17+ Banking secrecy laws singapore information

Home » about money loundering idea » 17+ Banking secrecy laws singapore informationYour Banking secrecy laws singapore images are ready in this website. Banking secrecy laws singapore are a topic that is being searched for and liked by netizens now. You can Download the Banking secrecy laws singapore files here. Get all royalty-free photos and vectors.

If you’re searching for banking secrecy laws singapore pictures information related to the banking secrecy laws singapore interest, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

Banking Secrecy Laws Singapore. 2212 The common law and principles and rules of equity are derived from case law. Swiss giants Credit Suisse Group and UBS AG have expanded private-banking operations in Singapore to cater to new demand from Asians and Europeans. Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland and Lebanon among other off.

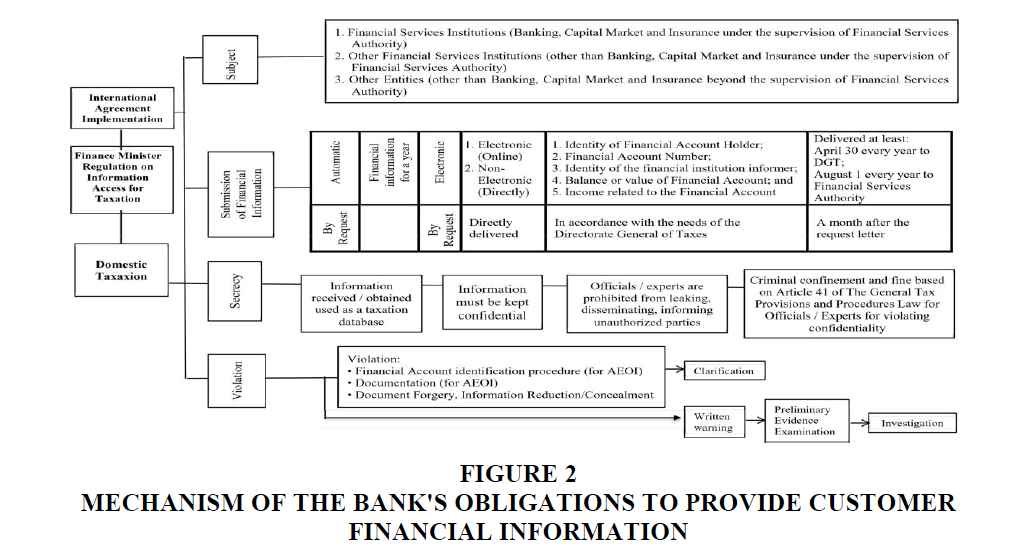

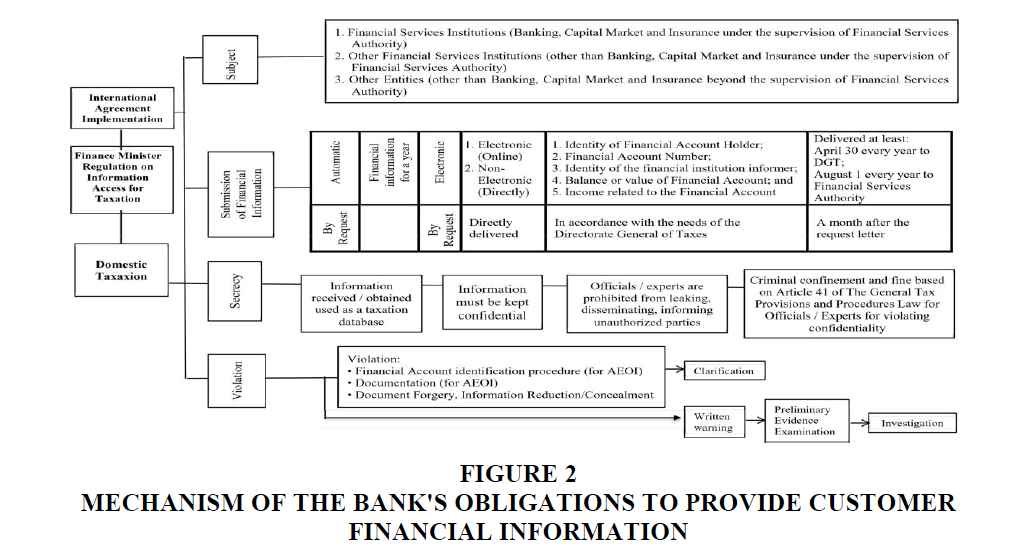

The Obligation Of Bank To Provide Customer Financial Information Due To Taxation Violating Of Bank Secrecy From abacademies.org

The Obligation Of Bank To Provide Customer Financial Information Due To Taxation Violating Of Bank Secrecy From abacademies.org

General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. 55T Minimum capital requirements of merchant banks. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. 2212 The common law and principles and rules of equity are derived from case law. Swiss giants Credit Suisse Group and UBS AG have expanded private-banking operations in Singapore to cater to new demand from Asians and Europeans. Although Hong Kong does not have the same bank privacy laws it offers flexibility in the creation of opaque companies that can serve as tax conduits.

General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS.

In the case of a customer who has been issued with a credit or charge card by a bank in Singapore disclosure is strictly necessary for notification of the suspension or cancellation of the card by the bank by reason of the customers default in payment to the bank. 19 Governs the licensing and regulation of banks merchant banks and related institutions including their credit card and charge card business. General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. SECTION 1 INTRODUCTION TO BANKING LAW IN SINGAPORE. Swiss giants Credit Suisse Group and UBS AG have expanded private-banking operations in Singapore to cater to new demand from Asians and Europeans. Their strict bank secrecy regulations allow banks to share information only in specific situations when the investigations are initiated by the authorities of this country.

Source:

Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. SECTION 1 INTRODUCTION TO BANKING LAW IN SINGAPORE. Their strict bank secrecy regulations allow banks to share information only in specific situations when the investigations are initiated by the authorities of this country. Section 47 states that customer information shall not in any way be disclosed by a bank in Singapore. It is also accepted that the right to confidentiality of customer information cannot be absolute.

Source: fozl.sg

Source: fozl.sg

Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or the branches and offices located within. 2212 The common law and principles and rules of equity are derived from case law. Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or the branches and offices located within. Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. 55S Application for merchant bank licence.

Source: pinterest.com

Source: pinterest.com

Their strict bank secrecy regulations allow banks to share information only in specific situations when the investigations are initiated by the authorities of this country. 2211 In Singapore the laws regulating banking are found in the relevant Acts passed by Parliament and their related subsidiary legislation the common law and principles and rules of equity. 2212 The common law and principles and rules of equity are derived from case law. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act.

Source: pinterest.com

Source: pinterest.com

General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. 55T Minimum capital requirements of merchant banks. Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. Banking Act Cap.

Source: dentons.rodyk.com

Source: dentons.rodyk.com

Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. Their strict bank secrecy regulations allow banks to share information only in specific situations when the investigations are initiated by the authorities of this country. 19 Governs the licensing and regulation of banks merchant banks and related institutions including their credit card and charge card business. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. The IRS claims that Singapores bank secrecy laws should not stand in the way of a disclosure required by international comity Americas interest in combating tax evasion by its citizens.

Source: cambridge.org

Source: cambridge.org

Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland and Lebanon among other off. 55T Minimum capital requirements of merchant banks. 55V Businesses that merchant banks in Singapore may carry on. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. The law states that they may only inspect the banks general books and that they may not single out individual bank accounts.

Source: researchgate.net

Source: researchgate.net

Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. Banking Act Cap. 55S Application for merchant bank licence. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. Strict banking secrecy laws tax friendly policies and a suite of wealth management services created a private banking boom.

Source: abacademies.org

Source: abacademies.org

2211 In Singapore the laws regulating banking are found in the relevant Acts passed by Parliament and their related subsidiary legislation the common law and principles and rules of equity. 2211 In Singapore the laws regulating banking are found in the relevant Acts passed by Parliament and their related subsidiary legislation the common law and principles and rules of equity. Singapores finance ministry said it would amend its bank secrecy laws in mid-2009 to take account of the OECDs standards on exchange of information. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland and Lebanon among other off. Singapore has bank secrecy provisions comparable to those in Switzerland.

Source: academia.edu

Source: academia.edu

55T Minimum capital requirements of merchant banks. It is also accepted that the right to confidentiality of customer information cannot be absolute. 55V Businesses that merchant banks in Singapore may carry on. Bank secrecy laws and the lack of routine currency reporting requirements make Singapore an attractive destination for drug traffickers criminals terrorist organizations and their supporters seeking to launder money. SECTION 1 INTRODUCTION TO BANKING LAW IN SINGAPORE.

Source:

Singapore has bank secrecy provisions comparable to those in Switzerland. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Article 65 of Cabinet Decree 238 regulates the manner in which the National Banking Commission can gain access to banking information and documents. 55U Restrictions on merchant banks in Singapore accepting or soliciting deposit or raising money in Singapore dollars. Banking Act Cap.

Source: pinterest.com

Source: pinterest.com

In the case of a customer who has been issued with a credit or charge card by a bank in Singapore disclosure is strictly necessary for notification of the suspension or cancellation of the card by the bank by reason of the customers default in payment to the bank. 2211 In Singapore the laws regulating banking are found in the relevant Acts passed by Parliament and their related subsidiary legislation the common law and principles and rules of equity. In the case of a customer who has been issued with a credit or charge card by a bank in Singapore disclosure is strictly necessary for notification of the suspension or cancellation of the card by the bank by reason of the customers default in payment to the bank. Section 47 states that customer information shall not in any way be disclosed by a bank in Singapore. Singapore has bank secrecy provisions comparable to those in Switzerland.

Source: in.pinterest.com

Source: in.pinterest.com

Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or the branches and offices located within. Although Hong Kong does not have the same bank privacy laws it offers flexibility in the creation of opaque companies that can serve as tax conduits. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. Article 65 of Cabinet Decree 238 regulates the manner in which the National Banking Commission can gain access to banking information and documents. 55S Application for merchant bank licence.

Source: abacademies.org

Source: abacademies.org

General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. General restrictions on businesses of banks Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. 55V Businesses that merchant banks in Singapore may carry on. 55S Application for merchant bank licence. Swiss giants Credit Suisse Group and UBS AG have expanded private-banking operations in Singapore to cater to new demand from Asians and Europeans.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title banking secrecy laws singapore by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information