10++ Bank secrecy act summary information

Home » about money loundering idea » 10++ Bank secrecy act summary informationYour Bank secrecy act summary images are available in this site. Bank secrecy act summary are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act summary files here. Find and Download all royalty-free photos and vectors.

If you’re searching for bank secrecy act summary pictures information connected with to the bank secrecy act summary topic, you have visit the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

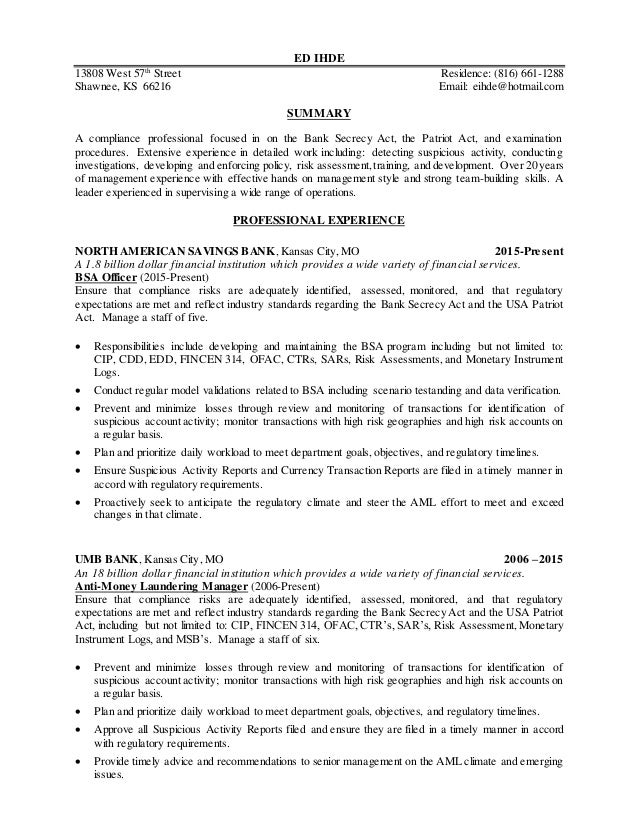

Bank Secrecy Act Summary. As part of the broad antimoney laundering agenda multiple US government agencies working in concert with other countries enacted laws and imposed regulations to support antimoney laundering detection and prosecution. This Financial Institution Letter FIL applies to all FDIC-supervised institutions. 1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. The purpose of the BSA is to require United States US.

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. 10272 dated 18 November 1996. This Financial Institution Letter FIL applies to all FDIC-supervised institutions. The Bank Secrecy Act requires financial institutions not just banks to help the federal. As part of the broad antimoney laundering agenda multiple US government agencies working in concert with other countries enacted laws and imposed regulations to support antimoney laundering detection and prosecution. The Bank Secrecy Act BSA.

94 of 1990 As amended Including all amendments up to and including the Banks Amendment Act 2003 Act No.

As part of the broad antimoney laundering agenda multiple US government agencies working in concert with other countries enacted laws and imposed regulations to support antimoney laundering detection and prosecution. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. Congress passed the Bank Secrecy Act in 1970 as the first laws to fight money laundering in the United States. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. What is the Bank Secrecy Act. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA.

Source: slideplayer.com

Source: slideplayer.com

What is the Bank Secrecy Act. 1 1 Reproduced under the Government Printers Authority No. This Financial Institution Letter FIL applies to all FDIC-supervised institutions. Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as a. The following is a summary of the most significant changes to the AML legal landscape including.

Source: complianceonline.com

Source: complianceonline.com

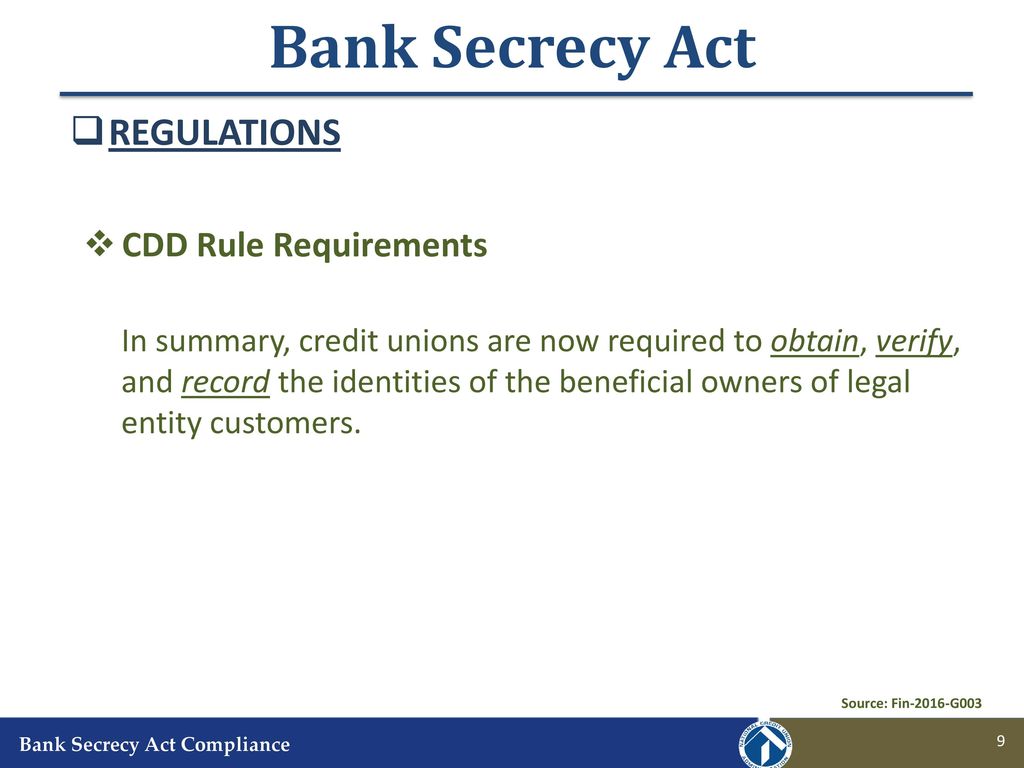

The Bank Secrecy Act BSA. Bank Secrecy Act. Under the Act any transaction consisting of 10000 or more in cash that seems suspicious is to be reported to the proper governmental. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. The Bank Secrecy Act requires financial institutions not just banks to help the federal.

1 1 Reproduced under the Government Printers Authority No. The Bank Secrecy Act BSA is US. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules. This Financial Institution Letter FIL applies to all FDIC-supervised institutions.

Source: slideplayer.com

Source: slideplayer.com

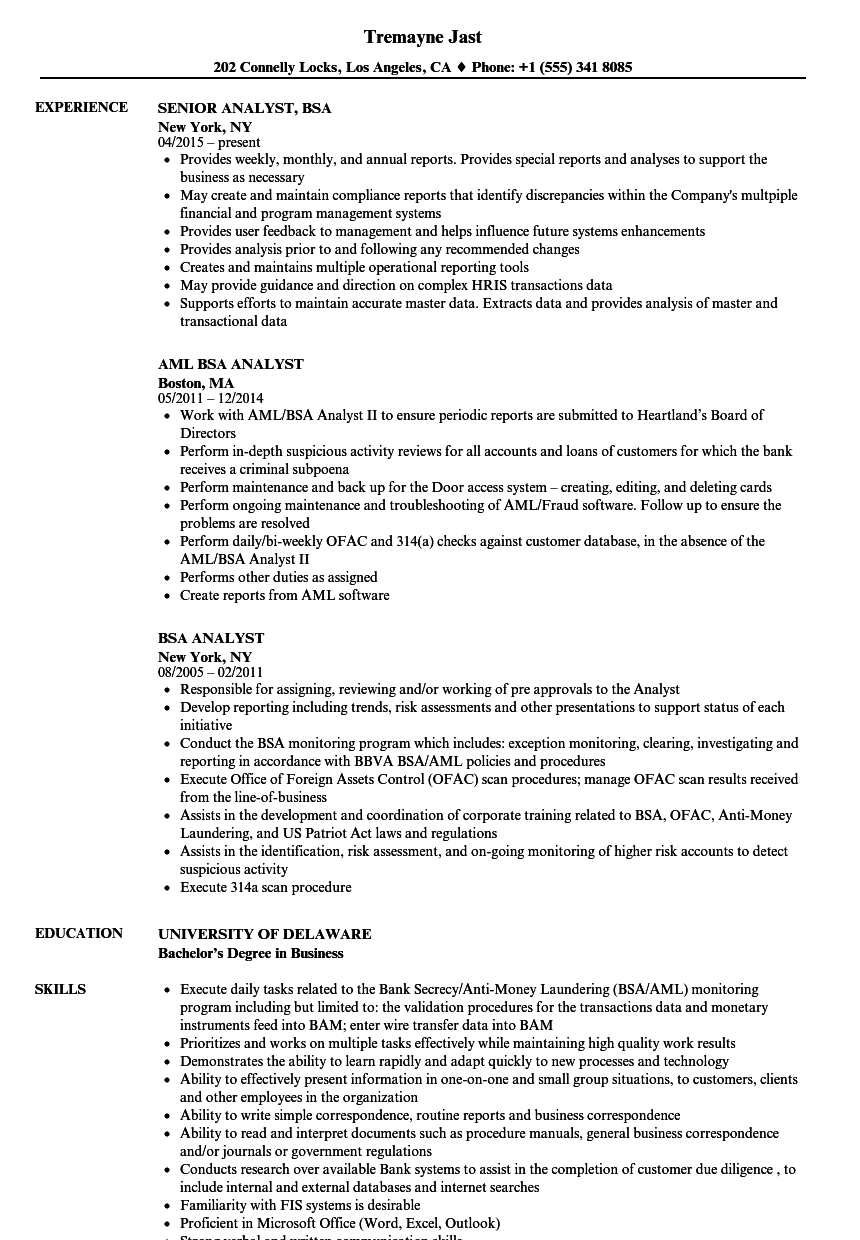

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Act is actually made up of several statutes including the Money. The BSA was amended to incorporate the. Banking law enforcement and technology have undergone rapid change in recent years but the basic BSAAML compliance structure is still heavily based on manual processing. Money Laundering Control Act Enacted 16 years after the Bank Secrecy Act the Money Laundering Control Act established money laundering as a.

Source: slideplayer.com

Source: slideplayer.com

The following is a summary of the most significant changes to the AML legal landscape including. The documents filed by businesses under the BSA requirements. Law requiring financial institutions in the United States to assist US. NCUA monitors credit unions for compliance with the BSA and its implementing regulation 31 CFR 103. Bank Secrecy Act.

Source:

THE BANKS ACT 1990 Act No. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. 5311 et seq is referred to as the Bank Secrecy Act BSA. The documents filed by businesses under the BSA requirements. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA.

Source: slideplayer.com

Source: slideplayer.com

Under the Act any transaction consisting of 10000 or more in cash that seems suspicious is to be reported to the proper governmental. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. The purpose of the BSA is to require United States US. The Act is actually made up of several statutes including the Money. THE BANKS ACT 1990 Act No.

![]() Source: slideplayer.com

Source: slideplayer.com

It has evolved over time to keep pace with new and emerging threats related to financial crime. The BSA requires businesses to keep records and file reports that are determined to have a high degree of usefulness in criminal tax and regulatory matters. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. The documents filed by businesses under the BSA requirements. Banks and other financial institutions must ensure they meet the compliance obligations it involves.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

Law requiring financial institutions in the United States to assist US. 1 The BSA was designed to help identify the source volume and movement of currency and other monetary instruments transported or transmitted into or out of the US. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. Under the Act any transaction consisting of 10000 or more in cash that seems suspicious is to be reported to the proper governmental. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US.

Source: complianceonline.com

Source: complianceonline.com

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. In accordance with the authority this version of the Banks Act may only be used for internal purposes. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Under the Act any transaction consisting of 10000 or more in cash that seems suspicious is to be reported to the proper governmental. As part of the broad antimoney laundering agenda multiple US government agencies working in concert with other countries enacted laws and imposed regulations to support antimoney laundering detection and prosecution.

Source: slideplayer.com

Source: slideplayer.com

1 1 Reproduced under the Government Printers Authority No. Signed into law by President Richard Nixon on October 26 1970. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA.

Source: complianceonline.com

Source: complianceonline.com

Statement of Applicability to Institutions. 10272 dated 18 November 1996. The Bank Secrecy Act of 1970 as well the USA Patriot Act of 2001 created authority and policies to reduce financial institutions role in funding terrorist activities. 5311 et seq is referred to as the Bank Secrecy Act BSA. Under the Act any transaction consisting of 10000 or more in cash that seems suspicious is to be reported to the proper governmental.

Source: slideshare.net

Source: slideshare.net

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The law requires financial institutions to provide. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Federal Financial Institutions Examination Council FFIEC is updating sections and related examination procedures in the FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information