11+ Bank secrecy act staff training information

Home » about money loundering Info » 11+ Bank secrecy act staff training informationYour Bank secrecy act staff training images are available. Bank secrecy act staff training are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act staff training files here. Find and Download all royalty-free photos.

If you’re looking for bank secrecy act staff training pictures information linked to the bank secrecy act staff training topic, you have come to the ideal blog. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Bank Secrecy Act Staff Training. Bank Secrecy Act Workshop BSAAML Training for Banks Bank Secrecy Act BSAAnti-Money Laundering AML We can evaluate and verify that your institutions process for identifying and reporting suspicious. Objectives Our objectives are to. THE BANK SECRECY ACT. Explain the Bank Secrecy Act.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations. This Training on Demand course provides an overview of BSA includ-ing specific actions that you must know to be BSA compliant. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes. In addition it provides access to five onine exams with the opportunity to purchase additional for 2450 each to record proof of the knowledge gained. It can be used as a Train the Trainer course or as annual training for all employees. In this course we are going to establish a general understanding of money laundering.

Objectives Our objectives are to.

It reviews the timeline of events that gives the BSAAML laws and regulations the teeth it has today. Explain the Bank Secrecy Act. Bank Secrecy Act Staff Training This webinar gets back to basics. It can be used as a Train the Trainer course or as annual training for all employees. BSA for the Frontline Regarded as the most crucial annual Bank Secrecy Act training initiative in years this program covers the new BSA Customer Due Diligence rules that directly impact tellers loan officers and other frontline bank employees. The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations.

Source: slideplayer.com

Source: slideplayer.com

This Training on Demand covers what operations staff need to know to be in compliance with the Bank Secrecy Act. BSA for the Frontline Regarded as the most crucial annual Bank Secrecy Act training initiative in years this program covers the new BSA Customer Due Diligence rules that directly impact tellers loan officers and other frontline bank employees. Bank Secrecy Act Bank Secrecy Act BSA compliance remains high on the examiners list so all credit unions need to be familiar with BSA requirements. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes. Bank Secrecy Act BSA compliance remains high on the examiners list for all credit unions so credit union professionals need to be familiar with BSA requirements.

Source: slideserve.com

Source: slideserve.com

Start today and improve your skills. This Training on Demand covers what operations staff need to know to be in compliance with the Bank Secrecy Act. Next well explore the AML and CTF regulations in place and finally learn what preventive measures are available to combat money laundering and terrorist financing activities. BSA for the Frontline Regarded as the most crucial annual Bank Secrecy Act training initiative in years this program covers the new BSA Customer Due Diligence rules that directly impact tellers loan officers and other frontline bank employees. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance.

Source: training.cuna.org

Source: training.cuna.org

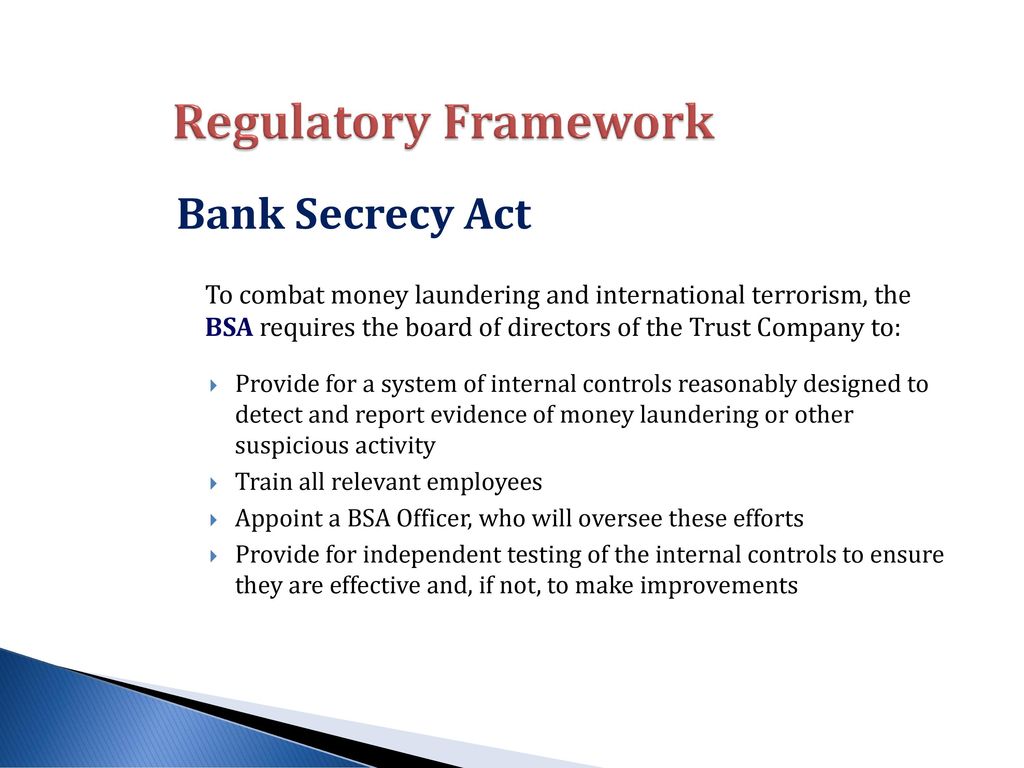

Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes. Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. This Training on Demand course provides an overview of BSA including specific actions and documentations that front-line staff must complete to comply with regulations.

Source: docplayer.net

Source: docplayer.net

2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. Start today and improve your skills. This Training on Demand covers what operations staff need to know to be in compliance with the Bank Secrecy Act. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes. Ad Learn Banking online at your own pace.

Source: bankerscompliance.com

Source: bankerscompliance.com

Reporting Recordkeeping CTRs SARs Member Identification WiresFunds Transfers Sale of Monetary Instruments 4. Bank Secrecy Act BSA compliance remains high on the examiners list for all credit unions so credit union professionals need to be familiar with BSA requirements. Bank Secrecy Act Workshop BSAAML Training for Banks Bank Secrecy Act BSAAnti-Money Laundering AML We can evaluate and verify that your institutions process for identifying and reporting suspicious. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes.

Source: compliancecohort.com

Source: compliancecohort.com

Start today and improve your skills. Start today and improve your skills. History Overview of the Bank Secrecy Act 2. Equip the staff of your financial institution with the right tools and processes and combat money laundering. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you as a member of your credit unions operations staff must take to be BSA.

Source: slideplayer.com

Source: slideplayer.com

Ad Learn Banking online at your own pace. This Training on Demand course provides an overview of BSA includ-ing specific actions that you must know to be BSA compliant. BSA OFAC Training Agenda 1. BSA for the Frontline Regarded as the most crucial annual Bank Secrecy Act training initiative in years this program covers the new BSA Customer Due Diligence rules that directly impact tellers loan officers and other frontline bank employees. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance.

Source:

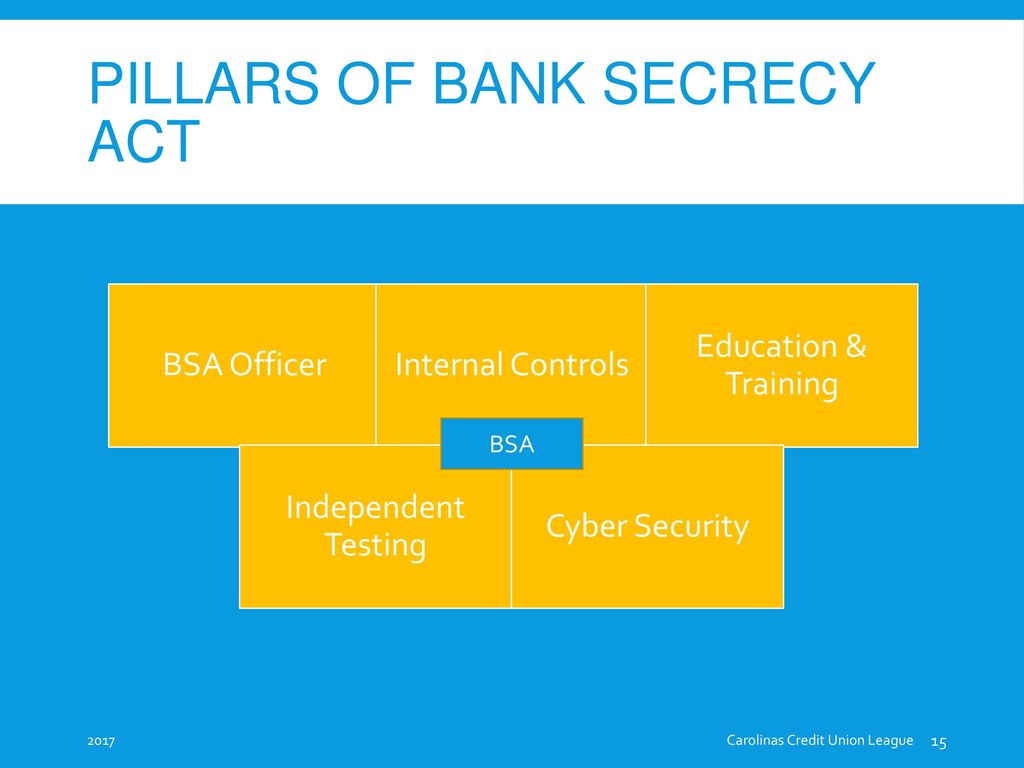

Compliance Requirements Risk Assessment Policies Programs Compliance Officer Internal Controls 3. 2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. Bank Secrecy Act Staff Training This webinar gets back to basics. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Start today and improve your skills.

Source: acamstoday.org

Source: acamstoday.org

Next well explore the AML and CTF regulations in place and finally learn what preventive measures are available to combat money laundering and terrorist financing activities. Join millions of learners from around the world already learning on Udemy. Bank Secrecy Act Workshop BSAAML Training for Banks Bank Secrecy Act BSAAnti-Money Laundering AML We can evaluate and verify that your institutions process for identifying and reporting suspicious. This Training on Demand course provides an overview of BSA including specific actions and documentations that front-line staff must complete to comply with regulations. Ad Learn Banking online at your own pace.

Source: slideserve.com

Source: slideserve.com

It reviews the timeline of events that gives the BSAAML laws and regulations the teeth it has today. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. Bank Secrecy Act Bank Secrecy Act BSA compliance remains high on the examiners list so all credit unions need to be familiar with BSA requirements. Compliance Requirements Risk Assessment Policies Programs Compliance Officer Internal Controls 3. Start today and improve your skills.

Source: complianceonline.com

Source: complianceonline.com

The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes. Reporting Recordkeeping CTRs SARs Member Identification WiresFunds Transfers Sale of Monetary Instruments 4. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. Start today and improve your skills.

Source: slideplayer.com

Source: slideplayer.com

This Training on Demand course provides an overview of BSA including specific actions and documentations that front-line staff must complete to comply with regulations. BSA and OFAC Compliance - Staff Training. The BSA training program for your credit union is a vital component of your Bank Secrecy Act Compliance Program. BSA OFAC Training Agenda 1. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime.

Source: slideplayer.com

Source: slideplayer.com

Start today and improve your skills. Start today and improve your skills. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. Well trained staff are more proficient at spotting suspicious activity as well as completing more timely and accurate BSA report submissions. The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act staff training by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas