judgment was overruled by the Appellate Division as it then was in Densam. 262 But it is possible for X to represent or act on behalf of Z with the latters consent for the purpose of bringing Z into legal. It will not include any analysis on the Islamic Financial Institution Act 2013.

Source: slideplayer.com

Source: slideplayer.com

261 As a result the notion of stipulation in favour of a third party stipulatio alterii is unknown to English law. At the core of their framework in efforts to combat money laundering and. THE SOURCES OF SOUTH AFRICAN BANKING LAW another Y with the view of conferring rights upon a third party Z without the third partys consent or co-operation. The CTA requires corporations limited liability companies and similar entities to report certain information about their beneficial owners the individual natural persons who ultimately own or control the companies. On April 15 2020 the US Federal Financial Institutions Examination Council FFIEC released an updated version of certain portions of its Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual the Manual which provides guidelines for examiners in assessing the adequacy of a banks BSAAML-compliance program.

Source:

George Consultants Investments v. The CTA amended the Bank Secrecy Act. Where there is no identifiable suspect and. But why do bankers have to bother with this seemingly unnecessary procedure. THE BANKS ACT 1990 To provide for the regulation and supervision of the business of public companies taking deposits from the public.

Source: acamstoday.org

Source: acamstoday.org

261 As a result the notion of stipulation in favour of a third party stipulatio alterii is unknown to English law. The oath is always administered by a Legal Officer in the Bank and the signed documents securely filed for the records. The common law laid the. However this duty is not absolute. On April 15 2020 the US Federal Financial Institutions Examination Council FFIEC released an updated version of certain portions of its Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual the Manual which provides guidelines for examiners in assessing the adequacy of a banks BSAAML-compliance program.

Source: slideplayer.com

Source: slideplayer.com

THE SOURCES OF SOUTH AFRICAN BANKING LAW another Y with the view of conferring rights upon a third party Z without the third partys consent or co-operation. This duty is also contractual in nature and is to be implied by a banker and customer relationship. The BSA regulations require every bank to file a Suspicious Activity Report SAR when they detect certain known or suspected violations of federal law or suspicious transactions related to a money laundering activity or a violation of the BSA. As an outcome the duty of secrecy imposed on banking institutions has become more controversial. The CTA requires corporations limited liability companies and similar entities to report certain information about their beneficial owners the individual natural persons who ultimately own or control the companies.

Source: slideplayer.com

Source: slideplayer.com

On the tax front there is currently not a formal VDP available. THE BANKS ACT 1990 To provide for the regulation and supervision of the business of public companies taking deposits from the public. The materials herein are for informational purposes only and do not constitute legal advice. However this duty is not absolute. The new legislation would permit financial institutions such as the Postbank and the Land Bank to be licensed as fully operational banks.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act south africa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas