15++ Bank secrecy act training requirements ideas in 2021

Home » about money loundering Info » 15++ Bank secrecy act training requirements ideas in 2021Your Bank secrecy act training requirements images are ready in this website. Bank secrecy act training requirements are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act training requirements files here. Download all free vectors.

If you’re searching for bank secrecy act training requirements pictures information connected with to the bank secrecy act training requirements interest, you have visit the right site. Our site always gives you hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

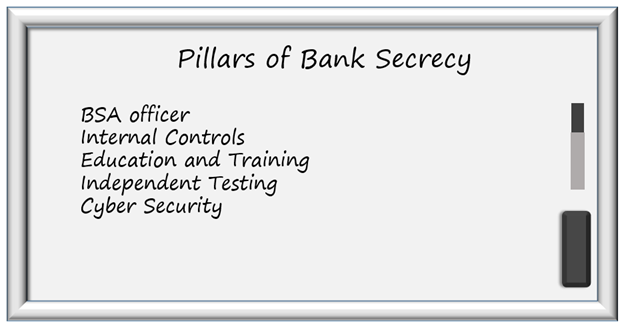

Bank Secrecy Act Training Requirements. Second-A well trained well informed staff is critical to the. The long-term goal of the InfoBase is to provide just-in-time training for new regulations and for other topics of specific concern to examiners within the FFIECs member agencies. As amended section 5318h 1 requires financial institutions to establish anti. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

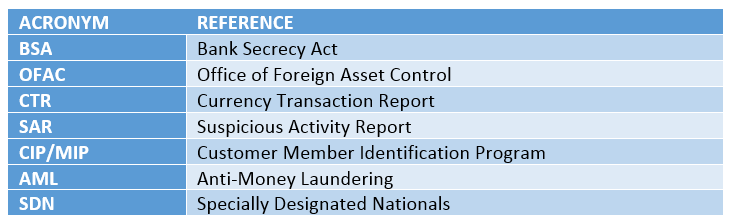

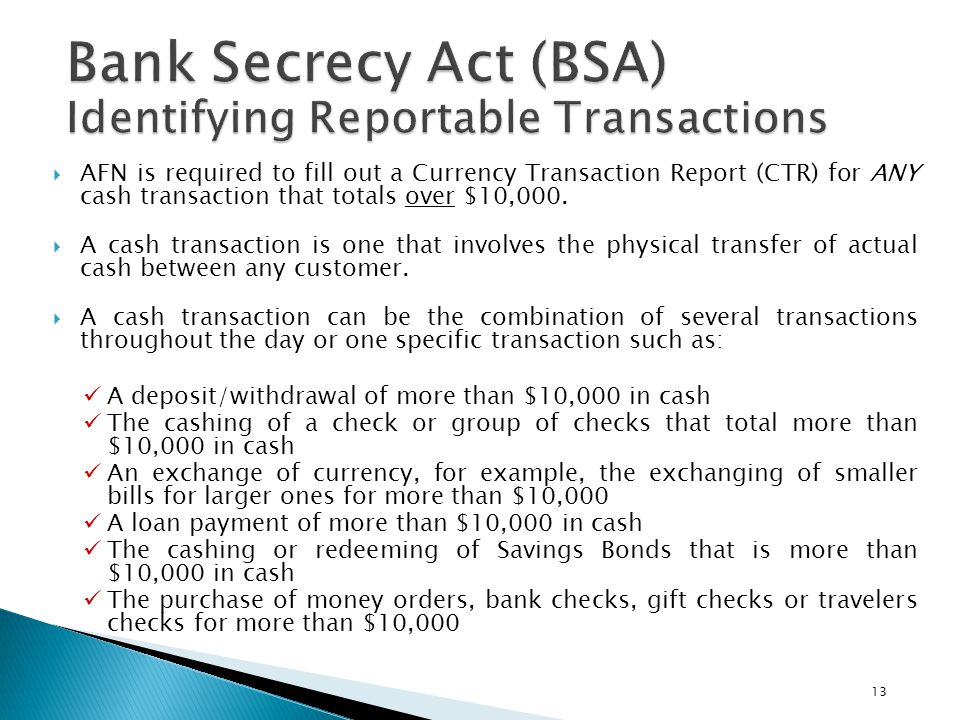

Training should cover the aspects of the BSA that are relevant to the bank and its risk profile and appropriate personnel includes those whose duties require knowledge or involve some aspect of BSAAML compliance. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Join millions of learners from around the world already learning on Udemy. Some of the main requirements of the Bank Secrecy Act include Customer Identification Program CIP Customer Due Diligence CDD Currency Transaction Reports CTRs Suspicious Activity Reports SARs Information Sharing Monetary Instrument Recordkeeping Funds Transfers wires Recordkeeping Beneficial Ownership and more. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121.

Training should be tailored to.

THE BANK SECRECY ACT. THE BANK SECRECY ACT. FinCen requests for information are sent every two weeks. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Get training to meet your Bank Secrecy Act BSA training requirements. The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations.

Source: complianceonline.com

Source: complianceonline.com

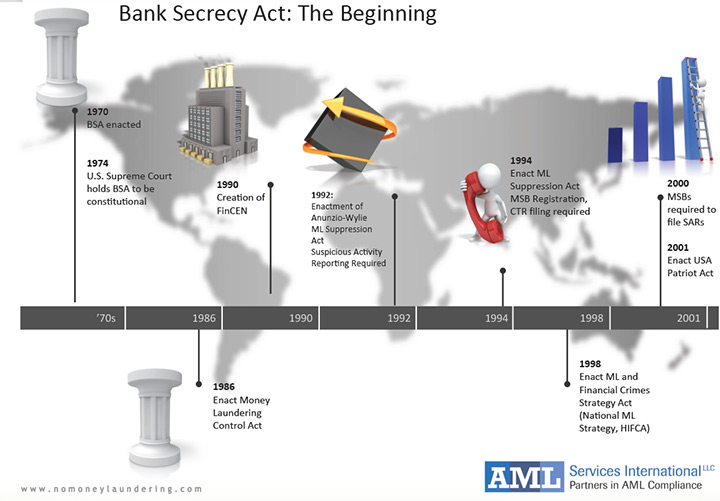

Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. History Overview of the Bank Secrecy Act 2. THE BANK SECRECY ACT. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121.

Source: blog.gao.gov

Source: blog.gao.gov

Training should cover the aspects of the BSA that are relevant to the bank and its risk profile and appropriate personnel includes those whose duties require knowledge or involve some aspect of BSAAML compliance. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. First-Training is one of the required components of a BSA Compliance Program as mandated under the Act and further expressed under the mantle of the FFIEC Examination Manual. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121.

Source: youtube.com

Source: youtube.com

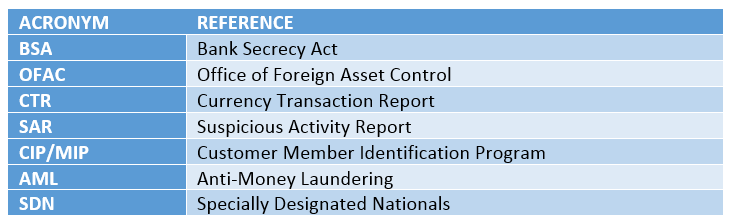

Training should be tailored to. BSA OFAC Training Agenda 1. Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation National Credit Union Administration Office of the Comptroller of the Currency Consumer Financial Protection Bureau and the State. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. Join millions of learners from around the world already learning on Udemy.

Source: slideplayer.com

Source: slideplayer.com

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Why is Bank Secrecy Act Training So Important. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Training should cover BSA regulatory requirements supervisory guidance and the banks internal BSAAML policies procedures and processes. History Overview of the Bank Secrecy Act 2.

Source: acamstoday.org

Source: acamstoday.org

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Second-A well trained well informed staff is critical to the. Start today and improve your skills. THE BANK SECRECY ACT. As the first line of defense for financial crimes credit unions play in important role in minimizing fraud money laundering terrorist financing and other financial crimes.

Source: blog.gao.gov

Source: blog.gao.gov

Second-A well trained well informed staff is critical to the. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. Reporting Recordkeeping CTRs SARs Member Identification WiresFunds Transfers Sale of Monetary Instruments 4. Training should cover the aspects of the BSA that are relevant to the bank and its risk profile and appropriate personnel includes those whose duties require knowledge or involve some aspect of BSAAML compliance. Join millions of learners from around the world already learning on Udemy.

Source: slideplayer.com

Source: slideplayer.com

USA PATRIOT Act 314a 314a Mandatory Information Sharing Credit unions are required to share information with Federal Law Enforcement agencies when requests are made through the 314a request system. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. Why is Bank Secrecy Act Training So Important. It will familiarize the learner with the Act itself in addition to how when and why to file Currency Transaction Reports. History Overview of the Bank Secrecy Act 2.

Source: compliancealert.org

Source: compliancealert.org

The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. As amended section 5318h 1 requires financial institutions to establish anti. History Overview of the Bank Secrecy Act 2. When the USA Patriot Act was passed in 2002 it also amended certain sections section 5318h1 of the bank Secrecy Act which deal with terrorist financing. Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation National Credit Union Administration Office of the Comptroller of the Currency Consumer Financial Protection Bureau and the State.

Source: probank.com

Source: probank.com

This course introduces the learner to the requirements of the Bank Secrecy Act BSA and provides detailed information regarding compliance with the BSA. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. Training should be tailored to. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

FinCen requests for information are sent every two weeks. Start today and improve your skills. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

Source: banktrainingcenter.com

Source: banktrainingcenter.com

Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. USA PATRIOT Act 314a 314a Mandatory Information Sharing Credit unions are required to share information with Federal Law Enforcement agencies when requests are made through the 314a request system. The answer to that question is threefold. FinCen requests for information are sent every two weeks. It will familiarize the learner with the Act itself in addition to how when and why to file Currency Transaction Reports.

Source: probank.com

Source: probank.com

Get training to meet your Bank Secrecy Act BSA training requirements. The Bank Secrecy Act and related federal and state law requirements are a critical component of credit union operations. The answer to that question is threefold. THE BANK SECRECY ACT. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and.

Source: bankerscompliance.com

Source: bankerscompliance.com

Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. BSA OFAC Training Agenda 1. This course introduces the learner to the requirements of the Bank Secrecy Act BSA and provides detailed information regarding compliance with the BSA. THE BANK SECRECY ACT.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act training requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas